TSMC posts record quarter results as skyrocketing AI and HPC demand drives two-thirds of revenue — company pulls in $33.1 billion

$33.1 billion per quarter.

TSMC on Thursday reported revenue of $33.10 billion, marking its best quarter ever. The record earnings were driven by booming sales of AI processors and infrastructure — which now command nearly two-thirds of the company's sales — as well as ramp-up of Apple's latest N3P-based processors for smartphones and PCs. The company expects AI drive to continue in the foreseeable future and forecasts further revenue growth in the final quarter of the year.

TSMC's third quarter revenue topped $33.1 billion (NT$989.92 billion, nearly a trillion Taiwan Dollars), up 40.8% year-over-year and 10.1% quarter-over-quarter. The foundry posted net income of $14.77 billion (NT$452.30 billion), up 39.1% year-on-year, while earnings per share came in at NT$17.44, or US$2.92 per American Depositary Receipt. TSMC's gross margin reached 59.5%, which is an extraordinary result for a foundry that makes chips for others and does not sell them itself. Still, as the company is ramping up its fabs in Japan and the U.S., its gross margin is taking a hit.

The company's revenue in the recent quarters was primarily driven by skyrocketing sales of AI accelerators and various AI infrastructure processors, such as CPUs, DPUs, and networking components. In the third quarter, TSMC also began to recognize revenue from Apple's latest processors made on its N3P (3rd generation 3nm-class) fabrication process, including A19 and A19 Pro for smartphones and M5-series for desktops, notebooks, and high-end tablets.

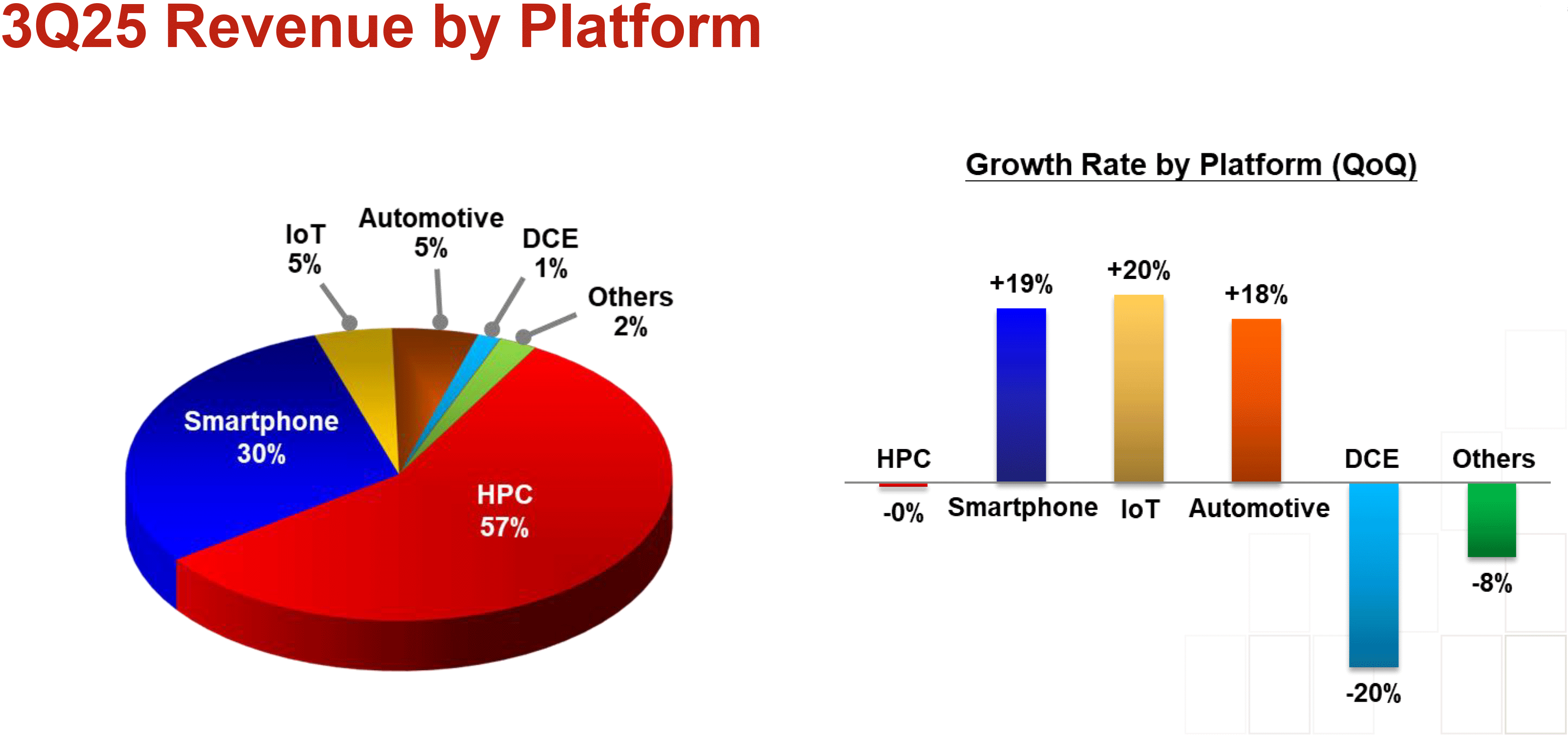

Overall, HPC products retained their leadership in terms of TSMC's revenue share and accounted for 57% of the company's total wafer sales. Smartphone processors were distant second with 30%, followed by automotive (5%) and IoT (5%). Interestingly, dollar sales of HPC components did not really grow from last quarter, which highlights strong and stable demand for these processors, whereas smartphone chips were up 19% sequentially, primarily due to the iPhone 17-series ramp.

Note that TSMC's HPC platform is a broad and somewhat ambiguous category that spans a wide range of chips — from entry-level CPUs for PCs and SoCs for game consoles to top-tier data center CPUs and massive AI accelerators built with advanced packaging technologies.

In its latest report, the company emphasized that strong demand from AI and HPC customers continued to be one of the main drivers of its sales and indicated that demand from these clients will remain strong going forward.

"We expect our business to be supported by continued strong demand for our leading-edge process technologies," said C.C. Wei, chief executive of TSMC, during the company's earnings call with analysts and investors. "We continue to observe robust AI-related demand throughout 2025, while non-AI end market segment have bottomed out and are seeing a mild recovery."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

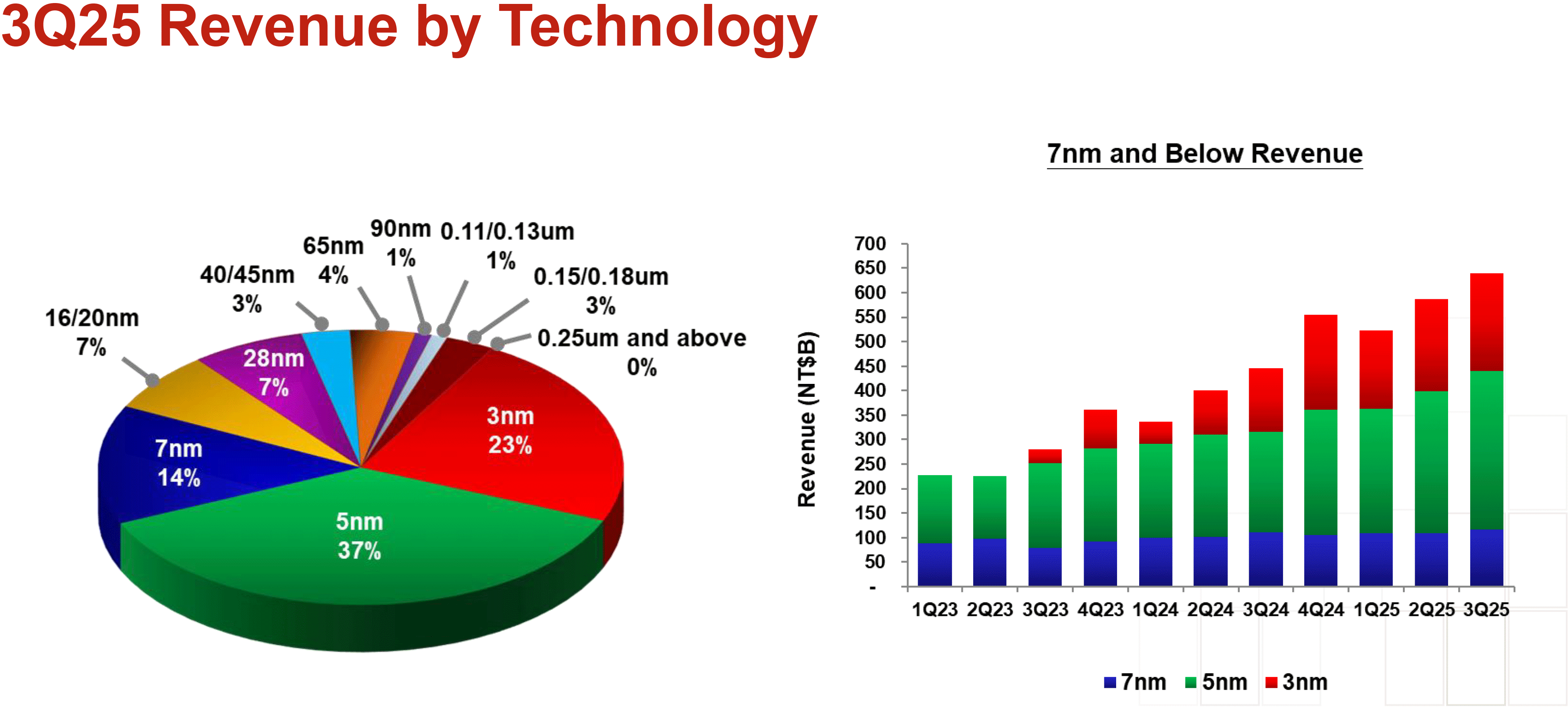

Speaking of leading-edge nodes, in the third quarter, TSMC's 3nm-class production node contributed 23% of TSMC's total wafer revenue, N5-series technologies accounted for 37%, while N7 processes made up 14%. Altogether, advanced process technologies — defined as 7nm and below — represented 74% of total wafer revenue during the period.

TSMC does not expect its sales — driven by AI, HPC, and mobile offerings — to slow down in the fourth quarter. The company expects revenue to be between $32.2 billion and $33.4 billion and gross profit margin to be between 59% and 61%.

"Our business in the third quarter was supported by strong demand for our leading-edge process technologies," said Wendell Huang, Senior VP and Chief Financial Officer of TSMC. "Moving into fourth quarter 2025, we expect our business to be supported by continued strong demand for our leading-edge process technologies."

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.