TSMC to reportedly raise quotes on advanced process nodes by up to 10% next year to pay for new fabs

But will customers accept higher costs with no questions asked?

TSMC intends to raise prices on wafers produced using its advanced process technologies by 5% to 10% starting in 2026, according toa report by DigiTimes. The new pricing strategy reportedly is said to reflect the company's increased capital expenditures (CapEx) — driven by expansion of advanced manufacturing capacities in the U.S. and Taiwan — amid the intention to keep its margin targets on track. We performed the basic math and found that a price increase would significantly improve the company's CapEx position; however, we await further clarification from TSMC regarding the reported price hikes.

An up to 10% price hike next year

The new pricing model will purportedly apply to the N5, N4, and N3-series (5nm, 4nm, and 3nm-class) process technologies, but adjustments will differ depending on the application segment and the customer's purchasing behavior. Smartphone processors are expected to see a 5% increase, production quotes on CPUs are projected to rise by 7%, whereas large processors for AI and HPC applications will see a 10% increase.

Customers who order both legacy and cutting-edge nodes may be eligible for special pricing benefits in a bid to encourage the use of TSMC's technology portfolio, deepen client engagement across multiple product categories, and ensure that the foundry's outdated fabs remain fully utilized. However, customers focusing only on the latest nodes would bear the full extent of the increase.

It is noteworthy that, at present, chip production at TSMC's Fab 21 in Arizona already comes at a roughly 15% premium compared to the company's fabs in Taiwan. Despite this, the upcoming 2026 price adjustments are said to be implemented uniformly across all geographical sites, with no location-specific exceptions, so a hypothetical N5/N4-based chip made in Taiwan this year will be 25% more expensive once produced in the U.S. next year. Hence, it will still be cheaper to make silicon in Taiwan.

Lisa Su, the chief executive of AMD, recently confirmed that the cost of producing chips in the U.S. is between 5% and 20% higher compared to Taiwan. However, AMD has accepted these higher costs, which indicates that TSMC has successfully passed on extra expenses from U.S. fabs to its customers, softening some of the company's own margin pressures.

Node | Rumored price | Year |

A16 | $45,000 | 2026 H2 |

N2 | $30,000 | 2025 H2 |

N3 | $18,000 - $20,000 | 2022 H2 |

N5 | $16,000 | 2020 |

N7 | $10,000 | 2018 |

N10 | $6,000 | 2016 |

N28 | $3,000 | 2014 |

40nm | $2,600 | 2008 |

90nm | $2,000 | 2004 |

$9 billion extra revenue?

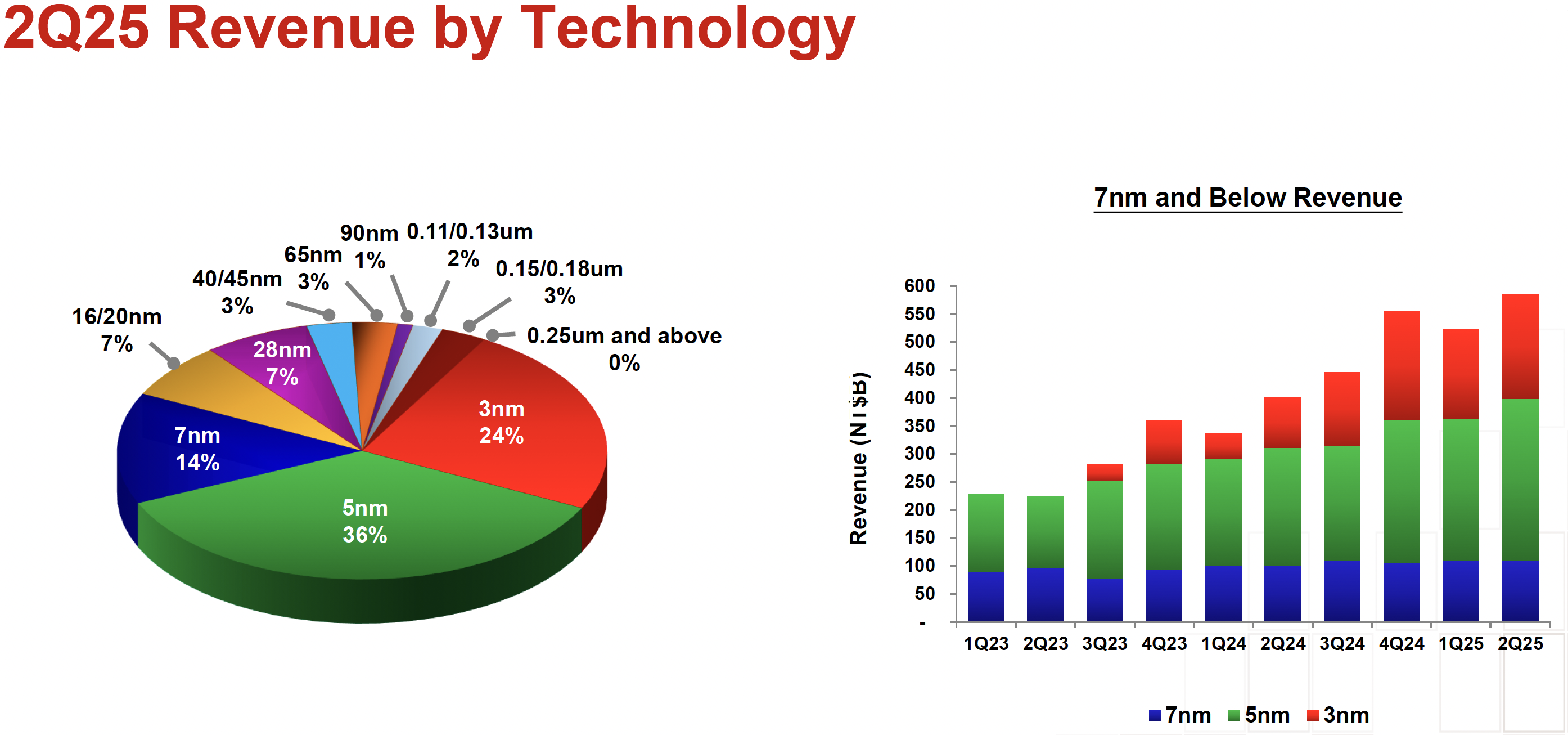

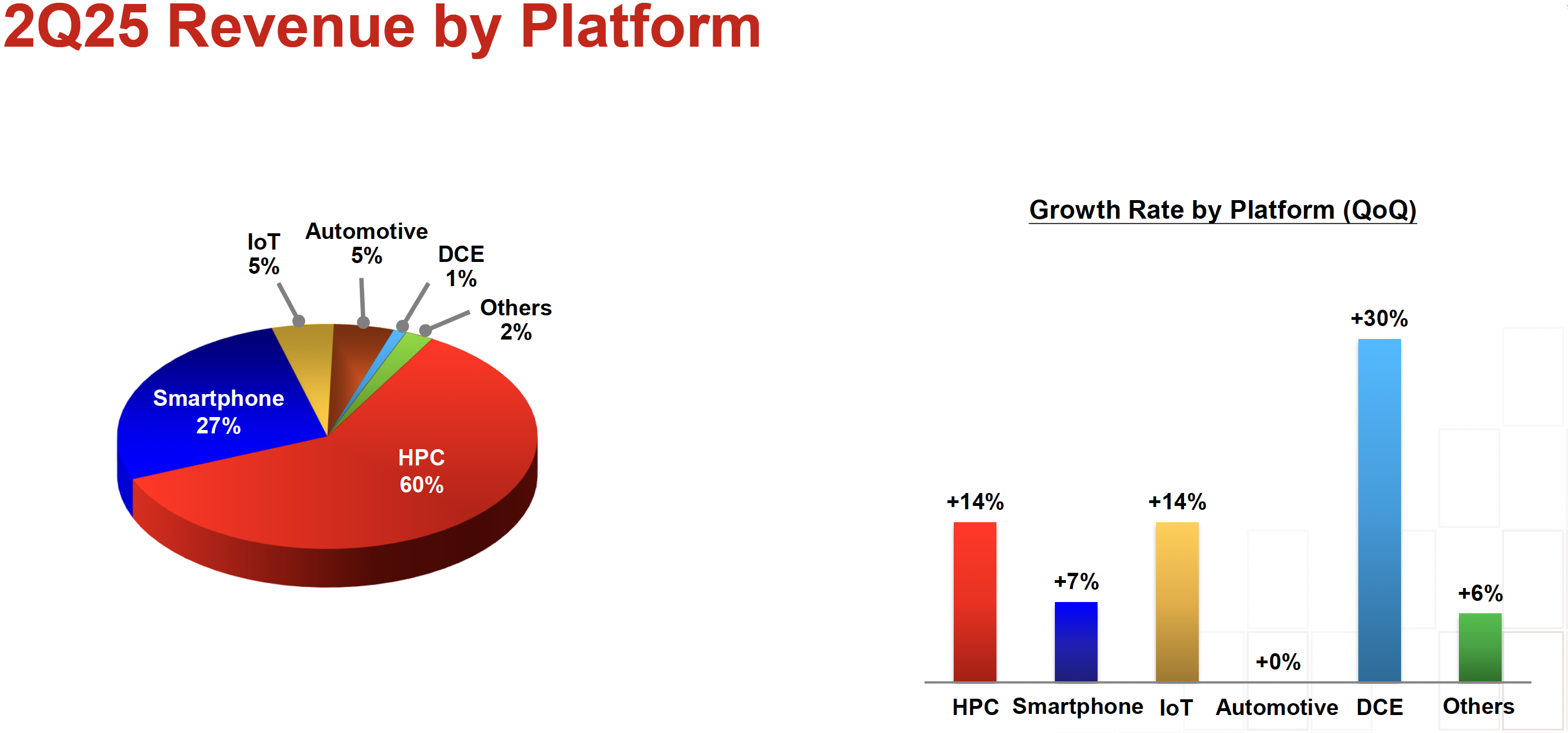

TSMC's official numbers reveal that N5/N4 and N3 process technologies accounted for around 50% of the company's wafer processing revenue in the second quarter of 2025. TSMC's HPC segment — which includes everything from game consoles to client PCs, and from graphics processors for gaming to GPUs for AI and HPC applications — accounted for 60% of its earnings, whereas SoCs for smartphones accounted for 27% of the company's $30.07 billion revenue in Q2 2025.

Given that the vast majority of smartphones and AI/HPC processors tend to transit to more advanced nodes from TSMC's N7/N6 fabrication technologies, it appears that TSMC plans to increase quotes on the vast majority (circa 87%) of products that it produces by 5% to 10% next year. Assuming that the average increase will be around 7.5% for N3 and N4/N5, the company will get an 'extra' $9 billion provided that TSMC's N3 and N4/N5 absolute revenues will remain at current levels. Since Apple will be ramping up production of chips on TSMC's N2 (which is more expensive than N3), TSMC's revenue is expected to increase; however, it remains to be seen whether the company's N3 revenue will remain at current levels.

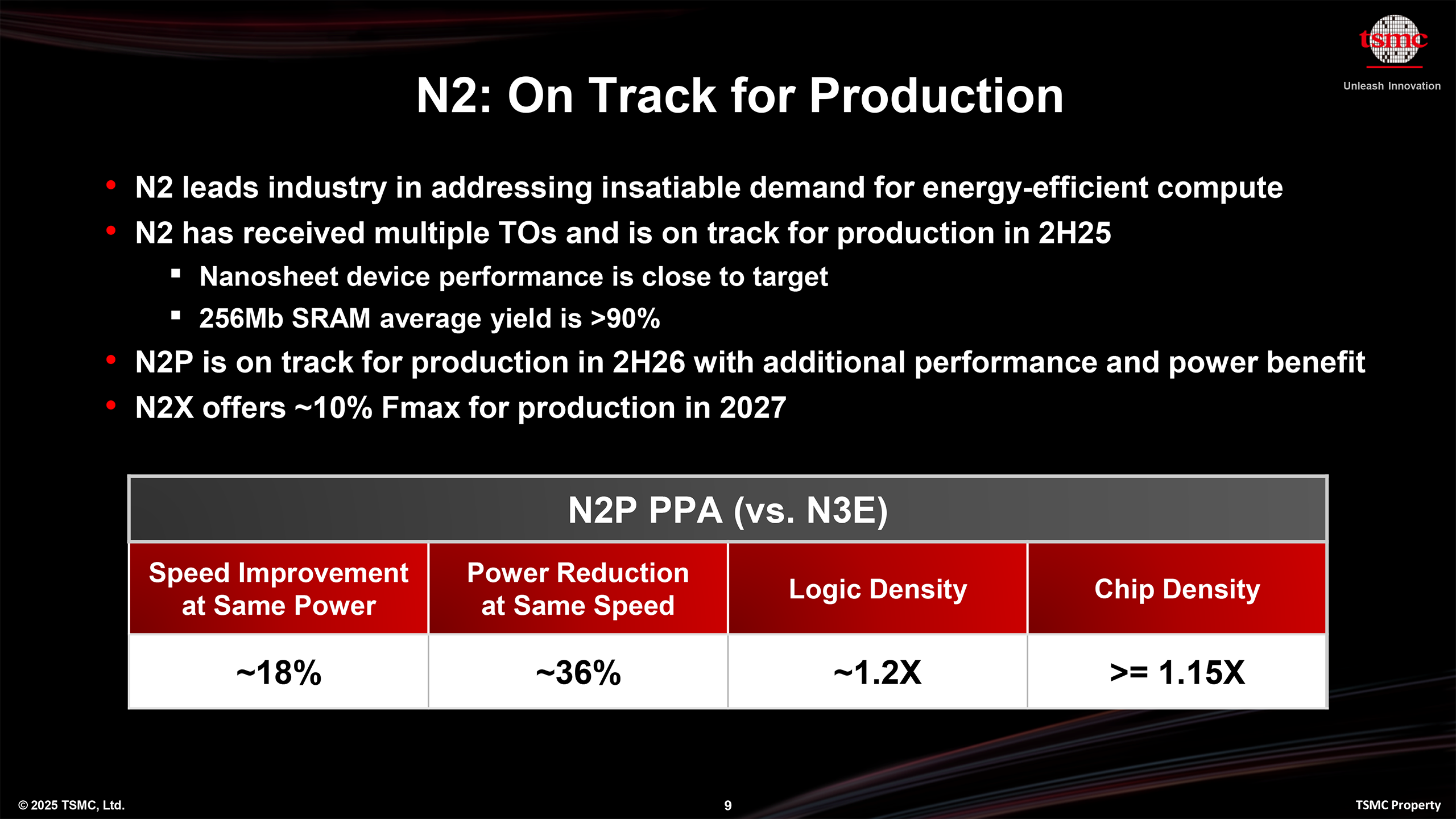

Keep in mind that N2/N2P/A16-capable fabs are more expensive than N3-capable fabs, so TSMC is spending more on its next-generation fabs than it did on its current-generation production facilities. In addition, the foundry must spend more on its N2-capable capacity as the technology is more popular among chip designers than N3 and N5 were at the same stage of development.

Also, given the company's commitment to build additional fabs in Arizona, an advanced packaging facility nearby, and an R&D center in the U.S. on top of leading-edge fabs in Taiwan in the coming years, the company might need to increase its CapEx for 2026, 2027, and 2028 beyond $42 billion, which is why a portfolio-wide price increase makes sense for the company.

$9 billion in extra earnings driven by increased prices will not buy TSMC a new N2-capable fab, but it represents 21% - 23% of the company's CapEx for 2025, which is expected to be between $38 billion and $42 billion. Therefore, $9 billion would be very instrumental to TSMC in terms of maintaining its margin and/or increasing its CapEx.

Are customers ready to pay more?

TSMC's customers seem to be ready for such price hikes, at least judging by comments from AMD and Nvidia's CEOs. TSMC's 3nm and 4nm/5nm-class technologies do not have any competition from Intel Foundry and have limited competition from Samsung Foundry.

With 2nm-class nodes, TSMC will feel even more comfortable for at least a couple of years. TSMC's 2nm-class technology provides significant performance, power, and area improvements compared to N3E and N3P, so the company's customers are expected to be willing to pay extra for it. This is why the foundry is rumored to be planning to charge $30,000 per N2 wafer and $45,000 per A16 wafer. Since there are multiple companies taping out N2/N2P chips now and planning to mass produce them in 2026 – 2027, they will have no choice but to purchase those wafers at TSMC.

Last but not least, keep in mind that TSMC will not have any rivals with its 2nm-class fabrication technologies for quite a while. Intel's 18A — even though it features gate-all-around transistors and backside power delivery, unlike N2/N2P that only rely on GAA transistors — is still not even qualified for mass production by third parties at Arizona fabs. Furthermore, it does not appear that there is significant interest in 18A outside of Intel.

Hence, at least before 18A-P or even 14A becomes available to Intel Foundry customers, TSMC's N2/N2P/A16 will be unrivalled, at least in terms of high-volume production. To that end, TSMC will reportedly rapidly expand N2/N2P/A16-capable capacity from less than 20,000 wafer starts per month in Taiwan in late 2025 all the way to 200,000 WSPM at multiple fabs in Taiwan and one in the U.S. by 2028.

TSMC needs tens of billions of dollars to fuel such massive leading-edge production capacity, and price hikes are among the ways to get them. We've reached out to TSMC for further clarification and await a response.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.