AMD Overtakes Nvidia in Overall GPU Shipments for the First Time in Five Years (Updated)

Update 8/29/19 7:55am PT: Jon Peddie Research provided us with more market share information, which we added below. We also removed reference to graphics units present in consoles, as the report only quantifies PC-based graphics units.

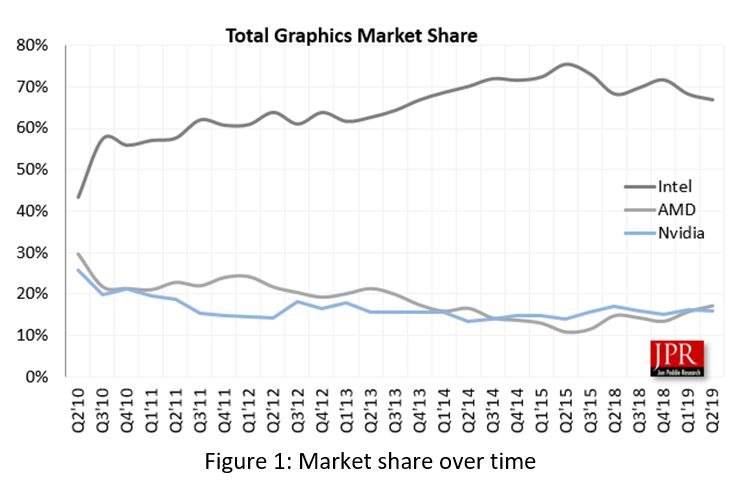

Jon Peddie Research has released its Q2 2019 GPU market results, and it's official: AMD shipped more graphics unit than Nvidia for the first time in five years, thanks to AMD shipping almost 9.85% more GPUs than in Q1 (by comparison, Nvidia sold about the same). The market share data represents cumulative shipments of all types of desktop PC graphics units, including those present in processors, which is an area that Nvidia doesn't have a significant market presence.

The last time AMD led in GPU shipments, the Radeon R9 290X was the fastest gaming GPU you could buy, and Nvidia had not yet released the performance powerhouse that would be Maxwell. Nvidia has been the market leader ever since the Maxwell-based 9-series GPUs launched, but it seems AMD has finally gotten over it at last.

| Total Graphics Market Share | Q2'19 | Market Share Last Year | Unit Growth YoY | Market Share Change YoY | Last Quarter | Share % Change | Qtr. to Qtr. Share % Difference |

| AMD | 17.2% | 14.8% | 4.1% | 2.4% | 15.7% | 9.2% | 1.5% |

| Intel | 66.9% | 68.2% | -12.2% | -1.4% | 68.2% | -2.0% | -1.4% |

| Nvidia | 16.0% | 17.0% | -15.9% | -1.0% | 16.1% | -0.6% | -0.1% |

| Total | 100.0% | 100.0% | -10.4% | Row 4 - Cell 4 | Row 4 - Cell 5 | Row 4 - Cell 6 | Row 4 - Cell 7 |

Jon Peddie Research also reports that discrete GPUs were in fewer PCs than last quarter (from 29% to 27%), that the PC market increased by 9.25% since last quarter, and that AIB sales actually declined 16.62% since last quarter. Despite the overall market growth, Nvidia didn't ship significantly more or less GPUs than before, unlike AMD, which had a large jump in sales.

AMD's resurgence in GPU shipments is somewhat surprising considering the company's product stack and market penetration; AMD doesn't have a faster GPU than Nvidia, support hardware-accelerated ray tracing in any capacity, have a strong presence in the laptop market, or have a full product stack based on its most recent architecture. Perhaps the abundance of cheaper 14nm 500-series and Vega GPUs, decent APU graphics performance, and (if it was included in this report) promising 5700-series support pushed AMD above Nvidia. Of course, AMD likely wouldn't be generating revenue than Nvidia because less expensive products are not usually high margin products.

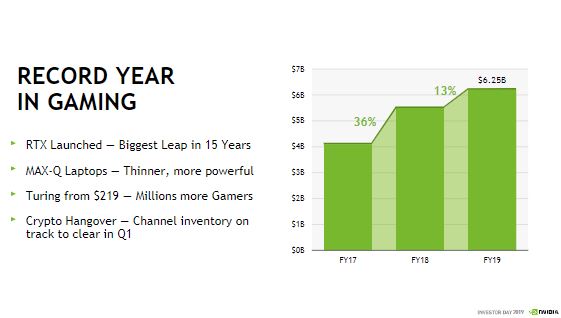

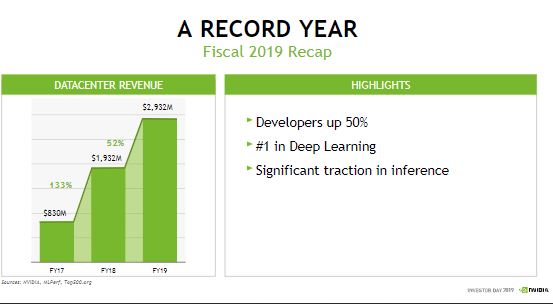

If AMD continues to gain ground on GPUs, it could be challenging for Nvidia, which is heavily dependent on the PC gaming market and has enjoyed a record year of revenue driven by Turing-based graphics cards.

Though Nvidia does have sources of income from the data center and professional users, gaming still makes up the bulk of Nvidia's revenue. It's highly likely that AMD's recent gains will encourage Nvidia to diversify more quickly to compete with AMD, an already diverse company, and Intel, which is planning on entering into the discrete GPU market in just a couple of years.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Matthew Connatser is a freelancing writer for Tom's Hardware US. He writes articles about CPUs, GPUs, SSDs, and computers in general.

-

bloodroses Given that this generation Nvidia cards are either a) way overpriced or b) under performing for its price compared to last generation chips and AMD alternatives, there is no surprise that AMD has overtaken them for shipping. Most people I know are either using the 10xx (or lower) series of Nvidia cards or AMD cards due to value/performance. I even upgraded to a used short length 1060 6gb a few months ago since the price was right and upgraded my aging 7770.Reply -

Veradun From the news: "The market share data represents cumulative shipments of all types of graphics units, including those present in processors and consoles, both of which are areas that Nvidia doesn't have a significant market presence. "Reply

Nope. It doesn't include consoles since the report is about PC.

"This is the latest report from Jon Peddie Research on the GPUs used in PCs." -

ern88 Once Intel is on the scene with their dGPU's next year. It will almost be like the old days of GPU competition. When us old Gamers had a choice between ATI, NVIDIA, and 3DFX. The more competition. The better for us consumersReply -

Soaptrail Replybloodroses said:Given that this generation Nvidia cards are either a) way overpriced or b) under performing for its price compared to last generation chips and AMD alternatives, there is no surprise that AMD has overtaken them for shipping. Most people I know are either using the 10xx (or lower) series of Nvidia cards or AMD cards due to value/performance. I even upgraded to a used short length 1060 6gb a few months ago since the price was right and upgraded my aging 7770.

I remember buying a GPU for under $200 and Nvidia options under $200 are not great. AMD still has the RX 580 and RX 570, albeit an aged platform, but they still play games at high frame rates for most of us. -

Paul Alcorn ReplyVeradun said:From the news: "The market share data represents cumulative shipments of all types of graphics units, including those present in processors and consoles, both of which are areas that Nvidia doesn't have a significant market presence. "

Nope. It doesn't include consoles since the report is about PC.

"This is the latest report from Jon Peddie Research on the GPUs used in PCs."

Good eye, thanks for the heads-up. Article corrected. -

jimmysmitty Replybloodroses said:Given that this generation Nvidia cards are either a) way overpriced or b) under performing for its price compared to last generation chips and AMD alternatives, there is no surprise that AMD has overtaken them for shipping. Most people I know are either using the 10xx (or lower) series of Nvidia cards or AMD cards due to value/performance. I even upgraded to a used short length 1060 6gb a few months ago since the price was right and upgraded my aging 7770.

I would bet removing iGPU from the ratings would flip it though. With them considered Intel still ships vastly more than both combined since every mainstream part has an iGPU. I wouldn't mind seeing how many Turing/Pascal units shipped vs Navi/Polaris. -

Veradun ReplyPaulAlcorn said:Good eye, thanks for the heads-up. Article corrected.

JPR's headlines on paywalled reports are a bit confusing at times :D

For reference and perspective you can find a report that includes consoles here:

https://www.jonpeddie.com/images/uploads/The_Balance_of_Power_in_Gaming_2018_-_V4.pdf

(this is at page 26) -

Veradun Replyjimmysmitty said:I would bet removing iGPU from the ratings would flip it though. With them considered Intel still ships vastly more than both combined since every mainstream part has an iGPU. I wouldn't mind seeing how many Turing/Pascal units shipped vs Navi/Polaris.

I'm looking forward to read from someone willing to get behind that huge paywall and spread this info :D