VMware's New Licensing Fees are Going to Hurt AMD's 64-core EPYC Rome

You'll pay twice as much for VMware if you have more than 32 cores in a single CPU

AMD's beefy core counts on its EPYC Rome processors, not to mention its far lower per-core price points, are a big advantage for the company as it grapples with Intel for data center market share. However, an announcement from VMWare today appears to blunt some of that advantage: VMWare will essentially double the price of licensing the company's software for CPUs that have more than 32 cores.

The new move applies to all of VMWare's software, and given that the Dell-owned company holds ~75% of the server virtualization market, the change will have a far-ranging impact on data center processors with high core counts, like AMD's EPYC Rome. Intel will also be impacted which its processors move to 56-core Cooper Lake models (slated to begin production in H1 2020).

In the enterprise world, software is often licensed on a per-core or per-socket basis, meaning software customers have to pay a set fee based on either the number of CPU cores they wish to run the software on, or the number of CPU sockets. That means that the price of the hardware is often a secondary consideration compared to the cost of software licensing.

Processors with faster cores often win the total cost of ownership (TCO) equation for software licensed on a per-core basis because they utilize software licenses more fully. In short, faster cores result in more performance for each license, which then reduces the need for additional licenses (and overall cost of the server platform).

And these fees aren't chump change: For instance, an Oracle Enterprise Edition database license can cost up to $47,500 per license based on the company's current pricing models. Other Oracle applications span up to $300,000 per license. However, Oracle uses a complex matrix to come to the final pricing values, so you might need multiple licenses for each CPU based on the number of cores it has, creating a type of quasi-per-core licensing model. Meanwhile, other companies license enterprise software strictly based on the number of CPU cores.

Historically, Intel Xeon processors have generally been thought to be better for these types of per-core licenses due to their faster per-core performance.

However, the knife cuts both ways. While some software is licensed on a per-core basis, others are licensed based on a per-CPU basis. So a single processor, regardless of core count, gets assigned a single license fee. Data centers and enterprises running these types of software can really benefit from EPYC's advantage of more cores: If you pay one fee for an entire processor, paying that fee for 64 cores of EPYC is obviously a better value than paying the same license fee for a 'mere' 28 Intel cores.

AMD's EPYC Rome has been a wonderful value for VMware, which used to charge only one license fee per CPU, regardless of the number of cores. VMWare's current pricing depends on the product, but spans up to $7,472 per license. For comparison, AMD's high-end 64-core EPYC 7742 costs 'only' $6,950.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

With up to 64 cores and 128 threads crammed into a single socket, AMD's Rome offers not only a new level of performance density, but also gave customers more value from their virtualization licensing fees.

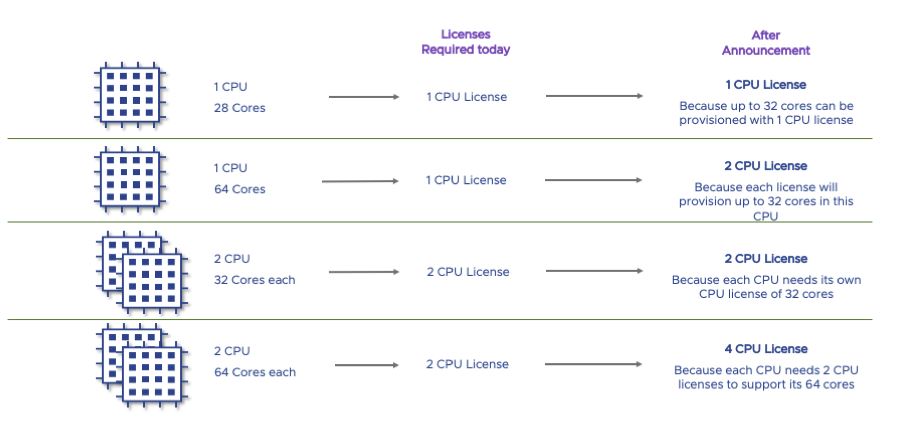

Unfortunately, that trend changes today with VMware's announcement that it will now charge for two licenses for any CPU that has more than 32 cores. That effectively doubles the price of VMware licenses for AMD's 48- and 64-core models. The change applies to both single- and dual-socket servers, so a dual-socket EPYC system with 48- or 64-core chips will now require four licenses, instead to two.

"Today we announced an important update to our per-CPU pricing model, reflecting our commitment to continue meeting our customers’ needs in an evolving industry landscape. This new pricing model will give our customers greater choice and allow us to better serve them. While we will still be using a per-CPU approach, now, for any software offering that we license on a per-CPU basis, we will require one license for up to 32 physical cores. If a CPU has more than 32 cores, additional CPU licenses will be required. " - VMware statement.

The impact to data center operators with 48-core (and beyond) AMD chips will be felt immediately, but Intel customers will emerge unscathed. At least for now. Intel's top-end general-purpose server chips currently tap out at 28 cores per socket, and while the company does have its 48-core Cascade Lake-AP models on offer, those chips don't seem to have gained much traction outside of specialized applications, so the impact will be slight on the broader market.

Intel will eventually move on to 56-core Cooper Lake processors that are slated for production in the first half of this year, but the jury is out on the pricing model that will largely determine if they could be considered general purpose chips.

The move to denser chips has foreshadowed a looming change on the licensing front, as noted by an insightful (if not prophetic) piece by ServeTheHome last year. Given market-leader VMware's licensing change, we can expect other software providers to follow suit and change their fee structures in the coming months.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jimmysmitty Pretty much everything is changing its licensing structure to increase costs. Windows Server also works the same way as does SQL Server.Reply

Any way to drag out more money I guess. -

zinabas This smells alot like Intel throwing around dark money behind the scenes to prevent people from buying AMD. Since they don't have a real competitor to 64 core EPYC it costs them nothing to have the fees increased for people who want to use them. They're going to do everything legal or otherwise to keep a hold of the enterprise market.Reply -

Giroro The software licensing business is amazing to me.Reply

Why stop at 2 licenses per CPU? Why not 4, or 100? What real choice do VMware's locked-in enterprise customers have, except to pay whatever made-up number they charge for it?

I mean, aren't there entire companies, if not entire industries that VMware could hold for ransom, if they wanted? -

USAFRet Reply

What the market will bear.Giroro said:The software licensing business is amazing to me.

Why stop at 2 licenses per CPU? Why not 4, or 100? What real choice do VMware's locked-in enterprise customers have, except to pay whatever made-up number they charge for it?

I mean, aren't there entire companies, if not entire industries that VMware could hold for ransom, if they wanted?

You want weird licensing, delve into Oracle databases. Ask 3 different reps, get 5 different answers, depending on the day the phase of the moon. -

bwana Oohhh. So now it makes sense why intel had 19% earnings pop from data center operations. Enterprise is sticking with xeon because it is still cheaper Considering vm costs. (Clearly intel marketing knew about this ahead of time..or maybe as was suggested above, intel was ‘subsidizing’ vmware in some way) Add to this the fact that AMD doesn’t have mature software tooling for managing their chips and I see why Rome has an uphill struggle. But isn’t virtualBox free? I guess it’s not as good as VMware. Or how about Microsoft’s hypervisor?Reply -

cfbcfb Replyzinabas said:This smells alot like Intel throwing around dark money behind the scenes to prevent people from buying AMD. Since they don't have a real competitor to 64 core EPYC it costs them nothing to have the fees increased for people who want to use them. They're going to do everything legal or otherwise to keep a hold of the enterprise market.

Look out! Chemtrails!!!1!

Someone hasn't seen newer intel products with many, many cores. -

cryoburner Reply

Or, you know, VMWare might just not want to lose profits from companies switching to servers with fewer physical processors running the same workloads. The alternate option would be to raise prices across the board, effectively punishing companies not upgrading their processors to higher core-count models. Actually, if you think about it, having server software licensed on a per-socket basis is kind of silly. If there are two companies with data centers each housing a million processor cores, each with relatively similar total performance, but one does so using half the sockets, why should the other arbitrarily get charged twice as much for the same software running on the same number of cores and performing the same amount of work?zinabas said:This smells alot like Intel throwing around dark money behind the scenes to prevent people from buying AMD. Since they don't have a real competitor to 64 core EPYC it costs them nothing to have the fees increased for people who want to use them. They're going to do everything legal or otherwise to keep a hold of the enterprise market.

Ideally, VMWare should be charging on a per-core basis rather than arbitrarily picking 32 cores though. That kind of makes 48-core server processors kind of undesirable, as any processors not running a multiple of 32 cores will be getting charged more per-core. They undoubtedly didn't want to give a price break to the majority of servers running fewer than 32 cores though. -

InvalidError Reply

Per-core pricing would still be a bit wonky since a core at 2GHz does not perform the same as an otherwise identical core running at 4GHz or an SMT4 core with a handful of extra execution units to give all of its four threads much higher thread-level parallelism.cryoburner said:Ideally, VMWare should be charging on a per-core basis rather than arbitrarily picking 32 cores though.

If they really wanted to scale licensing with performance and not have to come up with convoluted multi-tier overlapping licenses, they'd have to go with some form of giga-ops per second licensing to account for most foreseeable ways that performance can scale. -

digitalgriffin What a load of horse manure. Should have read "VMWare never anticipated more than 32 cores per socket. Unfortunately our business model cannot be sustained by ever increasing core counts per socket. As a result to ensure a healthy business and long term support of vmware we have changed the terms of our licensing."Reply

Try honesty for once you idiots. You'll get more respect and understanding for it.

Today we announced an important update to our per-CPU pricing model, reflecting our commitment to continue meeting our customers’ needs in an evolving industry landscape. This new pricing model will give our customers greater choice and allow us to better serve them. While we will still be using a per-CPU approach, now, for any software offering that we license on a per-CPU basis, we will require one license for up to 32 physical cores. If a CPU has more than 32 cores, additional CPU licenses will be required. " - VMware statement.

-

Nick_C Why the step change at 32-cores?Reply

Probably because of this:

https://www.tomshardware.com/news/intel-to-fire-back-at-amds-epyc-rome-with-cascade-lake-xeon-refresh-report

i.e. nothing above 28 cores from team blue for the forseeable future.