Intel delays $100 billion Ohio chipmaking site to next decade: First fab now coming online in 2030

But can accelerate the launch if needed.

Intel has revised the construction schedule for its Ohio One semiconductor manufacturing site in New Albany, Licking County, delaying its launch to the next decade. The first phase (Mod 1) will now be completed in 2030, with production starting between 2030 and 2031. Mod 2 is set to finish in 2031, with operations launching in 2032. The company is slowing down the facility's construction to align its investments with market conditions. However, Intel stressed that it could accelerate construction if needed.

Intel originally planned to complete the first phase of its Ohio site — once called the Silicon Heartland — in 2025. However, massive investments amid uncertain demand made Intel push the completion of the first module to 2027 or 2028. Now, the company believes it will need its fabs in Ohio only in 2030 and beyond. The delay suggests that it does not expect demand for its production capacity to skyrocket soon, which may be a not-so-positive development. On the other hand, Intel will also not have to invest heavily in its Ohio site now, which is good news for the company's balance sheet as it is struggling to return to profitability. Investments in production equipment are the most significant investments in semiconductor fabrication facilities, so by delaying them, Intel significantly cuts its capital expenditures for the 2025 – 2028 period.

The upcoming campus will cover approximately 1,000 acres (4 square kilometers), accommodate up to eight semiconductor fabrication plants, and foster space for support operations and industry partners. Intel previously estimated that fully developing the site would require an investment of around $100 billion. The first round of investments was set at around $28 billion.

Given the new schedule for the Ohio One (or the Silicon Heartland?) fabs, expect the new facilities to use process technologies that the company will develop after its 14A and 14A-E, currently set for 2026 – 2027 introduction. These nodes will rely on ASML's Twinscan EXE:5200 or more advanced High-NA EUV tools that cost $350 million per unit.

"We are taking a prudent approach to ensure we complete the project in a financially responsible manner that sets up Ohio One for success well into the future," wrote Naga Chandrasekaran, executive vice president, chief global operations officer and general manager of Intel Foundry Manufacturing, in a message to employees. "We will continue construction at a slower pace, while maintaining the flexibility to accelerate work and the start of operations if customer demand warrants, but I want to be upfront and transparent with you all about our current plan."

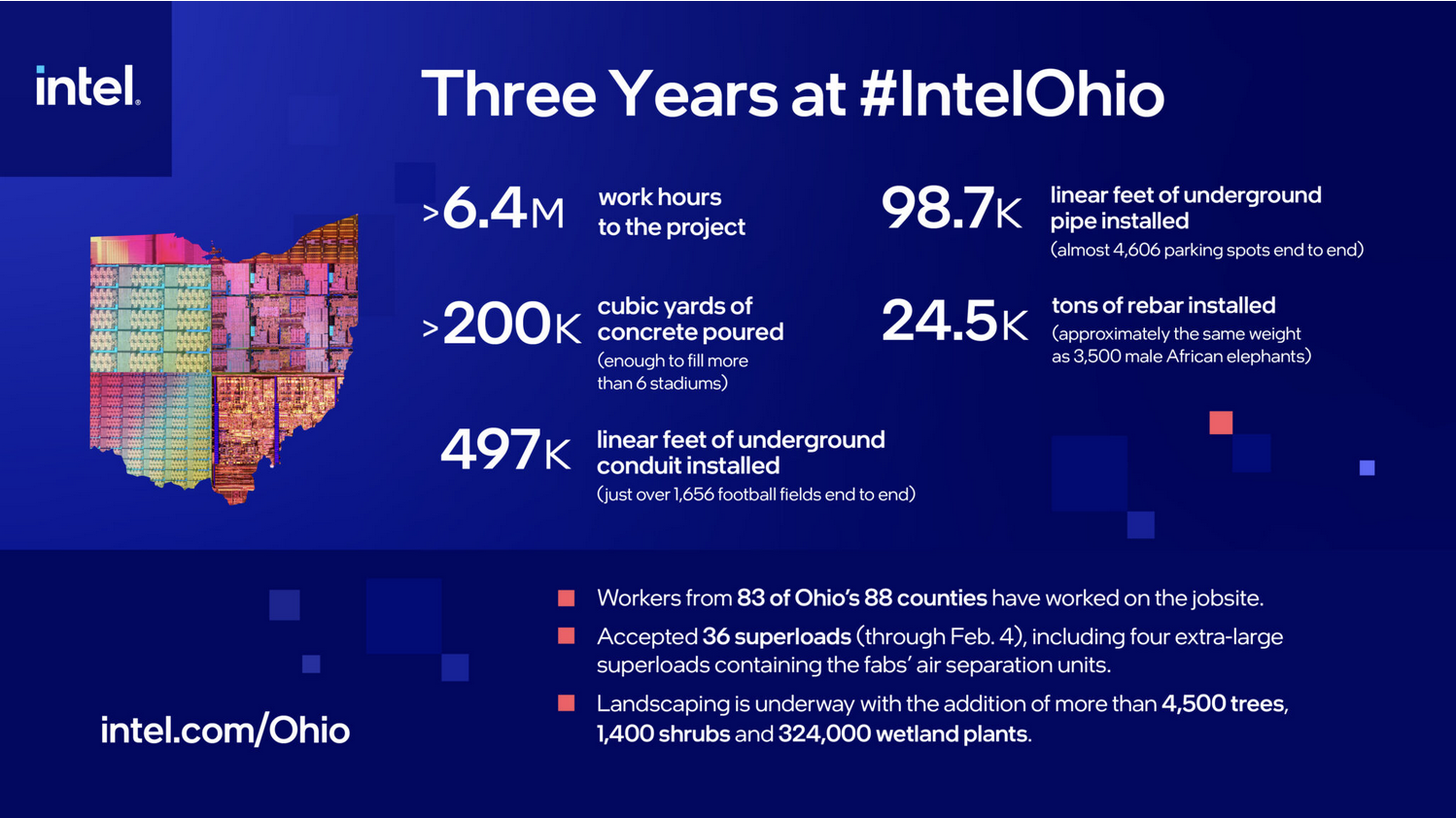

Intel began work at the site in 2022. Since then, construction at the site has advanced significantly. The project recently reached a milestone as the underground foundation was finished, and construction above ground has begun. According to Intel, since the beginning of the construction, the site has accepted 36 superloads (through February 4), including four extra-large superloads containing the fabs' air separation units. More than 6.4 million labor hours have been invested, covering key installations such as underground piping, 200,000+ cubic yards of concrete, and sub-utility trenches (SUTs). Office structures are also taking shape.

One interesting thing about the Ohio fab is that despite the revised timeline, hiring has already begun, with Ohio employees training in Arizona, New Mexico, and Oregon ahead of the local facility's launch. Presumably, Intel is training employees to install production tools and other machinery. Workforce initiatives are set to expand as operational dates approach.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

DS426 Maybe an acknowledgement that they won't have Ohio ready in time to ride the AI wave, eh? Just wait for the next opportunity?Reply

Hoping and waiting for new CHIPS Act type funding and tax incentives? -

rluker5 Intel is probably still waiting on old CHIPs act funding to be paid. The check will be in the mail as soon as all of the AI hype dies down.Reply -

phead128 The new CEO will likely spin off the Intel Foundry, so no point to rush into this project with so much risk and uncertainty.Reply -

rluker5 Reply

Yeah, think of all of the money Intel could make by selling off the foundry with the most advanced nodes in the world in 6 months, not even utilizing their best lithography machines. They could make a short term fortune if the US gov let them. Probably dwarf even Nvidias earnings. The shareholders would be rich. So long as they sold their shares quickly.phead128 said:The new CEO will likely spin off the Intel Foundry, so no point to rush into this project with so much risk and uncertainty. -

Hooda Thunkett Oh! Oh! Can I be the pedantic one who points out the next decade starts in 2031, not 2030? Please? Pretty please? CanIcanIcanI? Pleeeeeeeese?Reply -

TerryLaze Replyphead128 said:The new CEO will likely spin off the Intel Foundry, so no point to rush into this project with so much risk and uncertainty.

And who thew heck do you think would buy not even finished fabs? At least at any price that would make intel a decent amount of money.rluker5 said:Yeah, think of all of the money Intel could make by selling off the foundry with the most advanced nodes in the world in 6 months, not even utilizing their best lithography machines. They could make a short term fortune if the US gov let them. Probably dwarf even Nvidias earnings. The shareholders would be rich. So long as they sold their shares quickly.

TSMC is already also building fabs so they don't have the money to spend right now, if they would even be able to use fabs build for someone else, and nobody else is a big enough company to deal with it, they would just buy it to chop it up and sell it peace meal, if even that is an option.

Also spin off that phead is mentioning means new company that still belongs to the old company so any cost and risk would still be on intel. -

endocine Intel isn't going to be around in 2030 at least in its current form. They had bad leadership that bankrupted itReply -

TerryLaze Reply

Have you even any idea about financials?!endocine said:Intel isn't going to be around in 2030 at least in its current form. They had bad leadership that bankrupted it

Intel is not even close to bankruptcy, they are expanding right now, that's the exact opposite of going bankrupt. -

rluker5 Reply

I was being sarcastic. Intel cutting financial ties with the part of the company that they have been spending a ton of money to update in half the time it took the rest of the industry just as they are about to claim a significant milestone with 18A only makes sense if you look at it from the point of chopping up and selling off the company in parts for whatever short term profit you can get before the leftover bits fall back to low value irrelevance.TerryLaze said:And who thew heck do you think would buy not even finished fabs? At least at any price that would make intel a decent amount of money.

TSMC is already also building fabs so they don't have the money to spend right now, if they would even be able to use fabs build for someone else, and nobody else is a big enough company to deal with it, they would just buy it to chop it up and sell it peace meal, if even that is an option.

Also spin off that phead is mentioning means new company that still belongs to the old company so any cost and risk would still be on intel.

Some points I've noticed that when you put them together support Intel keeping their in house fab for long term profitability:

The barrier to entry in the CPU design business is rapidly decreasing and seems like it will keep that trend.

The barrier to node improvement is rapidly increasing and seems like it will keep that trend.

In general, CPU performance improvements are tied to # of transistor increases and work per second per transistor increases (which increases heat density).

More profit can be made by better fitting manufacturing to chip design.

You can put those together however you want, but I'm pretty sure the conclusion you will get is it is better for Intel to keep their fabs in house if they don't want the company to fade away to irrelevance.

But thanks for pointing out that my previous post made no sense.