NAND wafer shortages push November contract prices up by over 60% — market tightens as hyperscalers purchase capacity for AI data centers

AI demand and rapid shutdowns of legacy nodes tighten supply.

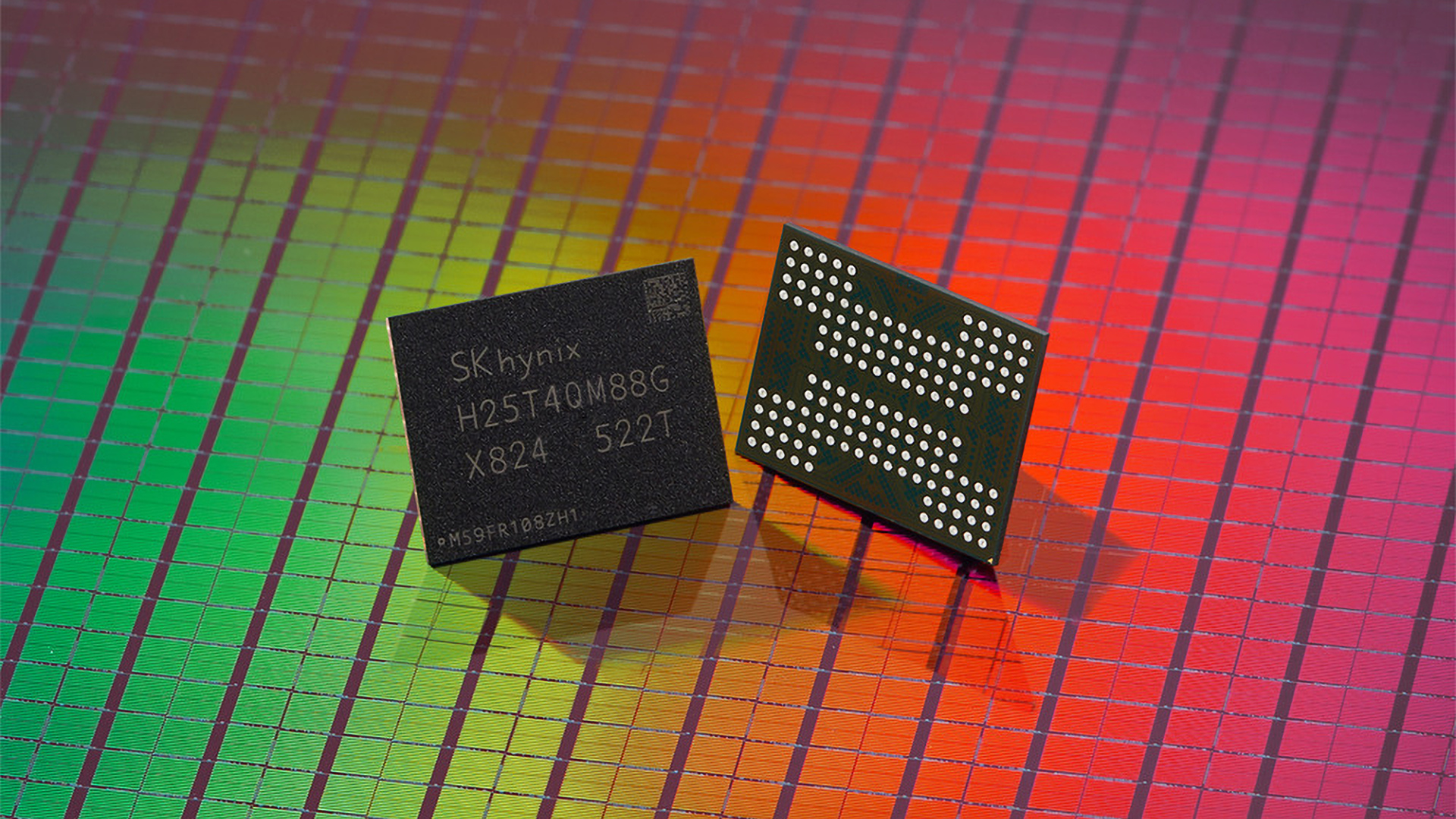

TrendForce reported on December 1 that NAND Flash wafer supply tightened sharply in November as AI workloads and enterprise SSD orders continued to drive sustained demand. The firm said suppliers have prioritized capacity for higher-margin enterprise and premium products while stepping back from older manufacturing nodes. That shift has reduced the available pool of mainstream wafers and pushed monthly contract prices up by 20% and more than 60% across all major product categories.

The steepest increases landed with TLC. TrendForce noted that 1Tb TLC remained in short supply through November because enterprise SSD demand has not eased, and the firm described its average contract-price rise as “sharp.” The fastest phase-out of legacy process nodes affected the 512Gb TLC segment, which experienced the largest jump of the month with an increase of more than 65%. TrendForce added that 256Gb TLC also saw renewed pressure as further legacy-node shutdowns reduced inventory and aggravated an already tight market.

The same pattern extended into QLC products. TrendForce said the supply chain became “much tighter” in November as high-capacity enterprise drives continued to gain traction in cloud infrastructure and cold-storage applications. That shift pushed 1Tb QLC into significant price increases, reinforcing the broader theme that capacity-oriented segments are being pulled upward by data-center demand. Even MLC, which tends to move on the cadence of embedded and industrial customers, recorded higher average selling prices during the month due to steady orders in those markets.

Together, these price movements demonstrate how suppliers are controlling output to protect margins at a time when demand at the top of the stack remains strong. TrendForce assesses that manufacturers currently hold substantial pricing power and that wafer-level shortages are unlikely to ease in the near term. The firm expects contract prices to continue rising in December, a view that aligns with earlier fourth-quarter commentary from controller vendors and NAND producers who warned that 2025 and 2026 supply is already tightly allocated.

This latest update shows how quickly the market has moved since the autumn outlook, when forecasters anticipated a more modest fourth-quarter rise. With multiple TLC densities now up more than half in a single month and QLC following behind, the cost of NAND at the wafer level has broken from the gradual trend of previous quarters. Manufacturers have placed their focus on enterprise and premium products, and the rapid retirement of older nodes has removed the buffer that normally absorbs demand spikes. TrendForce indicated that this imbalance will persist into the final weeks of the year.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Luke James is a freelance writer and journalist. Although his background is in legal, he has a personal interest in all things tech, especially hardware and microelectronics, and anything regulatory.