AMD takes CPU market share from Intel in desktops and servers, but Intel fights back in laptops

AMD continues to eat Intel's lunch.

AMD managed to gain both unit and revenue market share in server and consumer PCs in the first quarter of the year as demand for 4th-Generation EPYC processors set another record, whereas Ryzen 8000-series processors were popular with makers of desktop PCs and notebooks. A new report from CPU market tracker Mercury Research outlines several of AMD's advances during the quarter.

"Mercury noted in their first quarter report that AMD gained significant server and client revenue share driven by growing demand for 4th Gen EPYC and Ryzen 8000 series processors," a statement by AMD shared by the company via email reads.

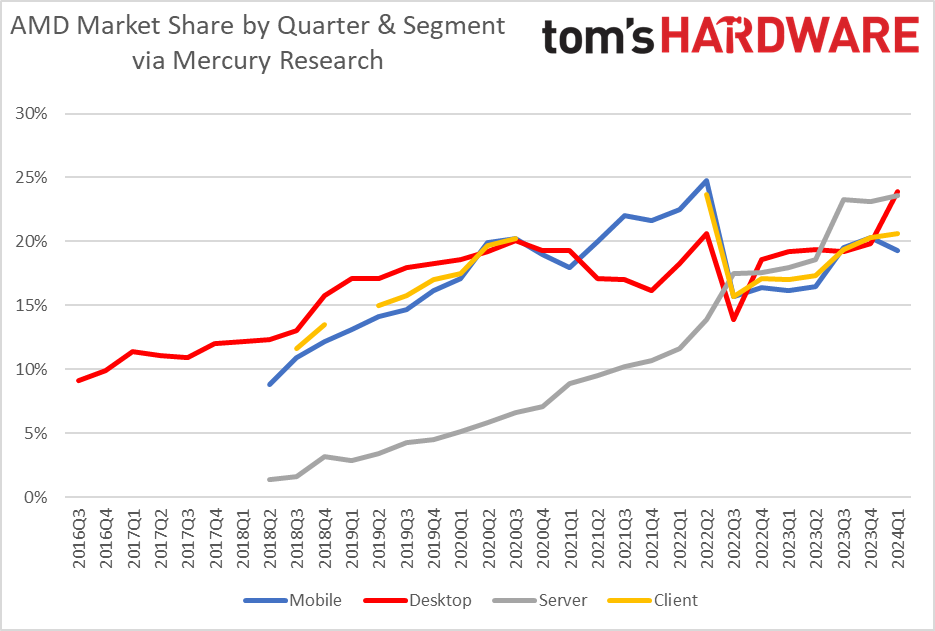

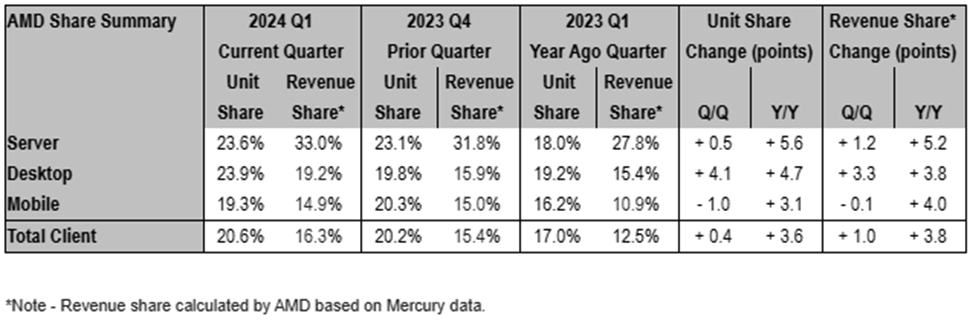

Looking at the total client market, AMD's unit share in the first quarter of 2024 was 16.3%, whereas its revenue share was 20.6%. While AMD's quarter-over-quarter advances may be considered small, the company's year-over-year increases are nothing but impressive, as the company gained 3.6 percentage points (PP) of unit share and 3.8 PP of the revenue share.

Desktop PC, Mobile, Client Revenue / Unit Share

| Row 0 - Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 23.9% | 19.8% | 19.2% | 19.4% | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | +4.1 / +4.7 | +0.6 / +1.2 | -0.2 / +0.5 | +0.1 / -1.02 | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

When it comes to processors for desktop PCs, AMD commanded a 23.9% unit share and a 19.2% revenue share in Q4 2024, up from 19.2% and 15.4% in the same quarter a year ago. AMD does not attribute this to the success of any particular product, though it looks like the gains were a result of the ramp of the company's Ryzen 8000/Ryzen Pro 8000-series for mainstream desktops and their success among PC makers.

| Row 0 - Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 19.3% | 20.3% | 19.5% | 16.5% | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | -1 / +3.1 | 0.8 / 3.9 | 2.9 / 3.8 | 0.3 / -8.3 | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 22 | Row 2 - Cell 23 | Row 2 - Cell 24 |

On the mobile front, AMD's unit share increased from 16.2% in Q1 2023 to 19.3% in Q1 2024, whereas its revenue share bumped massively to 16.3% in the first quarter from 10.9% in the same quarter a year ago.

AMD attributes these gains to Ryzen mobile CPU sales nearly doubling year-over-year as new Ryzen 8040 notebooks ramped up. However, AMD's unit and revenue shares dropped slightly sequentially, possibly as a result of Intel's Core Ultra 'Meteor Lake' launch.

Server Revenue / Unit share

| Row 0 - Cell 0 | 1Q24 | 4Q23 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 23.6% | 23.1% | 23.3% | 18.6% | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.5 / +5.6 | -0.2 / 5.5 | 4.7 / 5.8 | 0.6 / 4.7 | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 24 | Row 2 - Cell 25 |

In the first quarter of the year, AMD continued its winning streak in the data center CPU market. The company controlled 23.6% of server processors in terms of units and 33% of server CPU revenues. This is up from 18% and 27.8% in Q1 2023, and the gains look quite impressive, to put it mildly.

AMD's EPYC processors also gained share quarter-over-quarter, which signals that servers based on the company's 4th-Gen EPYC CPUs are ramping and winning share from Intel.

AMD's statement reads: "As we noted during our first quarter earnings call, server CPU sales increased YoY driven by growth in enterprise adoption and expanded cloud deployments."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

We'll add commentary from Dean McCarron of Mercury Research when he sends the full report in the coming days. Stay tuned.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

hotaru251 honestly I can't see a future where Intel takes back server...they just havent been able to keep up w/ epyc at price or performance.Reply

not surprised at laptop share being intels thign though (for every amd laptop you see theres liek 4 other intel) -

Jimbojan Intel is about to gain share in every market as its technology is getting ahead of TSMC, ( so, it will be ahead of AMD since AMD relies on TSMC for its fab). As Intel's Ultra Cores are ahead already, so will its Server market. Although Intel is investing a large sum of Capex now, it will not show any profit until it produces its own chip, Intel is still using TSMC as a foundry for a significant portion of its production.Reply -

Neilbob Reply

I'm surprised this old record isn't completely broken at this point, but keep on playing it; one day the needle might hopefully slip into the groove and stay there for at least a full rotation.Jimbojan said:Some kind of nonsense. -

thestryker The improvement in the server market is unsurprising as the groundwork was set with Zen 2 when they offered much more compute density, and they still do. It would however take a lot of Intel falling flat on their faces to actually surpass them. I imagine it will be other architectures/semi/custom that slowly push both AMD and Intel down in the server market. Intel is already reacting to Apple/Arm in the laptop market and it will be interesting to see what AMD actually delivers given all of the rumors.Reply

I sure hope you noticed that AMD hasn't broken 25% of any market in unit share, and they have a bigger chunk of server revenue than unit which means they're actually charging a premium.hotaru251 said:honestly I can't see a future where Intel takes back server...they just havent been able to keep up w/ epyc at price or performance.

not surprised at laptop share being intels thign though (for every amd laptop you see theres liek 4 other intel) -

redgarl Reply

Intel is dead. They are in a death spiral lead by their insanity to pursue fab business. They will never dethrone TSMC and now they are wasting money to this fool journey while AMD has never had so much money to execute their roadmap.Jimbojan said:Intel is about to gain share in every market as its technology is getting ahead of TSMC, ( so, it will be ahead of AMD since AMD relies on TSMC for its fab). As Intel's Ultra Cores are ahead already, so will its Server market. Although Intel is investing a large sum of Capex now, it will not show any profit until it produces its own chip, Intel is still using TSMC as a foundry for a significant portion of its production.

The last bastion of Intel is mobile because of their monopolistic behaviors. -

ingtar33 Reply

agreed. we're looking into a half million dollar upgrade project to a server room at one of our locations with the company i work with, we can't see any reason to go with intel at this time for that project. they're not even remotely competitive right now. I can get an epyc server chip from AMD with x2 the cores at the same power draw and higher clocks (and significantly more processing power per core).hotaru251 said:honestly I can't see a future where Intel takes back server...they just havent been able to keep up w/ epyc at price or performance.

not surprised at laptop share being intels thign though (for every amd laptop you see theres liek 4 other intel)

Assuming this project goes well the rest of the company will be following suit. -

hotaru251 Reply

yes, but again prior to 7yrs ago that was unthinkable.thestryker said:e hope you noticed that AMD hasn't broken 25% of any market in unit share, and they have a bigger chunk of server revenue than unit which means they're actually charging a premium.

i mean AMD didn't break even 10% until like what 2021? Thats an incredible gain in the time frame given it was a place intel literally dominated for ages.

which ever "best" CPU side is will ofc charge premium (as again thats the crown reward for being the best)...nothing wrong with that.

Issue is even if Intel tries to sell cheaper (since they lack performance of rival)....the performance just isnt even worth the savings. (about only reason you would pick intel atm is if you have something in your chain that requires intel cpu's perks which would be due to past choices)

Intel honestly should do what AMD did and focus less on immediate payoff and work towards a few yrs and flip tables. (they have the people, talent, & $ to do so) Costs in short term but the payout is you are no longer always playing catch up and still not be competitive.

Intel's current best Xeon came out a yr after amd's and cost more and had less performance. that was a facepalm moment they shouldnt of ever done. you dont charge more for less.

bite bullet, take the L, focus work towards a product you can be proud of sooner than focusing on a product that is doa against competition & then take back market share ratehr than wasting resources. -

thestryker Reply

They can't afford to do that lest they lose the massive amount of marketshare they still have. You can call it wasted resources, but they're still moving a lot more than AMD is. You don't just bail on that and tell your customers to wait as they might as well just tell everyone to go to the competition then they will have lost the market entirely.hotaru251 said:Intel's current best Xeon came out a yr after amd's and cost more and had less performance. that was a facepalm moment they shouldnt of ever done. you dont charge more for less.

bite bullet, take the L, focus work towards a product you can be proud of sooner than focusing on a product that is doa against competition & then take back market share ratehr than wasting resources.