Toshiba Now Holds More Than a Third of the NAND Market

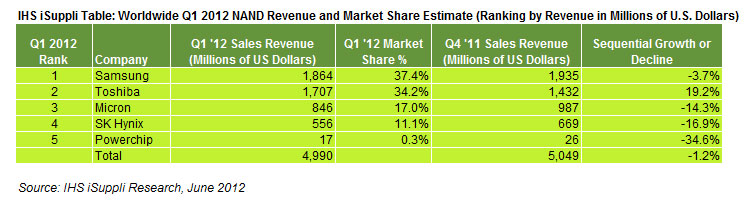

According to market estimates published by IHS, Toshiba was the only major flash maker to post sales growth in the first quarter of this year. While Samsung shed 3.7 percent of revenue and dropped from $1.94 billion in Q4 to $1.86 billion in Q1, Toshiba added 19.2 percent from $1.4 billion to $1.71 billion in the same time frame.

As a result, Samsung's market share fell to 37 percent, while Toshiba jumped from 28 to 34 percent. Overall, the market declined by 1.2 percent in sales volume, with Micron losing 14.3 percent, SK Hynix 16.9 percent and Powerchip 34.6 percent.

Given its size, Samsung posted the largest drop in NAND revenues among the top 5 flash makers. The drop was attributed to a 10 percent fall of its NAND prices, as well as to reduced production in one of its fabs that is transitioned to manufacture processors and chipsets.

"Toshiba's improved performance in the first quarter came after a troubling 2011," said Dee Nguyen, memory analyst at IHS. "Last year the company's NAND market share saw two major declines. The first drop came during the second quarter because of disrupted production stemming from the Japan earthquake-tsunami disaster in March. The second decline arrived during the fourth quarter when uncertain market conditions necessitated a carryover of inventory into the first quarter this year. Toshiba’s strong results show that the company has regained its footing and has put a tumultuous year behind it."

According to IHS, Toshiba's inventory carryover from the fourth quarter enabled the company to outship its competitors in Q1.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

rantoc Hope the die shrik with Nand's will stop soon, sure its lower costs BUT the write endurance drops significantly with each die shrink and i doubt anyone want to either dedicate 1/2 their drive as spare (to take over when cells die) or replace them yearly!Reply -

Until Toshoba's Value Added package software stops working, and you find out that toshiba never updates their UBER-crappy system software. Yes, go ahead buy a toshiba laptop, the software will stop working, if it ever works right to begin with!Reply

-

back_by_demand SystemNotWareUntil Toshoba's Value Added package software stops working, and you find out that toshiba never updates their UBER-crappy system software. Yes, go ahead buy a toshiba laptop, the software will stop working, if it ever works right to begin with!What the hell has that got to do with the NAND market? GTFO Troll!Reply -

jess80 Toshiba is the best brand od computers. I love ordenadores portátiles Toshiba.Reply

Congratulations Toshiba. -

phate Call me old fashioned, jingoistic, or whatever, but I try and support Micron where I can. They are the only one based in the US (though they now have fabs in Taiwan I believe).Reply -

gameover1993 jess80I love Toshiba computers like this:Toshiba is the best brand od computers.but too expensiveReply