U.S. Bitcoin Mining Consumed 50 Billion kWh of Energy in 2022

"Making cryptominers pay for costs they impose on others", wrote the White House.

There've been rivers of ink written on all aspects of cryptocurrency ever since that fateful day of the Bitcoin whitepaper publishing. Still, one question that's repeatedly brought to the limelight (and understandably so) surrounds energetic and environmental sustainability. Now, the White House itself is adding fuel to the fire through its DAME Tax proposal, whose aim is, and we quote: "making cryptominers pay for costs they impose on others."

How, you ask? By phasing in an additional 30% tax penalty for cryptocurrency mining firms on any energy they consume in that process. According to the White House, this is "an example of the President's commitment to addressing both long-standing national challenges as well as emerging risks – in this case, the economic and environmental costs of current practices for mining crypto assets." The idea is simple: Bitcoin mining consumes a lot of power; this consumption drives electricity prices up; which is bad for everyone unfortunate enough to share a grid with a cryptocurrency mining firm.

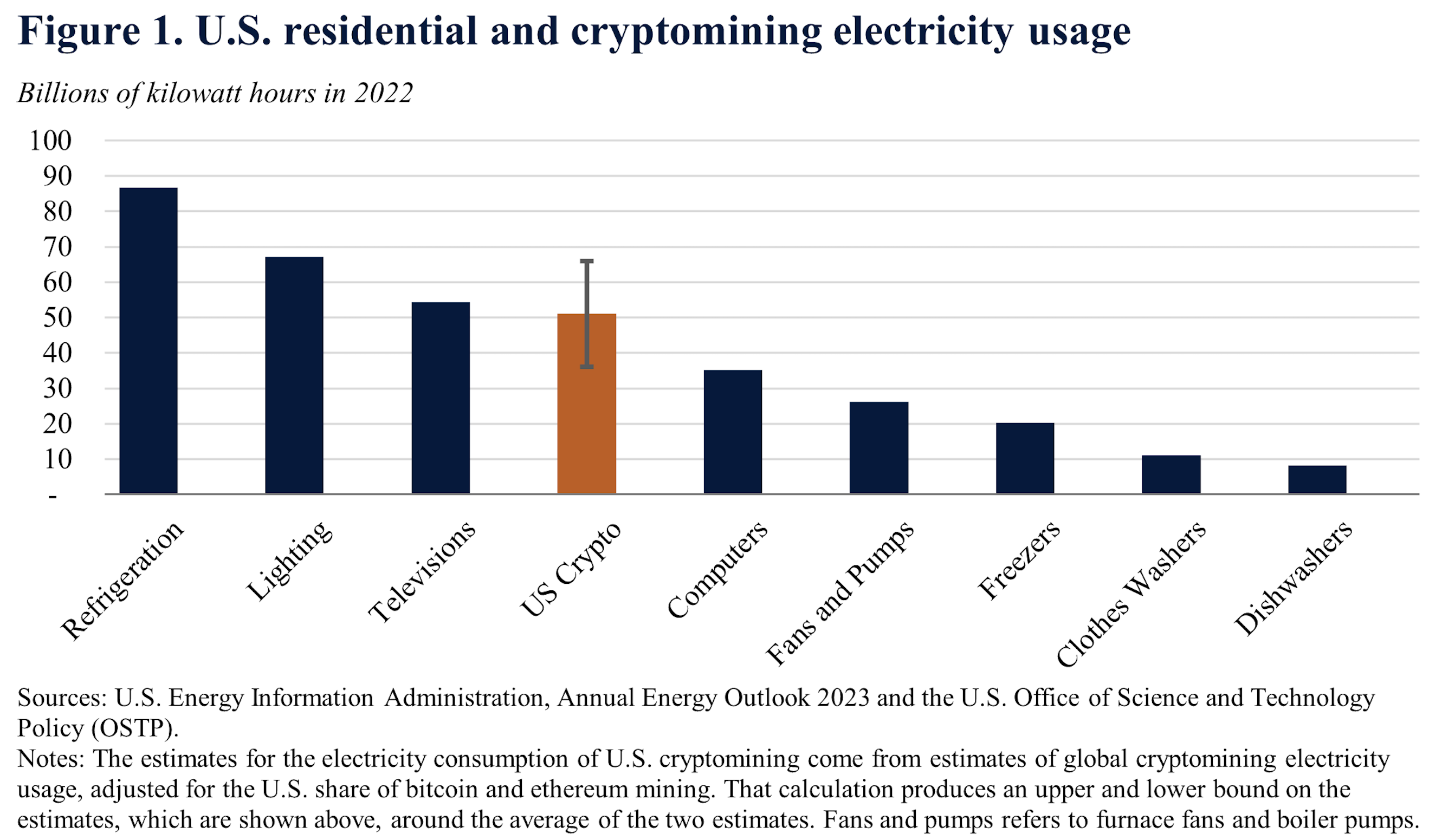

It seems that the White House's hand has been forced by their very own report, which estimates total Bitcoin mining energy consumption in 2022 at an eye-watering 50 billion kilowatt-hours (in fact, the estimate places consumption anywhere between the low of 30 billion kWh and a high of 60 billion kWh). That's greater power consumption than all operating computers in the United States put together - and within the margin of error of the countrywide electrical consumption for as basic a necessity as lighting.

It's also more energy than Americans consume through their TV sets, and it's right here, in a nice graph:

Let's get this straight right off the bat: public and private lighting is definitely (and inarguably) more important than Bitcoin mining.

However, some arguments favoring the proposal seem to be mired in inconsistencies. Back when Intel announced its "Bonanza Mine" cryptocurrency mining chips, we took a relatively detailed look at Bitcoin's global power consumption and the utility that can already be extracted from it: anyone who has taken profits can attest to its utility; anyone who sold anything to someone and got paid in Bitcoin can attest to its utility; so can anyone who crossed an embattled border while invisibly carrying their wealth, or the citizens of El Salvador, where Bitcoin is legal tender. I'd be interested to know which process the White House used to quantitatively analyze cryptocurrency applications' social benefits before concluding that they "are yet to materialize."

There's also the question of what amount of Bitcoin's energy consumption actually hails from carbon-intensive sources; according to the Bitcoin Mining Council (BMC), a global forum of mining companies that represents 48.4% of the worldwide Bitcoin mining network, it's estimated that in Q4 2022, renewable energy sources accounted for 58.9% of the electricity used to mine bitcoin - against an estimated 36.8% as of Q1 2021.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

It'll be interesting to see what results from this legislative push. For one, a 30% tax for cryptocurrency mining firms would drive most of them out of business, resulting in a concentration of hashing power in the hands of the few firms with strong enough financials to stand above the waterline. That would be terrible for Bitcoin, whose network security assumes that processing power is distributed, not concentrated. We wouldn't go so far as saying that Bitcoin Core devs would be open to changing Bitcoin's security model from Proof of Work (the cause for the monumental energy consumption) to Proof of Stake (Ethereum did this transition through its Merge, basically cutting its energy consumption on transaction validation by over 99%). But Ethereum isn't Bitcoin, and Bitcoin isn't the only Proof of Work cryptocurrency out there.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

Alvar "Miles" Udell So cryptominers who haven't already moved to places like Iceland will leave, no big loss.Reply -

derekullo Bitcoin farming operation in the basement?Reply

Don't know what they are talking about!

That's my highly elaborate hot water heating system! -

digitalgriffin Reply

Considering the article said they consume MORE than every PC put together in the USA, I would say less.Endymio said:How many billion kWhs did videogaming consume in 2022? -

Reply

Oh no, not another one of those "vIdEo gAmEs cOnSuMe pOwEr tOo" people. Unlike crypto mining, gaming actually provides real value to people.Endymio said:How many billion kWhs did videogaming consume in 2022?

But to answer your question. From the article:

It seems that the White House's hand has been forced by their very own report, which estimates total Bitcoin mining energy consumption in 2022 at an eye-watering 50 billion kilowatt-hours (in fact, the estimate places consumption anywhere between the low of 30 billion kWh and a high of 60 billion kWh). That's greater power consumption than all operating computers in the United States put together - and within the margin of error of the countrywide electrical consumption for as basic a necessity as lighting.

Emphasis mine.

And the graph puts "Computers" at around 35 billion kWh (with crypto's low estimate also at around 35 billion kWh), which most likely includes videogaming on top of other, more productive tasks.

And let's not forget that crypto miners are just as likely to play video games as everyone else. -

Endymio Reply

Nice ... except the article is wrong. The author forgot to check his source, which specifically notes the estimate is only for residential home computers - excluding office and industrial computers, servers, etc. And the author's methodology for calculating crypto's share of electricity consumption in the US contains a glaring error which overstates the value substantially. Can you find it?Nolonar said:But to answer your question. From the article: "That's greater power consumption than all operating computers in the United States put together"

Says a "Living Today" journalist for Geico insurance. What an outstanding reference! However, I can easily find many more studies and references on the negative effects of videogaming. A wise man would conclude that videogaming has both positive and negative aspects ... as does cryptocurrency mining. Are you a wise man? Whenever the government gets involved in the business of choosing winners and losers, the consumer ultimately loses out.Nolonar said:Oh no, not another one of those "vIdEo gAmEs cOnSuMe pOwEr tOo" people. Unlike crypto mining, gaming actually provides real value to people. -

USAFRet Reply

Struggling to find the positive in crypto mining.Endymio said:A wise man would conclude that videogaming has both positive and negative aspects ... as does cryptocurrency mining. -

Endymio Reply

Snark aside, ignoring the purported benefits of crypto itself, the act of mining $50B in crypto adds $50B to the GDP, and provides jobs, tax revenues, and downstream spending, the same as any other $50B industry.USAFRet said:Struggling to find the positive in crypto mining.

Furthermore, those of you who've spent your entire life without ever conducting a single financial transaction in anything other than stable US/EU currencies may struggle to see the benefits of a non-fiat currency, but a few years ago when Venezuela neared a hyperinflationary spiral and the government banned citizens from transporting or converting currency , and even from withdrawing their own money from the bank, hundreds of thousands of citizens with Bitcoin were able to escape the worst ravages of the effects. See the (paywalled) NYT article "When Venezuela banned its own currency" or the Venezuelan-written op-ed "How Bitcoin saved my family" for an informative summary. -

USAFRet Reply

Bitcoin saved Venezuela?Endymio said:Snark aside, ignoring the purported benefits of crypto itself, the act of mining $50B in crypto adds $50B to the GDP, and provides jobs, tax revenues, and downstream spending, the same as any other $50B industry.

Furthermore, those of you who've spent your entire life without ever conducting a single financial transaction in anything other than stable US/EU currencies may struggle to see the benefits of a non-fiat currency, but a few years ago when Venezuela neared a hyperinflationary spiral and the government banned citizens from transporting or converting currency , and even from withdrawing their own money from the bank, hundreds of thousands of citizens with Bitcoin were able to escape the worst ravages of the effects. See the (paywalled) NYT article "When Venezuela banned its own currency" or the Venezuelan-written op-ed "How Bitcoin saved my family" for an informative summary.

Agreed.

But that devolves from Venezuela being a failed economy that needs 'saving'.

I'm out.... -

The negative affects of video games. I guess that would be getting too fat sitting in front of your television and that’s about it. All the rest of that stuff is bunk. Don’t believe anything you see iand less than half of what you read. Good advice given by my grandfather has served me well because this world is just too full of crap.Reply