Server memory prices to double year-over-year in 2026, LPDDR5X prices could follow — 'seismic shift' means even smartphone-class memory isn't safe from AI-induced crunch

Shortage and high DRAM prices can undermine.

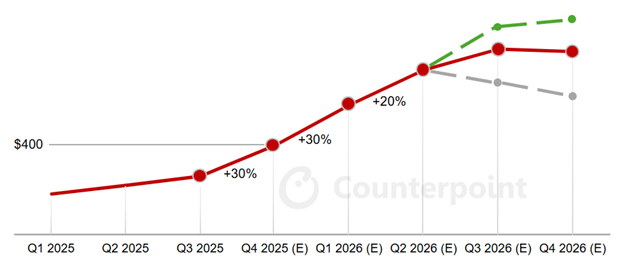

Due to shortages of commodity dynamic random access memory, prices of DRAM have already increased by around 50% year to date and are on track to increase by a further 30% in the fourth quarter and then by 20% more in early 2026, according to data from Counterpoint Research seen by Tom's Hardware. Server-grade DDR5 prices are likely to continue rising and double year over year by late 2026. Furthermore, as Nvidia uses LPDDR5X memory with its Grace and Vera CPUs, smartphone-class memory prices are poised to climb as well, Counterpoint asserts.

Demand for HBM memory — which uses more wafer space than commodity memory ICs — and the lack of new DRAM manufacturing capacity due to come online shortly are driving commodity DRAM prices to new highs. A 16GB DDR5 chip used to cost $6.84 on average at DRAMeXchange on September 20. As of November 19, its spot price was $24.83 on average (session low was $17.5, whereas session high was $35, which is why the average price was inflated). Without a doubt, this has an immediate effect on the DIY PC market, but it will certainly affect other parts of the industry, including those that tend to stockpile inventory worth months of sales, such as the automotive, server, and smartphone manufacturing sectors.

Given the galloping increases in DRAM prices, Counterpoint models a scenario in which DDR5 64GB RDIMM units could cost twice as much by the end of 2026 as in Q1 2025. Furthermore, as Nvidia uses LPDDR5X in its Grace Blackwell and Vera Rubin platforms and as demand for such servers is skyrocketing, prices of smartphone memory will also rise in the coming quarters. Indeed, each Grace CPU in today's platform is equipped with 480 GB of LPDDR5X memory (a premium smartphone uses 16 GB of LPDDR5X), but this is going to at least double with Vera CPUs, possibly straining LPDDR5X supply.

"The bigger risk on the horizon is with advanced memory as Nvidia's recent pivot to LPDDR means it is a customer on the scale of a major smartphone maker — a seismic shift for the supply chain which can’t easily absorb this scale of demand," said MS Hwang, research director at Counterpoint Research.

Budget smartphones that depend on LPDDR4 will be the first to feel the impact, but higher-end handsets and broader consumer electronics are also exposed. Some mid-tier and premium devices may face bill-of-materials increases of roughly 25%, which will either tighten manufacturers' margins or make them more expensive, according to Counterpoint Research.

In fact, the co-CEO of SMIC warned last week that the DRAM shortage could hit automotive and smartphone makers sooner rather than later. Specifically, the DRAM shortage may affect sales of logic chips in the automotive, smartphone, and consumer electronics segments.

"Be it carmakers, smartphones or consumer electronics, everyone that uses memory is facing pressure from price hikes and supply constraints in the coming year," said Zhao Haijun, co-CEO of SMIC, during a conference call with analysts and investors on Friday, as reported by Bloomberg. "Our customers are reluctant to place too many orders in the first quarter as they are not sure how many memory chips they can secure."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

SMIC is far from the world's largest producer of microelectronics for the automotive or smartphone industries, yet the share of automotive in its revenue is growing, accounting for 11.9% ($283.5 million out of $2.382 billion in revenue) in the third quarter. The smartphone share of SMIC's revenue declined to 21.5% ($512.13 million) from 25.2% in the prior quarter, which could reflect customers' reluctance to place orders amid uncertainty over DRAM supplies.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JayGau It's getting ridiculous. At some point consumers in general will start experiencing those insane price increases and won't be happy. In a couple of years, we might no longer be talking about the AI revolution but rather the AI crysis.Reply

Especially that prices for things everybody needs (laptops, desktops, phones, and now cars) will ramp up significantly directly because of AI but companies keep using the supposed AI capabilities of their products for branding and advertisement. When I look online for laptops, it's all AI this AI that. Will be interesting to see how consumers react to an advertisement argument that they know to be the direct cause of the price increase for every electronic products they need.