Intel Bitcoin Bonanza Chips to Double Giant Mining Farm's Hashrate

Intel's blockchain strategy is winning big client contracts.

Intel's bets on the blockchain space are attracting significant design wins, with the latest including one of the world's leading bitcoin mining companies. Blockchain company Hive has announced that it has agreed to purchase Intel's next-generation "BZM2" Bonanza Mine ASICs. Hive announced that the addition of Intel's upcoming chips would almost double its bitcoin mining power from 1.9 to 3.8 exahashes per second (Eh/s). The chips will be deployed in a new, 100 MW renewable-energy-focussed installation operated by Compute North LLC in Texas.

The deal establishes that the cryptocurrency mining devices will be delivered over one year starting in the second half of calendar 2022, lining up nicely with Intel's ASIC delivery for another of its Bonanza Mine clients, GRIID. Both companies expect the Intel-provided ASICs to offer increased performance and power efficiency compared to other available mining chip offerings. No information on the agreements' impact on the companies' bottom lines was revealed. Still, considering how we're looking at an almost doubling (95% increase) of HIVE's available hashpower on the shoulders of Intel's ASICs, this deal isn't a small one by any measure — and we have the doors open to some napkin math.

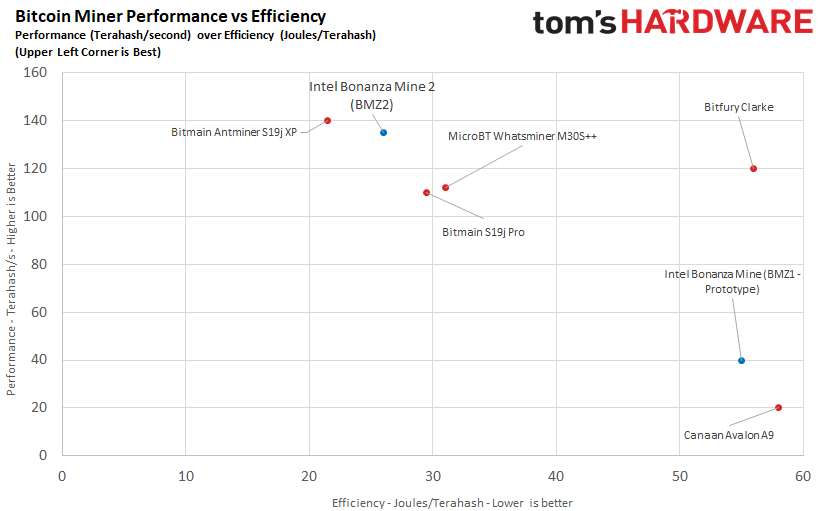

Intel's BZM2 pricing has already been non-officially disclosed as going for $5,625 per miner, with performance rated at 135 TH/s with an energy efficiency of 26 J/THs. HIVE's predicted hash power increase of 1.9 EH/s after the successful deployment of Intel's miners tells us that the company is installing ~14,000 thousand BZM2 devices.

In pure dollar terms, that means the Intel/HIVE deal could be worth around $79 million solely on hardware costs. However, despite the gargantuan cost, Intel has its competitors between a rock and a hard place: the company is extremely competitive in both efficiency and performance while undercutting its closest competitor, Bitmain's Antminer S19j XP, by almost 50% (Bitmain prices its S19j at around $10,455, with pricing being pegged to Bitcoin's value and updated daily).

Aydin Kilic, President & COO of HIVE, said that "Intel's energy-efficient and high performance blockchain accelerator is expected to reduce our power consumption over current ASIC miners on the market." He also expanded on the company's part in the product development and deployment, positioning HIVE more as a partner than a client: "HIVE will participate in the system development process from design verification, through to the prototype stages, and then factory & test engineering regimens to arrive at a production model; we are well-positioned and excited to undertake the process ahead."

Blockchain-related technologies and products are only expected to increase as time passes, and Intel seems to have pivoted its position to take advantage of the current and future market. While the last several years saw Intel mostly ignore the cryptocurrency space, the company now has three distinct product segments (and related business decisions) that are either directly or indirectly related to blockchain. In fact, Intel beat both AMD and Nvidia in its blockchain dive, at least when it comes to designing silicon that's especially geared towards blockchain workloads.

While Nvidia and AMD have been content in allowing their GPU solutions to be either freely used (AMD) or by adapting existing products towards cryptocurrency-mining-specific product lines (think Nvidia's Cryptocurrency Mining Processors [CMP]). Intel now stands as the first company of the three to fully design a mining-oriented product with its Bonanza Mine ASICs.

At the same time, Intel's latest FPGA solutions, in the form of the Agilex-M series, are now also being marketed for blockchain-related workloads, a first for the product segment. The third (current) angle of attack on the market isn't as direct as this one and doesn't carry a distinct marketing angle, but perhaps that's a wise decision on Intel's part: the company has confirmed that its upcoming ARC Alchemist graphics cards will perform at 100% of their capabilities when it comes to cryptocurrency mining workloads.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.