Analyst estimates Nvidia is now TSMC's second largest customer accounting for 11% of revenue in 2023

Nvidia paid TSMC $7.73 billion in 2023 for its services

Although TSMC doesn't disclose the details of its business with its customers, it has to disclose if a customer accounts for over 10% of its revenue in accordance with U.S. laws. As it turns out, Nvidia accounted for 11% of TSMC's revenue in 2023, according to estimates by Dan Nystedt, a financial analyst specializing in semiconductor companies.

Last year, Apple — which TSMC's SEC filing calls 'Customer A' — accounted for 25% of TSMC's revenue and paid TSMC $17.52 billion. Meanwhile, Nvidia — which Nystedt believes is designated as Customer B in the filing — paid TSMC $7.73 billion and accounted for 11% of TSMC's net revenue in 2023.

"TSMC's Top 10 customers accounted for 70% of net revenue last year, up from 68% in 2022," wrote Nysted in an X post. "These companies include MediaTek, AMD, Qualcomm, Broadcom, Sony, and Marvell."

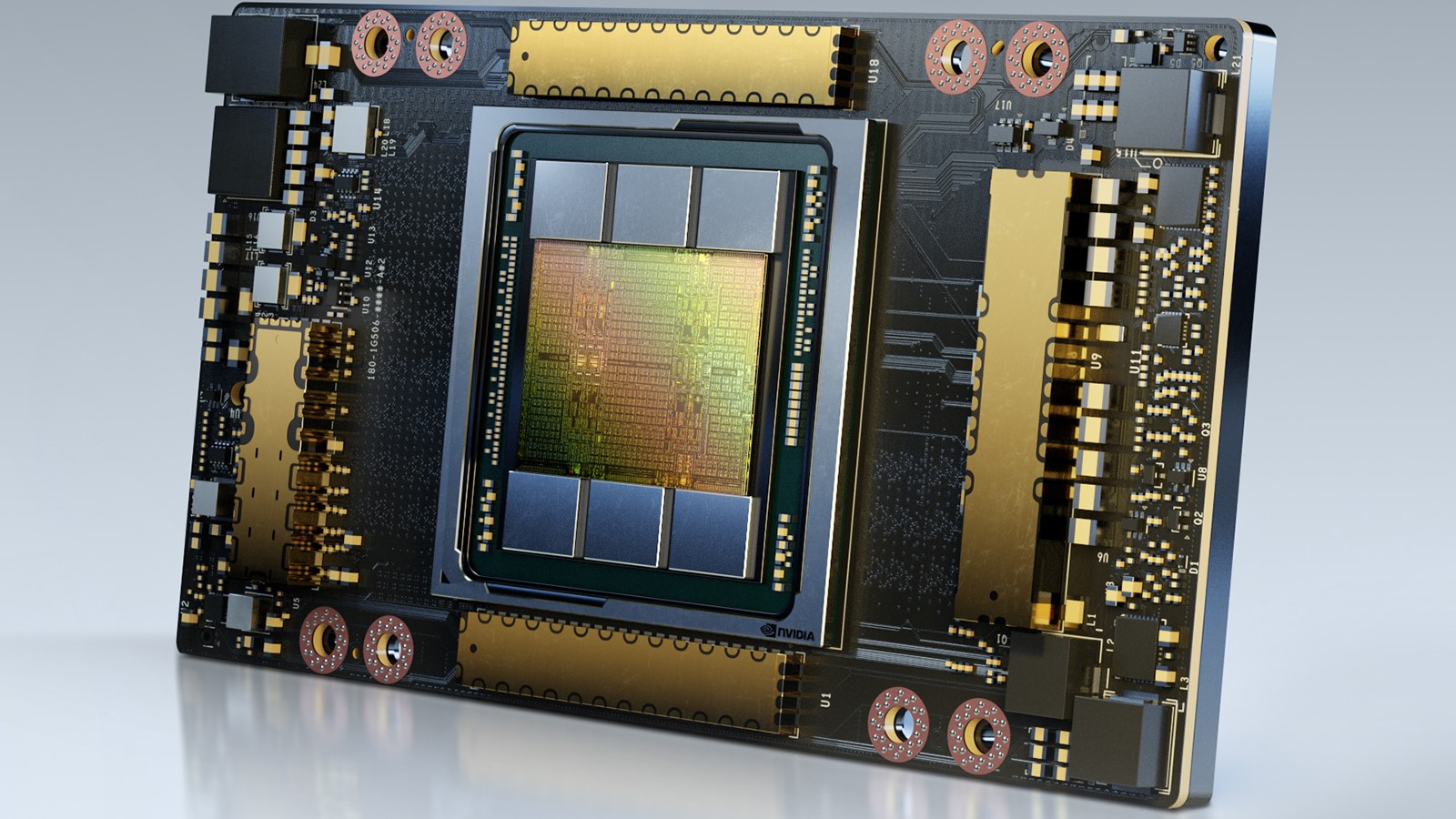

Apple has been TSMC's top customer for years and will probably stay the foundry's No.1 client, given its volumes, for years. But no other client has accounted for over 10% of TSMC's net revenue for quite a while. Although companies like AMD, MediaTek, and Qualcomm have been ramping their orders to TSMC in recent years, the AI frenzy drove demand for Nvidia's H100 and A100 processors to unprecedented levels, which is why it increased its orders to TSMC, the world's largest contract maker of chips. In fact, during the crypto mining craze from 2021 - 2022, Nvidia pre-paid TSMC for production capacity.

It should be noted that complex AI processors like Nvidia's A100 and H100 are made by TSMC and packaged by the company using its CoWoS packaging technology. Therefore, Nvidia pays TSMC both for silicon and for advanced packaging services.

As demand for AI processors increases, Nvidia's share in TSMC's revenue will likely increase in 2024. The company has already booked silicon and CoWoS capacity to ensure a steady supply of its premium processors for AI.

It remains to be seen if AMD's share in TSMC's net revenue will cross 10% this year. The company sells loads of datacenter-oriented EPYC processors, and its Instinct MI300-series products for AI and HPC are also said to be in high demand, so AMD's share in TSMC's earnings might increase.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.