Nvidia's market capitalization hits $5.12 trillion — AI powerhouse is the first company in history to hit seismic milestone

The most expensive company ever.

The market capitalization of Nvidia passed the $5 trillion mark on Wednesday, following a host of potentially lucrative deals and projects the company announced at its GPU Technology Conference event on Tuesday. The company's stock price continues to be driven by the broad interest towards artificial intelligence and Nvidia's unique position in the AI supply chain that now spans from humble chips for inference to gigawatt-scale data centers for massive AI training.

At its GTC 2025 conference in Washington, D.C., Nvidia made a number of announcements that could potentially bring tens, if not hundreds, of billions of dollars in revenue to the company in the coming years. Among the highlights announced by Nvidia are reference designs for gargantuan gigawatt-scale AI data centers that will let newcomers to build new AI factories using Nvidia blueprints and hardware; partnership with Palantir to build an integrated stack for operational AI; the deal with Uber to use Nvidia's Level 4 AGX Drive Hyperion platform for its fleet of autonomous robotaxis as well as adoption of the same platform by Mercedes, Stellantis, Volvo, Lucid, and Foxconn; NVQLink technology to attach Nvidia GPUs to quantum computers; partnership to build AI-RAN products with Nokia; contracts to build seven AI supercomputers for the U.S. government; and plans to build AI-native 6G networks in the U.S. together with partners.

The new announcements place Nvidia at the center of the large-scale AI supply chain, which will drive demand for the company's hardware and software solutions. Nvidia's AI platform comprises numerous products, including GPUs, CPUs, DPUs, NVLink switches, and Ethernet and Infiniband solutions. If one wants to build an Nvidia-based cluster or data center for AI, they will inevitably procure plenty of Nvidia-designed hardware and software to build it and operate it.

While for now Nvidia supplies AI hardware to companies like AWS, Alphabet, Google, Microsoft, OpenAI, and xAI, in the coming years, it is going to expand its total addressable market to both established players across industries (e.g., Lilly is already building its own AI data center) and new players that have yet to become significant in their realms. Even established companies are increasing their demands for AI GPUs. For example, Nvidia supplied about four million Hopper-based AI GPUs throughout the architecture's active lifetime, and shipments of Blackwell stand at six million units now and yet have to peak. With new participants entering the AI field, sales of Nvidia's hardware are poised to skyrocket.

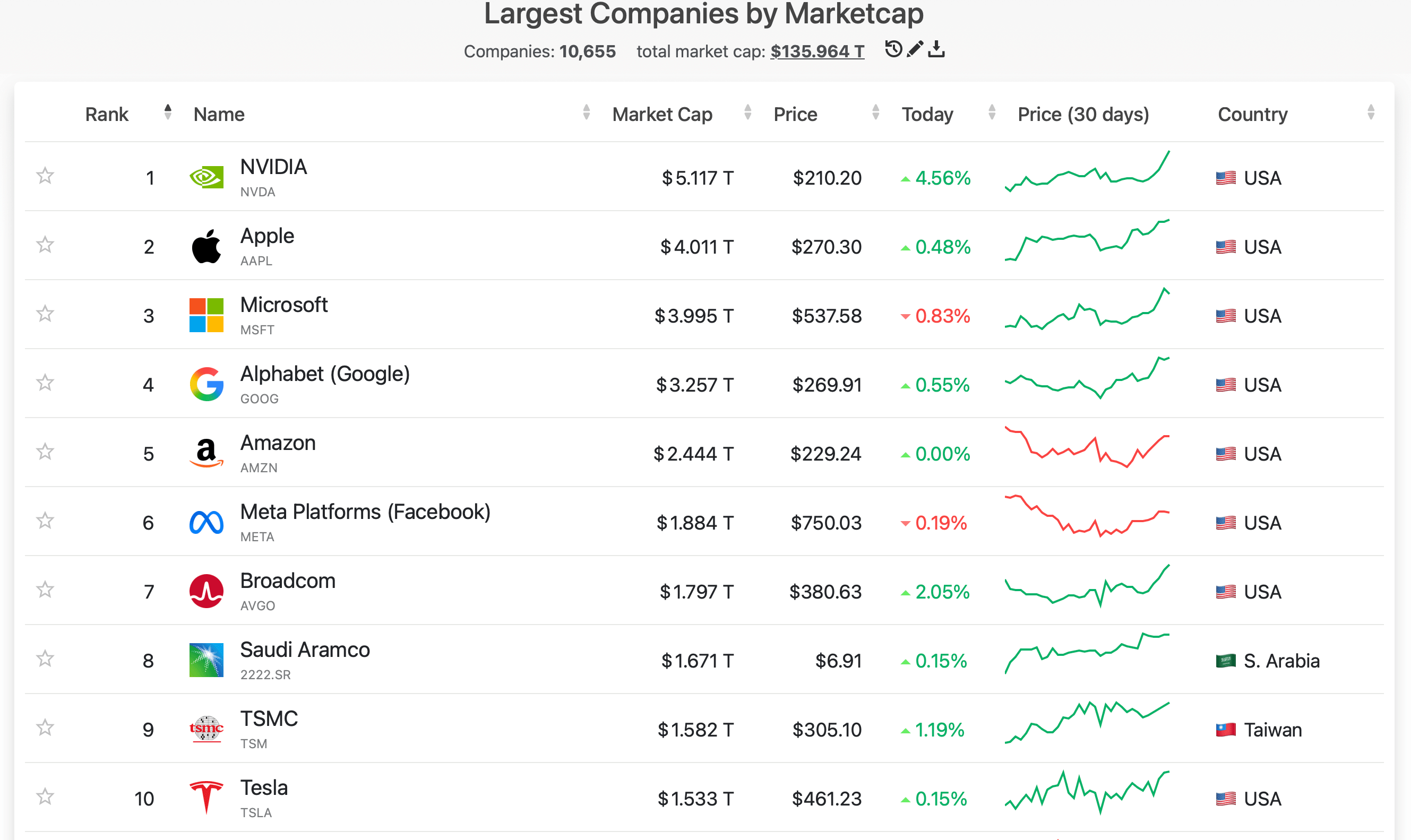

Nvidia's unique position in the growing AI supply chain places it well above other semiconductor and high-tech companies as far as market capitalization is concerned. The company at press time cost over a trillion dollars more than Apple ($4.011 trillion) and Microsoft ($3.995 trillion), nearly two trillion dollars more than Alphabet ($3.257 trillion), and two times more than Amazon ($2.444 billion).

Interestingly, TSMC — the key supplier to Nvidia that produces all of its silicon — now has a market capitalization of $1.582 trillion, whereas ASML — the key supplier to TSMC — now costs $416.5 billion.

Market capitalization of Nvidia's traditional rivals — AMD and Intel — stands at $429 billion and $197 billion, respectively.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Dementoss Reply

There's going to be some massive losses if, as some predict, the AI bubble goes pop.Admin said:Nvidia's market capitalization hits $5.12 trillion. -

Neilbob Reply

And even if there's not an outright 'pop', this kind of growth cannot be sustainable.Dementoss said:There's going to be some massive losses if, as some predict, the AI bubble goes pop.

On the plus side, Jensen can flog half of his hide-based wardrobe on eBay and claw back another trillion if things go downhill. -

bit_user Reply

He's only a rock star while the hype train keeps going. If the market crashes, his star power will decline along with it. Not to zero, but he won't be quite such a celebrity.Neilbob said:On the plus side, Jensen can flog half of his hide-based wardrobe on eBay and claw back another trillion if things go downhill. -

Nvidia’s market cap graph looks like it’s been training on steroids. Somebody nerf this company before it becomes self-aware.Reply

-

Bigshrimp ReplyDementoss said:There's going to be some massive losses if, as some predict, the AI bubble goes pop.

It's going to pop is my guess as well. Going to be really bad when it does too... -

alrighty_then Quantum, robots, self driving cars...they're in everything that matters in the future. Sure lots of speculation but, go big green!Reply

Admittedly, NVIDIA stock profits already paid for my wedding multiple times over, so I'm biased. -

bit_user Reply

Nvidia definitely will not go away, after the big AI crash. I think they're doing more than enough to secure their future. However, protecting their valuation is a very different question.alrighty_then said:Quantum, robots, self driving cars...they're in everything that matters in the future. Sure lots of speculation but, go big green!

BTW, do you know of any car makers who are using their self-driving stuff? -

thisisaname How much of the increase in Nvidia's "worth" is down to the circular investment of chip and AI companies?Reply -

bit_user Reply

AI companies aren't investing in Nvidia. They're all losing money and dependent on their investors.thisisaname said:How much of the increase in Nvidia's "worth" is down to the circular investment of chip and AI companies?

If your question is how much of Nvidia's revenues are from AI companies they're effectively selling hardware in exchange for equity, that's a good question. You could check Nvidia's financials and see how much their equity holdings have increased, and then I'll bet that's pretty much all due to purchases of their hardware they've financed.