TSMC leads healthy growth in foundry industry for Q3 2023

Contract chipmaking industry shows mixed results.

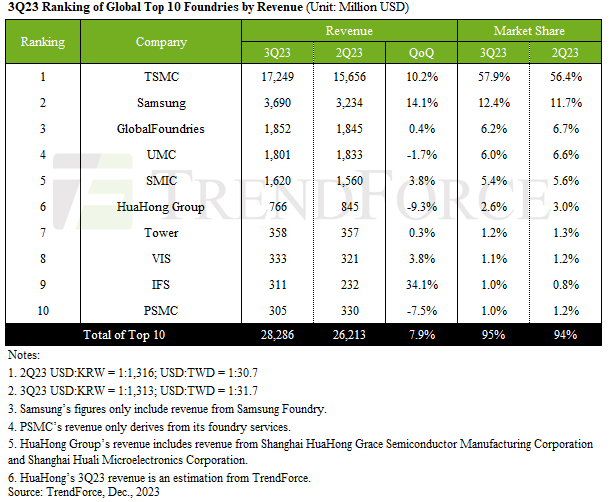

The global foundry industry was on the rise in Q3 2023, led by TSMC, Samsung, SMIC, and Intel Foundry Services (IFS), based on a TrendForce report. The combined revenue of the Top 10 foundries reached approximately $28.29 billion, a notable 7.9% rise from the previous quarter due to a resurgence of demand for smartphones and PCs. TSMC was certainly a star of the report as it continued to dominate the market, IFS made its debut in the Top 10 rankings for the first time in some time, whereas SMIC did not show any particular financial gains from its 2nd generation 7nm ramp for Huawei.

3nm Drives Revenues Up for TSMC

TSMC's revenue reached $17.249 billion in the third quarter of 2023, which allowed the company to claim a 57.9% market share of the whole foundry sector (by revenue). The surge in TSMC's growth can be attributed to the high demand in several key areas, notably in the PC and smartphone markets. Meanwhile, a significant contributor to TSMC's financial success in the quarter was its 3nm fabrication technology, which is used to make Apple's A17 Pro, M3, M3 Pro, and M3 Max processors for smartphones and PCs. As TSMC began to formally recognize its 3nm revenue during the quarter, the technology immediately contributed 6% of its earnings per quarter. Meanwhile, 60% of the foundry's earnings stemmed from its more advanced manufacturing processes (7nm and thinner).

Samsung Foundry is another contract maker of semiconductors who has a 3nm fabrication process in its fleet. Meanwhile, the company only produces smaller chips for cryptocurrency mining on this technology, so the node has yet to become a significant revenue contributor. Samsung Foundry posted a $3.69 billion revenue for the quarter, a 14.1% increase quarter-over-quarter, according to TrendForce. While Samsung attributes this rise to a growing demand for its advanced process technologies (which certainly made a significant contribution), TrendForce believes that Samsung's revenue growth was due to a variety of other factors, including orders for Qualcomm's 5G application processors for mid-to-low range smartphones, 5G modems, and the well-established 28 nm OLED display driver ICs.

7nm Barely Has Impact on SMIC

China's semiconductor champion Semiconductor Manufacturing International Corp. (SMIC) did not make it into the Top 3 foundry's list, though its revenue — $1.62 billion, up 3.8% quarter-over-quarter — was not significantly behind those of GlobalFoundries and UMC, two specialty foundries. But it made quite a breakthrough in the third quarter when it started shipments of Huawei's HiSilicon Kirin 9000S application processor based on SMIC's 2nd generation 7nm process technology. Unfortunately for SMIC, this did not really drive its revenue significantly upwards, based on numbers from TrendForce,

TrendForce attributes this to the shift of SMIC's client base: the share of revenue coming from Chinese customers rose sharply to 84%, driven by the government's emphasis on local sourcing and a surge in orders for smartphone parts from Chinese makers. On the other hand, revenue from American clients saw a decline, attributed to a diversification in the supply chain and the movement of American customers to production locations outside of China. It is possible that the shift in the nature of orders played a role as well, with Chinese firms possibly placing more orders for lower-cost chips compared to their American counterparts.

Intel Is Back to Top 10

A standout development in the contract chipmaking segment is the re-entry of Intel Foundry Services (IFS) into the Top 10 foundries for the first in several quarters. In Q3 2023, IFS reported a revenue of $311 million, marking a significant 34.1% increase from the previous quarter. This substantial growth may be attributed to IFS's collaboration with Amazon Web Services, which ramped up production and assembly of its Graviton4 and Trainium2 system-in-packages in Q3. These SiPs require advanced packaging technologies, such as Intel's Foveros 3D, therefore likely contributing to IFS's recent financial success.

Mixed Bag for Others

Other foundries demonstrated mixed results: some remained flat with the previous quarter, others demonstrated declines of revenues.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

GlobalFoundries showed steady performance, with its revenue remaining stable at about $1.85 billion, in line with its previous quarter's earnings. The company's sales were mostly drive by the Internet of Things (IoT) products for home and industrial applications alongside major orders from the U.S. aerospace and defense industries, according to TrendForce.

As for UMC, although its overall revenue dipped slightly by 1.7% to $1.8 billion, the company witnessed a noticeable rise in its 28/22 nm orders. This almost 10% revenue boost from these production nodes helped to offset a minor drop in total wafer shipments.

Tower Semiconductor saw a marginal increase in revenues of 0.3% quarter-over-quarter, essentially maintaining a steady status with $358 million, while Vanguard International Semiconductor recorded a 3.3% increase over the same period to $333 million.

In contrast, HuaHong Group faced a downturn, with a 9.3% decrease in revenue quarter-over-quarter, dropping to around $766 million. PowerChip Semiconductor Manufacturing Corp (PSMC) also experienced a decline in revenue by 7.5% to $305 million. This was largely due to reductions of nearly 10% and 20% in revenues from PMIC and power discrete products, respectively, impacting its overall financial results, as noted by TrendForce.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.