AMD posts record $7.685 billion revenue despite massive inventory charge — $800 million MI308 write-off not enough to stop biggest ever quarter

Best quarter ever.

AMD on Tuesday published its financial results for the second quarter of its fiscal 2025, posting revenue of $7.685 billion, which is its highest quarterly revenue ever. The company's results were driven by a significant uptick in client CPU sales and strong sales of its data center processors. But at the same time, the company's results were partially offset by the $800 million hit from Instinct MI308 GPU export restrictions to China.

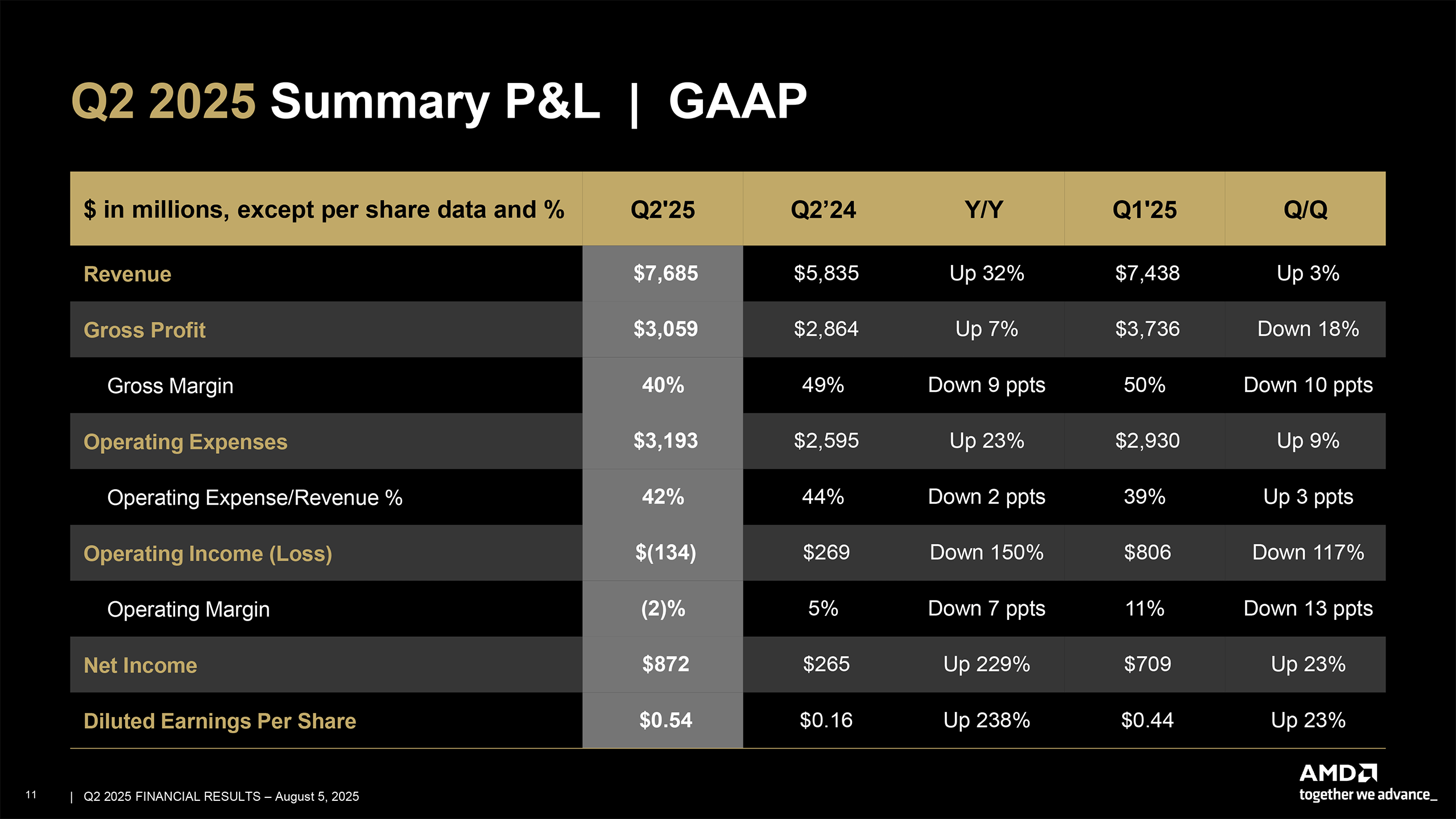

AMD's revenue for Q2 FY2025 reached $7.685 billion, marking a 32% year-over-year (YoY) and 3% quarter-over-quarter (QoQ) increase. The company's net income totaled $872 million, up 229% compared to the same quarter a year ago, and 23% sequentially. However, as a consequence of the $800 million writeoff, AMD's gross margin dropped to 40%, down from 49% YoY and from 50% QoQ.

"We delivered strong revenue growth in the second quarter led by record server and PC processor sales," said Dr. Lisa Su, AMD Chair and CEO. "We are seeing robust demand across our computing and AI product portfolio and are well positioned to deliver significant growth in the second half of the year, driven by the ramp of our AMD Instinct MI350 series accelerators and ongoing EPYC and Ryzen processor share gains."

Strong results across all product segments

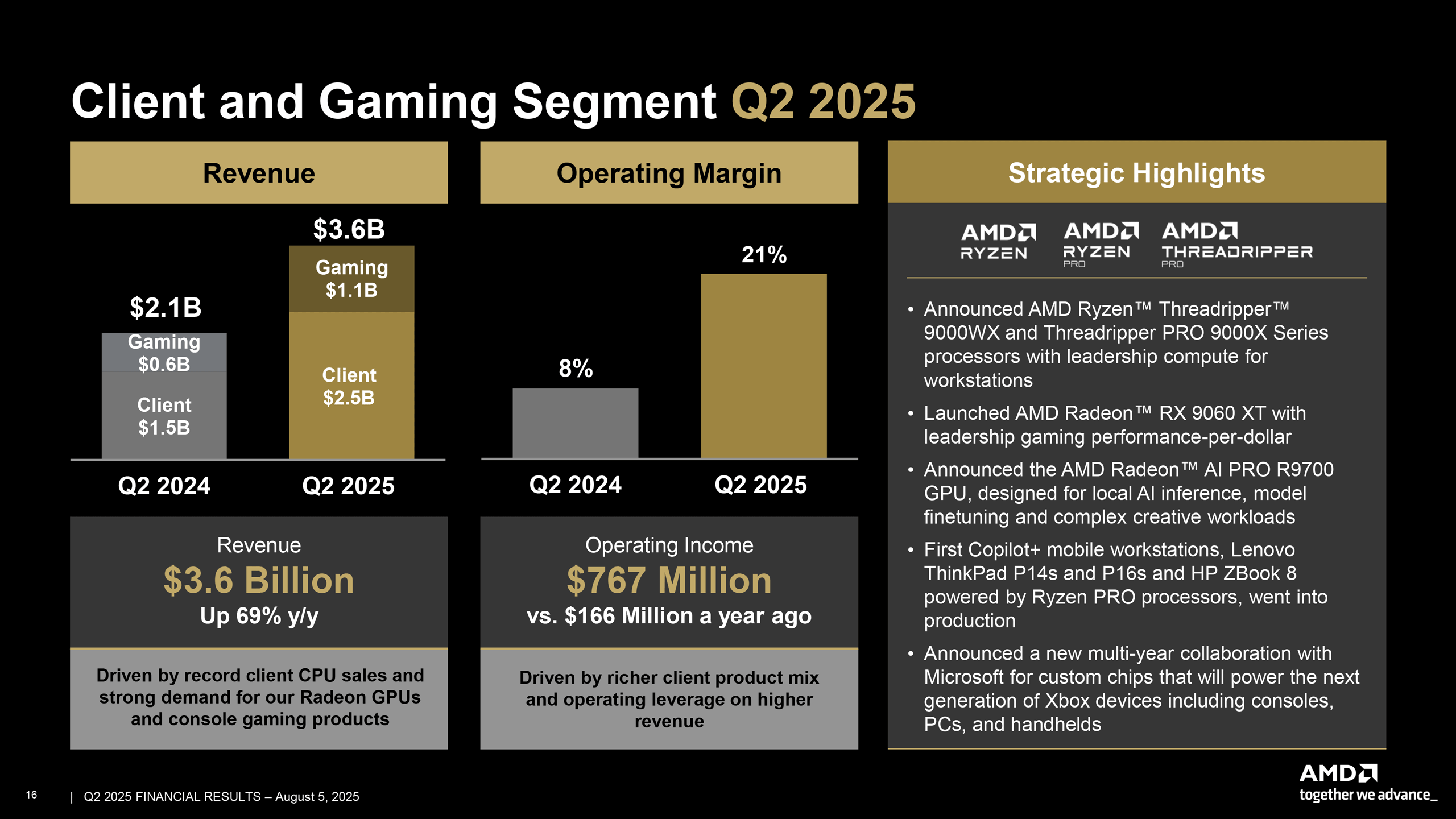

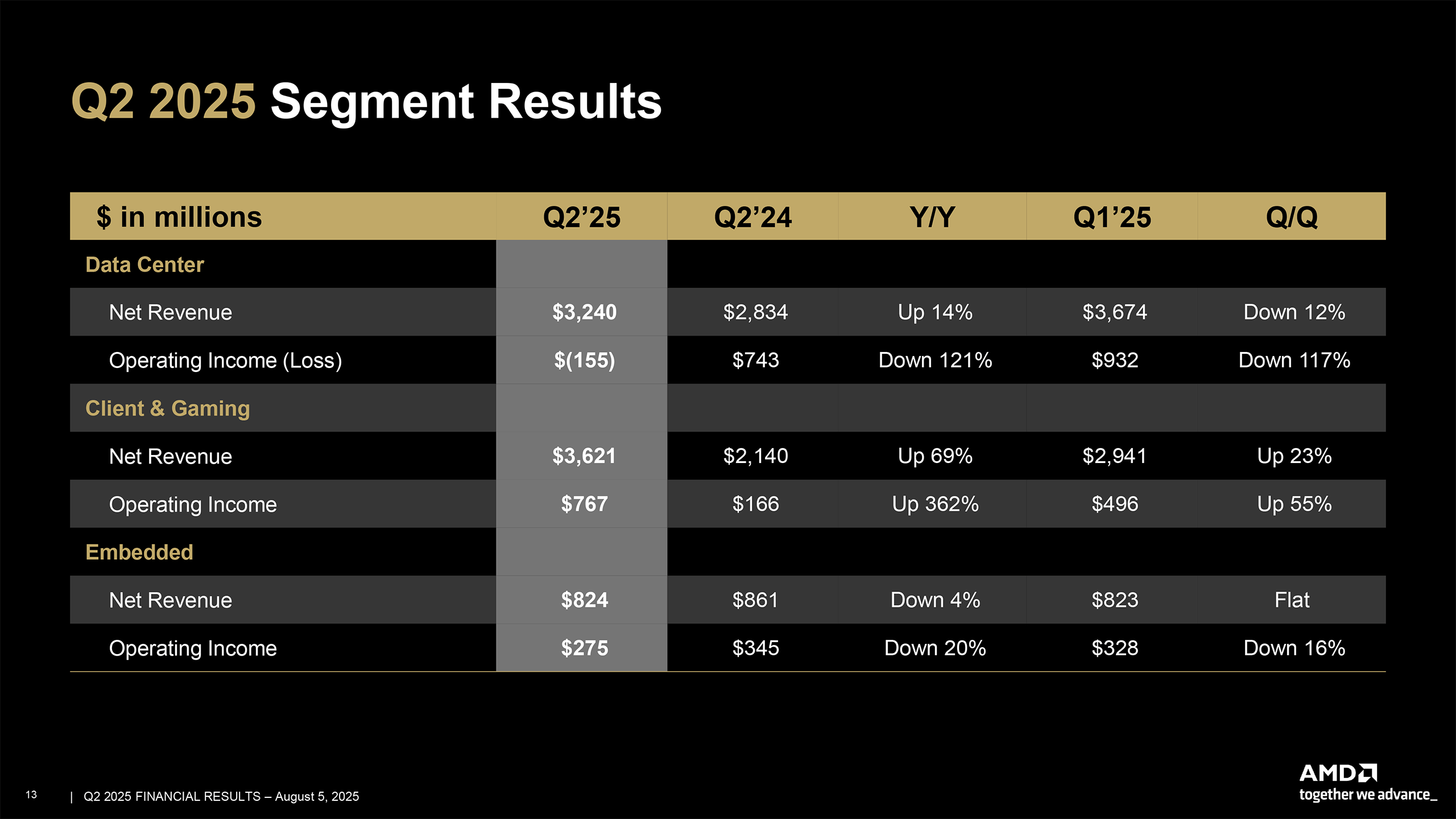

In Q2 2025, AMD's Client and Gaming division achieved a record $3.621 billion in revenue, marking a massive 69% year-over-year increase and significantly contributing to the company's overall growth.

The Client segment alone delivered $2.5 billion in revenue, driven by strong demand for AMD's latest Ryzen processors based on the Zen 5 microarchitecture and a richer product mix.

The Gaming segment also saw a 73% revenue increase compared to the same quarter of 2024, reaching $1.12 billion. This growth was fueled by higher shipments of semi-custom SoCs used in game consoles and strong demand for Radeon RX 9000-series GPUs for gamers and AI applications.

Combined, factors like favourable CPU product mix, increased demand for graphics cards, and rising demand for console processors led to a sharp YoY rise in operating income for the division, up 362% year-over-year to $767 million.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

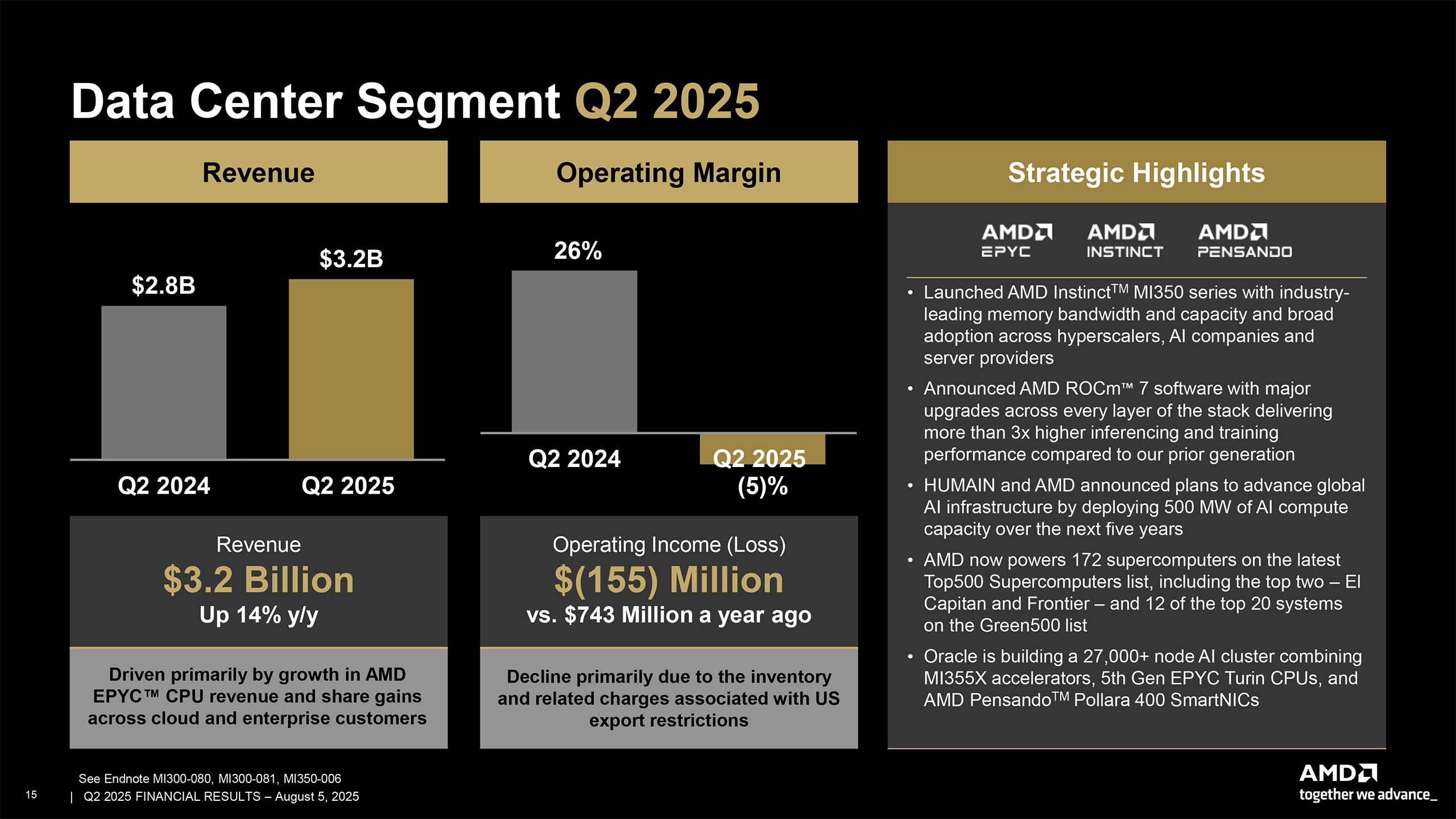

As for AMD's Data Center division, it generated $3.24 billion in revenue, growing 14% year-over-year despite significant headwinds.

The growth was primarily driven by strong demand for AMD EPYC CPUs as AMD gained share across both cloud and enterprise markets. However, the division's profitability was severely impacted by $800 million in inventory and related charges due to U.S. export restrictions on the Instinct MI308 AI accelerator, resulting in an operating loss of $155 million, compared to $743 million in income a year ago. Excluding this charge, the business would have remained profitable.

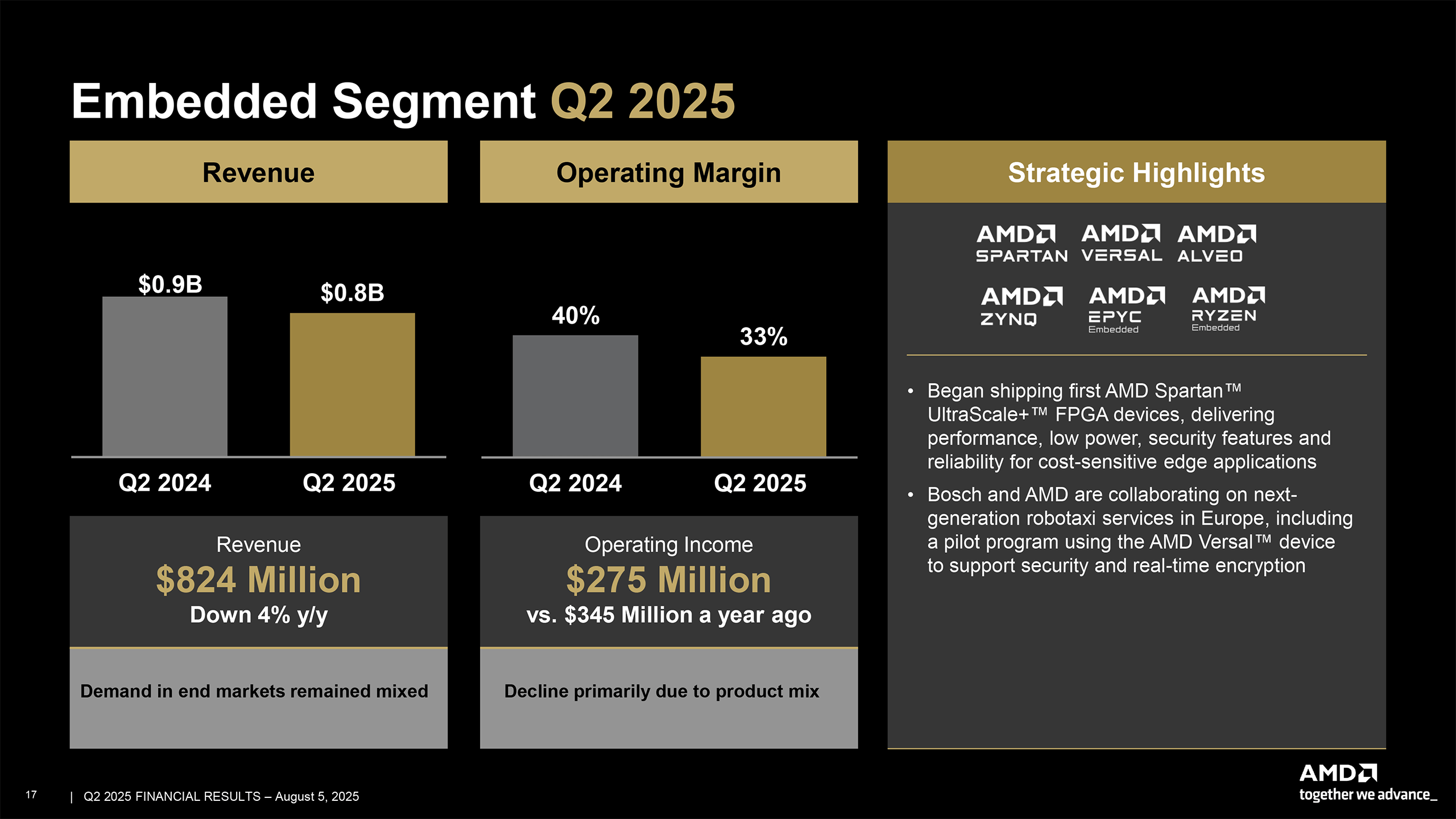

AMD's Embedded division posted revenue of $824 million, down 4% YoY and flat sequentially.

The decline was attributed to mixed demand across end markets, macroeconomic softness, and variability in customer ordering patterns, according to the company. Operating income for the Embedded segment was $275 million, a 20% decrease compared to the same quarter last year.

Optimistic forecast

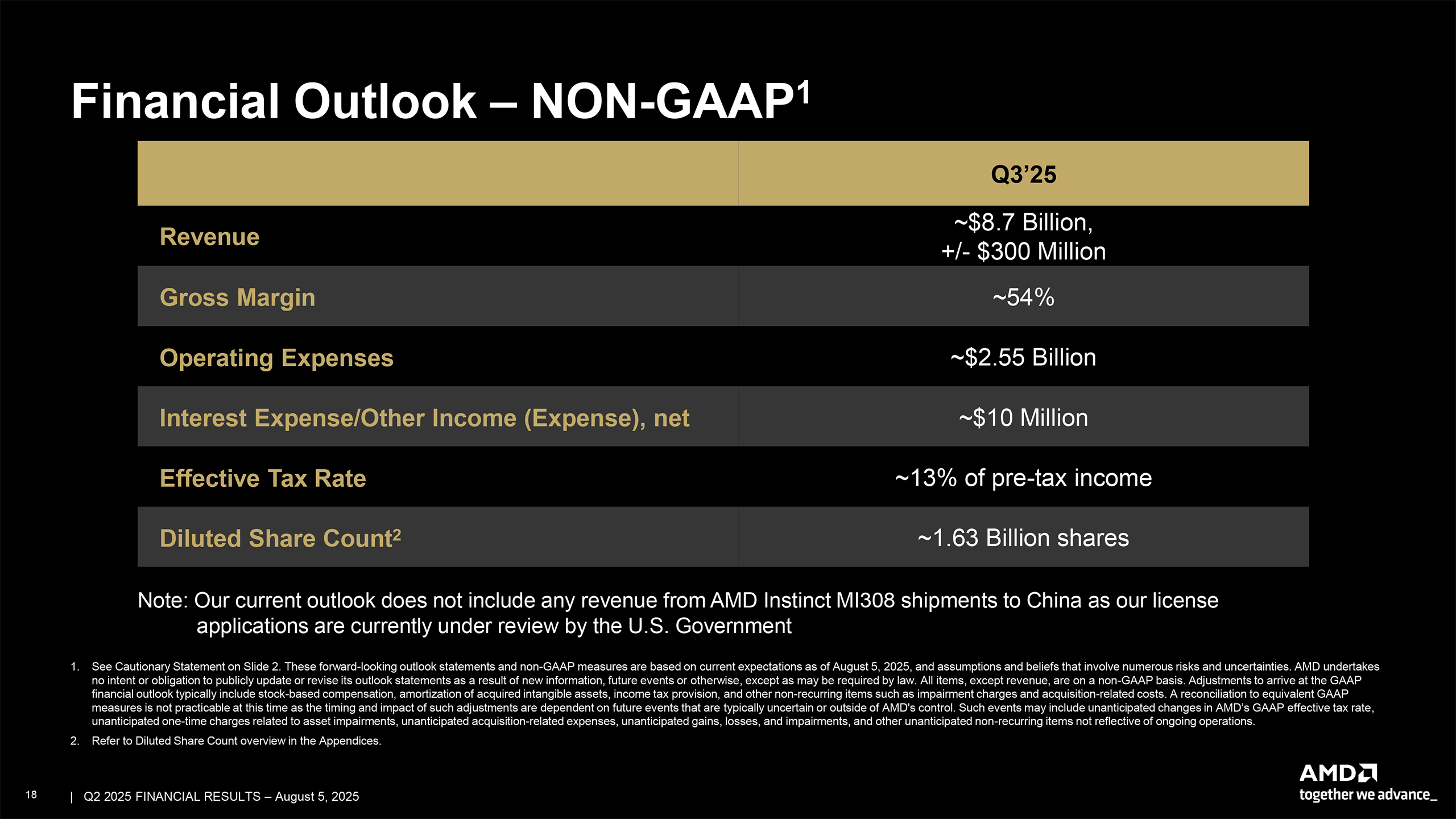

For Q3 2025, AMD expects revenue of approximately $8.7 billion ± $300 million, representing around 28% year-over-year and 13% sequential growth at the midpoint, and another record quarter for AMD.

This outlook reflects strong demand for AMD's AI accelerators as the company expects its Instinct MI350-series to ramp in Q3, EPYC server processors, and client products due to start of the back-to-school season and stockpiling for the upcoming Christmas season, though it excludes any potential revenue from Instinct MI308 GPU shipments to China, as export license applications remain under U.S. government review. While Q3 is traditionally good for AMD's gaming segment as console makers Microsoft and Sony increase purchases of SoCs for their products, this time around, AMD expects flattish revenue.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Gururu Sounds great but the stock is all over this year. Also weaker than expected earnings hurt more than the revenue helped.Reply -

dalek1234 Meanwhile, Intel insiders are reporting 18A process yields to be at only 10%. Intel's future quarterly results should be quite entertaining, as AMD is eating Intel's lunch.Reply -

TerryLaze Reply

For giant chips.dalek1234 said:Meanwhile, Intel insiders are reporting 18A process yields to be at only 10%.

For normal sized chips they are doing pretty well.

https://www.linkedin.com/pulse/tech-news-intel-18a-process-yield-rises-55-surpasses-samsung-pvkpc

Did you look at the actual quarterly report that AMD posted?!dalek1234 said:Meanwhile, Intel insiders are reporting 18A process yields to be at only 10%. Intel's future quarterly results should be quite entertaining, as AMD is eating Intel's lunch.

The only money maker amd had was server and that went from +932 to -155 (operating income) in one quarter... more than a billion less.

Based on sales of products alone AMD made a loss this quarter and that's with tariffs and tsmc's price increases not fully impacting them yet. -

Gururu Reply

Well Intel dumped a while ago and has been hanging onto $20 by a thread. Its not like one should buy one or the other. Neither are good choices right now.dalek1234 said:Meanwhile, Intel insiders are reporting 18A process yields to be at only 10%. Intel's future quarterly results should be quite entertaining, as AMD is eating Intel's lunch. -

vanadiel007 As Intel slowly starts fading away, AMD prices will go up over time due to lack of competition.Reply

Should make for an interesting second hard market. -

DS426 Reply

The stock market has had much higher than normal volatility this year. More importantly, AMD is in a long-game battle with nVidia over AI, with this year certainly not being AMD's time-to-shine. We'll have to see how MI450 and the other related software and dev ecosystem enhancements pan out.Gururu said:Sounds great but the stock is all over this year. Also weaker than expected earnings hurt more than the revenue helped. -

DS426 Reply

They still made a positive net income. That shift in server operating income loss was due to the ~$800m MI308 write-off; it would have been positive without that. That's a one-off problem, not a greater system problem at AMD. Moreover, AMD is expecting revenues of almost $1 bn more next quarter while operating costs actually drop somewhat, which would provide decent positive operating income numbers.TerryLaze said:...

Did you look at the actual quarterly report that AMD posted?!

The only money maker amd had was server and that went from +932 to -155 (operating income) in one quarter... more than a billion less.

Based on sales of products alone AMD made a loss this quarter and that's with tariffs and tsmc's price increases not fully impacting them yet.

Also, the Client and Gaming Segment was also a money maker, coming in with a $767m operating income. Both of those bits -- Client and Gaming -- were way up on revenue YoY. -

bit_user Reply

No, for Panther Lake's compute die. Hardly giant.TerryLaze said:For giant chips.

For normal sized chips they are doing pretty well.

https://www.linkedin.com/pulse/tech-news-intel-18a-process-yield-rises-55-surpasses-samsung-pvkpc

Although a leak, this is more recent than what you cited:

https://wccftech.com/intel-is-reportedly-struggling-with-its-next-gen-panther-lake-chips/ -

TerryLaze Reply

Yes, that's why I said based on sales alone, they had a positive net income due to taxes.DS426 said:They still made a positive net income.

Tariffs and export restrictions are not a one-off, they will affect everybody for a long time.DS426 said:That shift in server operating income loss was due to the ~$800m MI308 write-off; it would have been positive without that. That's a one-off problem, not a greater system problem at AMD.

There are new ones on the way.

https://www.tomshardware.com/tech-industry/trump-promises-new-semiconductor-tariffs-we-want-them-made-in-the-united-states-says-u-s-president

Huh?!DS426 said:Moreover, AMD is expecting revenues of almost $1 bn more next quarter while operating costs actually drop somewhat, which would provide decent positive operating income numbers.

Operating expenses went up 9% from last quarter and 23% y/y.

Also revenue increased by almost 2bil y/y while that increased operating income by -400M

Operating income went down by 150% y/y.

An increased revenue does not automatically mean high income.

Where does that say that they are at 10% for panther lake????bit_user said:No, for Panther Lake's compute die. Hardly giant.

Although a leak, this is more recent than what you cited:

https://wccftech.com/intel-is-reportedly-struggling-with-its-next-gen-panther-lake-chips/

As a matter of fact that article takes its info from an reuters article which says:

"early in the ramp" "Intel in the past has aimed for a yield north of 50% before ramping production"

There is no mention of what percentage the anonymous leakers think intel is at. -

bit_user Reply

Third paragraph from the bottom:TerryLaze said:Where does that say that they are at 10% for panther lake????

"only 10% of PTL chips made by the 18A wafer are up to the specifications Intel wants them to be at, which indicates that chip defects are massive right now. It is said that Panther Lake chips have "three times too many defects" for HVM, and this is a concerning situation."

The article further characterizes this as a "stall" and suggests that Panther Lake may miss its planned launch of Q4 2025, as a result.