AMD Q2 2020 Earnings: Record Revenue, Notebook and EPYC Sales, Highest Consumer CPU Sales in 12 Years

Execution execution execution

It couldn't possibly be more of a disparate tale between Intel and AMD: Intel's earnings last week found the company announcing that it faces a delay to its 7nm process node until 2023, sending the stock plummeting 16% in spite of its solid financials. In contrast, AMD's stock soared to record highs on the news of its stellar financial performance and on-track execution for its next-gen Milan CPUs, Zen 3 consumer processors, and RDNA 2 GPUs, all of which come to market later this year. AMD's stock reached a record $74.47, a 9.9% jump in after-hours trading (at the time of writing).

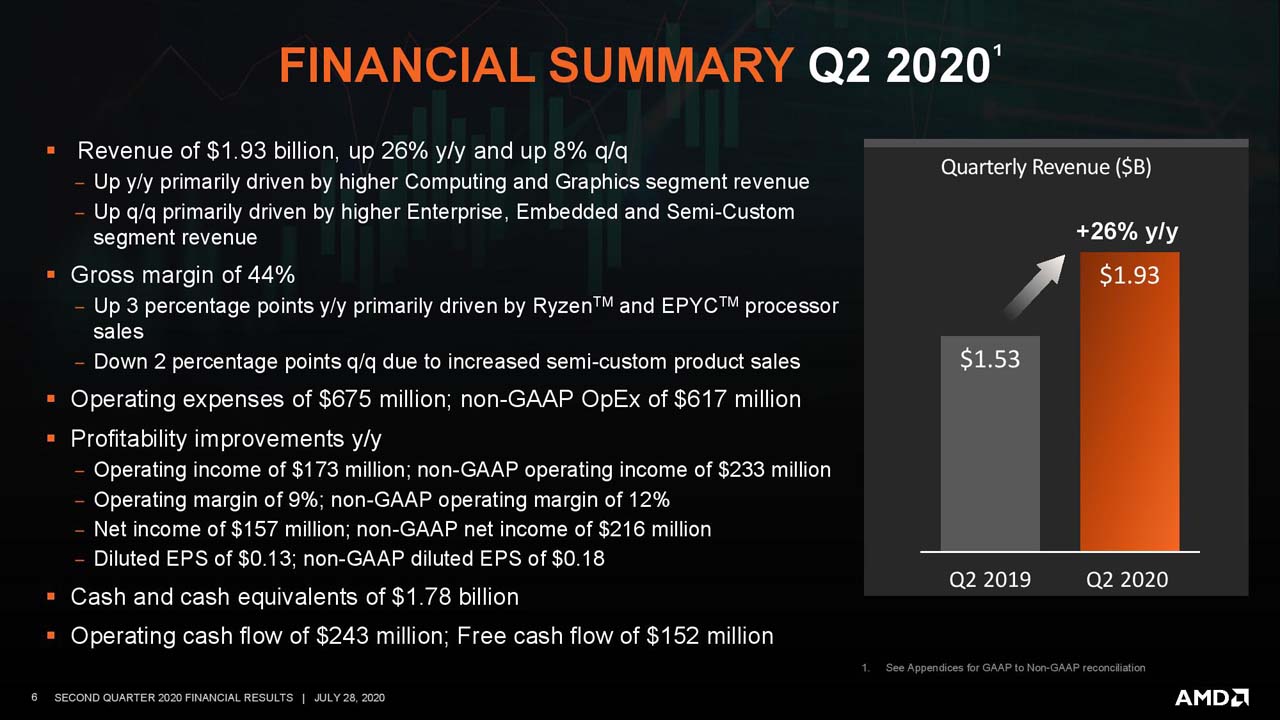

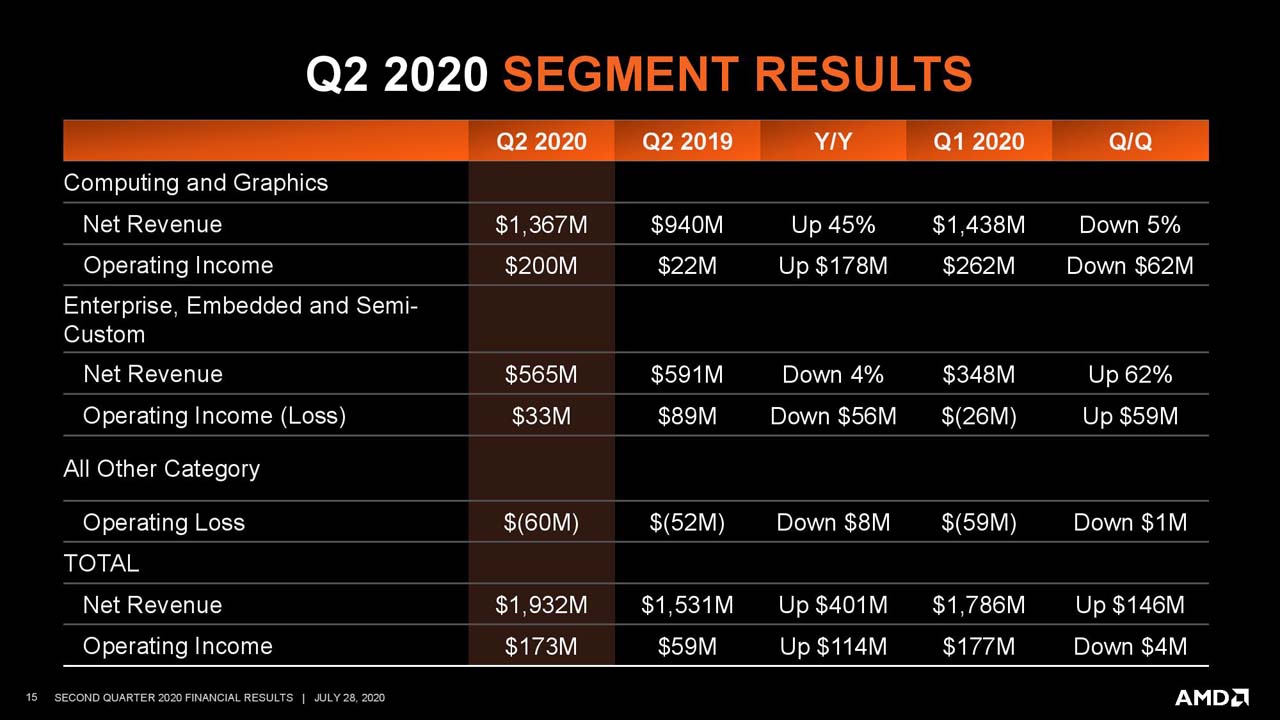

AMD reported record revenue of $1.93 billion (up 26% YoY), along with record notebook and EPYC CPU sales in its 2Q 2020 earnings report today. AMD also notched a 12-year high in consumer processor sales as its client computing group notched 45% growth propelled in part by doubled sales of notebook processors. AMD CEO Lisa Su also said the company had doubled its EPYC sales and reached its target of double-digit server market share as the segment reached 20% of AMD's overall second-quarter revenue.

Even more telling, the company raised its full-year revenue projections from 25% growth to 32% on the back of continued growth in the key PC, data center, and gaming segments. The company earned $157 million in profit for the quarter, a marked increase over the $35 million from a year prior. AMD's margins weighed in at 44%, a 2% sequential decline but 3% improvement year over year.

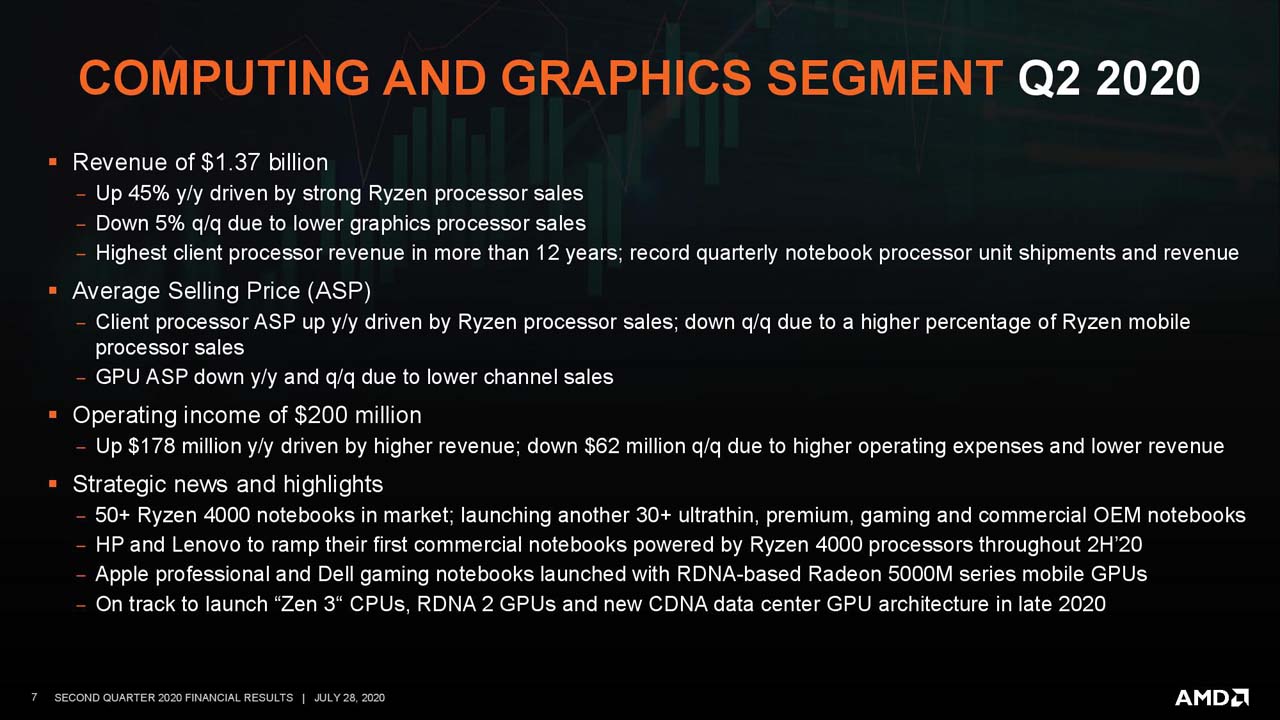

AMD's Computing and Graphics revenue grew 45% year-over-year to $1.37 billion on strong Ryzen sales despite lower graphics sales. AMD reported its highest consumer CPU revenue in 12 years, but much of the gain came on the back of AMD's Ryzen 4000 processors for laptops. AMD's mobile processor sales doubled YoY and the 50+ notebooks on the market will be joined by another 30+ models by the end of the year. The mobile segment comprises roughly 65% of the total client CPU market, so these gains are important as Intel preps to release its 10nm Tiger Lake models later this year.

Meanwhile, AMD's desktop CPU sales declined compared to the previous quarter, but increased year over year. Sales of more expensive models also led to improved average selling prices (ASPs). Su noted that the company has it's first Zen 3 processors for the consumer market coming later this year.

AMD's discrete GPU sales and ASPs also declined, which was partially offset by increased mobile graphics sales (up double-digits). Su also said the company remains on track for its launch of the RDNA 2 "Big Navi" graphics cards later this year, commenting that "I think it's a full refresh for us from the top of the stack through the rest of the stack"

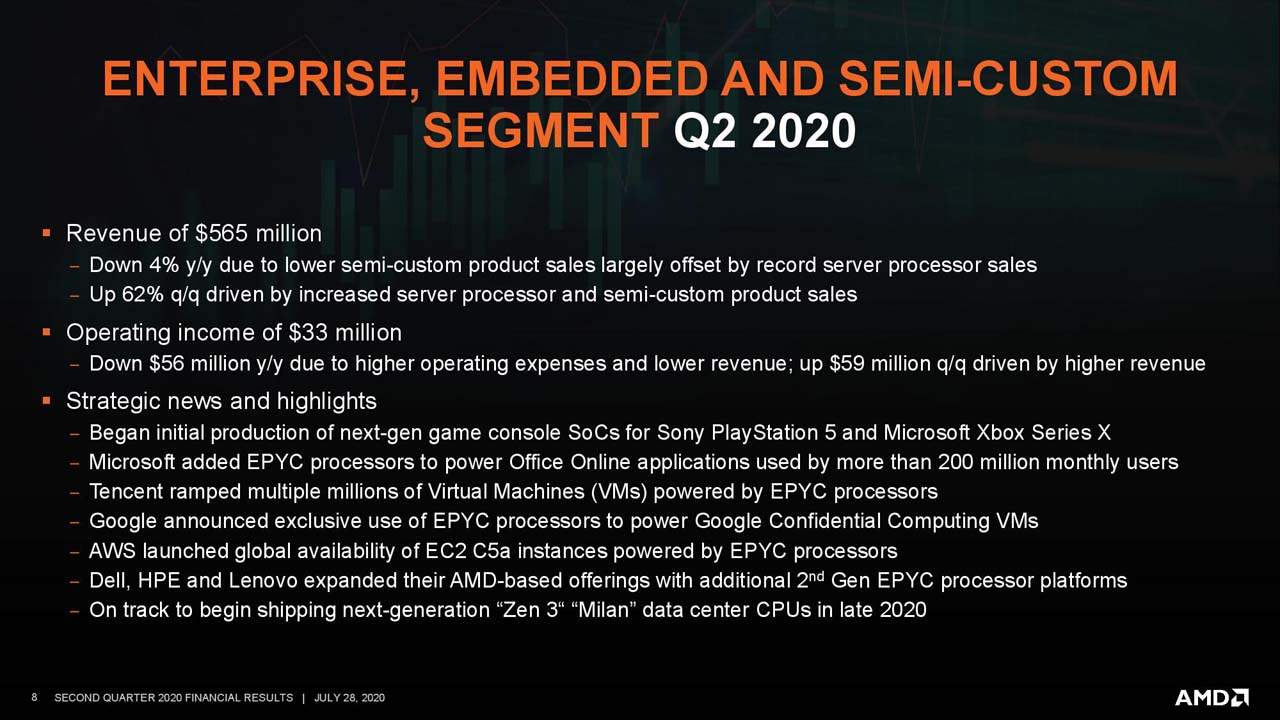

AMD's data center EPYC sales set a quarterly record and doubled year-over-year as the Enterprise, Embedded and Semi-Custom group delivered $565 million in revenue. For comparison, Intel's data center group recorded $7.1 billion last quarter, which highlights why investors are so optimistic about AMD's gains in the server market, especially in light of Intel's looming process delays.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD said it has reached its goal for a double-digit percentage of the server CPU market. However, while AMD has eclipsed that number, the company doesn't include several large segments in its accounting of server share, instead focusing solely on single- and dual-socket servers.

The company didn't set a new goal for market share penetration, but predicts accelerating uptake of its data center CPUs in the back half of the year. Su stated at a recent investor event that the company wouldn't project server CPU sales based on market share in the future, instead focusing on revenue targets: "I think as we go through the second quarter and the second half of the year, we're going to transition from share targets to more of a percentage of AMD revenue because that will give you a better idea of the progression. [...]So the server business will continue to be very strategic. I probably won't give you another share target. But what we did say, though, and it gives you an idea of what we think the size of the business can be, when we did our Financial Analyst Day a couple of months ago, we said we saw the server – or the data center business for us, being upwards of 30% of overall AMD." During today's earnings call, Su noted that EPYC comprised 20% of the company's revenue, so it's clear the company has plans for significantly more uptake.

AMD's data center GPU sales also declined on the quarter, which the company hopes will improve as its CDNA 2 graphics accelerators arrive later in the year. AMD's semi-custom business continues to recede as it prepares for the ramp of the Microsoft Xbox Series X and Sony PS5 that land later in the year. Those products should also help improve sales and margins.

Looking forward to the remainder of the year, AMD predicts that it will continue to grow share in the Desktop PC and notebook markets and guided for $2.55 billion in revenue for Q3, an increase of 42% YoY.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

Arbie Go AMD! We desperately need two solid players. Learned that, at least, from the Intel years.Reply -

Rdslw Reply

AMD was so off track by FX years, that intel was cussing at snail speeds.Arbie said:Go AMD! We desperately need two solid players. Learned that, at least, from the Intel years.

When intel noticed they are back and tried to race again

tI-xi26m3EU:1View: https://youtu.be/tI-xi26m3EU?t=1 <<< this happened (end video at ~5 sec).

I am sure you can spot intel.

Hopefully they will recover faster than AMD from FX....

and we will see those good times when they had very even competition. -

jasonf2 With Intel's recent purchase of TSMC excess capacity almost equaling AMD's total TSMC allocation I would say that AMD's enjoyable process node advantage has come to an end. Intel's purchase of that capacity also means that AMD (which is fabless) will now have to go to other fabs (Samsung) to produce additional chips. While not impossible this will be a pain for AMD. Someone in here will correct me if I am wrong, but I don't think GlobalFoundries even has a production node pushing under 12-14nm so they would be out of the question. With TSMC producing 7nm Intel is just a matter of time before moving there with their fabs. They have usually enjoyed a full node ahead advantage though and Intel would need to skip 7nm and go straight to 5nm in order to get back into their historic position (Before it starts I know that Intel doesn't measure the same and Intel 10nm is on par with others 7nm). I don't see this happening with their fabrication node delays. AMD and Intel are going to go head to head based off of their design teams, not process advantage. My guess is that we are in for a worsening supply shortage of high end processors built on the latest process nodes with everyone pulling from two global fabs instead of three and no one willing to increase capacity due to Intel's position. I think these supply shortages are what is going to slow AMD's market share growth.Reply -

digitalgriffin Replyjasonf2 said:With Intel's recent purchase of TSMC excess capacity almost equaling AMD's total TSMC allocation I would say that AMD's enjoyable process node advantage has come to an end. Intel's purchase of that capacity also means that AMD (which is fabless) will now have to go to other fabs (Samsung) to produce additional chips. While not impossible this will be a pain for AMD. Someone in here will correct me if I am wrong, but I don't think GlobalFoundries even has a production node pushing under 12-14nm so they would be out of the question. With TSMC producing 7nm Intel is just a matter of time before moving there with their fabs. They have usually enjoyed a full node ahead advantage though and Intel would need to skip 7nm and go straight to 5nm in order to get back into their historic position (Before it starts I know that Intel doesn't measure the same and Intel 10nm is on par with others 7nm). I don't see this happening with their fabrication node delays. AMD and Intel are going to go head to head based off of their design teams, not process advantage. My guess is that we are in for a worsening supply shortage of high end processors built on the latest process nodes with everyone pulling from two global fabs instead of three and no one willing to increase capacity due to Intel's position. I think these supply shortages are what is going to slow AMD's market share growth.

Where did you hear Intel had secured all TSMC's excess capacity @ 7nm? Source please.

TSMC has no excess capacity between Apple, AMD, and others. That's why NVIDIA had to go to Samsung's 8nm node even through it's inferior. -

yronnen hmmm, thought that the site supposed to be a technology news site, but I feel an animosity against Intel in the last while... no objectivity?Reply -

digitalgriffin Replyyronnen said:hmmm, thought that the site supposed to be a technology news site, but I feel an animosity against Intel in the last while... no objectivity?

Everybody has their favorites. But competition is good. Intel for better or worse has been a near monopoly for about 10 years now. And as a result consumers didn't have a choice and intel raked in countless profits for minimal investment on their part (little improvement). So it's obvious resentment grew. What do you expect?

I want competition. I think a delay till 2023 for intel will give AMD the chance to reach equal footing company health wise. And that's a good thing for all us consumers and companies that depend upon them alike. Competition is a good thing. -

jasonf2 Reply

An article on the burnin indicates that Intel has ordered 180000 wafers on TSMCs upcoming 6nm process node. This is in contrast with AMDs order of 200000. Tomshardware also had an article with TSMC indicating that they would not be increasing fab capacity due to the order as they see the relationship as short term. It wasn't my intention to indicate imply that it was on the 7nm process only make a point of where intel was in contrast with TSMC fab tech that is currently being produced. It is arguable that Intel's 10nm is on par with TSMC 7nm when the whole die is looked at under a microscope but again they are not at full run on 10nm yet.digitalgriffin said:Where did you hear Intel had secured all TSMC's excess capacity @ 7nm? Source please.

TSMC has no excess capacity between Apple, AMD, and others. That's why NVIDIA had to go to Samsung's 8nm node even through it's inferior. -

digitalgriffin Replyjasonf2 said:An article on the burnin indicates that Intel has ordered 180000 wafers on TSMCs upcoming 6nm process node. This is in contrast with AMDs order of 200000. Tomshardware also had an article with TSMC indicating that they would not be increasing fab capacity due to the order as they see the relationship as short term. It wasn't my intention to indicate imply that it was on the 7nm process only make a point of where intel was in contrast with TSMC fab tech that is currently being produced. It is arguable that Intel's 10nm is on par with TSMC 7nm when the whole die is looked at under a microscope but again they are not at full run on 10nm yet.

Link? TSMC's next node is 5nm not 6nm. Maybe you are thinking of 7nm+ (enhanced)

Intels 10nm would be technically equivalent to TSMC's 7nm. However it has so many problems, its like saying you can put a Jaguar in a race against Porsche. Jaguars look better on paper than they perform. -

jasonf2 Reply

If I am coming across as anti Intel that isn't the case. I go all the way back to my first build on an 8088 and cut my teeth on computers through the 80286/386 era. I have built on X86 for alot of years and have at times used about every manufacturer out there when they were price/performance competitive. Intel as the owner of X86 though is a love hate relationship for everyone involved even if they don't know it. AMD can only make X86 because of license to it that was established clear back in the IBM days due to production concerns by IBM. Intel had a few of these out to begin with, but has worked overtime to maintain a monopoly over the X86 architecture and done a pretty darn good job of it clearing the field down to pretty much AMD and itself which up until recently held negligible market share. The bigger picture here though is that while some chip manufactures have had their day in the sun at the end of the day Intel has seriously dominated the X86 game. They have held this by process lead, design lead and aggressive market control. Seeing them falter is not good for the computer industry. The fact that AMD is gaining market share isn't really a new story, just part of the cycle that we have seen historically. Intel gets comfortable and lets something run too long, a competing X86 manufacturer throws out an architecture that competes and Intel drops a new product that moves the bar so far forward that it obsolesces everything and they get their 90%+ market share back. At least that has been the story up until now. With Moore's Law getting ever more expensive to maintain and the physical limits of silicon approaching we have seen a slow down in process node development from Intel. On the other hand cell phone processors have driven the fabs like TSMC and Samsung to majorly innovate and speed up process nodes because they gain business by having the latest and greatest. AMD, having gone fabless after its global foundries spin-off, is reaping the advantages of the smartphone evolution. This is without having to directly invest billions of dollars in research and facility upgrades like Intel for the chip production process. Because of the outside fab innovation this cycle is different and I don't think anyone is sure where it is going. I honestly hope that Intel gets it worked out. The biggest reason is somewhat selfish honestly. If they hold true to cycle we are going to see a once every decade or so major jump in PC processing power. If we don't the PC industry is really showing the first effects of Moore's law falling apart.yronnen said:hmmm, thought that the site supposed to be a technology news site, but I feel an animosity against Intel in the last while... no objectivity? -

jasonf2 Reply

https://www.theburnin.com/industry/intel-orders-180000-6nm-wafers-from-tsmc-2020-07-28/digitalgriffin said:Link? TSMC's next node is 5nm not 6nm. Maybe you are thinking of 7nm+ (enhanced)

Intels 10nm would be technically equivalent to TSMC's 7nm. However it has so many problems, its like saying you can put a Jaguar in a race against Porsche. Jaguars look better on paper than they perform.