SSDs pricing to 'skyrocket' as flash shortages are already underway — critical NAND packages are already in short supply, high-capacity SSD models will be first to see price hikes

Consumer SSDs will get substantially more expensive soon.

The price of higher-capacity consumer SSDs will "skyrocket" this quarter as NAND packages consisting of four and eight NAND devices are already in short supply, an industry source told Tom's Hardware. Some price upticks are starting to show in retail already, but sudden shortages of critical 4- and 8-die NAND packages will spur more significant price increases expected to hit later in the quarter.

A single-sided SSD in an M.2-2280 form factor can carry four 3D NAND packages. Modern 2TB and 4TB drives in this form factor tend to use packages consisting of four or eight 3D NAND devices to ensure high performance. There is already a shortage of these packages today as SSD makers are struggling to find adequate supply. Some suppliers are already raising their quotes, which will affect SSD prices, with the shortages filtering down as higher pricing for end users over the coming months.

It may take two to three months before the full impact of the NAND package shortages works its way into the supply chain when pricing for some of the best 2TB and 4TB SSDs is set to 'skyrocket,' the source noted.

There are several reasons why the supply of higher-capacity 3D NAND packages may be limited. On the one hand, makers of 3D NAND have cut memory production in recent quarters due to low demand and said they would slow down the transition to nodes that enable higher bit densities. This greatly reduces the amount of flash capacity supplied to the market.

Furthermore, as reported by TrendForce, some buyers are increasing their purchases despite a low-demand season in the first quarter of 2024, leading to a rise in 3D NAND contract prices by 15% to 20%. This increase is a response to suppliers' strategies to minimize losses and manufacturers' aggressive price hikes, with future price trends depending on enterprise SSD procurement.

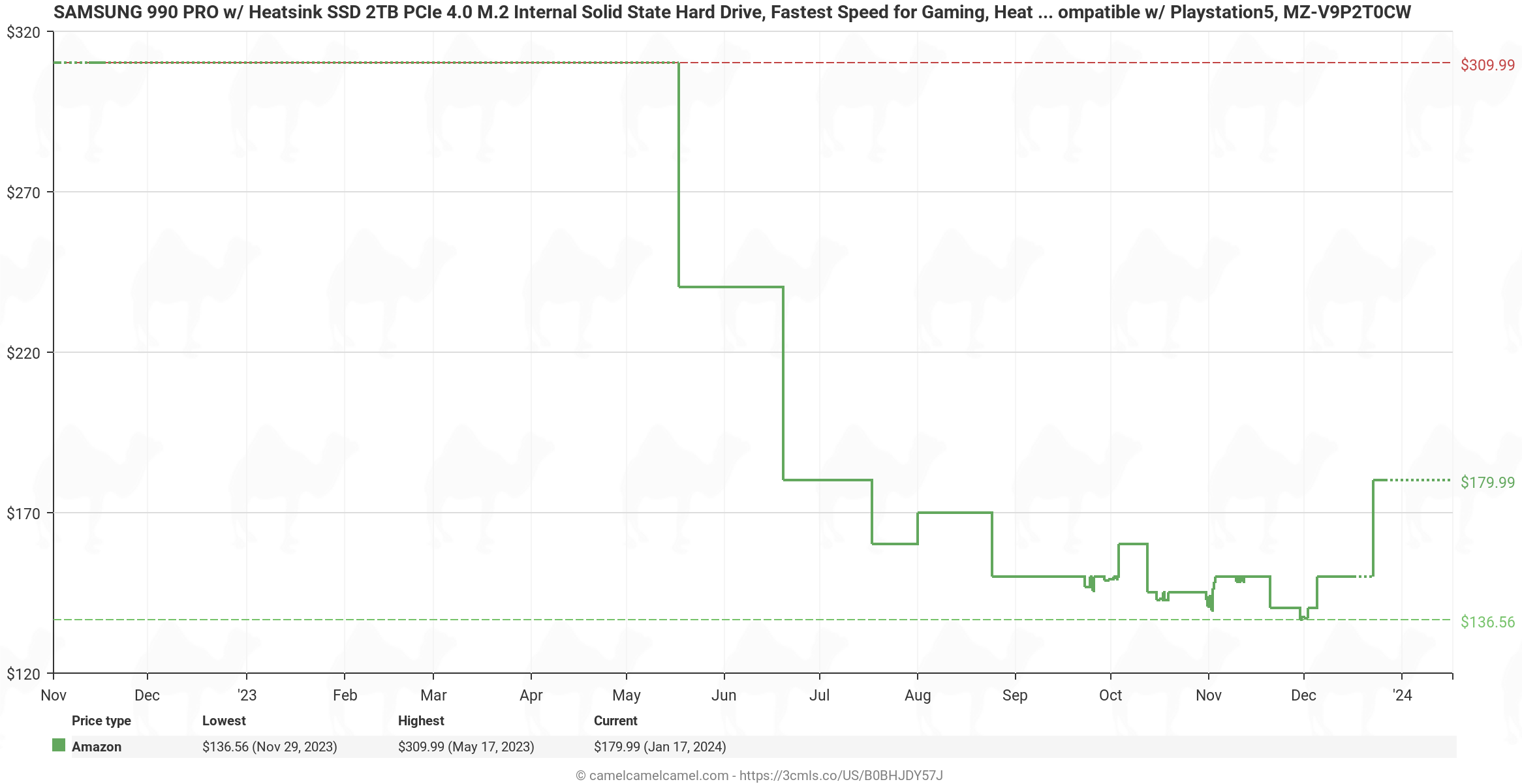

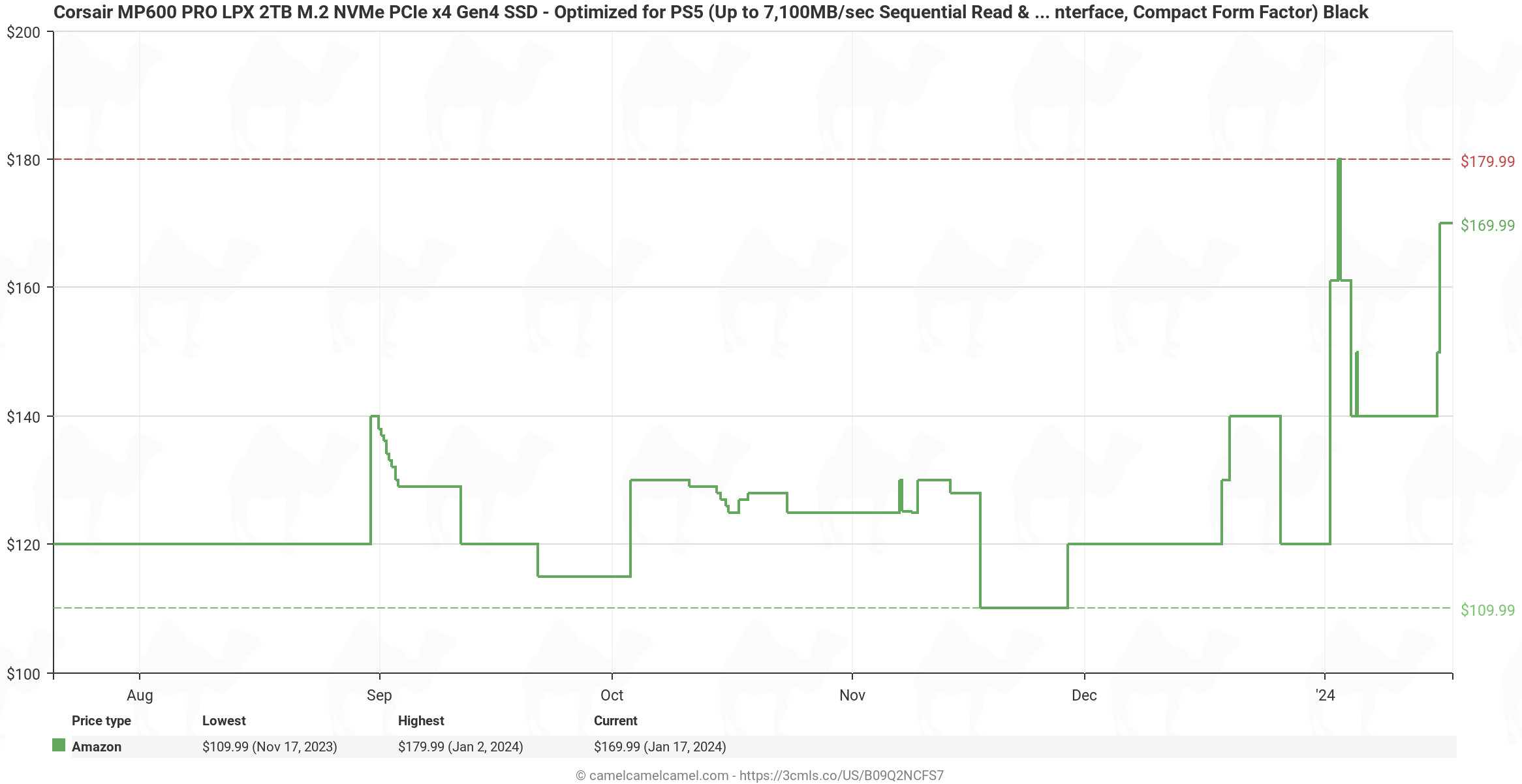

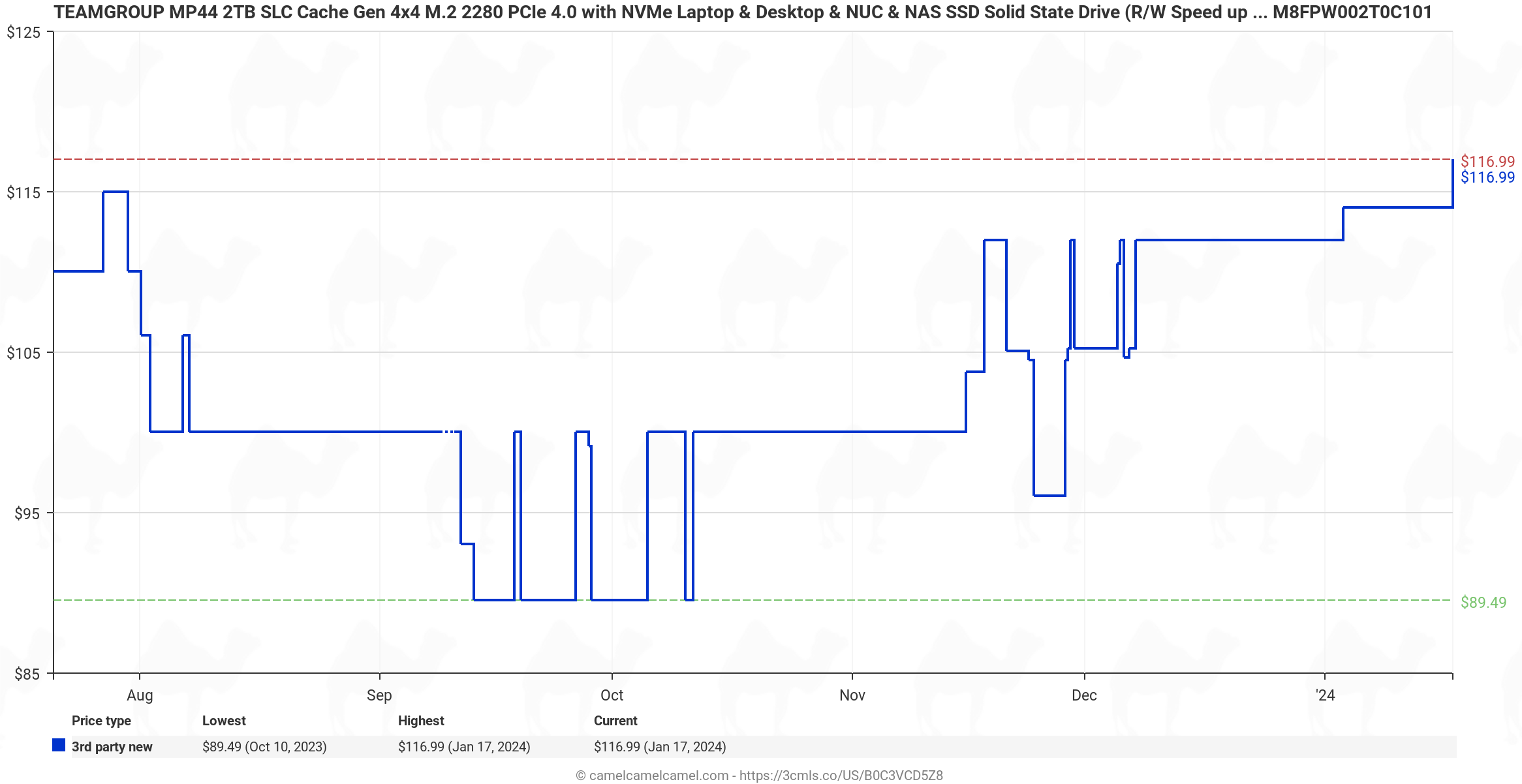

The market for consumer SSDs, particularly among PC OEMs, is reaching a peak in purchasing, driven by the growing adoption of PCIe 4.0 SSDs. In response to this demand and the need to balance their books, suppliers are raising prices for PCIe 4.0 products, the report says. This trend is expected to result in a 15%–20% jump in PC client SSD contract prices. The acceptance of these new rates is more likely among notebook makers. Meanwhile, prices of some popular SSDs have increased in the last several weeks at CamelCamelCamel.

By contrast, the enterprise SSD market shows a different dynamic. While demand from North American Cloud Service Providers (CSPs) remains tepid, Chinese CSPs and server brands are offsetting this, keeping the market robust. This activity, combined with suppliers' firm pricing strategies, is anticipated to propel enterprise SSD contract prices by about 18% to 23% for the quarter, according to TrendForce.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Notton In my area, I still see some good deals for 4TB and 2TB capacities from TEAM and Kingspec.Reply -

g-unit1111 ReplyNotton said:In my area, I still see some good deals for 4TB and 2TB capacities from TEAM and Kingspec.

Yeah I can get a Crucial P3 for $109. I might buy one this week as I'm in the process of upgrading one of my rigs. -

HaninTH Replymagbarn said:Memory "OPEC" Cartel strikes again.

Indeed! Let us all not forget that this is the same entity that publicly declared that they would induce these higher prices by restricting output of NAND chips last year. This is not a natural supply shortage, it is planned.

Thanks, Unregulated Capitalism! -

Co BIY ReplyHaninTH said:Indeed! Let us all not forget that this is the same entity that publicly declared that they would induce these higher prices by restricting output of NAND chips last year. This is not a natural supply shortage, it is planned.

Thanks, Unregulated Capitalism!

You think they should be forced to produce the products at a loss ?

Not even sure shortage is the right word. Are there bare shelves with none available ? -

JTWrenn Reply

They don't even see that they are just setting the whole world up to be completely smashed by China on this. They are going to corner the market with cheap chips in a few years that all suck and die like crazy....but are so much cheaper nobody will be able to compete.magbarn said:Memory "OPEC" Cartel strikes again.

It's idiotic, short sighted, and it's going to hurt the overall market. -

thestryker They made too much which caused the drop in demand and subsequent pricing now they're shifting the other way. This is how supply and demand works and while it's not good for the consumer it's generally the right thing for the market. When the floor drops out we end up with consolidation (which there has already been a fair amount of) which is what happened in the DRAM industry. Hopefully things don't readjust too far, but only time will tell where it ends up.Reply -

cyrusfox Reply

Thats quite a paradox, China will take over with inferior quality products because of how they price them... Have you ever had a drive go bad? How were your feelings towards said manufacturer? Not a good long term strategy for business survival, ask OCZ how that worked for them...JTWrenn said:They don't even see that they are just setting the whole world up to be completely smashed by China on this. They are going to corner the market with cheap chips in a few years that all suck and die like crazy....but are so much cheaper nobody will be able to compete.

It's idiotic, short sighted, and it's going to hurt the overall market.

NAND is commodity, if China can supply enough and produce cheaper, they can win the market, if they cannot match the quality, they will not be able to compete.