Acer Founder Doubts US Can Match Asia's Chip Making Dominance

Acer Founder Stan Shih talks tough about America's plans to bolster domestic chip production.

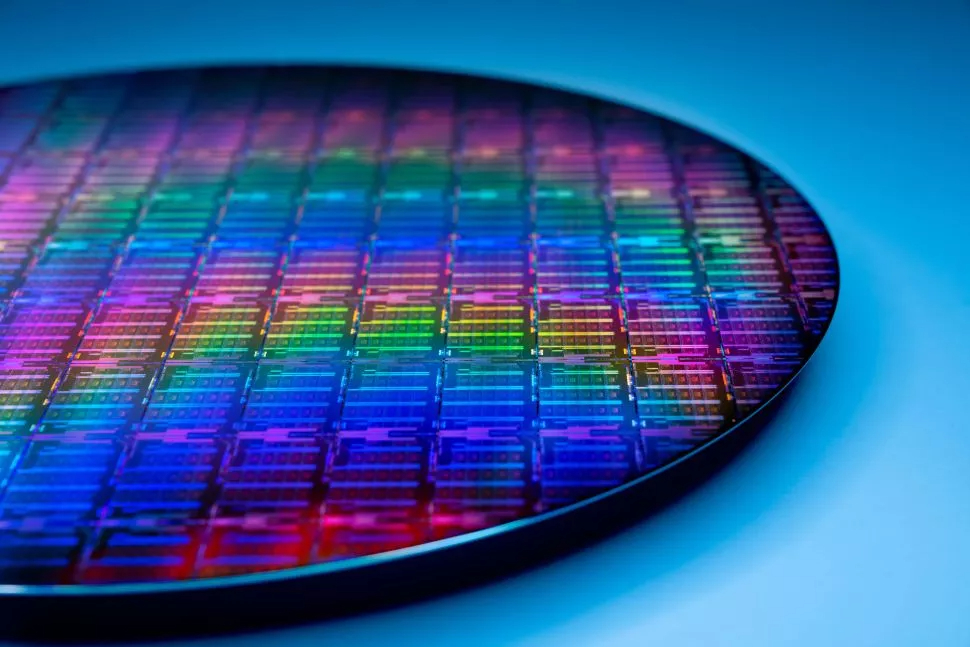

Acer has some tough words for the U.S. government and its plans to expand domestic semiconductor production to better compete with entrenched global players. Acer founder Stan Shih said in a recent interview with Yahoo Taiwan that the U.S. is too far behind its Asian counterparts, particularly Taiwan, when it comes to producing sufficient quantities of chips that go in everything from smartphones to servers to self-driving automobiles to military hardware.

According to Shih, the U.S. didn't do itself any favors by outsourcing much of its semiconductor production decades ago. The supply chain necessary to sustain a consistent flow of chips heavily favors Asia, and there will be a significant lag in getting those operations fully entrenched stateside.

That last statement regarding supply chain deficiencies is borne out by comments made by TSMC last week. Last Thursday, TSMC chairman Mark Liu said that the Taiwanese company would delay mass production of its Arizona fab from early 2024 to 2025, partly due to a lack of cleanroom tools necessary to produce ships at scale.

More importantly, Liu added that there is a shortage of workers qualified to staff its Fab 21 production lines. "We are encountering certain challenges, as there is an insufficient amount of skilled workers with the specialized expertise required for equipment installation in a semiconductor-grade facility." These staffing setbacks come even though TSMC flew Taiwan-based engineers to Arizona to help train new hires.

As part of the $280 billion CHIPS Act, the U.S. wants to strengthen its domestic semiconductor industry to create new high-tech jobs and as a means to protect national security interests. The U.S. is uneasy about Taiwan being the lifeblood of the world's chip supply, especially with the geopolitical concerns surrounding China's outsized influence in the region.

Intel is one of the many companies taking advantage of the subsidies available from the CHIPS Act and is constructing the Silicon Heartland campus in Ohio. This will be the company's first all-new domestic fab site in decades. "The establishment of the Silicon Heartland is testament to the power of government incentives to unlock private investment, create thousands of high-paying jobs, and benefit U.S. economic and national security," said Intel CEO Pat Gelsinger in September 2022.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Brandon Hill is a senior editor at Tom's Hardware. He has written about PC and Mac tech since the late 1990s with bylines at AnandTech, DailyTech, and Hot Hardware. When he is not consuming copious amounts of tech news, he can be found enjoying the NC mountains or the beach with his wife and two sons.

-

I don't believe throwing money left and right can solve anything today. Acer and TSMC made it clear, you can't buy your way out off of years of negligence.Reply

-

Eximo "partly due to a lack of cleanroom tools necessary to produce ships at scale"Reply

The idea behind it is strategic and should help future demand swells and environmental disaster or other production interruptions from being localized to a single region.

I'm sure these places would love to be profitable high volume enterprises. That takes time, but the idea is solid to have fabs all over the place. Especially considering technology adoption rates in the developing world. -

ottonis I wouldn't be overly pessimistic, though. Intel has demonstrated that it's back on track and not too far behind the latest and greatest chip manufacturing processes of the far east.Reply

Japan is building new facilities aiming for 2 nm production in 2027.

Samsung is neck and neck with TSMC, although there is converging consensus that it cannot match TSMC for process quality (see Snapdragon 8 Gen 1 vs 8 + Gen 1).

And last but not least: I wonder what Apple's strategy might be in order to act preemptively just in case something happens to TSMC: strategic partnership with Intel and/or Samsung, or building own production facilities from scratch? -

hotaru251 I mean TSMC's already having issues getting skilled enough workers for its US fab right?Reply

& educating enough people that well isn't easy nor fast.

if soemthing happened you for sure arent building from scratch as you don't have the time to do so.ottonis said:I wonder what Apple's strategy might be in order to act preemptively just in case something happens to TSMC: strategic partnership with Intel and/or Samsung, or building own production facilities from scratch? -

ottonis Replyhotaru251 said:I mean TSMC's already having issues getting skilled enough workers for its US fab right?

& educating enough people that well isn't easy nor fast.

if soemthing happened you for sure arent building from scratch as you don't have the time to do so.

Exactly! And that's why I was wondering whether or not Apple might already be preparing something preemptively, just in case.

Even though Intel has declared to be building up huge production capacities, it might be difficult to satisfy the massive demands of Apple. -

watzupken Reply

I feel it is still too early to conclude if Intel's fab is "out of the woods". If we just take it at face value that Intel's fab branding, i.e. Intel 4, the number makes it sound like they are keeping up. But will the yield and performance keep up with competition, I think we have to see the real product to conclude.ottonis said:I wouldn't be overly pessimistic, though. Intel has demonstrated that it's back on track and not too far behind the latest and greatest chip manufacturing processes of the far east.

Japan is building new facilities aiming for 2 nm production in 2027.

Samsung is neck and neck with TSMC, although there is converging consensus that it cannot match TSMC for process quality (see Snapdragon 8 Gen 1 vs 8 + Gen 1).

And last but not least: I wonder what Apple's strategy might be in order to act preemptively just in case something happens to TSMC: strategic partnership with Intel and/or Samsung, or building own production facilities from scratch?

Other thing to consider is price. This is one area that I don't think western fabs will be able to compete, at least not in the near future. So to be honest, unless there is a very strong reason to not use the fabs in Asia, I really don't think the fabs in US will be running anywhere near full capacity. -

ottonis Reply

You make very valid points. I, too, think that Asia based fabs do have and will have quite some cost advantages.watzupken said:I feel it is still too early to conclude if Intel's fab is "out of the woods". If we just take it at face value that Intel's fab branding, i.e. Intel 4, the number makes it sound like they are keeping up. But will the yield and performance keep up with competition, I think we have to see the real product to conclude.

Other thing to consider is price. This is one area that I don't think western fabs will be able to compete, at least not in the near future. So to be honest, unless there is a very strong reason to not use the fabs in Asia, I really don't think the fabs in US will be running anywhere near full capacity.

That being said: If - and this a BIG "if" - TSMC for whatever reasons drops out off the market, the western countries, which are by the way also the biggest market for microchips, will no longer import any IT tech from China at all. There will be a complete separation of markets, just like we have seen with Huawei. So, in the biggest markets there will be no competetion anymore betweem American and Chinese based CPUs. And without competition, some modest differences in production costs will have no impact on product sales.