Nvidia posts $46 billion revenue in another record quarter — Data center and gaming GPU sales break records

More Blackwells, more money.

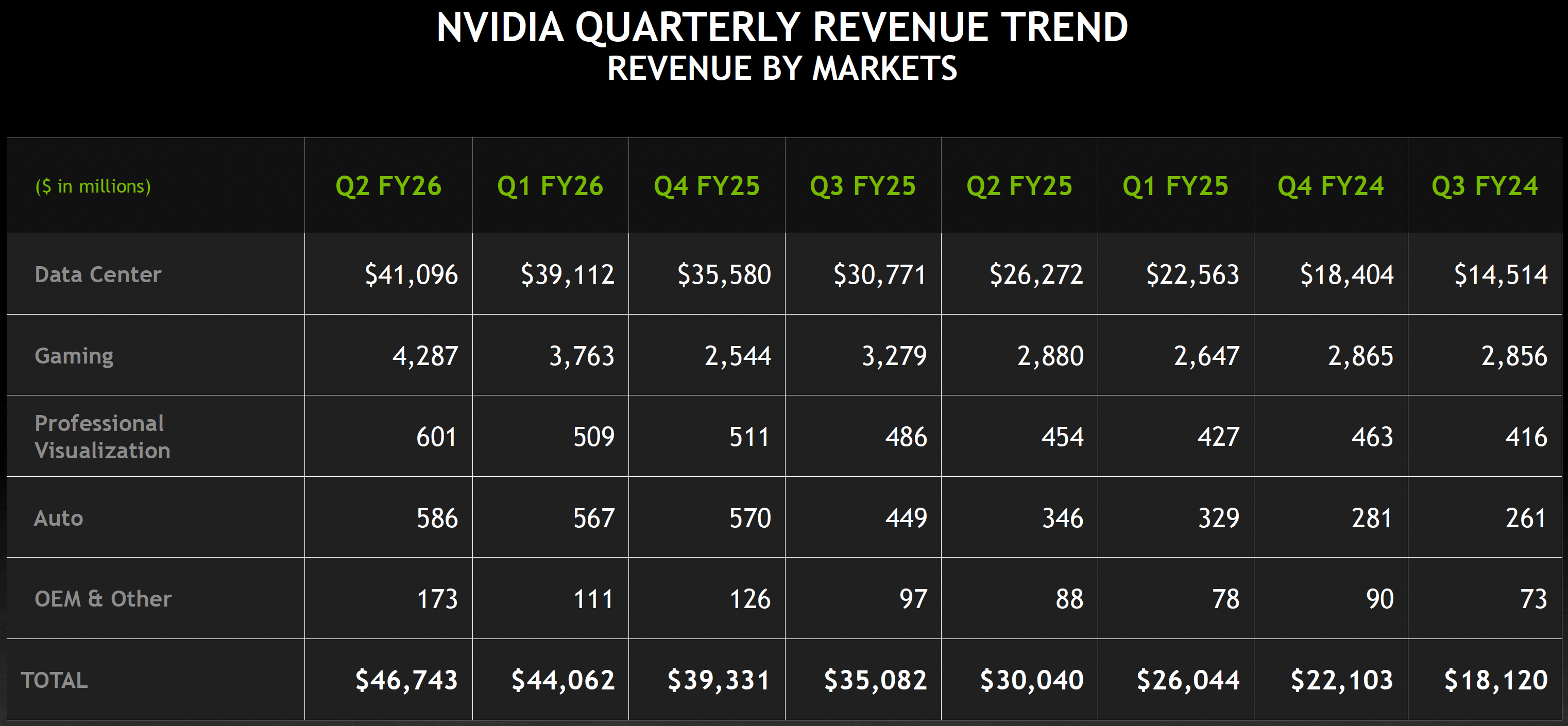

Nvidia on Wednesday published its financial results for the second quarter of its fiscal year 2026, posting record revenue of $46.743 billion and marking its best quarter ever. During the quarter the company managed to tangibly increase sales across all product categories both sequentially and year-over-year. Yet, AI GPUs accounted for nearly 88% of its revenue, asserting Nvidia's dominance in the AI hardware segment. But perhaps the biggest thing that will please Nvidia's investors is its outlook for the third quarter.

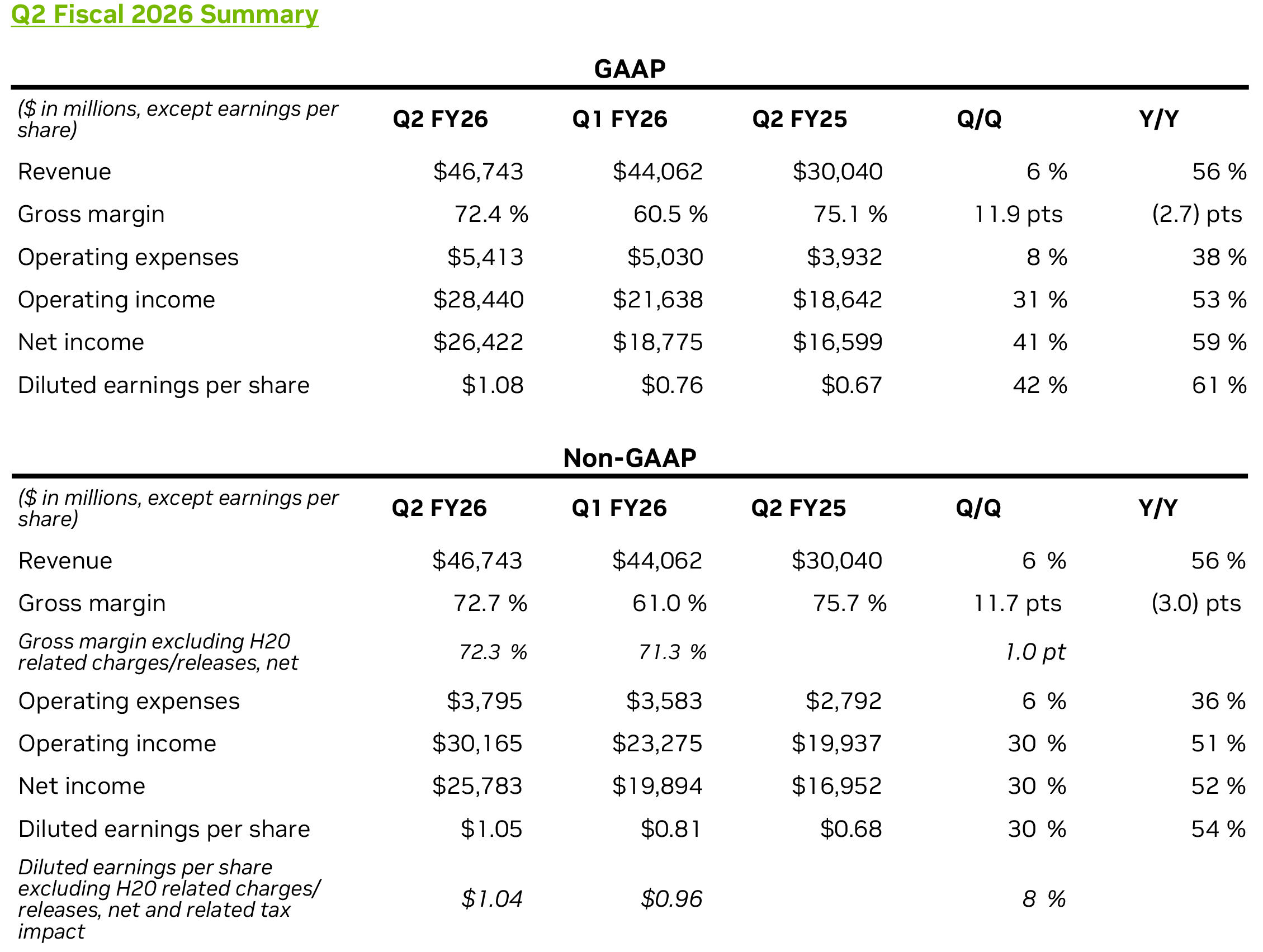

For the second quarter of fiscal year 2026, Nvidia posted GAAP revenue of $46.7 billion, up 56% year-over-year (YoY) and 6% quarter-over-quarter (QoQ). The company's net income surged to $26.4 billion, a 59% increase from the same period last year, despite the fact that the company's gross margin dropped 72.4% from 75.1% a year ago, to some degree due to a $180 million charge related to banned sales of its H20 AI accelerators to Chinese entities. However, Nvidia's gross margin increased sharply from 60.5% in the prior quarter.

Data center revenue exceeds $40 billion for the first time

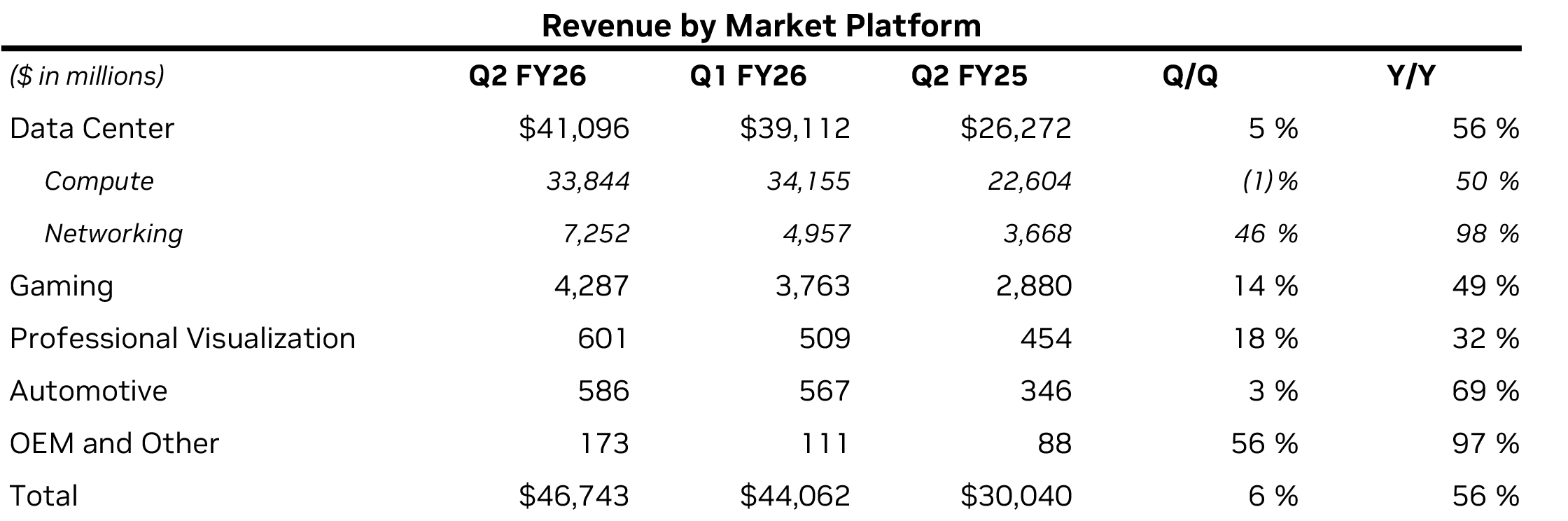

Data center AI platforms is by far Nvidia's biggest business with revenue reaching $41.1 billion, up 56% year-over-year and a 5% sequential gain. Large cloud service providers (CSPs) accounted for approximately 50% of total data center revenue.

Compute revenue was $33.8 billion, up 50% YoY, but declined 1% sequentially, primarily due to a $4.0 billion drop in H20 GPU sales to Chinese entities. Networking revenue surged to $7.3 billion, reflecting 98% YoY growth and 46% QoQ growth, driven by strong adoption of Nvidia's GB200 NVL72 and GB300 NVL72 systems that exclusively rely on NVLink fabric, Ethernet, and Infiniband solutions developed by Nvidia.

Perhaps the biggest highlight of Nvidia's data center business during the quarter was the ramp-up of Blackwell GPUs, including Blackwell Ultra, which grew 17% quarter-over-quarter and contributed revenue across all customer segments. Meanwhile, Nvidia still sold plenty of Hopper-based processors and HGX servers to various parties that still deploy such machines.

"Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary," said Jensen Huang, co-founder and chief executive of Nvidia. "Nvidia NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center."

Gaming and ProViz hit new highs, so does automotive

As Nvidia sells a great deal of AI GPUs for data centers, some people outside of the PC gaming world probably begin to forget that the company's origins are indeed in PC gaming. This business segment not only continues to bring Nvidia a lot of money, but it thrives.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In the second quarter of fiscal 2026, Nvidia sold a whopping $4.3 billion worth of gaming GPUs, reflecting a 49% increase year-over-year and a 14% rise from the previous quarter. The company attributed strong performance to robust demand and improved supply of its Blackwell-based gaming GPUs, which continued to gain traction in the consumer market. Another reason is of course the launch of highly-successful performance-mainstream GeForce RTX 5060 and RTX 5060 Ti graphics cards.

Additionally, the OEM and Other segment posted $173 million in revenue, up 97% year-over-year and 56% sequentially, which marks increasing demand even for Nvidia's low-end GPUs.

Nvidia's professional visualization (ProViz) business generated $601 million in revenue in Q2 FY2026, reflecting a 32% YoY increase and an 18% QoQ rise. What is a little bit unexpected, is that Nvidia claims that the growth was primarily driven by the accelerated adoption of Blackwell-based notebook GPUs by 'AI-powered workflows, real-time graphics rendering, and data simulation,' which somewhat implies that not all ProViz GPUs were set to be used for graphics.

Last but not least, Nvidia's Automotive segment achieved $586 million in revenue in Q2 FY2026, its best quarter ever. As adoption of Nvidia's autonomous driving and robotics platforms across global OEMs increase, sales of appropriate products increased 69% compared to Q2 FY2025 and 3% compared to the previous quarter.

Remarkable outlook amid China uncertainty

Nvidia projects revenue of approximately $54 billion ± 2% for the third quarter of its ongoing fiscal year. The outlook does not include any H20 shipments to China during the quarter, which is driven by the ongoing political uncertainity due to tensions between the U.S. and PRC.

Nvidia anticipates GAAP gross margin of 73.3% as the company set to benefit from product mix optimization and further Blackwell volume ramp. The company reaffirmed its goal to exit the fiscal year with a non-GAAP gross margin in the mid-70% range.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

bit_user Nvidia should've invested in some power generation companies, because that seems to be the looming bottleneck that's threatening to stall their meteoric rise.Reply

People will only buy as many of Nvidia's compute chips as they can power. And if they have to run them at lower clock speeds, due to power constraints, it'll hurt the value proposition and Nvidia won't be able to charge as much for them. -

jp7189 What other industry has high volume and 70+% margins? I would guess in every other circumstance competition would swarm such a market and drive margins down.Reply -

bit_user Reply

Software. How do you think Microsoft got so big, back in the days of shrink-wrapped Windows and MS Office? Sufficiently high-volume software is like almost pure profit.jp7189 said:What other industry has high volume and 70+% margins?

Complexity of the tech + other barriers to entry (i.e. proprietary APIs and SDKs) are the main reasons. Also, it's tremendously capital-intensive, with a long runway. Lots of AI chip startups have tried, but no one other than maybe Cerebras has really been able to find a foothold in this market.jp7189 said:I would guess in every other circumstance competition would swarm such a market and drive margins down.

I should note that I haven't tracked exactly how well Google and Amazon's in-house hardware compares. -

KyaraM Reply

Apparently Nvidia doesn't even make the top 10:jp7189 said:What other industry has high volume and 70+% margins? I would guess in every other circumstance competition would swarm such a market and drive margins down.

https://www.ibisworld.com/united-states/industry-trends/industries-highest-profit-margin/

So the answer is, many service industries. -

bit_user Reply

LOL, I stopped reading when I got to the third-ranked one in that list: "Psychic Services in the US".KyaraM said:Apparently Nvidia doesn't even make the top 10:

https://www.ibisworld.com/united-states/industry-trends/industries-highest-profit-margin/

So the answer is, many service industries.

Yeah, I know that's a business and I can believe it's quite profitable, but I don't think it's a very large market. Plus, IMO, it borders on fraud, since they're selling something they don't actually provide. -

eye4bear I recently watched a documentary on the making of the Ford Model T, which started out to cost ~$850.00, however, as Fords sales increased and costs to build each car decreased, Ford lowered the price of each car to ~$425.00 and still became a very rich man.Reply