AMD Smashes Records Again, Data Center and Semi-Custom Revenue up 286%, Consumer Up 46%

No Chips? No Problem.

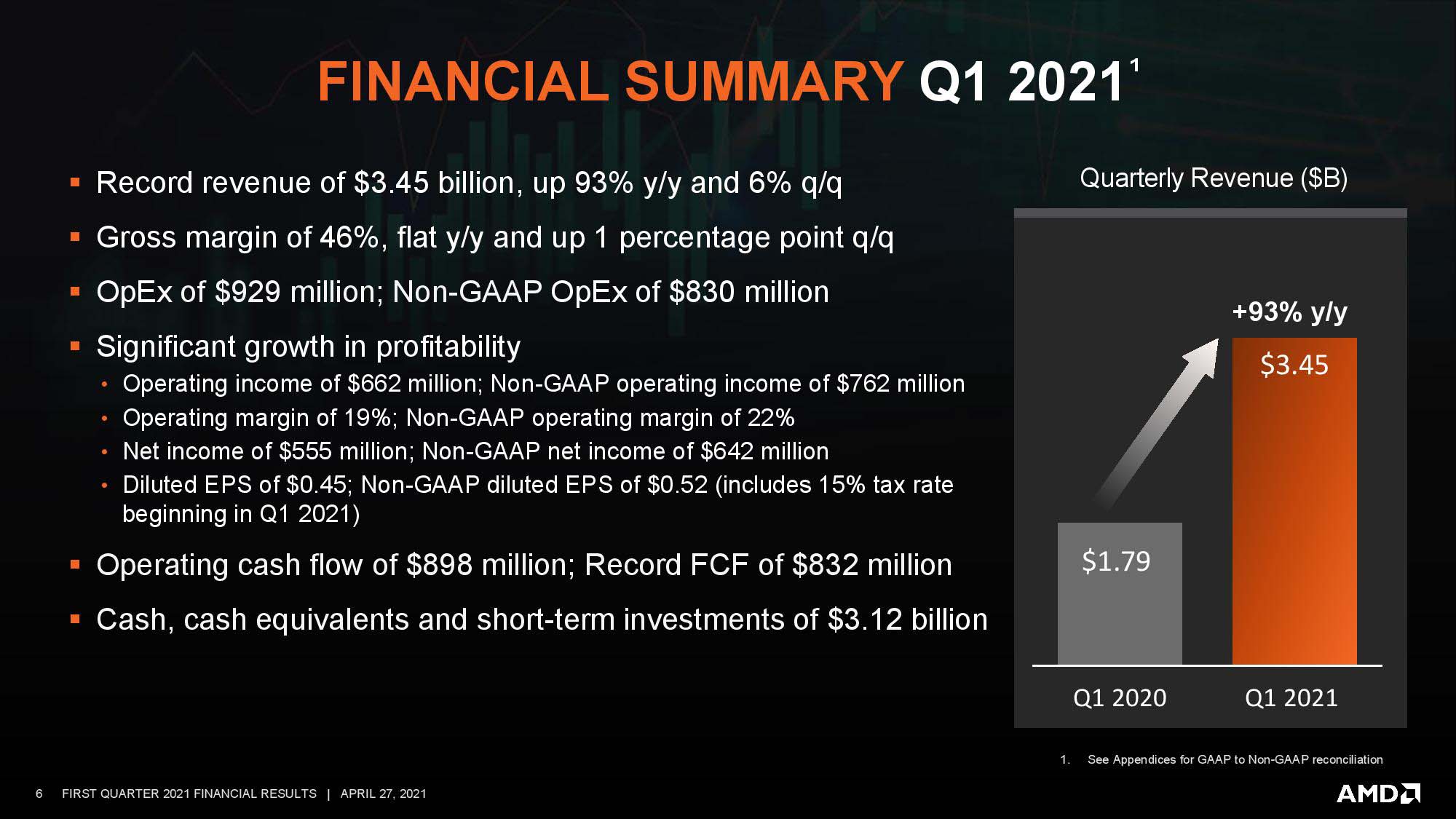

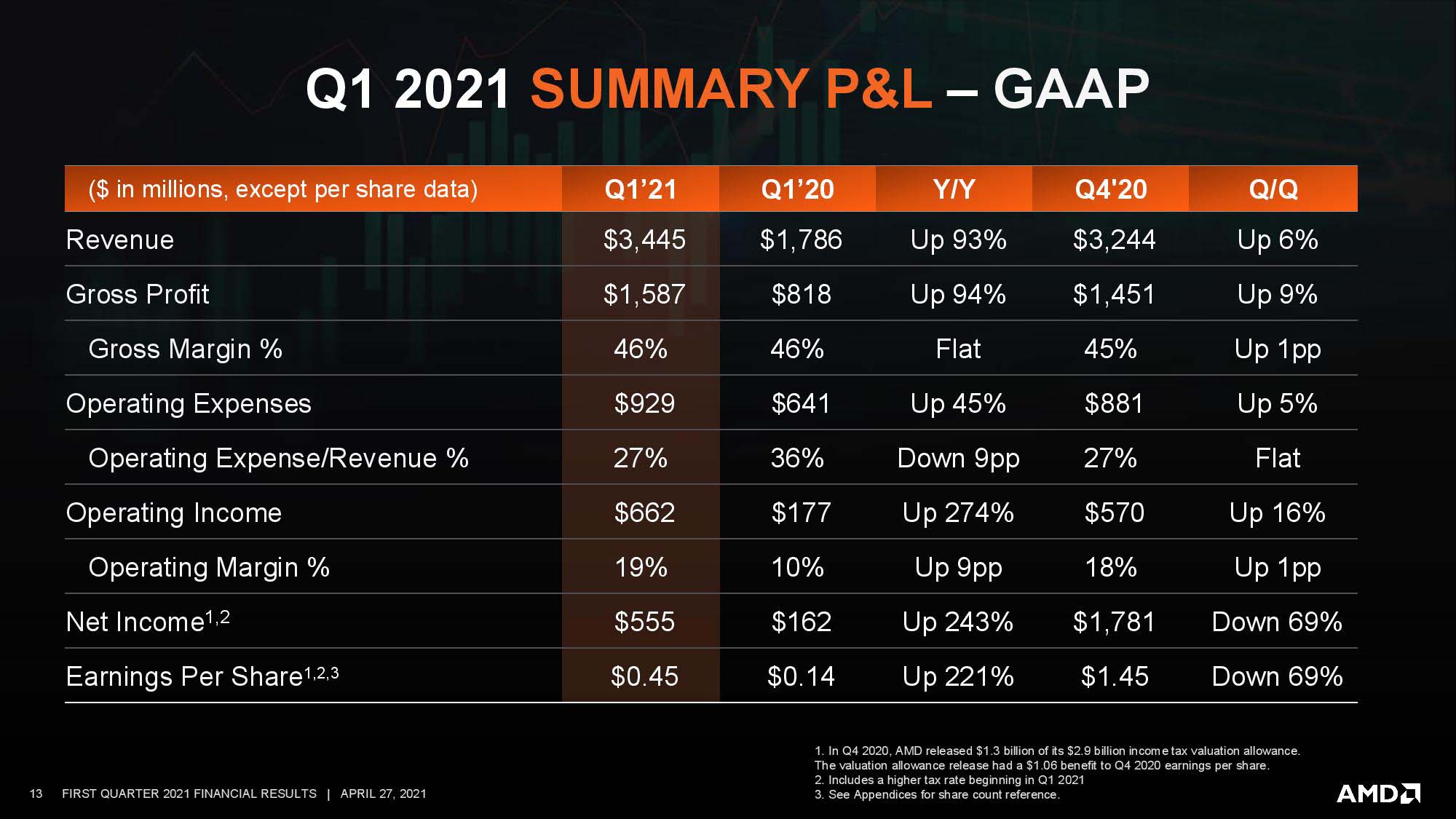

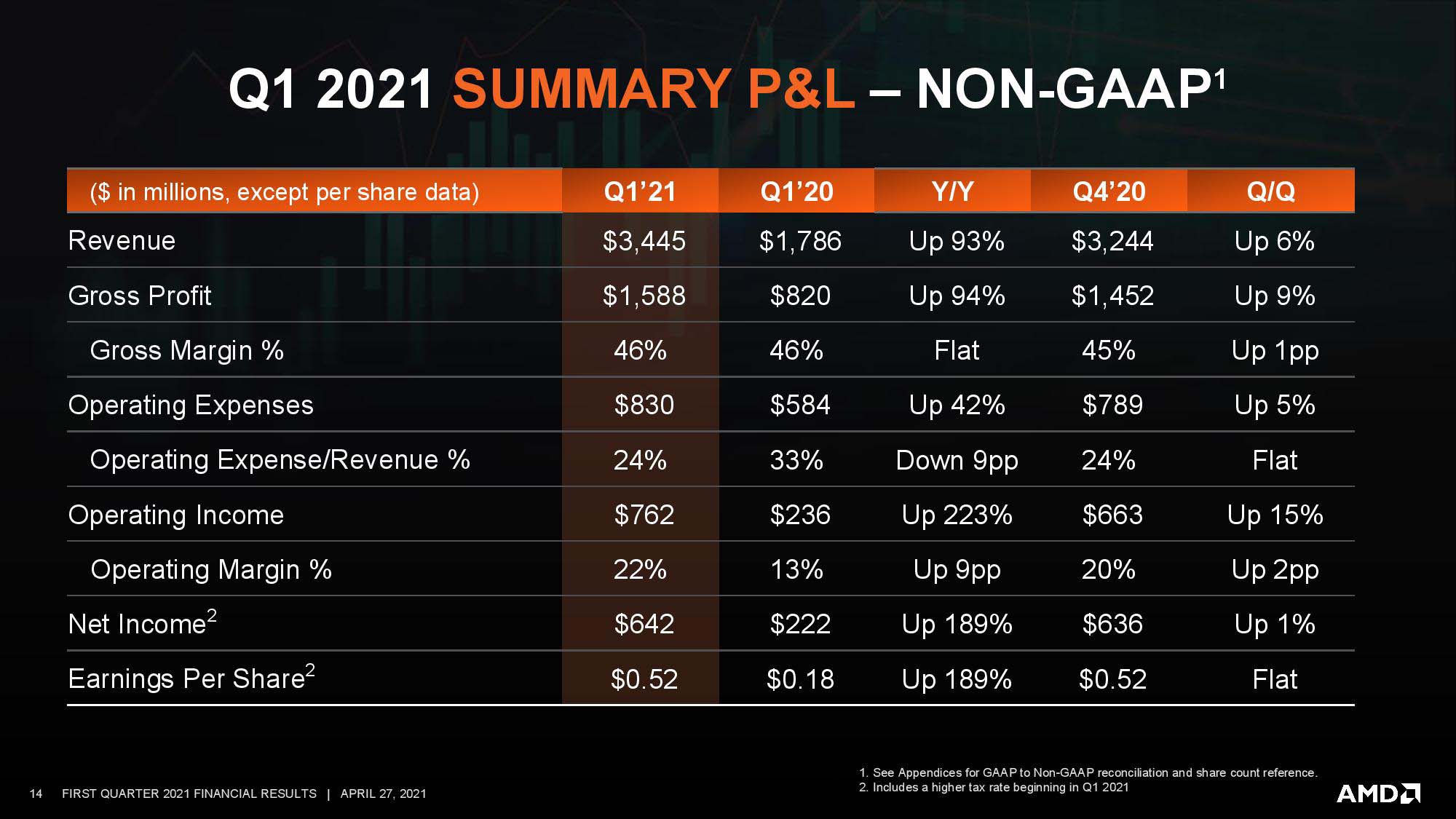

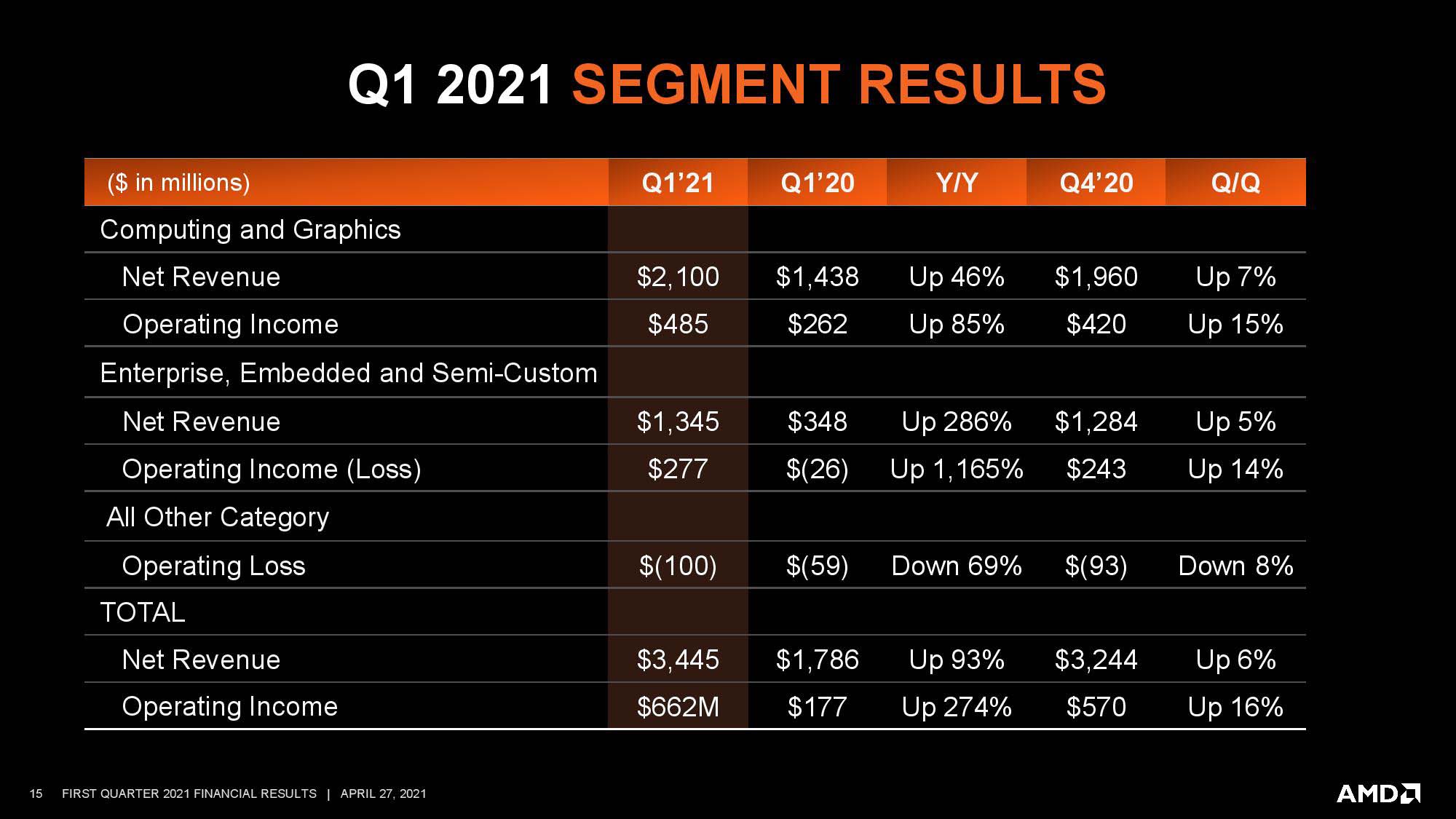

AMD crushed expectations with its first-quarter 2021 financial results today with record quarterly revenue of $3.45B, an increase of 93% year over year (YoY). AMD grew in every segment despite constant product shortages for its consumer CPUs and GPUs at retail, a byproduct of record demand and pandemic-spurred supply chain disruptions.

It's no secret that AMD has been plagued by shortages of consumer CPUs and GPUs, but the company is obviously selling every piece of silicon it can punch out. AMD raked in $2.1 billion for the computing and graphics segment (consumer CPUs and GPUs), a 46% improvement over the prior year driven by Ryzen and Radeon sales.

AMD's Ryzen processors set records for revenue and average selling prices (ASPs). AMD also says it has increased its desktop PC market share again, an encouraging sign for the company after Intel stole back some desktop PC market share last quarter. However, Intel reported last week that it suffered a sharp decline in ASPs for both its notebook and desktop PC chips due to a shift in its sales mix to lower-end processors. That shift is likely due to AMD's continued performance lead with its Ryzen 5000 processors and strong sales of its higher-end models. AMD CEO Lisa Su remarked that AMD remains firmly focused on its high-end products.

AMD is also doing well in the notebook segment, with Su remarking, "We delivered our sixth straight quarter of record mobile processor revenue based on sustained demand for Ryzen 4000 series processors and the launch of our new Ryzen 5000 series processors." Notably, Intel also sold a record number of notebook PC chips last quarter, but it suffered a sharp 43% decline in average selling prices.

Su also said that the company had doubled its Radeon 6000 GPUs sales over the prior quarter and that GPU supply will improve in the next quarter.

AMD's Enterprise, Embedded, and Semi-Custom (EESC) group, which covers data center chips and game consoles, was up an incredible 286% over last year as it raked in $1.35 billion, largely driven by strong EPYC processor sales that more than doubled (consoles declined slightly during the quarter).

Notably, during its last earnings report, Intel claimed that its data center processor business suffered from the second quarter in a row of cloud "digestion," meaning customers were still working through their existing inventory of chips, leading to a massive drop in its own revenue for this important high-margin segment. On the surface, it appears that some of that drubbing took place at the hands of AMD's EPYC Rome and Milan chips. AMD's data center revenue accounted for a 'high-teens' percentage of the company's revenue.

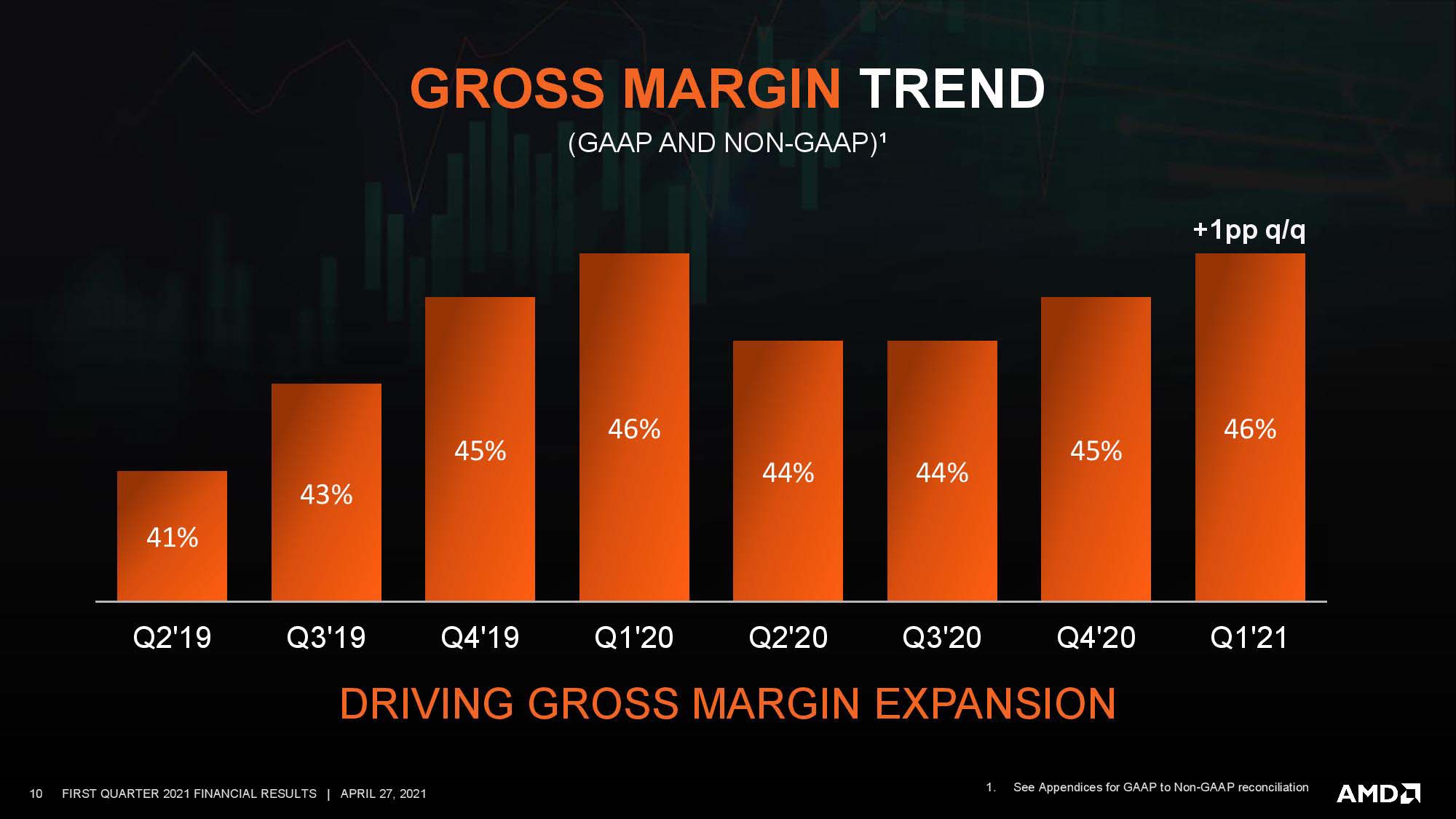

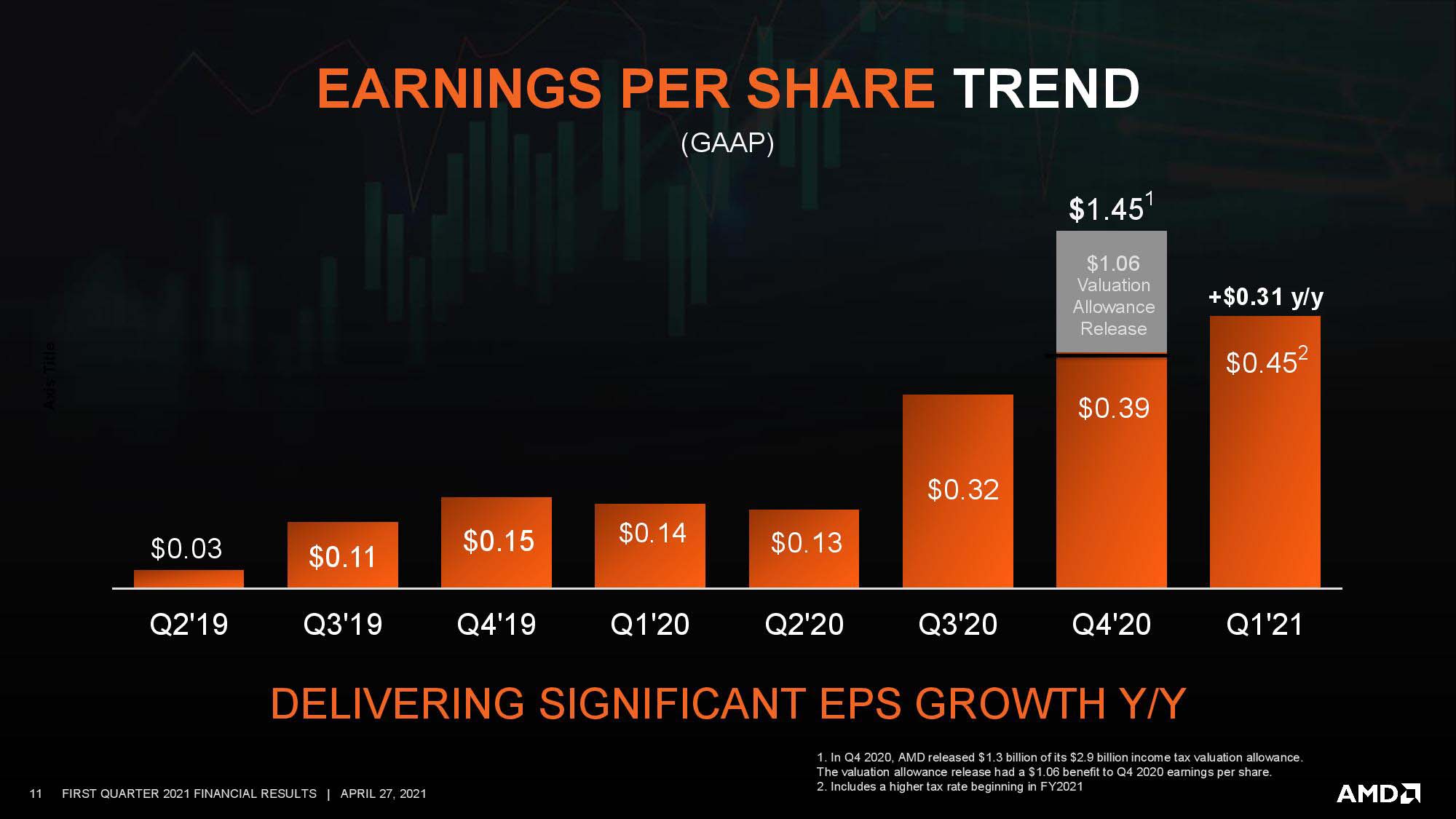

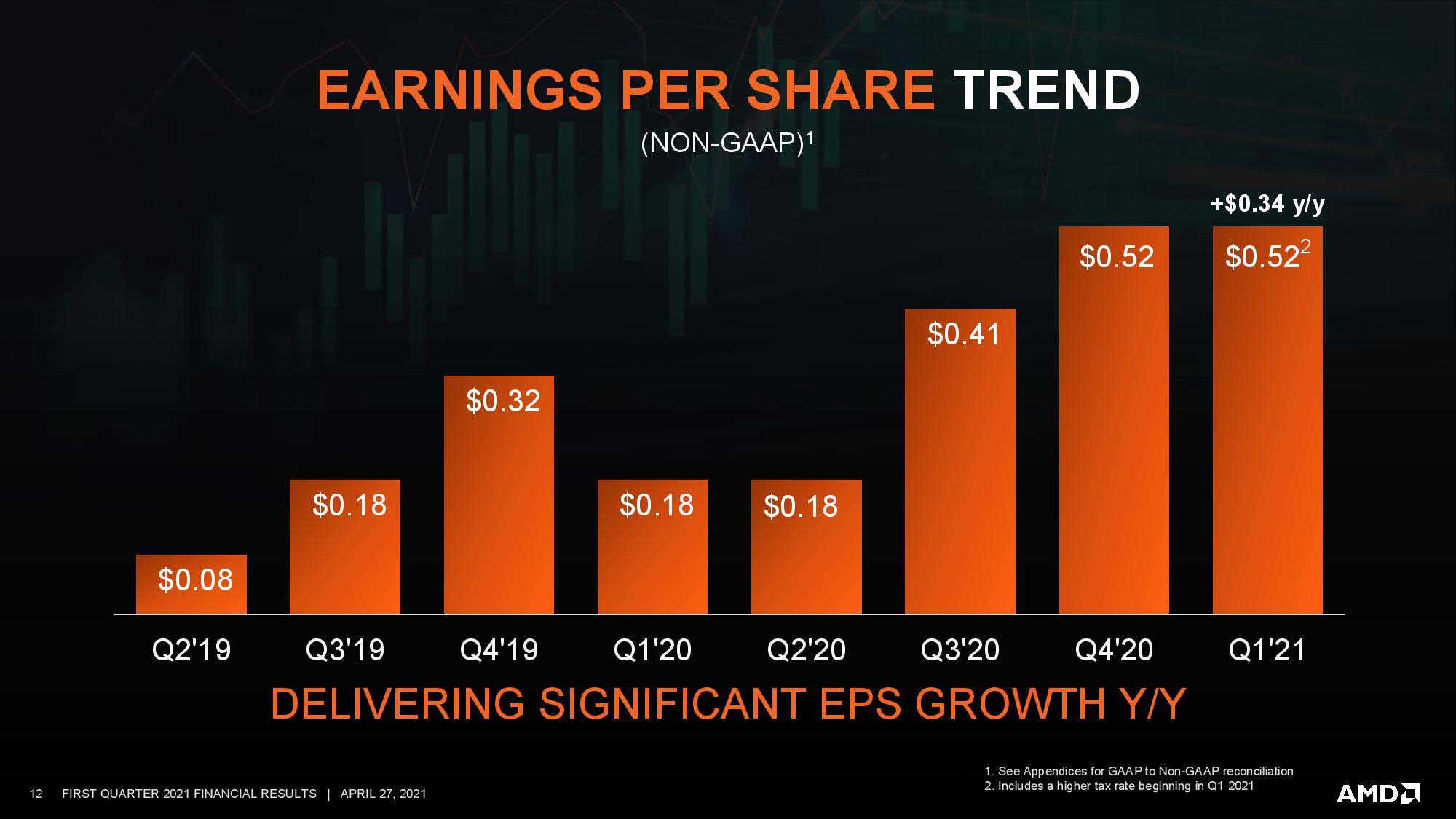

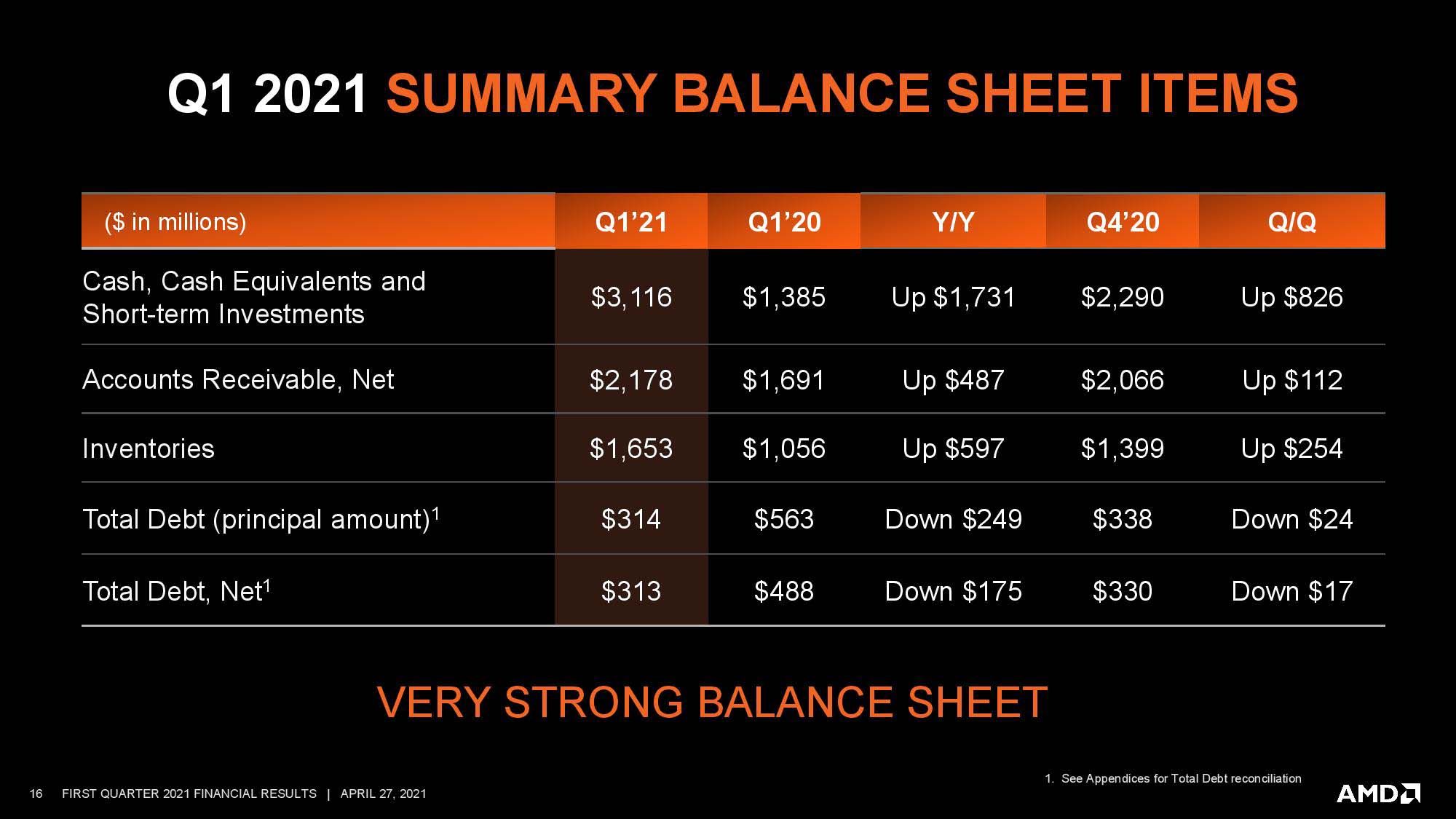

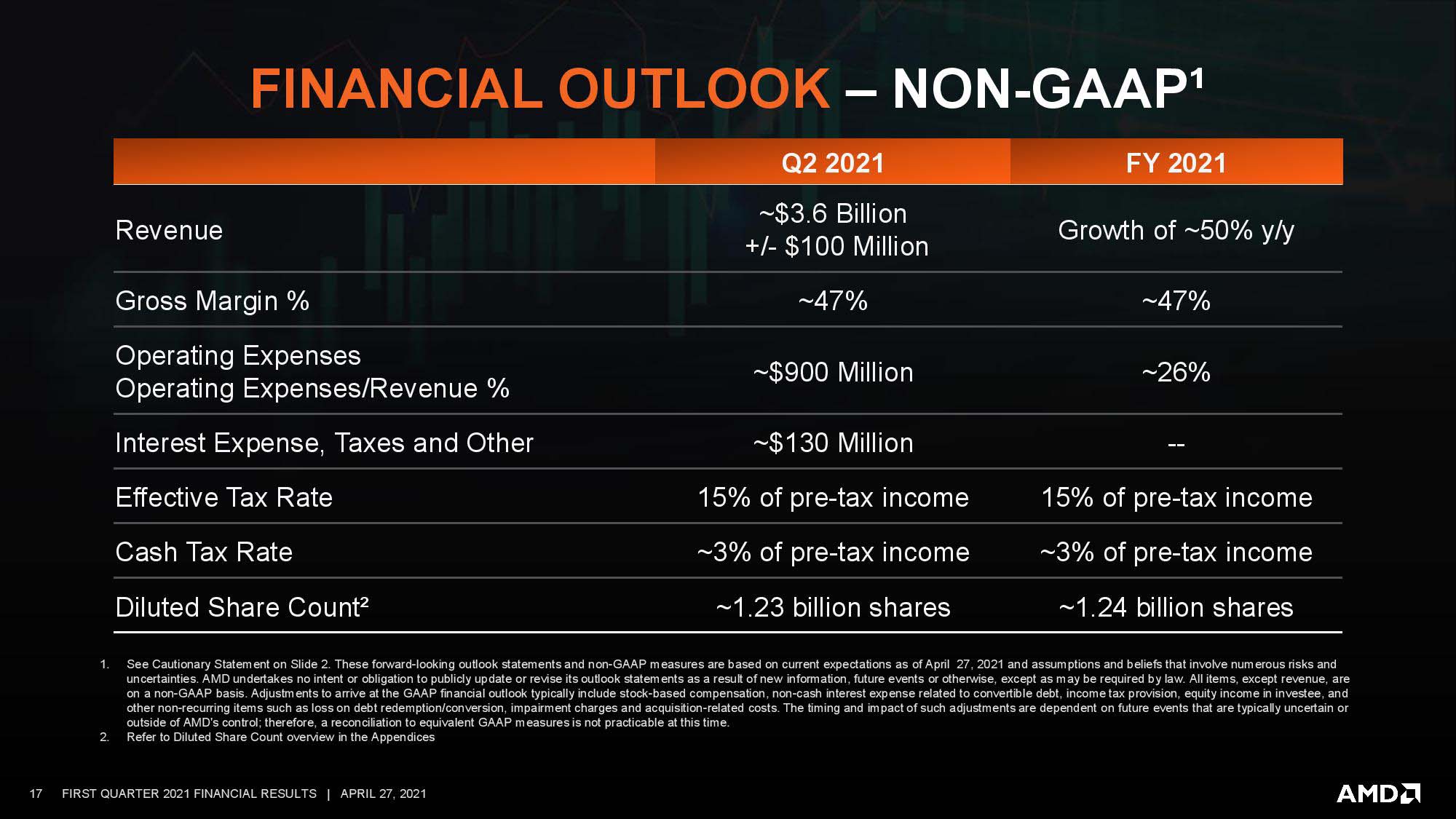

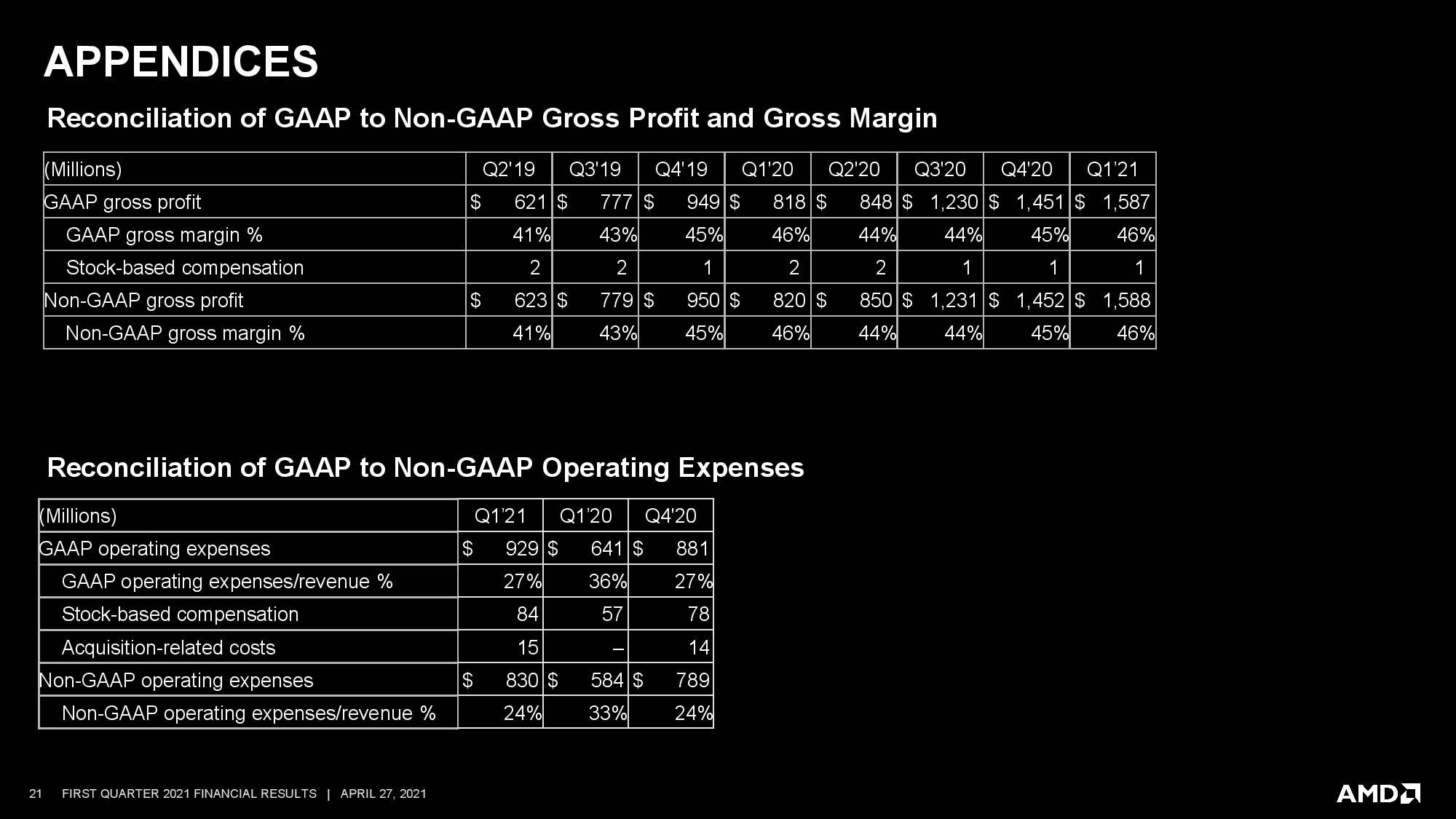

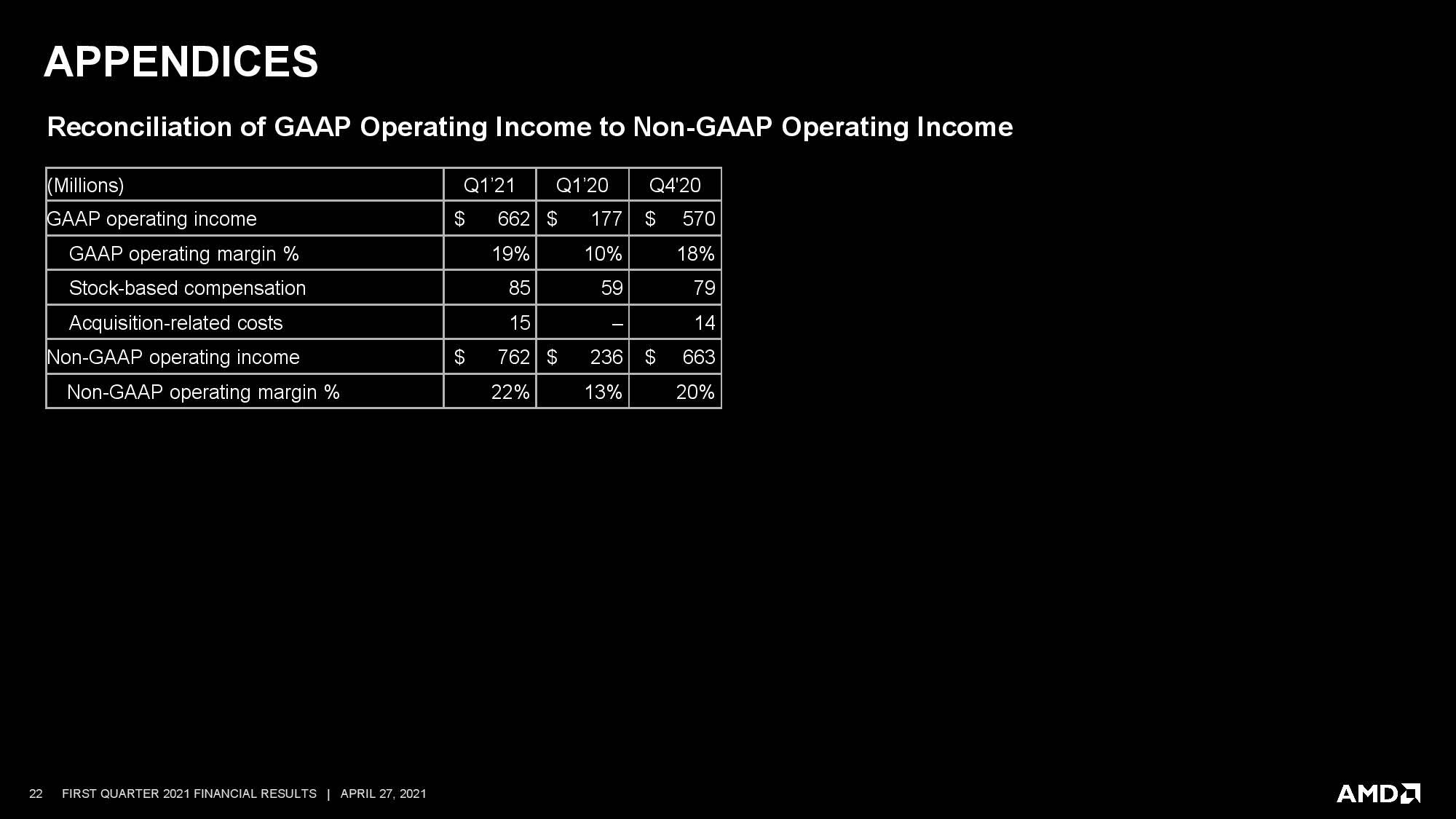

AMD reported gross margins of 46%, which is flat for the year. The company has also raised its guidance for the year by $1.3 billion dollars, indicating that it expects the impressive performance will continue throughout the end of the year. That's an increase from the previously-projected 37% annual growth to a projection for 50% annual growth. Su commented that this increased projection is due to increased demand in both the data center and consumer markets.

Overall, AMD posted an almost flawless quarter, especially in light of the current state of the global market. AMD also guides for an impressive $3.6 billion next quarter, an impressive 86% YoY gain during what is historically a slower quarter.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

watzupken This just shows that Intel's popularity is waning. Intel can deny this fact, but the truth is in the numbers. Intel still makes good chips, but the fact AMD is getting more popular over the years will eventually eat into their revenue since companies will either go for the more value for money AMD chips, or expect Intel to price their products more competitively. I am not expecting Intel's revenue and profit to go back to "normal" anytime soon.Reply -

Lorien Silmaril I almost choked when I saw Intel's explanation for the decline in the data center segment: client "digestion"? more like client "indigestion" from your subpar products and nonsensical segmentation! what a lame excuse! just admit you are behind and promise to do better!Reply

it's like when Intel blamed the pandemic for performing below expectations last year even though AMD was just soaring through the roof. -

Makaveli ReplyLorien Silmaril said:I almost choked when I saw Intel's explanation for they decline in the data center segment: client "digestion"? more like client "indigestion" from your support subpar products and nonsensical segmentation! what a lame excuse! just admit you are behind and promise to do better!

it's like when Intel blamed the pandemic for performing below expectations last year even though AMD was just soaring through the roof.

Typical corporate jargon for we are losing market share to our competitors but can't say that directly. -

VforV Reply

Good chips? Really? Compared to what? Maybe compared to "no chips", sure they are good, as in better than nothing, but compared to AMD they are not good at all.watzupken said:This just shows that Intel's popularity is waning. Intel can deny this fact, but the truth is in the numbers. Intel still makes good chips, but the fact AMD is getting more popular over the years will eventually eat into their revenue since companies will either go for the more value for money AMD chips, or expect Intel to price their products more competitively. I am not expecting Intel's revenue and profit to go back to "normal" anytime soon.

I'm not optimistic much that Alder Lake will be good either, but I guess we'll see. Maybe for mobile market it will be. -

Jim90 This is good news and good news for innovation and competition too - we can't have another prolonged and very deliberately underwhelming spell that we saw with Intel before AMD's Zen. Now that we know GPU's are in for a serious uplift with multi-die RDNA3/4 and Hooper, and Intel hopefully on GPU track too, this can be only good news for everyone.Reply

Now, if only mining could crash and burn. -

TerryLaze Just keep in mind that AMD pools data center and semicustom (consoles) into the same group.Reply

AMD may be doing great in datacenter but without having the exact numbers for each it would just be a guess.

For example xbox had a similar growth rate to AMDs datacenter numbers.

"Xbox hardware was up 232% YoY due to Series X | S demand + favorable comp vs last year"

https://gamerant.com/xbox-3-5-billion-q1-2021/ -

mitch074 Reply

True, but the article did mention a "high-teens" uplift in data center chips, meaning at least a 15% increase YoY in data center. Considering how slow to migrate this segment can be, it's still very good.TerryLaze said:Just keep in mind that AMD pools data center and semicustom (consoles) into the same group.

AMD may be doing great in datacenter but without having the exact numbers for each it would just be a guess.

For example xbox had a similar growth rate to AMDs datacenter numbers.

"Xbox hardware was up 232% YoY due to Series X | S demand + favorable comp vs last year"

https://gamerant.com/xbox-3-5-billion-q1-2021/ -

watzupken Reply

Being second don't automatically mean its a poor chip. Objectively speaking, if you look at Rocket Lake, it is actually competitive, but letdown by a dated 14nm which results in high power consumption and consequently high heat output. If you are looking for an example of a poor chip, then perhaps Bulldozer will be one that stands out as being poor. FYI, I am using a Zen 3 processor, so to clarify I am not some Intel fanboy. Just stating an objective view here.VforV said:Good chips? Really? Compared to what? Maybe compared to "no chips", sure they are good, as in better than nothing, but compared to AMD they are not good at all.

I'm not optimistic much that Alder Lake will be good either, but I guess we'll see. Maybe for mobile market it will be.

I would agree with your second point about Alder Lake. I am skeptical it will turn Intel's fortune around. The odd reason to include efficient cores, i.e. Atom processors or what they call Pentium/Celeron Silver, don't make much sense on a desktop processor. It almost feels like 10nm is not dense enough to accomodate 10 or more cores that they were forced to try to be "creative" and squeeze in efficient cores, instead of performance ones. Net effect, its gonna impact their multicore performance big time even if they market it as 16 cores/ 24 threads. It made sense in the mobile market for sure from a power saving standpoint, but its mostly a poor fit for desktop processors particularly in the DIY market. -

tomachas Reply

I just came across explanation of such language used in marketing and by politicians. It's called doublespeech . When you replace words with undesired effects to more acceptable. Let's say sugar can be called organically evaporates cane juice. Canibalism funny enough has one too and it's protein relocation. So for this instance what they probably mean consumers don't really have appetite for Intel chips as they used to.Lorien Silmaril said:I almost choked when I saw Intel's explanation for they decline in the data center segment: client "digestion"? more like client "indigestion" from your support subpar products and nonsensical segmentation! what a lame excuse! just admit you are behind and promise to do better!

it's like when Intel blamed the pandemic for performing below expectations last year even though AMD was just soaring through the roof. -

dalek1234 Replywatzupken said:Being second don't automatically mean its a poor chip. Objectively speaking, if you look at Rocket Lake, it is actually competitive, but letdown by a dated 14nm which results in high power consumption and consequently high heat output. If you are looking for an example of a poor chip, then perhaps Bulldozer will be one that stands out as being poor. FYI, I am using a Zen 3 processor, so to clarify I am not some Intel fanboy. Just stating an objective view here.

I would agree with your second point about Alder Lake. I am skeptical it will turn Intel's fortune around. The odd reason to include efficient cores, i.e. Atom processors or what they call Pentium/Celeron Silver, don't make much sense on a desktop processor. It almost feels like 10nm is not dense enough to accomodate 10 or more cores that they were forced to try to be "creative" and squeeze in efficient cores, instead of performance ones. Net effect, its gonna impact their multicore performance big time even if they market it as 16 cores/ 24 threads. It made sense in the mobile market for sure from a power saving standpoint, but its mostly a poor fit for desktop processors particularly in the DIY market.

For me high-power-consumption alone makes it a "poor chip", as it results in increased heat, cooling noise, and electrical bill, but I guess some people might not care about those specific fallouts. I do agree though, that bulldozer takes the crown for 'poor chip'.

Re: Alder Lake: I'm dying to see those multi-core benchmarks. I too think that they will be <Mod Edit> because of those 'efficient' cores. However, Intel will be telling many reviewers on how to test, to make them look not as bad. I suspect that an Intel 16 core (8 big, 8 small) CPU will be compared to AMDs 8 core one instead of the 16 core. Reviewers will be arguing that it is only fair to compare Intel's 8 big cores to AMDs 8 'big' cores, while in reality this will be comparing apples to oranges. When Alder Lake launches, I expect Intel's marketing and string-pulling departments to be in full BS swing.

Given Intel's roadmaps screw-ups, I expect Alder Lake to become available to purchase "later" rather than "sooner" so along-side Zen3+ probably.