AMD stock reaches 52-week high, nears all-time record — driven by AI demand and analyst optimism

Valuation rose 8% on Tuesday, closing at $158.74.

AMD stock surged on Tuesday, reaching a 52-week high of $158.74. Long-term stockholders were already enjoying riding a steady uptrend, but news of strong AI demand and price target increases from big-name analysts converged to boost the stock by 8% in a single day. AMD’s all-time high was $164.46 back in November 2021, and it has moved to within striking distance of breaking that record.

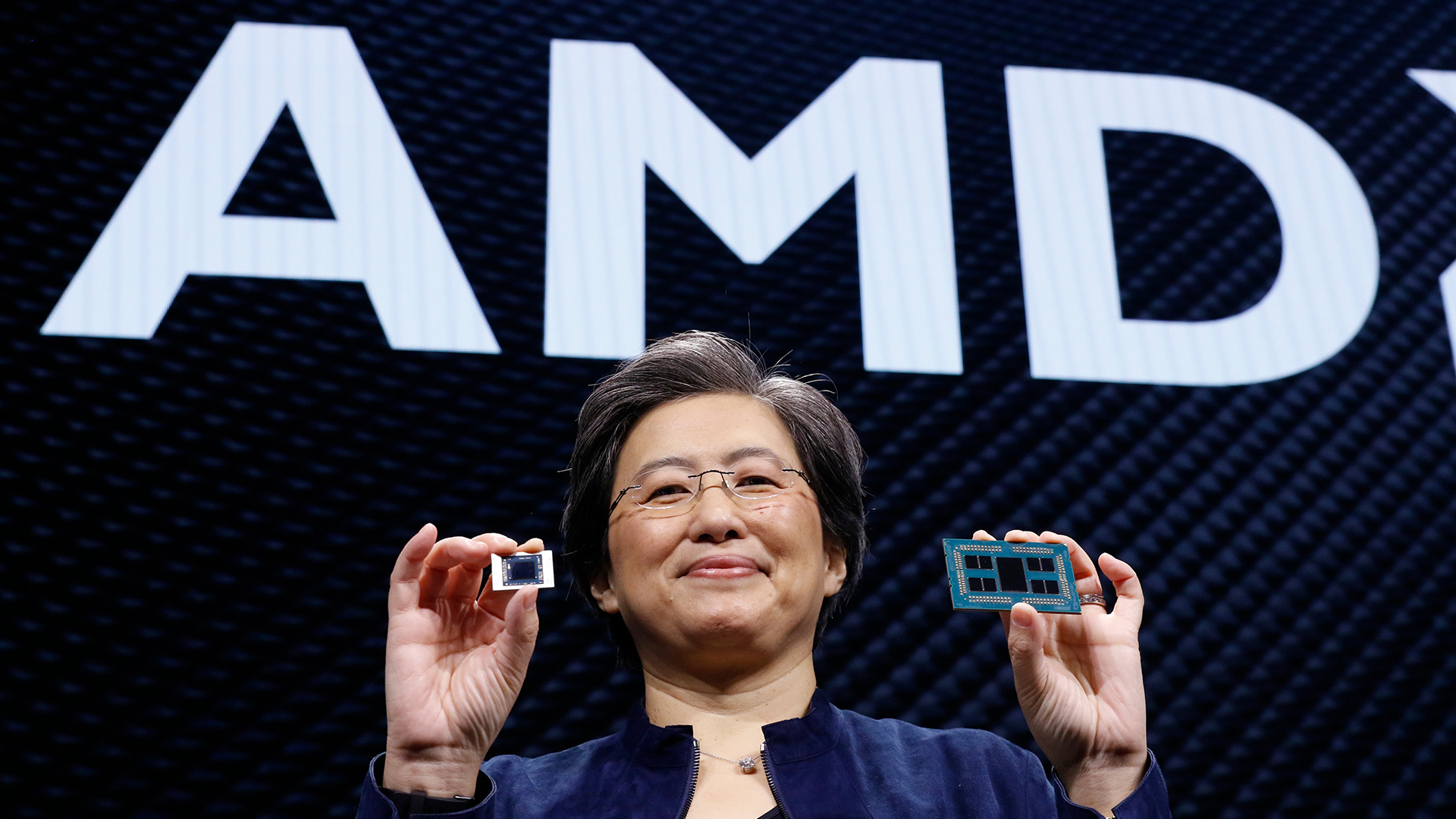

In addition to the overall optimism regarding greater demand for advanced AI chips, AMD was put in the spotlight via an investor note from Barclays. It suggested that while Nvidia is the dominant player as we enter 2024, AMD is going to gain ground as it ramps up deliveries of chips to enterprise customers. The red team revealed some new AI data center products just a few weeks ago: the Instinct MI300X AI accelerator and the Instinct MI300A.

It was therefore implied by Barclays that firms like AMD could get a whiff of the kinds of gains Nvidia achieved last year. This seems to be reflected in the updated target price for AMD stock touted by Barclays. It hiked AMD’s target price from its totally-eclipsed $120 to a confident $200.

Other big-name investment analysts with positive re-ratings for AMD stock yesterday included KeyBanc Capital Markets, which moved its price target from $170 to $195, and Susquehanna Financial Group, raising its target from $130 to $170.

The last time we wrote about the good fortunes of AMD stockholders was four years ago when AMD hit an all-time high and was trading at just under the $50 mark. At the time, AMD was being lifted by the greater confidence that successive Zen CPU architectures had given to industry watchers. Coincidentally, significant gains were seen shortly after re-ratings by investment analysts like Nomura.

Nvidia also got a little AI love on Tuesday

Nvidia stock also enjoyed a good Tuesday, moving up over 3% to reach a record high of $568.35 in intraday trading. Remember, the value of Nvidia stock tripled last year, propelled by its key role in accelerating AI businesses of all shapes and sizes. Reuters reports that the average price target for Nvidia, across 53 analyst ratings, actually fell slightly from $627.50 to $625. It is still rated as a ‘buy’ but for now its AI achievements seem to be priced in.

We wouldn’t be surprised if the momentum behind both AMD and Nvidia continues for some time – but no advice is intended, and stock prices can fall and make owners very unhappy. Nvidia and AMD will probably continue to face hurdles in making the most of AI chip demand from Chinese organizations, for example. Also, AI might turn out to be a passing fad, another tech bubble…

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

bit_user If there's one thing working in AMD's favor, it's that they've hopefully learned just how hard it is to leap-frog Nvidia. Ideally, this will have them doing some really outside-the-box thinking about their AI product plans, rather than continuing the path of evolutionary improvements to current designs. I expect hybrid CPU/GPU processors (i.e. MI300) is just the start.Reply -

spongiemaster The problem for AMD has always been the software side. With Nvidia's ecosystem so dominant in the industry, it's probably too late for AMD to make any serious headway. It's going to take the rest of the industry moving to an open standard for AMD to have any chance in the market.Reply -

bit_user Reply

They have a CUDA clone called HIP + tools for porting CUDA code to HIP. They've used these to add support for their GPUs to popular deep learning frameworks and other software, but it does have to be maintained as a separate backend. It does also mean that AMD will always have the perception (if not also the reality) of being a cheaper imitation.spongiemaster said:The problem for AMD has always been the software side. With Nvidia's ecosystem so dominant in the industry, it's probably too late for AMD to make any serious headway.

AMD would point out that their HIP API also supports Nvidia hardware, letting you convert your CUDA code to HIP and then maintain only that version. However, I'm not sure how many would trust AMD's support for Nvidia hardware to be at the same level of CUDA's native support for it.

We have open standards: OpenCL and SYCL. Some people like to bring up Vulkan Compute, but that's not comparable to OpenCL or CUDA. Intel is the main one still pushing OpenCL and SYCL, but even they have oneAPI, at a higher-level.spongiemaster said:It's going to take the rest of the industry moving to an open standard for AMD to have any chance in the market.

IMO, the main reason OpenCL didn't dominate is because no big platform provider forced the issue. It's still out there, and if support for it were ever ubiquitous across all hardware, it could enjoy something of a resurgence. Not sure it'll ever displace CUDA, at this point. -

Jimbojan I am sorry, AMD will never gain any significant shares in AI, as most data center companies are making their own chips, also Intel is making its next generation server and accelerators with scale, it is more power efficient than AMD's 5nm chip. Intel is moving to Intel 4 and Intel 3, data Center will not use AMD chips anymore, mainly because Intel has more power efficient chips in Intel 3 and 4 and later on 18A. Both AMD and TSMC will be falling behind in 2024. I can’t see AMD can be in any reasonable position from here. All those analysts are jokers, they are doing it for their pump and dump to make profit out of you.Reply -

SonoraTechnical ReplyJimbojan said:I am sorry, AMD will never gain any significant shares in AI, ....All those analysts are jokers, they are doing it for their pump and dump to make profit out of you.

You don't sound apologetic, but rather are gloating.... -

spongiemaster Nothing you said changes what I said. I am aware OpenCL exists. It's not going to be a serious threat to NVidia unless the rest of the industry gets behind it and there is no indication that is happening any time soon. AMD supporting OpenCL is not going to move the industry.Reply -

bit_user Reply

And yet they still buy Nvidia GPUs! That tells me the market is still there, if you can build something good enough.Jimbojan said:I am sorry, AMD will never gain any significant shares in AI, as most data center companies are making their own chips,

Ooh, someone is counting their chickens before they hatched!Jimbojan said:also Intel is making its next generation server and accelerators with scale, it is more power efficient than AMD's 5nm chip. Intel is moving to Intel 4 and Intel 3, data Center will not use AMD chips anymore, mainly because Intel has more power efficient chips in Intel 3 and 4 and later on 18A.

Too bad Meteor Lake (made on Intel 4) seems to be so underwhelming.

It's only Intel's 20A node that supposedly gains a lead, and I think we won't see a big volume ramp of those products until 2025.Jimbojan said:Both AMD and TSMC will be falling behind in 2024.

Considering your 100% stalwart track record of pumping Intel, that sounds like the pot calling the kettle black.Jimbojan said:I can’t see AMD can be in any reasonable position from here. All those analysts are jokers, they are doing it for their pump and dump to make profit out of you. -

bit_user Reply

What you're missing is that most of the industry doesn't write CUDA code. Their stuff sits a layer above it, by using frameworks like TensorFlow, PyTorch, etc. They (mostly) don't care what's underneath.spongiemaster said:Nothing you said changes what I said. I am aware OpenCL exists. It's not going to be a serious threat to NVidia unless the rest of the industry gets behind it and there is no indication that is happening any time soon.

Maybe you need to reread what I wrote, because I didn't say anything about that. AMD backed away from OpenCL a long time ago.spongiemaster said:AMD supporting OpenCL is not going to move the industry. -

Neilbob Reply

Every few months you post this exact message, or some variation of it, completely disregarding articles and tests from multiple sources that suggest otherwise when it comes to power efficiency in particular. This is the case for now, but you somehow possess the ability to see in to the future in order to make assessments about forthcoming products.Jimbojan said:blah

You also seem to be intent on suggesting that Intel will make advancements but AMD (and TSMC) will remain stationary, which certainly hasn't been the case for several years.

Also, you seem determined that AMD are going to fall and/or become irrelevant. We've already seen what happens if this weird event you seem to hoping for actually happens: products stagnate and prices rise - consumers don't win.

As for Intel's process developments, they often look to me like 33.3% improvement and 66.6% marketing. -

spongiemaster Reply

My original point was that AMD doesn't have the software to make any headway against Nvidia in AI. You brought up OpenCL as some sort of counter, so whether or not you actually said it, OpenCL is not the answer to AMD's problems.bit_user said:What you're missing is that most of the industry doesn't write CUDA code. Their stuff sits a layer above it, by using frameworks like TensorFlow, PyTorch, etc. They (mostly) don't care what's underneath.

Maybe you need to reread what I wrote, because I didn't say anything about that. AMD backed away from OpenCL a long time ago.