The state of Intel: What the company's $5 billion deal with Nvidia could mean for the floundering chipmaker — Investments, capex, and the beating heart of x86

An eye-watering and mind-boggling deal saw computer chips’ new king supplant what used to be the old name in town – but what does it all mean for Intel?

The news was as baffling as it was big: On September 18, Nvidia and Intel announced a collaboration to co-develop multiple generations of data center and PC products. As part of the deal, Nvidia said it would purchase $5 billion of stock in the troubled tech firm.

Intel was so dominant in the 1990s that it still holds a 75% share of the global consumer PC processor market. Being the biggest name in the space was a boon for Intel, which has been struggling for years. However, it also highlighted just how important Nvidia is in the space, and kick-started a spending splurge for Jensen Huang’s company, which has also involved supporting OpenAI, among others.

The deal is already being framed as a pivot point for the industry and a badly needed vote of confidence in a one-time king of chips that has been slipping on a downward slope for years.

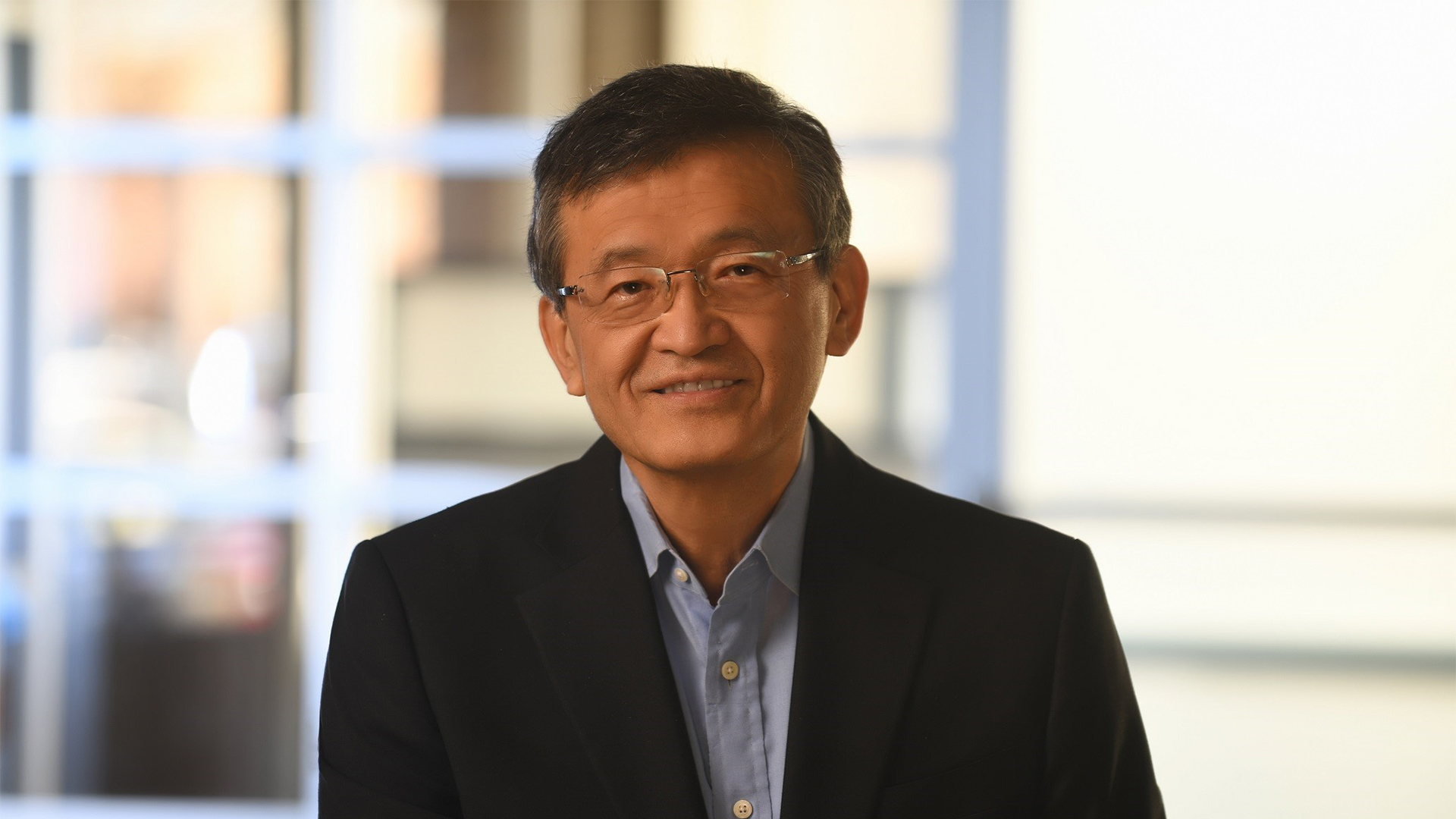

Who holds the power was clear through the awkward theatrics of Intel CEO Lip-Bu Tan remaining largely silent on a conference call with the media after the announcement, while Nvidia CEO Huang did most of the talking for him. However, it’s a significant moment for Intel.

The deal is a pact that puts products first, aims to keep Intel’s future secure, and is a boost in keeping Nvidia in Washington's good books regarding its America First industrial policy. The real question is how far a $7 billion equity injection – including $2 billion from SoftBank – can stretch for a company that has been burning cash and capex at a rate of tens of billions.

Jensen Huang said on the press call with Tan that Nvidia’s investment in Intel was a vote of confidence in its future. But its past has been rocky. It finished 2024 with negative adjusted free cash flow and entered 2025 still in the red. Tan admitted as much in April when he unveiled Intel’s first quarter earnings. “The reason I am here is simple: I love our company,” he said. “I saw the challenges we were facing. And I could not sit on the sidelines knowing I had an opportunity to turn things around and put us back on a path to gain market share and drive sustainable growth.”

Things didn’t improve quickly. The U.S. government under Joe Biden also stepped in to help with support. In 2024, the Commerce Department put up to $8.5 billion in CHIPS Act grants and up to $11 billion in loans on the table for Intel, and later announced up to $3 billion more for a secure enclave program to harden the defense supply chain.

This year, the Trump administration went further, converting part of that support into around a 10% equity stake in the firm – a controversial escalation that blurs the line between subsidy and ownership. It’s no coincidence that many on Wall Street say the whole package aligns with the Trump administration’s industrial policy narrative.

What was agreed

The two companies will co-design Nvidia-custom x86 server CPUs with integrated NVLink, intended to slot cleanly into Nvidia’s rack-scale NVL systems. Intel will also sell x86 client SoCs that fuse an Intel CPU tile with an Nvidia RTX GPU tile for notebooks, posing a challenge to rival AMD.

That’s a bonus for Intel, according to Quinn Bolton, managing director of equity research at Needham & Company. “We expect this collaboration to be positive for Intel in that it positions the company to gain share in Nvidia’s rack-level AI solutions over time,” he says. Still, as Bolton put it, “both Intel and Nvidia made it clear the collaboration was solely focused on products and there is no manufacturing agreement in place, at least for now.”

That matters because Intel’s supporters have long wanted the company to validate its long-troubled 18A process node for foundry customers beyond. This is not that. “The outlook for 2027 and beyond depends mainly on the success of the 18A node and the resulting ability of Intel to attract internal and external foundry customers to its subsequent 14A node,” says Janardan Menon, equity analyst at Jefferies. And how successful that will be “is not yet clear in our estimation,” Menon says.

Joseph Moore, equity analyst at Morgan Stanley, likewise frames the deal as a product-first deal that cements Intel’s presence where it had already been trying to get involved, by bringing NVLink into the x86 world, but “may take until 2027” to show up in volume. But Moore is overall unimpressed. “The company has done most of what we have prescribed, for better or worse, refocusing the business around the product businesses, while reducing the distractions from AI and foundry aspirations which weren't adding much,” he says. “The problem is, that isn't the same thing as being competitive.”

The political angle

So if the deal wasn’t brilliant business for Intel or Nvidia, then why did it happen? Was politics a factor? Reuters’ instant analysis asked “how much of a role the Administration played” and noted reporting that Donald Trump planned to speak to Huang around the announcement. While both CEOs insist this was about technology first and said Washington has no involvement, the deal’s choreography helps Nvidia’s already strong position with Washington, bringing the world’s most valuable chipmaker even more visibly into U.S. production and U.S. jobs. That connection could be useful as Nvidia navigates intensifying export controls and a China market that has begun banning its chips.

SoftBank’s $2 billion purchase the prior month adds another layer. The Japanese investor paid roughly $23 a share to take just under 2% of Intel – a move framed by both parties as a way to “deepen their commitment to investing in advanced technology and semiconductor innovation in the United States.” It is also a reminder that geopolitics now goes hand and glove with semiconductor finance: Tokyo has become a critical player in Western chip policy, and SoftBank’s check arrives as the U.S. and Japan are teaming up to tackle Chinese dominance.

Of course, there is a long business history behind the deal, too. Nvidia has been interested in Intel’s cutting-edge nodes for years. Back in 2022, Huang publicly said he was interested in exploring Intel Foundry. By 2023, Nvidia showed up on the government-backed RAMP-C roster, alongside Microsoft, IBM and Qualcomm, which gives select companies a route to build secure 18A prototypes on U.S. soil. By earlier this year, Nvidia was reportedly testing 18A – showing that Nvidia-on-Intel silicon has been on the cards for some time.

RAMP-C gives Nvidia valuable political capital. By putting work into Intel’s 18A for defence prototypes, Nvidia can point to a real contribution to secure domestic supply, which puts it firmly in a positive light when it comes to Donald Trump.

Money, money, money

While the deal was eye-opening because of the names involved, the amount of cash spent on the deal wasn’t that significant. The $7 billion involved pales into comparison with TSMC spending expectations of between $38 billion and $42 billion this year alone on capital expenditure.

Intel remains a comparative minnow: its own 2025 guidance implies net capex around $10 billion or so. But if the Nvidia partnership does result in meaningful x86 content in NVL racks, Intel will need incremental capacity to handle that. Morgan Stanley estimates that a recovery toward roughly $18 billion of Intel's capex in 2026/27 would lift wafer fab equipment demand by around 3%.

In terms of what the deal offers a cash-hungry Intel, it’s breathing room and bargaining power. The cash helps make the balance sheet look a little better at a time when things were looking precarious. But Intel still looks shaky compared to TSMC.

Nevertheless, it helps show the market that Intel will have meaningful x86 content in Nvidia AI platforms over time, and it could keep Intel CPUs central to the PC market. But there's a missing piece that analysts point out. The deal is missing a signed foundry wafer agreement to prove the value of 18A for external customers while changing Intel’s medium-term future.

The deal really highlights how Intel is a company in flux. It’s keeping what’s important while prioritising products that can succeed now. Whether it was a stay of execution or a kickstart into a new era isn’t yet understood, even by the analysts. “We are excited to see a stock move that is based on the elements that we think are important – a turnaround in the core products business, rather than foundry aspirations that seem unlikely to add up to much, or event-driven sum-of-the-parts-based theories, which quickly fade when those events don't play out,” says Moore.

Chris Stokel-Walker is a Tom's Hardware contributor who focuses on the tech sector and its impact on our daily lives—online and offline. He is the author of How AI Ate the World, published in 2024, as well as TikTok Boom, YouTubers, and The History of the Internet in Byte-Sized Chunks.