Intel's Blockscale ASIC Proves Blockchain Tech Has Become Too Big to Fail

Fully embracing the blockchain

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

After months of spoon-feeding information on its curiously codenamed "Bonanza Mine" approach to blockchain technology, Intel has officially taken the first concrete, product-laden steps in the form of its Blockscale ASIC (Application-Specific Integrated Circuit). The announcement comes hot on the heels of several design wins, with cryptocurrency mining heavyweights Argo Blockchain, BLOCK (formerly known as Square), GRIID Infrastructure, and HIVE all inking multi-million-dollar deals for Intel's Blockscale solutions. The products are expected to see first deliveries by Q3 2022.

Helped by Intel's decades of expertise in semiconductor design and refinement, as well as cryptographic technologies, the Blockscale ASIC builds on the company's first-generation Bonanza Mine accelerator (BMZ1), which served as a proof of concept for the second Blockscale design. It aims to bring energy-efficient cryptocurrency mining to mining specialist companies focusing on PoW (Proof of Work) workloads, one of the strategies that help secure transactions in blockchain environments. To that end, Intel has created a specific division that handles strategy and product development in this space: the Custom Compute Group, nested within Intel's Accelerated Computing Systems and Graphics business unit.

“Intel is committed to advancing blockchain technology in a responsible way, and we’re proud to collaborate with and provide solutions to companies that are creating a more sustainable cryptocurrency ecosystem globally," said Jose Rios, general manager of Blockchain and Business Solutions in the Accelerated Computing Systems and Graphics Group at Intel. "The Intel Blockscale ASIC is going to play a major role in helping bitcoin mining companies achieve both sustainability and hash rate scaling objectives in the years ahead.”

This division isn't unlike AMD's semi-custom business, which takes the company's IP and adapts it to customers' needs from a workload, power, and performance perspective — and its shown record-shattering growth. AMD's approach has found the greatest success in gaming consoles, powering the latest and greatest from both Microsoft, Sony, and even Valve's Steam Deck, which can and do leverage the company's CPU and GPU expertise. Intel's new group, however, is especially geared toward blockchain and edge supercomputing designs.

One Chip to Rule Them All

Intel's Blockscale is a relatively small, SHA-256 (Secure Hash Algorithm-256) hardware accelerator for blockchain proof-of-work consensus applications. Being an ASIC, the chips have been designed from the ground up with these workloads in mind, sacrificing the versatility of CPUs and GPUs in exchange for much higher throughput and power efficiency compared to other mining approaches.

Each first generation chip consumed a mere 14.2mm^2 in wafer area, meaning Intel could extract a theoretical maximum of around 4,000 chips from a single silicon wafer. Blockscale, however, occupies 52mm^2 per chip, while an AMD Zen 3 core (not including the cache and other CPU features) occupies a tiny 3.24mm^2. The increased chip size translates into higher performance, but it has the knock-on effect that Intel can now only theoretically extract around 1,250 chips from a single wafer.

While Intel hasn't confirmed who is manufacturing these chips, it's likely they aren't being produced in-house, but rather on TSMC's 5nm process, further condensing the design area, chip per wafer output, and power efficiency compared to Intel's current leading-edge manufacturing process, Intel 7.

Like mainstream computing solutions, Blockscale accelerators can be operated across a range of temperatures, frequencies and operating voltages, and are scalable at up to 256 ASICs per chain, delivering up to 580 GH/s (Gigahashes per second) per chip, down from BMZ1's 300 maximum chain size. A chain of 256 chips configured for maximum performance thus delivers a hypothetical 148 TH/s while consuming 5,811 W. Each ASIC can however be configured to consume between 4.8 to its maximum 22.7 watts of power, with an energy efficiency of up to 26 joules per terahash (J/TH). Higher TDP configurations would of course negatively affect power efficiency, so it's unlikely that most mining firms would configure their systems for maximum performance.

This provides Intel's clients with industry leading scaling opportunities, as they can find their own configuration sweet-spot according to limitations on floor space, power delivery, and cooling infrastructure available at time of deployment. And if any of those factors need adjustment over time, they can scale accordingly, in-line with whatever bottleneck they may be up against.

To further pressure the few competitors in the cryptocurrency mining ASIC space (namely Bitmain and MicroBT), Blockscale is supported by a reference hardware design and software stack to jump-start system development, which will likely become one of Intel's strongest business propositions. Whatever can be said about Intel's shortcomings and occasional missteps, it does provide excellent support and documentation via its Reference Design Materials.

One can only imagine the amount of funding Intel has poured into its new division, both in human resources and research and development. Judging by the huge contract wins that Intel has already secured even before its chips have left the actual silicon presses, the space is hungry for more capacity, with cryptocurrency mining companies — which actually should be thought-of as security and transaction enablers for blockchain ecosystems — facing extremely long lead-times in a specialized, somewhat monopolistic market.

Intel will undoubtedly secure profits directly derived from the sales of its Blockscale chips, but the company has pivoted its message around it to directly counter some of the most obvious backlash it could endure, which could itself result in lost profits. Intel knows its investment in the space threads a thin line in public perception, as most companies seem to when it comes to blockchain, the so-called Metaverse, and Web3. As such, Intel is keen to emphasize what could be defined as two of the most severe perception problems for blockchain technology: sustainability and the silicon shortage.

Threading the Sustainability Waters

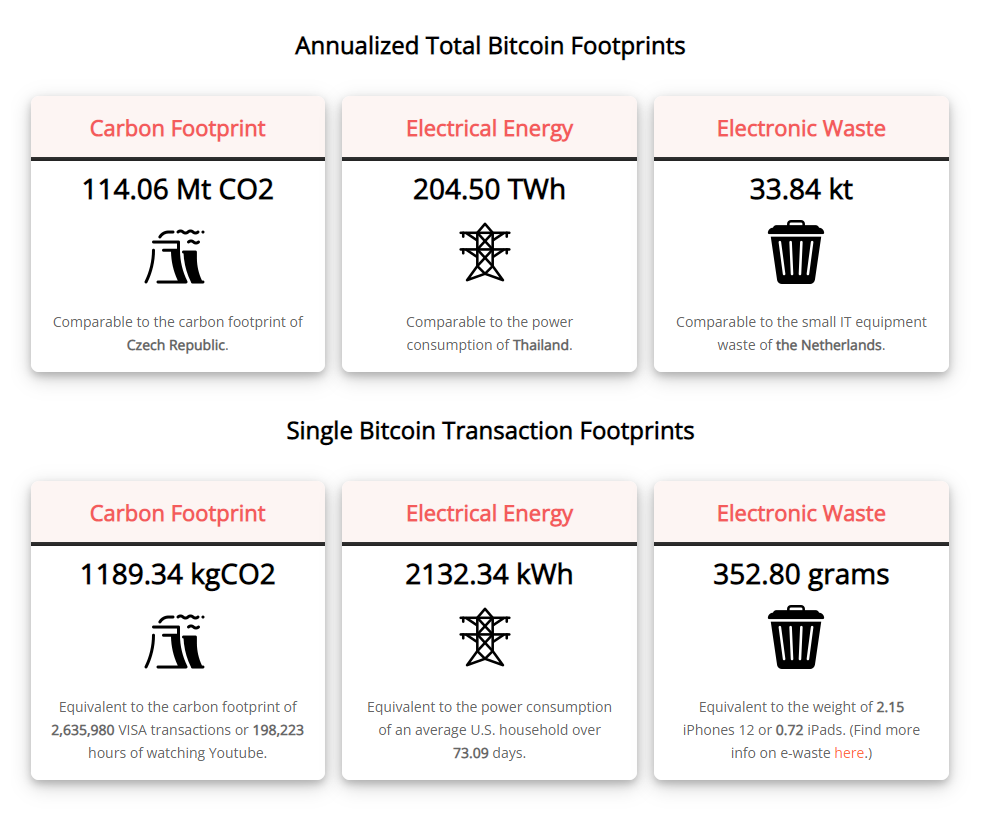

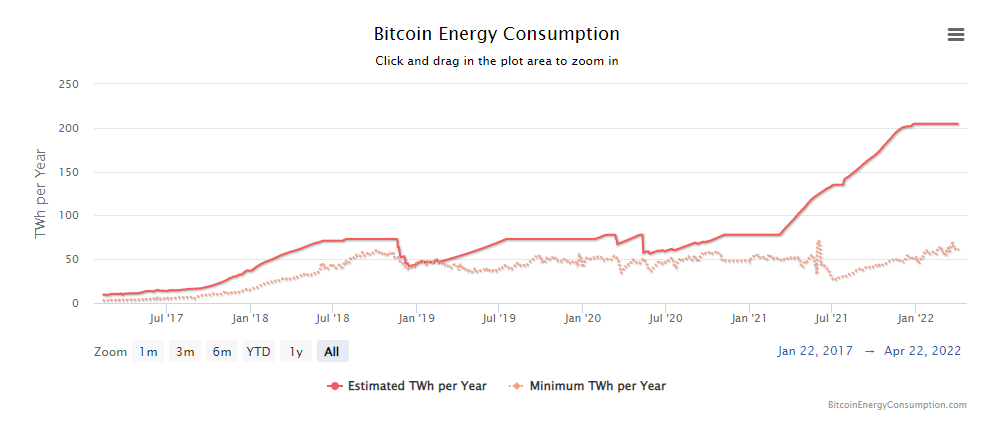

Sustainability is one of the most common arguments levied against blockchain technology in its most visible implementation. This mainly happens due to the perception around blockchain utility and the tremendous energy consumption of PoW chains like Bitcoin, Ethereum (which will transition to a more energy-efficient Proof of Stake [PoS] algorithm in the near future, if things go according to plan), and a number of others.

Estimates aren't friendly: a single Bitcoin operation consumes around 2,248 KW/h - more than twenty times the amount of energy required by the VISA payments system to process 100,000 transactions. As a transaction system, the entirety of Bitcoin consumes as much power as Thailand, a country with 70 million citizens.

Global warming and sustainability are deservedly in the spotlight, especially with rising electricity costs, which also fluctuate according to supply and demand. Nefarious consequences have already arisen from over-extended energy grids that have provoked blackouts in several countries and U.S. states due to suddenly spiking demand from the installation or relocation of Bitcoin farms.

This is a relatively threatening climate for Intel to launch a product that accelerates these workloads. And thus, the company is doubling down on communication that focuses on energy efficiency and 'green mining,' promising "over 1000x better performance per watt than mainstream GPUs for SHA-256-based mining." Which is a bit of a crock, since these days all the big players are using ASICs for SHA-256 mining anyway.

Intel's Raja Koduri states: "We are mindful that some blockchains require an enormous amount of computing power, which unfortunately translates to an immense amount of energy. Our customers are asking for scalable and sustainable solutions, which is why we are focusing our efforts on realizing the full potential of blockchain by developing the most energy-efficient computing technologies at scale."

While this is all true, it's also interesting to consider the other side of the argument: Millions of people already extract some sort of utility from blockchain technologies. Companies have been built, powering not only experiences but also financial systems that enable seamless transactions to punch through even war-contested borders such as Ukraine. Bitcoin alone is held by around 106 million people throughout the world, with 53 million of those having traded in the cryptocurrency to some extent. In theory, users living in contested territories can use blockchain to invisibly carry their life's savings out of the country — something that could otherwise be negated by the sheer volume of the equivalent in fiat or other valuable goods, such as gold.

User numbers are likely to only increase from here, as Bitcoin is already recognized and accepted as a means of payment by numerous businesses around the world. Large institutions and private companies have already started increasing their Bitcoin holdings and exploring blockchain technology for numerous pursuits, and it has even become legal tender in El Salvador, bringing undeniable utility to its roughly 6.5 million citizens.

It does seem like the only way for Bitcoin's energy consumption is up. Balaji Kanigicherla, Intel vice president and general manager of Custom Compute in the Accelerated Computing Systems and Graphics Group, said that "Momentum around blockchain continues to build. It is the enabler of decentralized and distributed computing, making way for innovative business models. To power this new era of computing, Intel is delivering solutions that can offer an optimal balance of hashing throughput and energy efficiency regardless of a customer’s operating environment. Intel’s decades of R&D in cryptography, hashing techniques and ultra-low voltage circuits make it possible for blockchain applications to scale their computing power without compromising on sustainability.”

The sustainability battle for Bitcoin and other cryptocurrencies likely stands closer to their chosen security method, i.e. via a change to a more energy-efficient consensus mechanism other than Proof of Work. But while that doesn't happen, Intel's expertise in designing energy-efficient circuits, and the increase in electrical efficiency for Bitcoin mining ASICS such as Blockscale, is certainly one of the ways of curtailing the exploding power consumption for the tech itself.

And while comparing Bitcoin's energy consumption with that of a country like Thailand is an eye-opening observation, the last available data puts the entire world's energy consumption at 160,000 TWh as of 2019.

Bitcoin's estimated energy consumption of 205 TWh in 2022 amounts to around 0.12% of the world's power consumption three years ago — and the world's power use has only increased. Bitcoin's slice of the world's power as of 2022 is thus even lower than 0.12%. Bitcoin mining today effectively consumes less energy per year than the world's billions of electrical appliances left on standby. Suddenly, Intel's investment in the blockchain space makes a lot more sense.

Mining in a Semiconductor Supply Gut

It's difficult to assess whether Intel's contract with TSMC for Blockscale will negatively impact the availability of other semiconductor products from the Taiwanese foundry. It's clear that there is an opportunity cost for every wafer that leaves TSMC's factories. Blockscale chips will be etched onto the same wafers that could've become the latest CPUs or GPUs for consumer or industrial applications. There is only so much capacity to go around, and planned multi-billion dollar capacity expansions from semiconductor manufacturers — including Intel's $80 billion Silicon Junction initiative in Europe — will take years to fully materialize.

Despite that, it seems unlikely that mining (whether via Intel's Blockscale chips or repurposed GPUs) will carry as much weight in the future as it has in the last two years. Ethereum mining stands as one of the highest impact pursuits for general consumer GPU availability, but that particular problem is potentially going the way of the proverbial dodo with that cryptocurrencies' impending move to PoS.

Intel, on one hand, says that its Blockscale chips were designed so as not to impact the supply of other electronics. The company now has fully embraced blockchain as a business vector, aiming to take advantage of its current (and future) value. The company has launched two products of its three-pronged attack on the space, following the release of blockchain-marketed Agilex-M series FPGAs and Blockscale. It remains to be seen if Intel's Arc Alchemist GPUs will surface in cryptocurrency mining rigs upon their release, although it seems that the worst of GPU-based mining is in its last throes.

It's a brave new world, and Intel has adapted its perspective to take advantage of a highly lucrative market. It remains to be seen how and if the company will also take a hand in shaping our possible blockchain futures, or if its Blockscale chip, and blockchain technology in general, will be a blip in humanity's radar. I'd bet three coffees on the former.

Note: This article was originally published on April 6, but our CMS accidentally ate it and apparently no one saw it. So we are republishing the content.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

digitalgriffin This thread will not end well....Reply

That said, Intel has dumped bigger investments without looking back from RDRAM, Itanium to Larabee/knights corner/knights landing, Optaine, Itanium, Atom investments for Android, and more.

If USA gov't gets involved, there will be unified coin within 10 years, thus negating many existing coins. The likelihood of this is increasing every day.

Intel: Welp, this isn't making us money <grabs axe and flame thrower> -

hotaru.hino Reply

If anything, I'm glad someone relatively large is dumping money into something that's new or trendy in order to figure out what we can do with it and if it's worth while. You can't really learn unless you're willing to fail.digitalgriffin said:That said, Intel has dumped bigger investments without looking back from RDRAM, Itanium to Larabee/knights corner/knights landing, optane, Atom investments for Android, and more. -

penguinslovebananas we all know this was inevitable. I have been telling my friends for years, if they think crypto is getting big now, just wait until a major chip maker throws their weight into it. I’m honestly surprised it has taken this long. I do feel somewhat bad for Bitmain and MicroBT, they did pioneer the arena, but they are no match for the design expertise of a big chip maker. At the same time they made a market desperate for another party party by their, what I view as very exploitive of their customers, business practices. Either way I hope they had the foresight to know this was coming and with intel in the mix, amd may be close behind.Reply