AMD Earnings: 7x Increase in AI Engagements, MI300A and MI300X GPU on Track

Outlook isn't as rosy as expected, though.

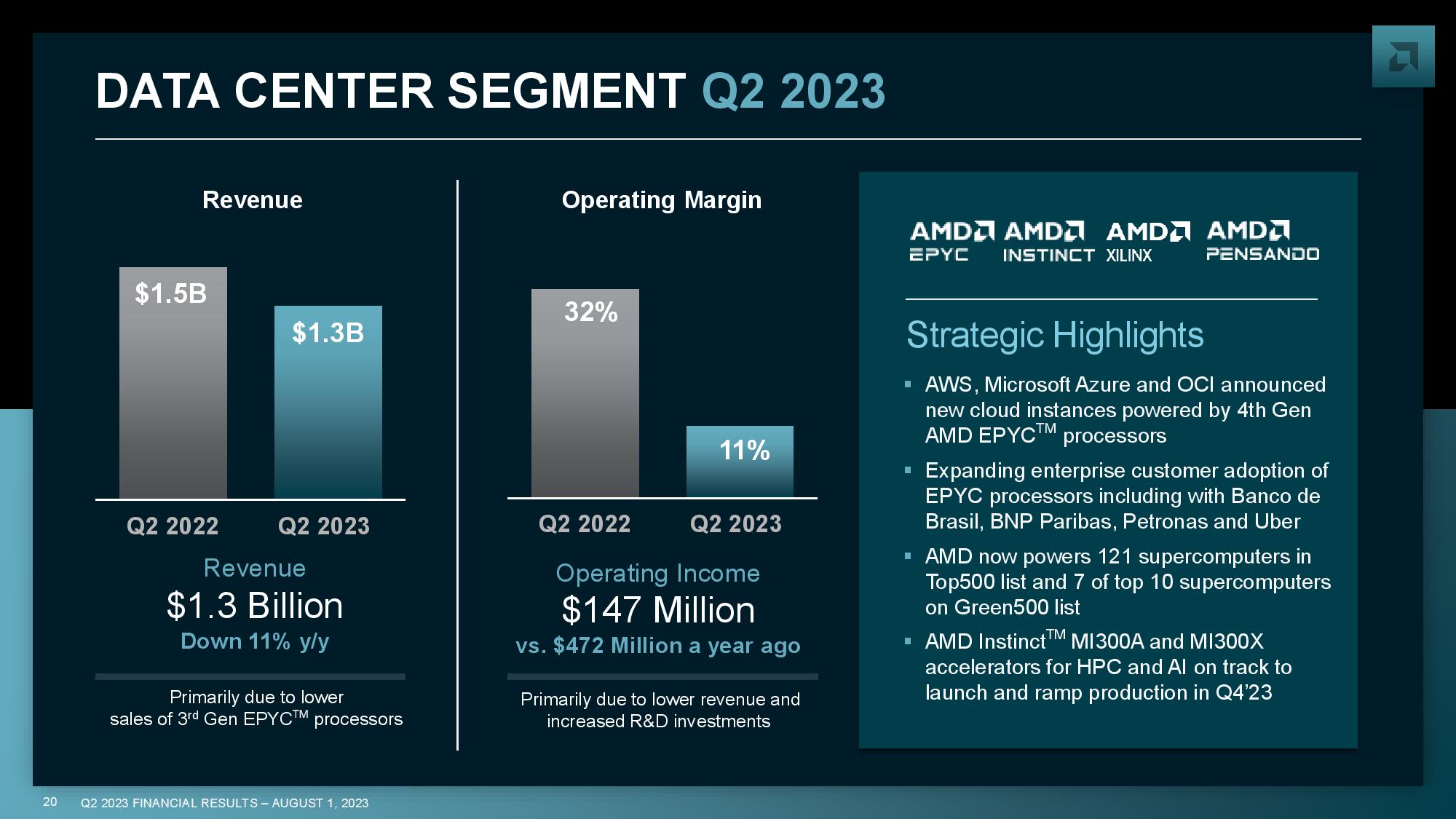

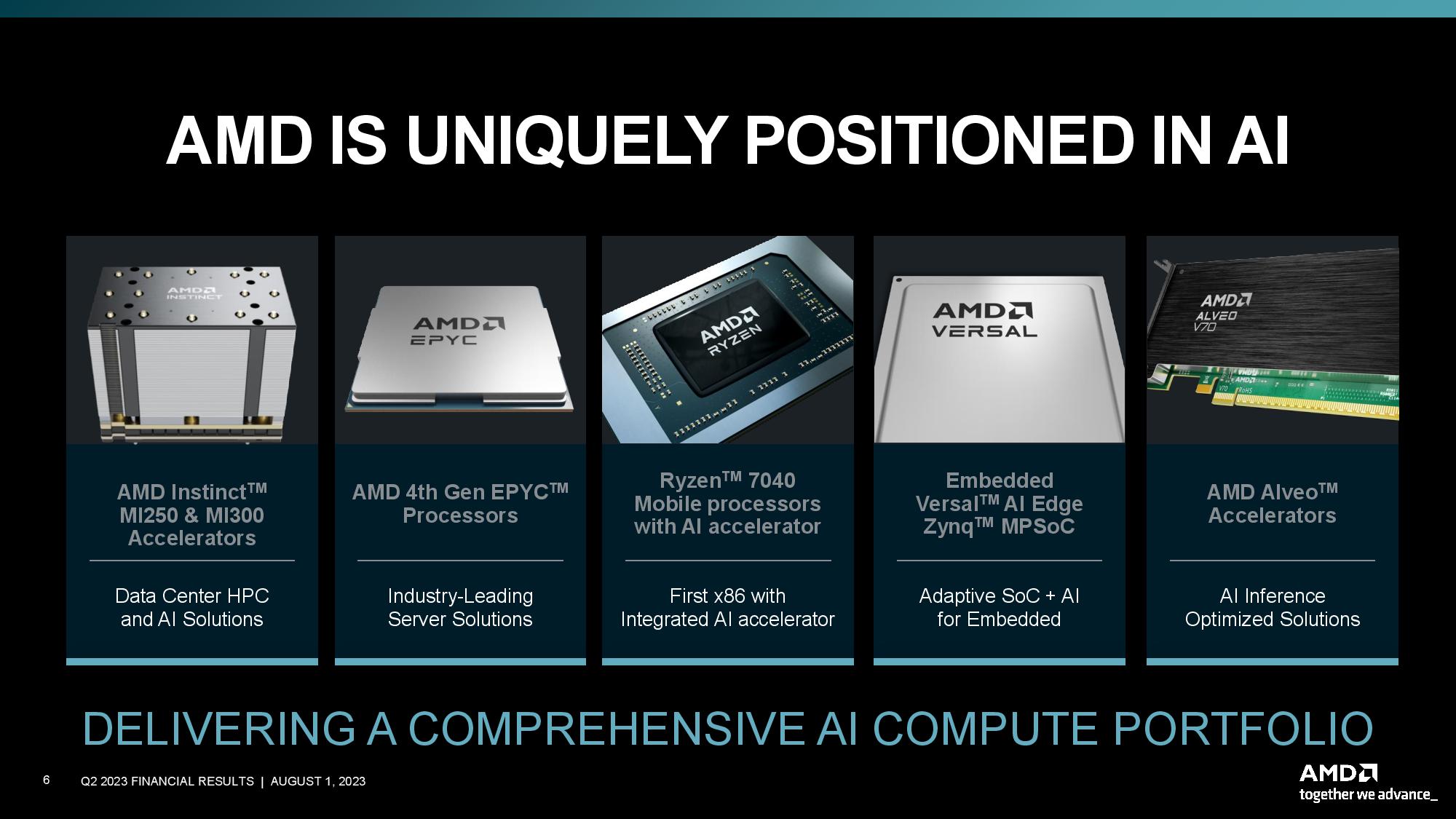

AMD announced its earnings today, notching a slight beat over its Q2 projections, taking the stock up 4% in after-hours trading. AMD CEO Lisa Su also announced that the company had seen its AI engagements increase 7x during the quarter as companies either initiated or expanded existing Instinct Accelerator programs for AI workloads. The company also announced that its hotly-anticipated MI300A and MI300X GPU is on track for a Q4 launch and already sampling to HPC, Cloud, and AI providers, providing the company with a fresh round of products to challenge Nvidia, the overwhelming leader for AI workloads.

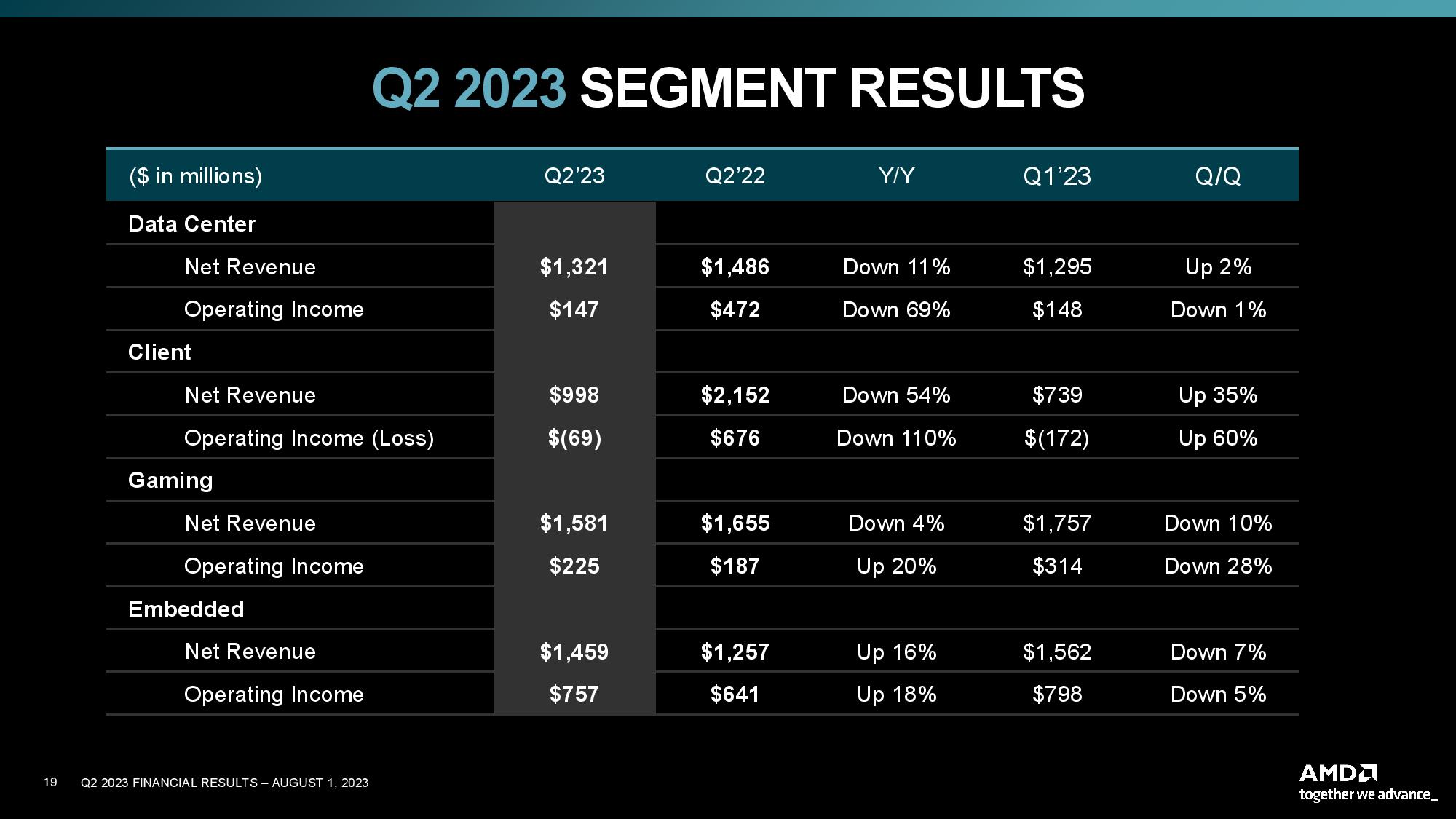

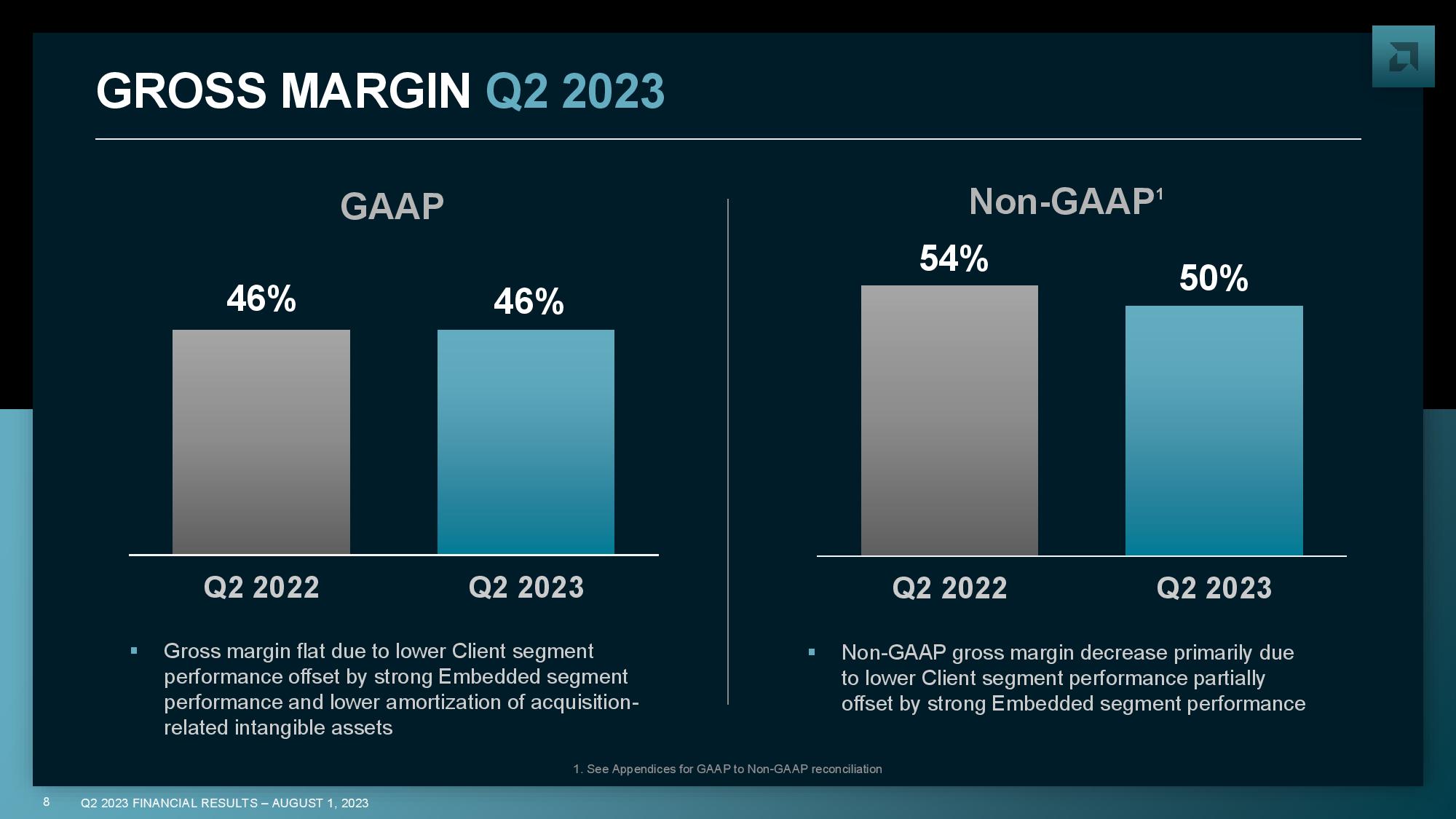

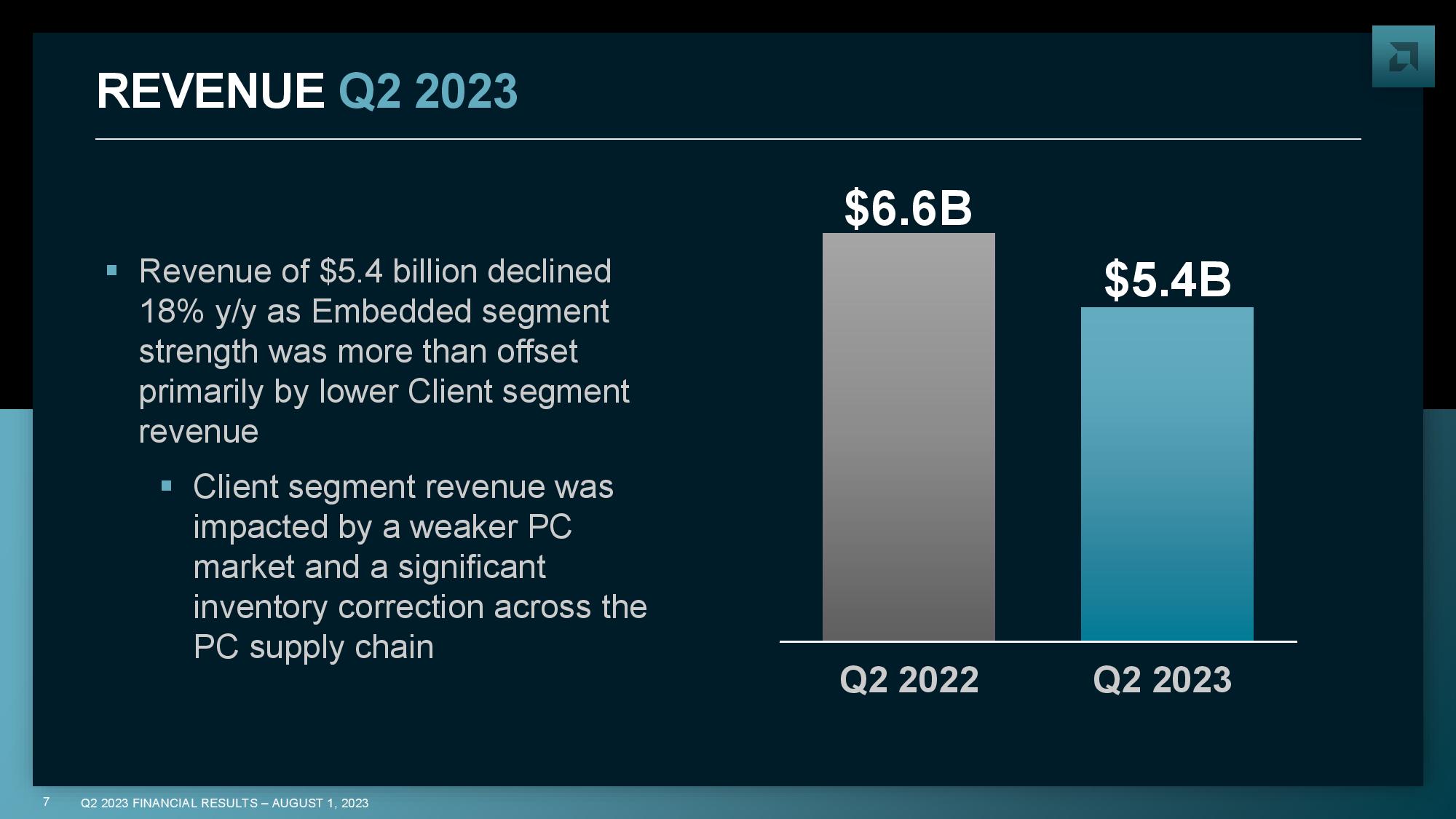

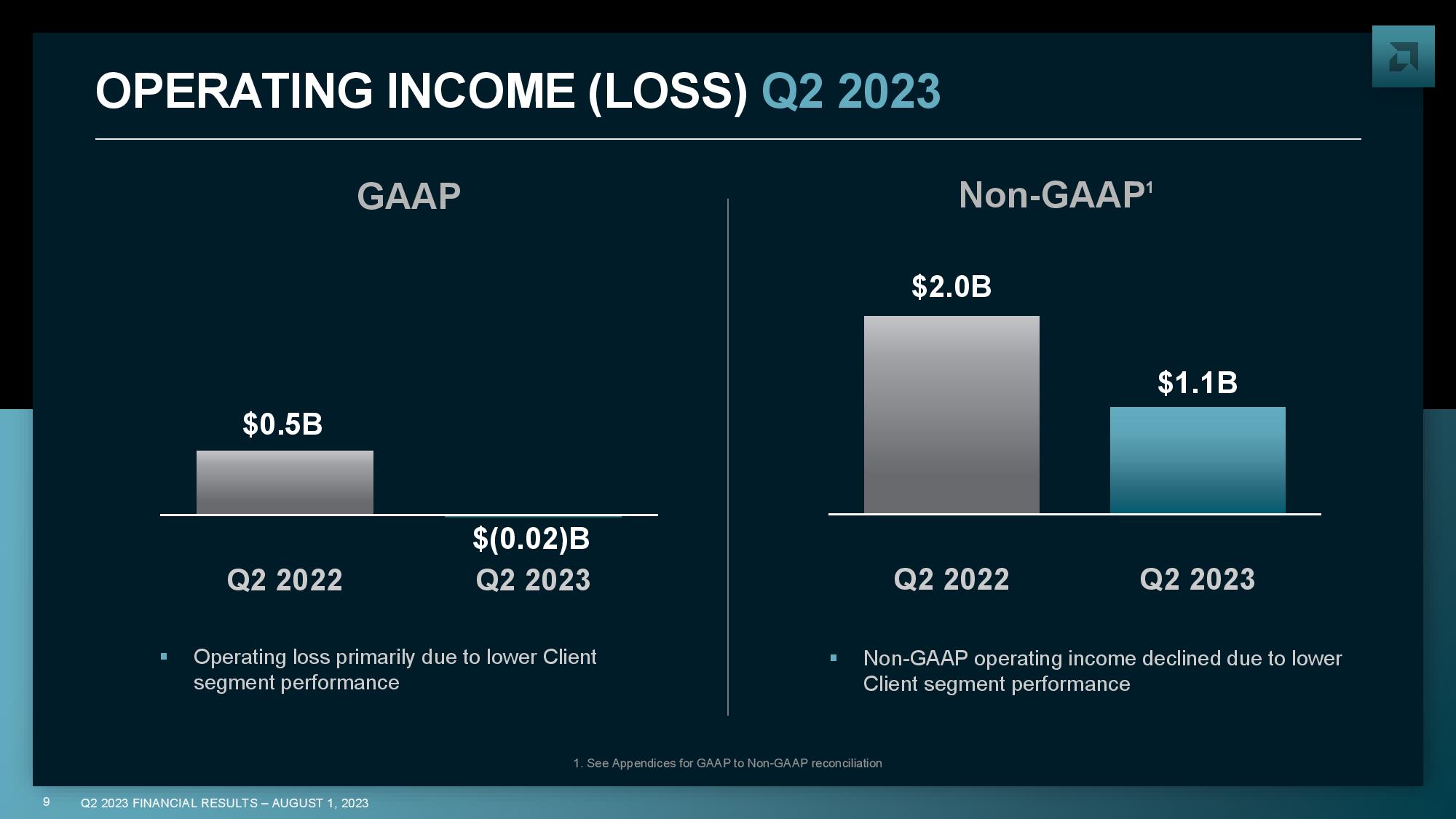

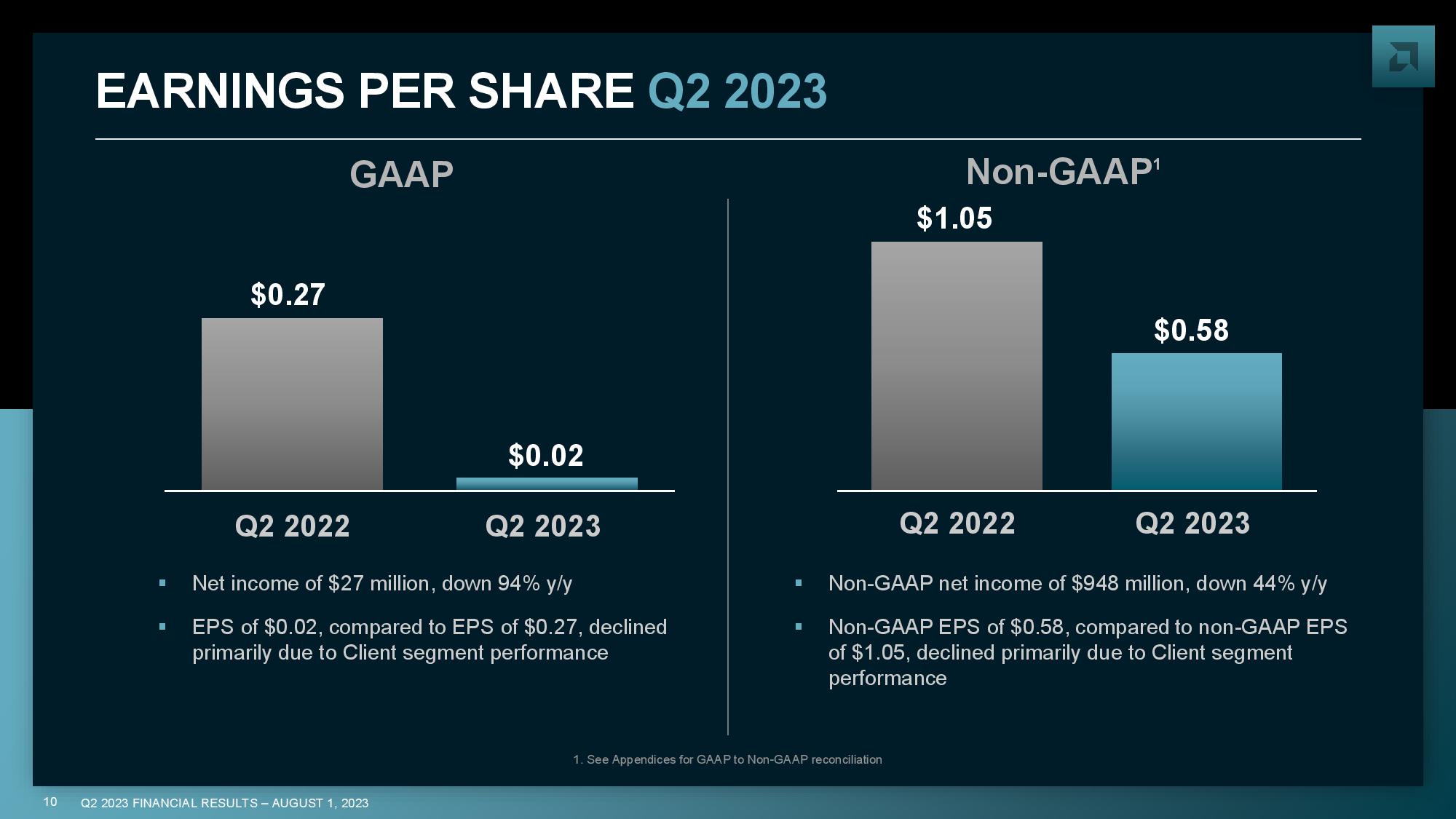

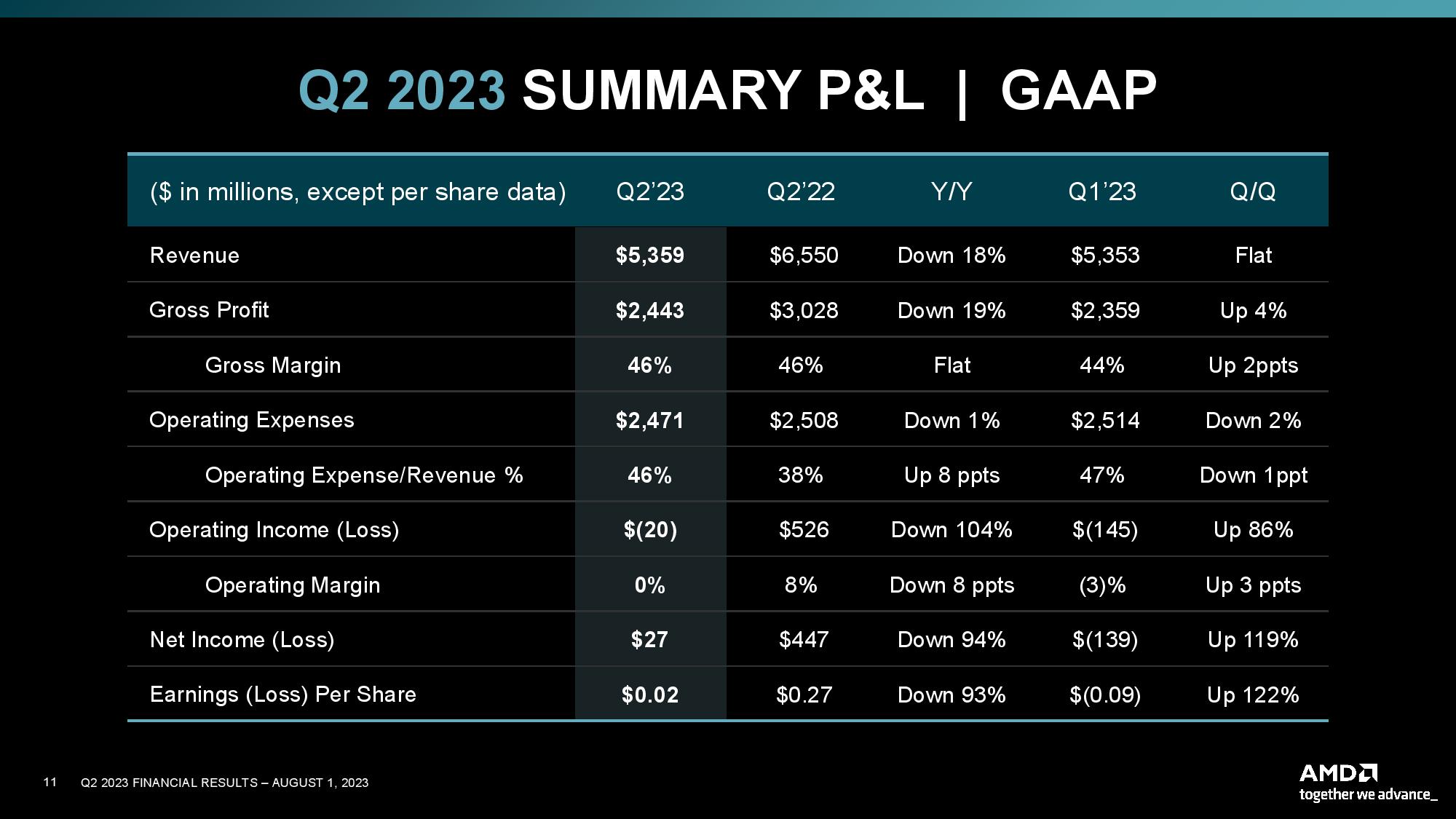

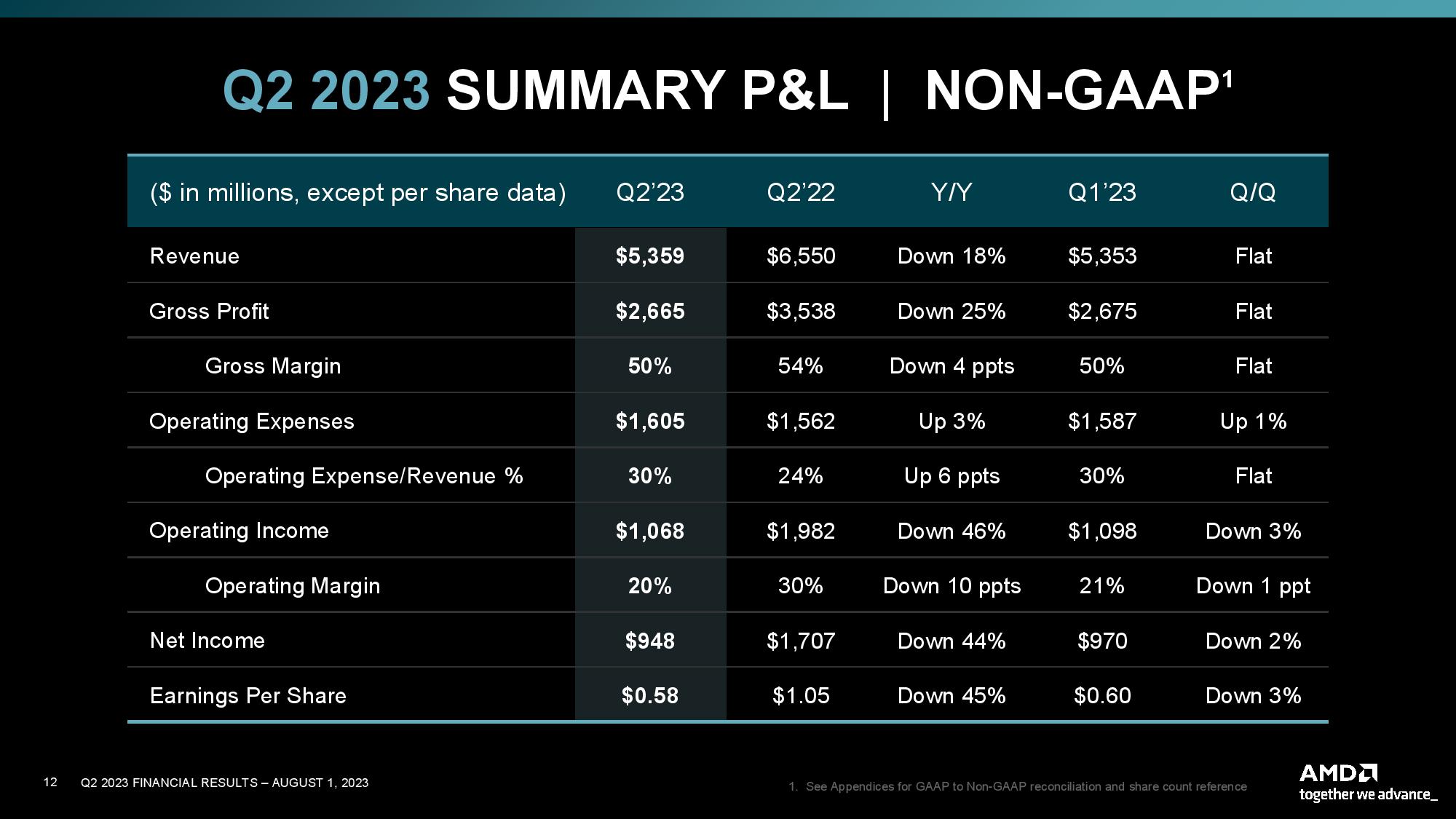

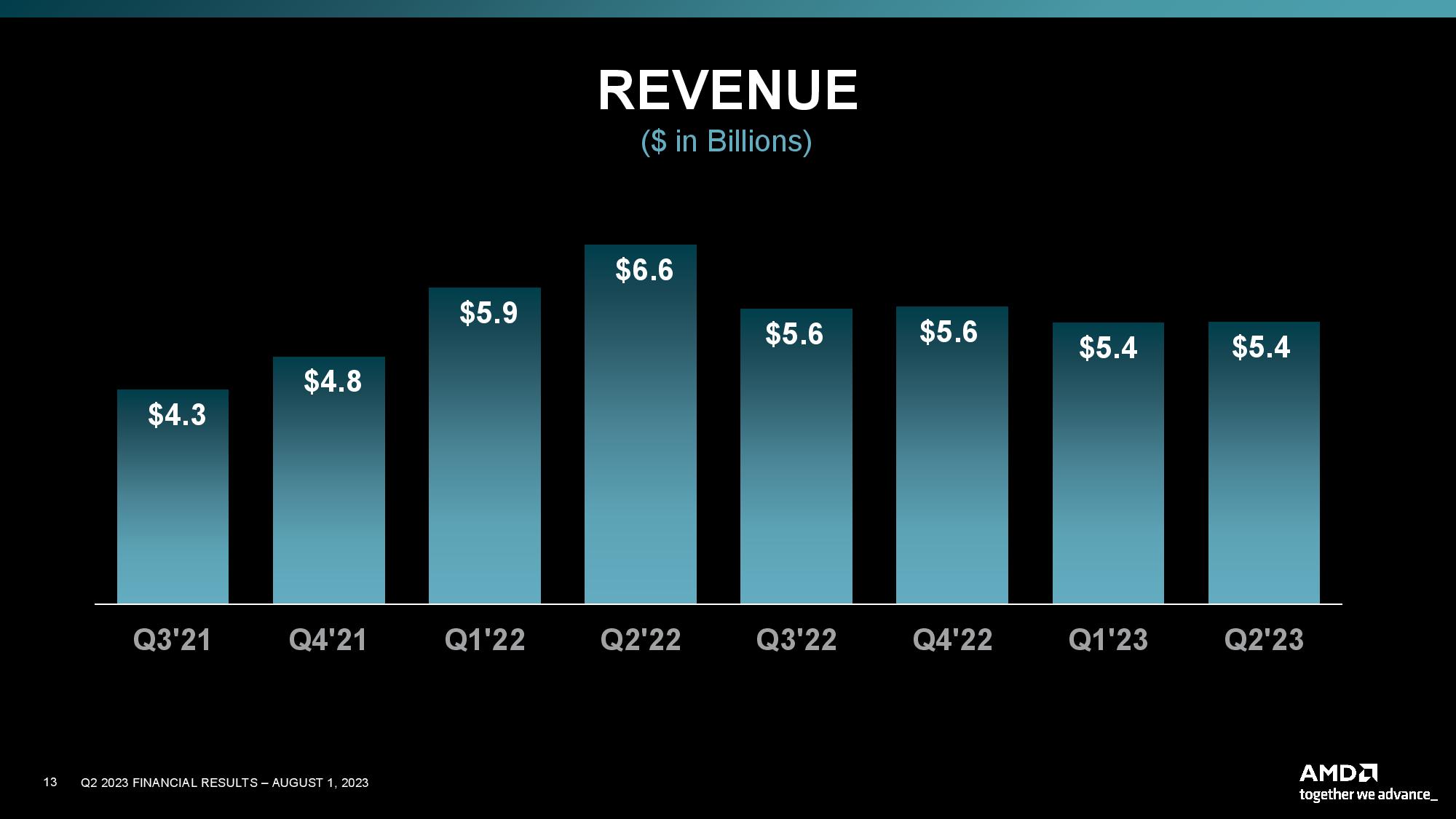

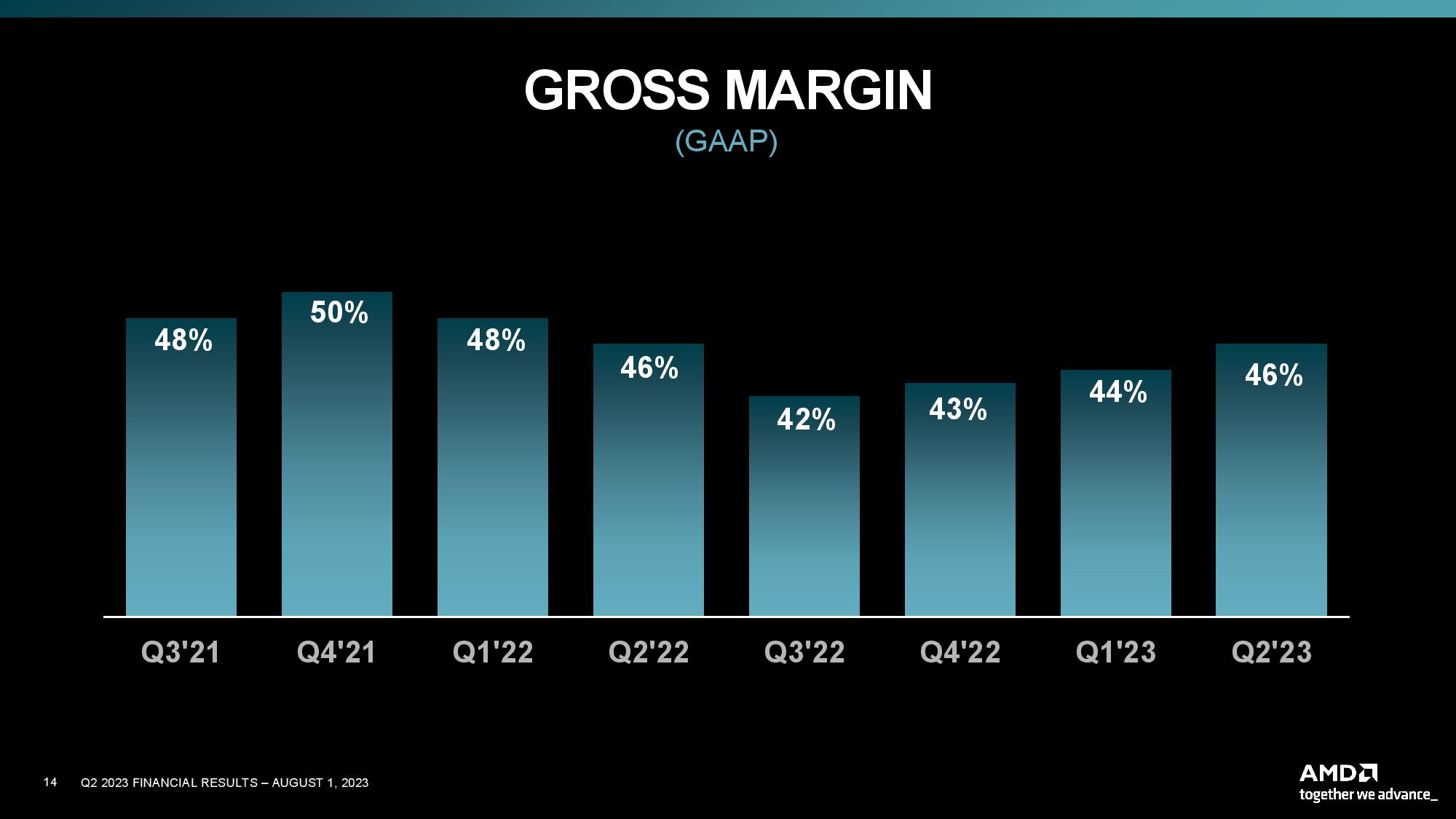

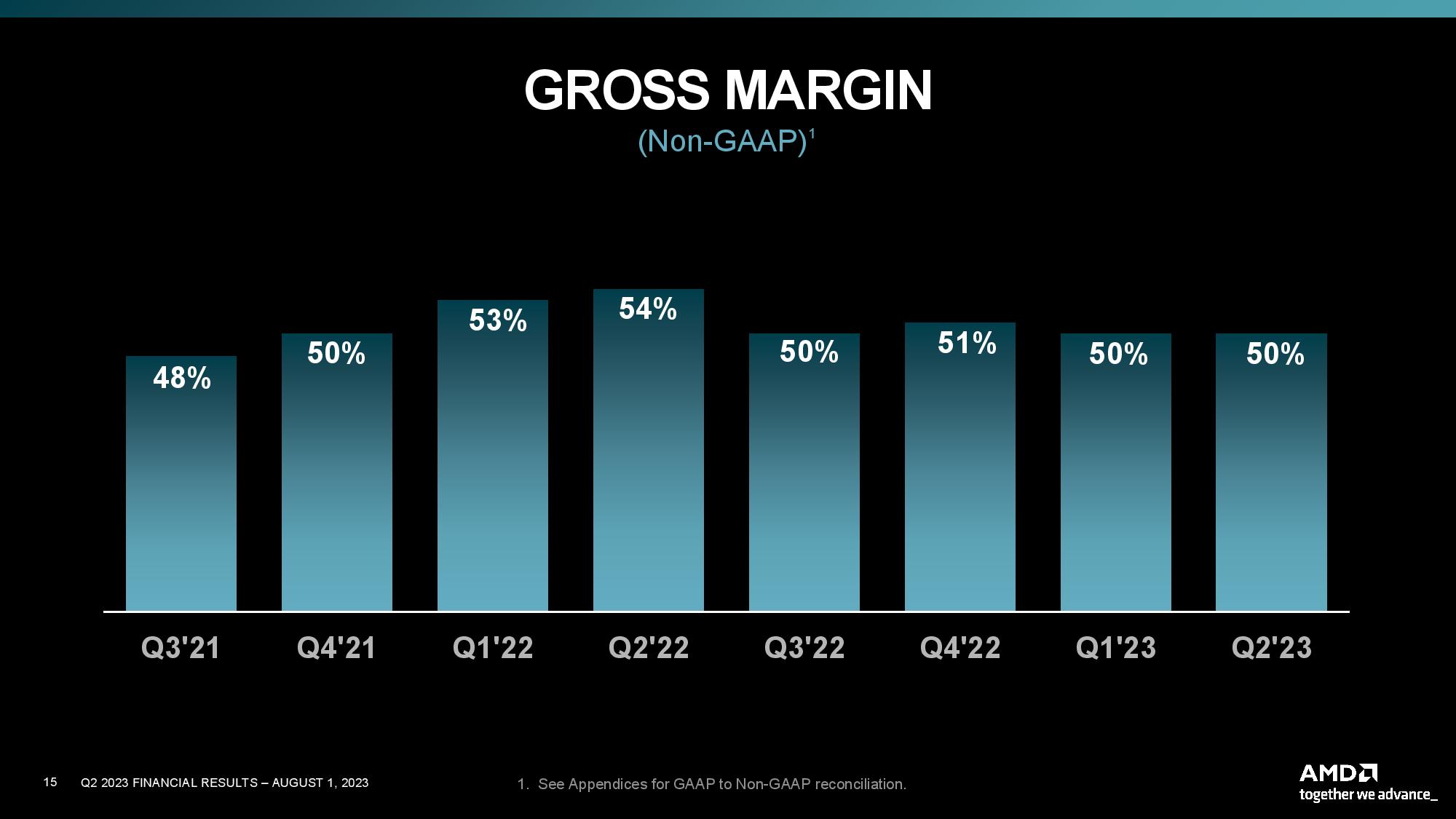

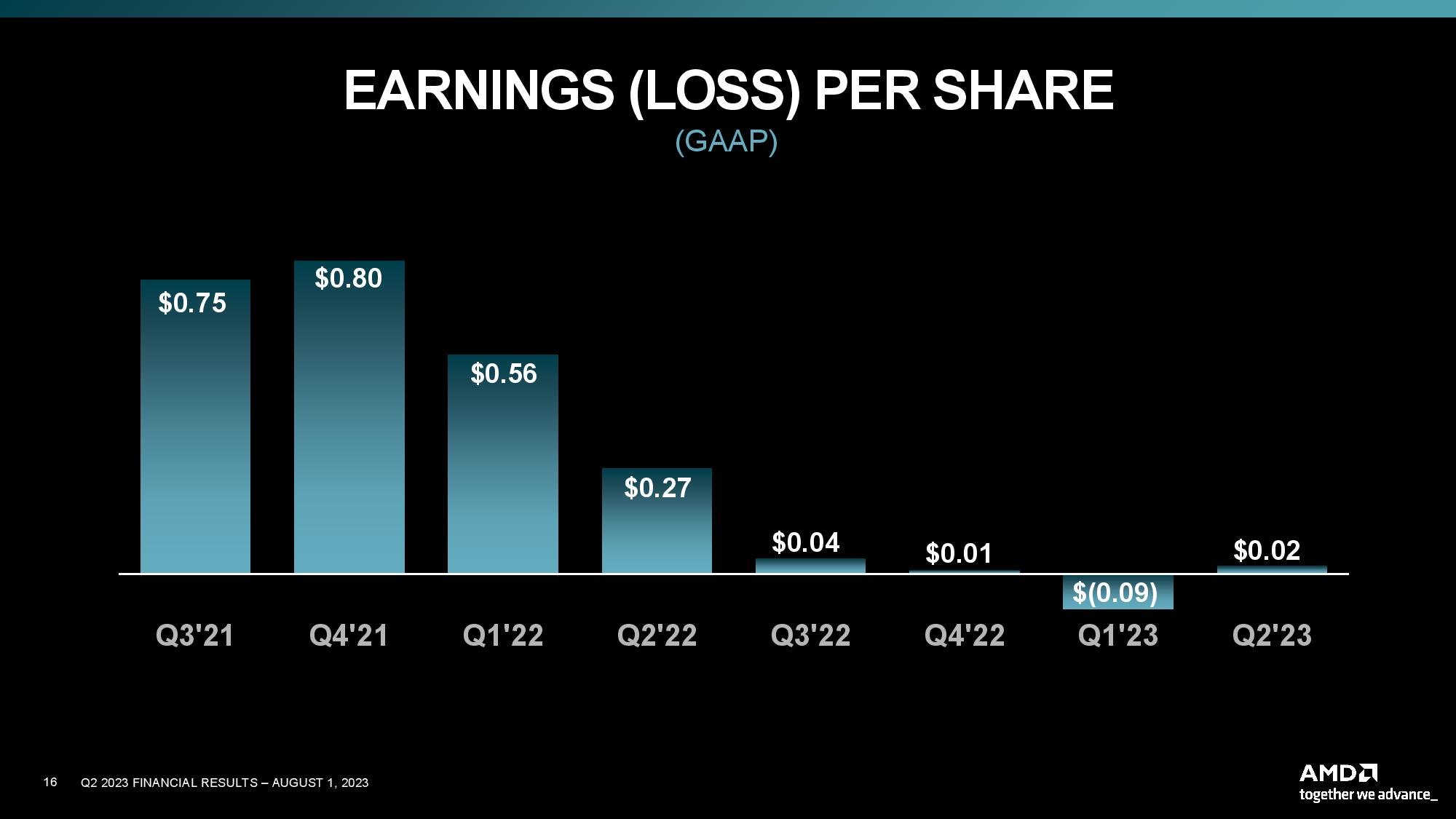

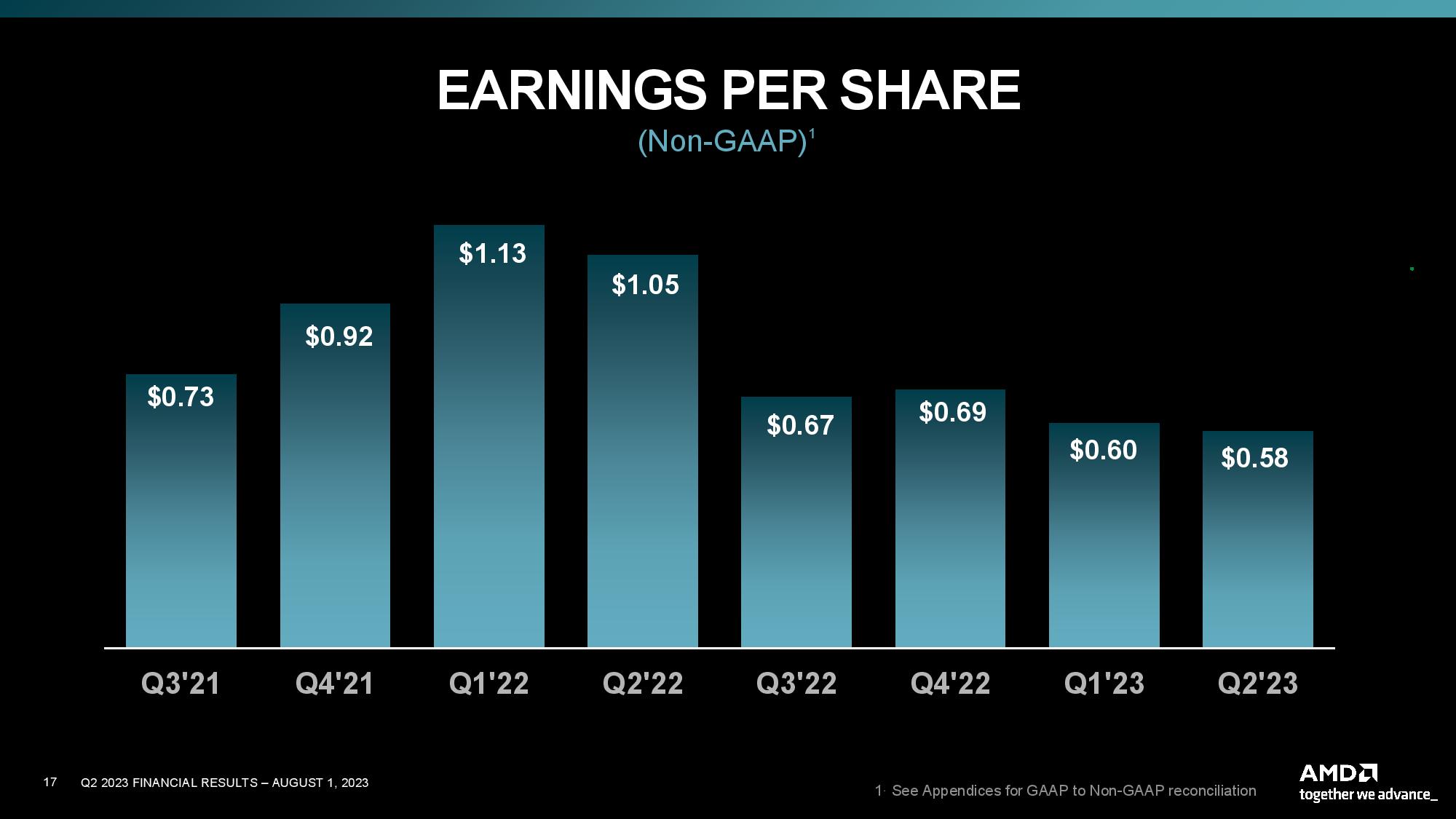

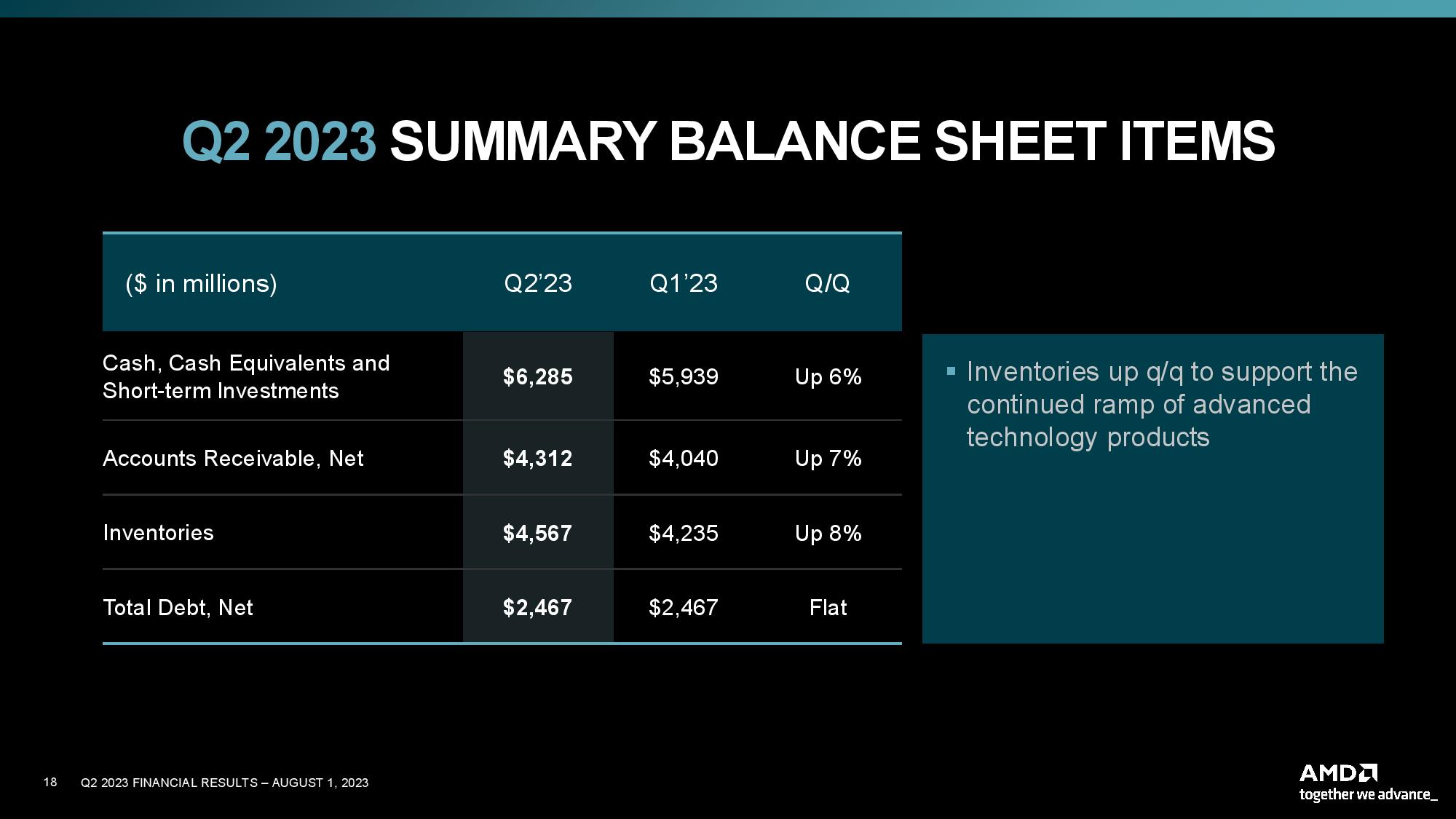

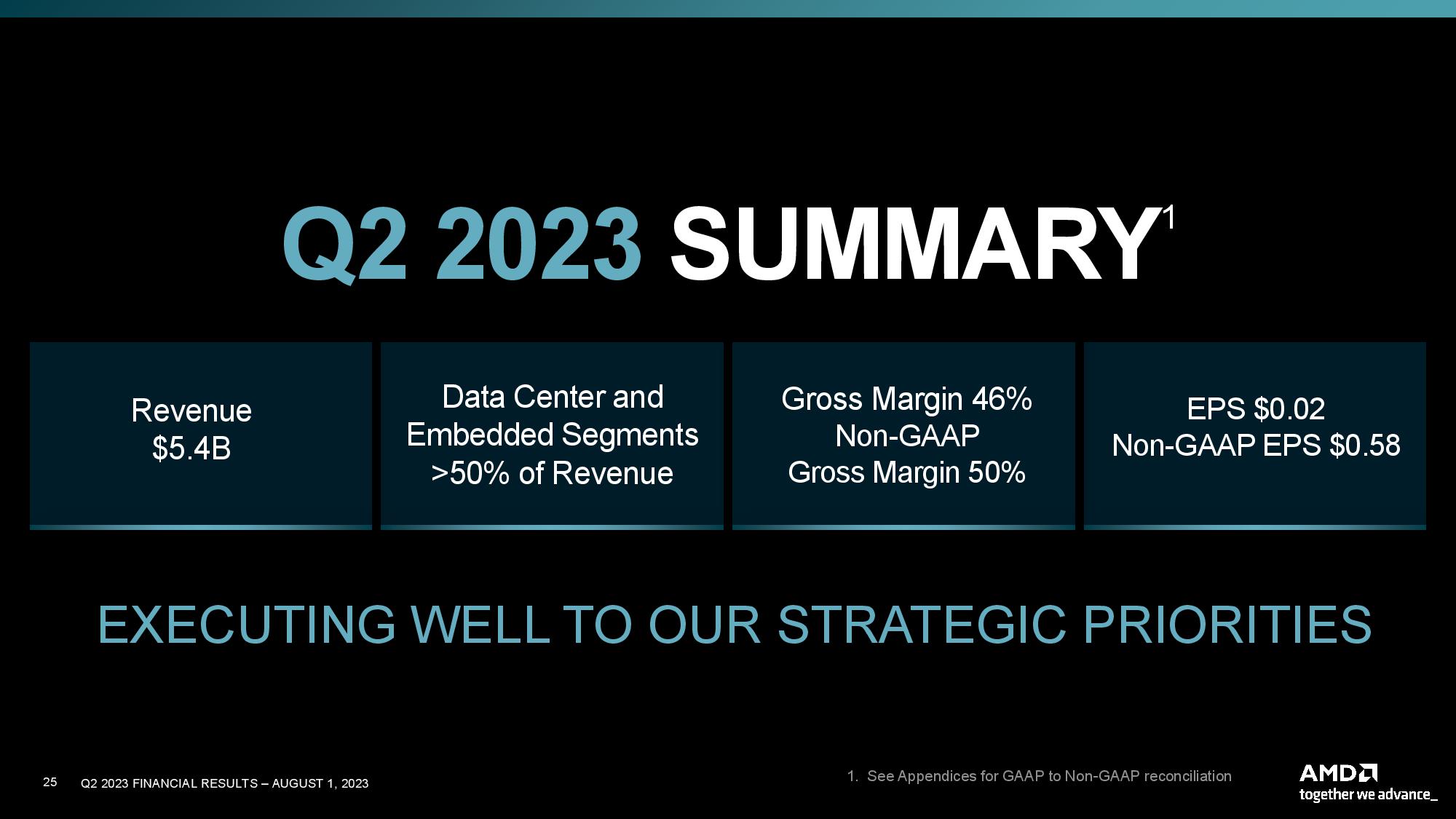

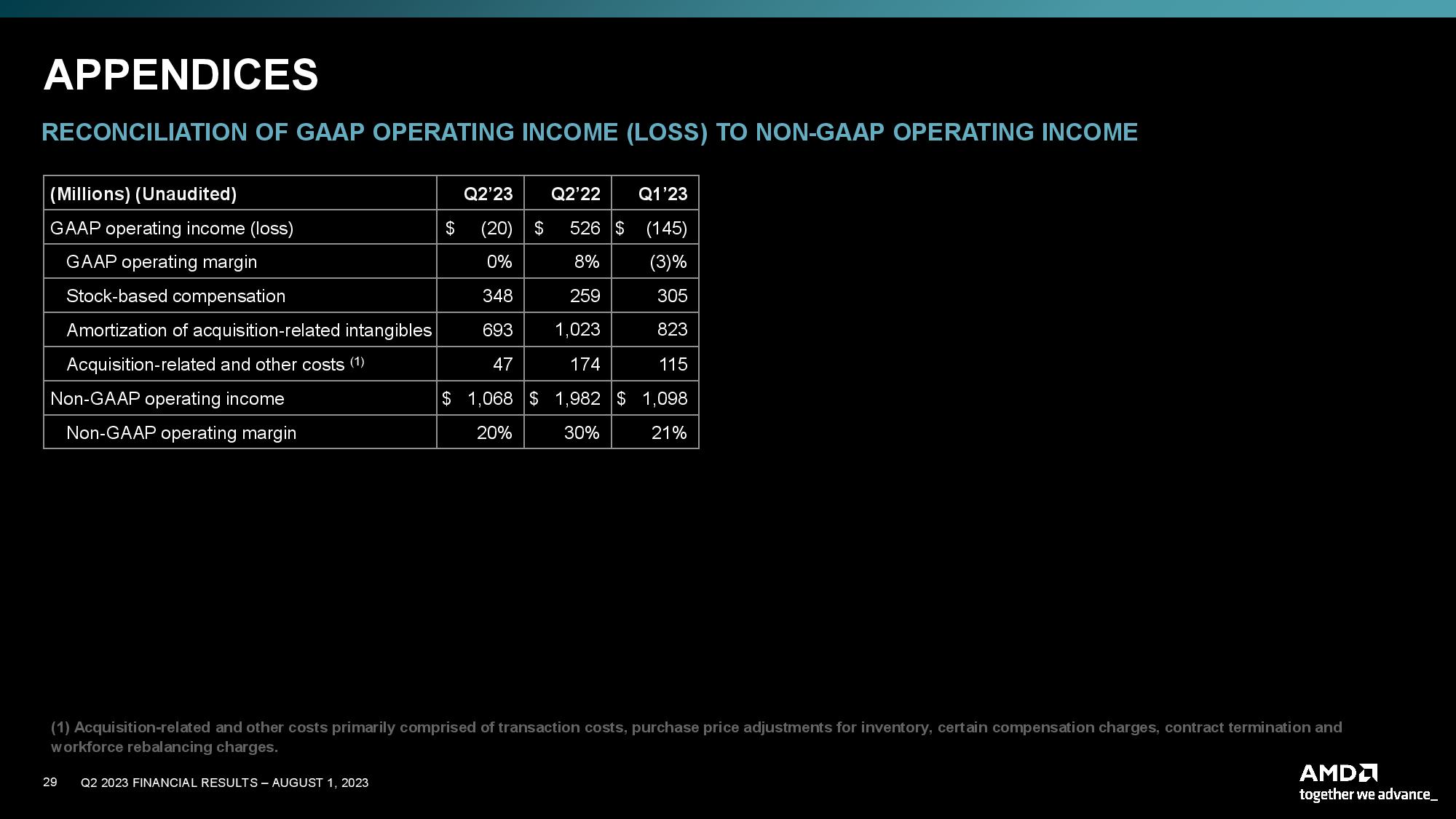

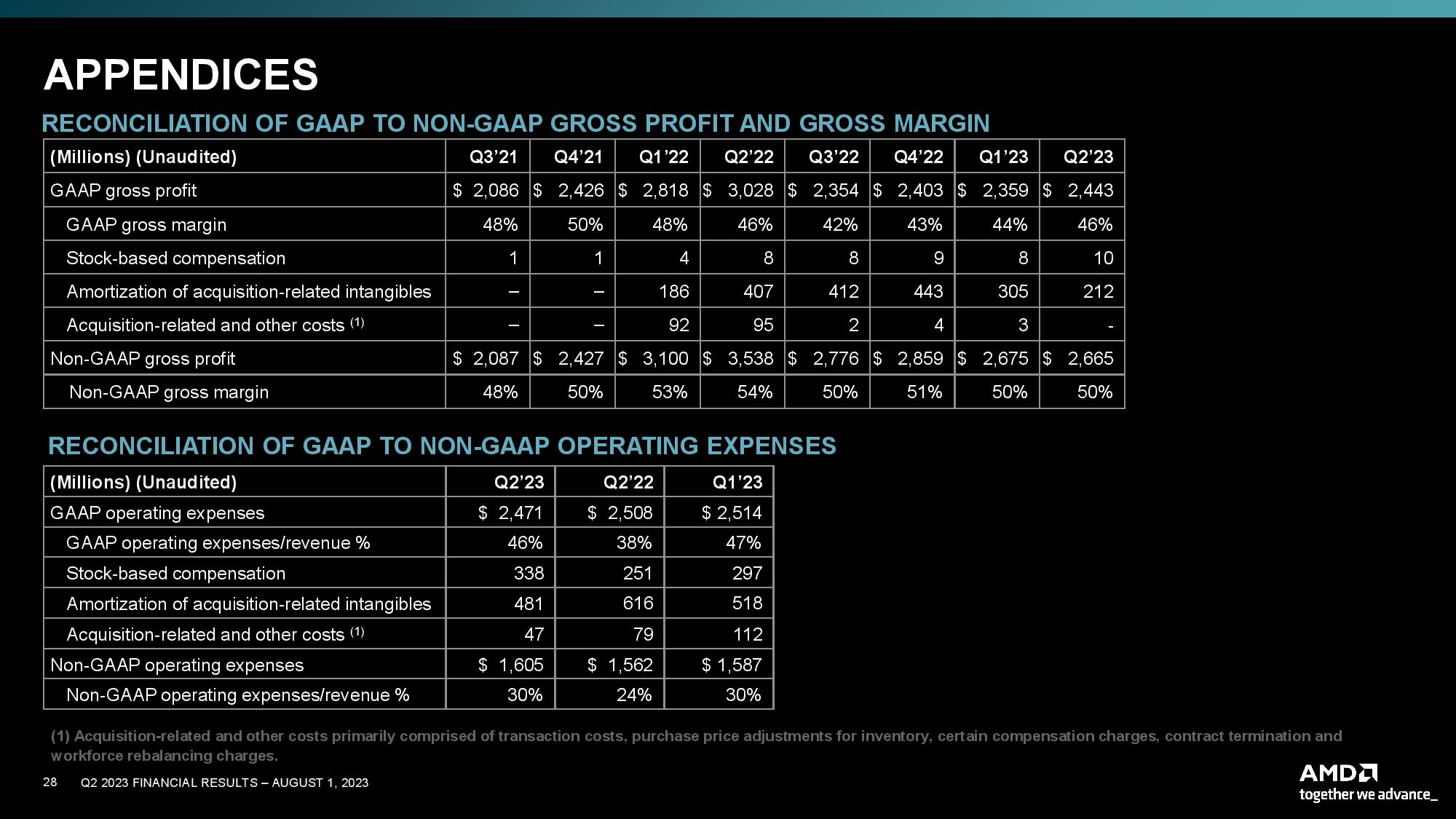

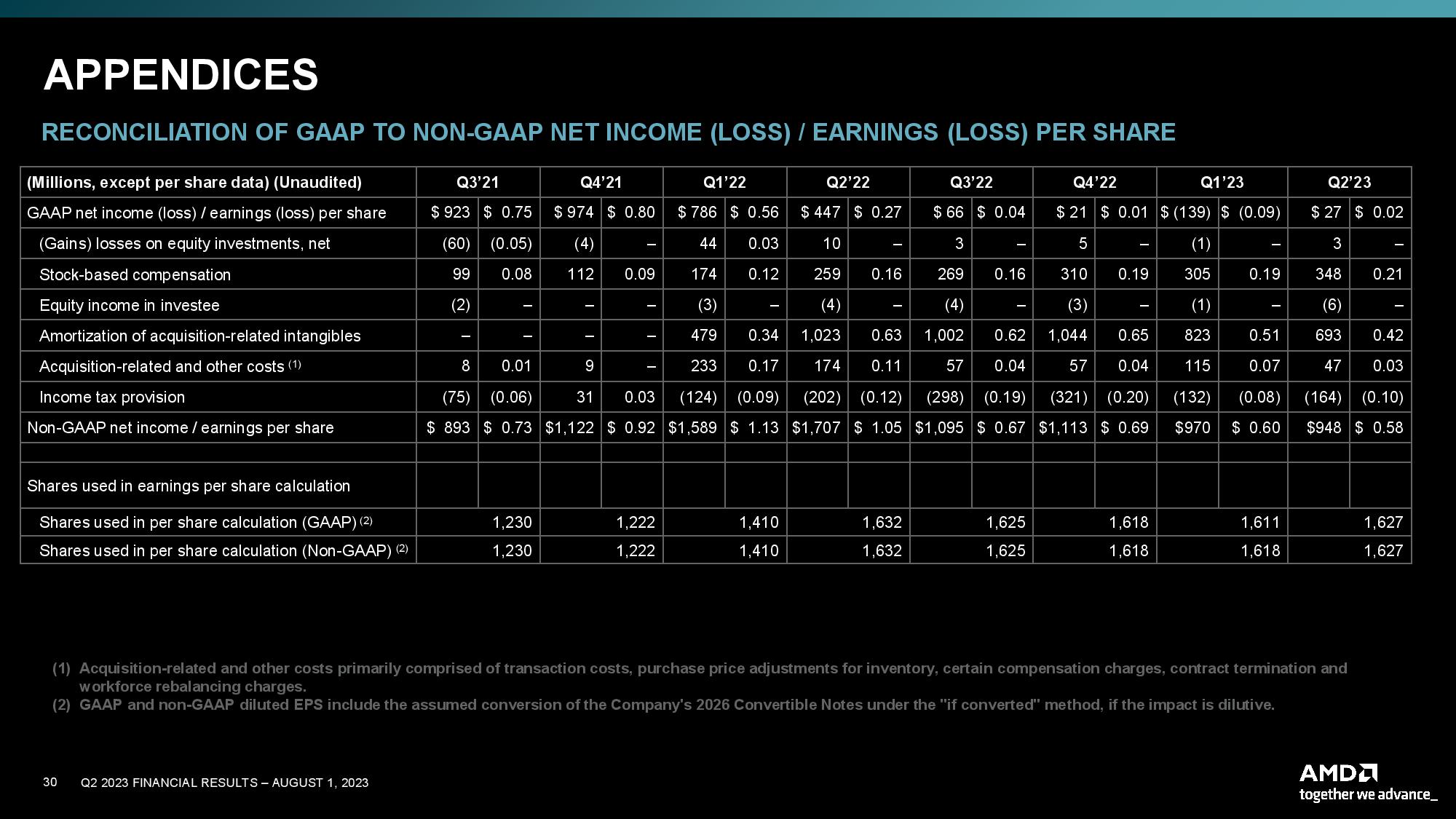

AMD's revenue weighed in at $5.4 billion, down 18% from a year ago, with a gross margin of 46%, an operating loss of $20 million, and net income of $27 million. AMD provided a lower-than-expected guide for the third quarter, tempering the positive news.

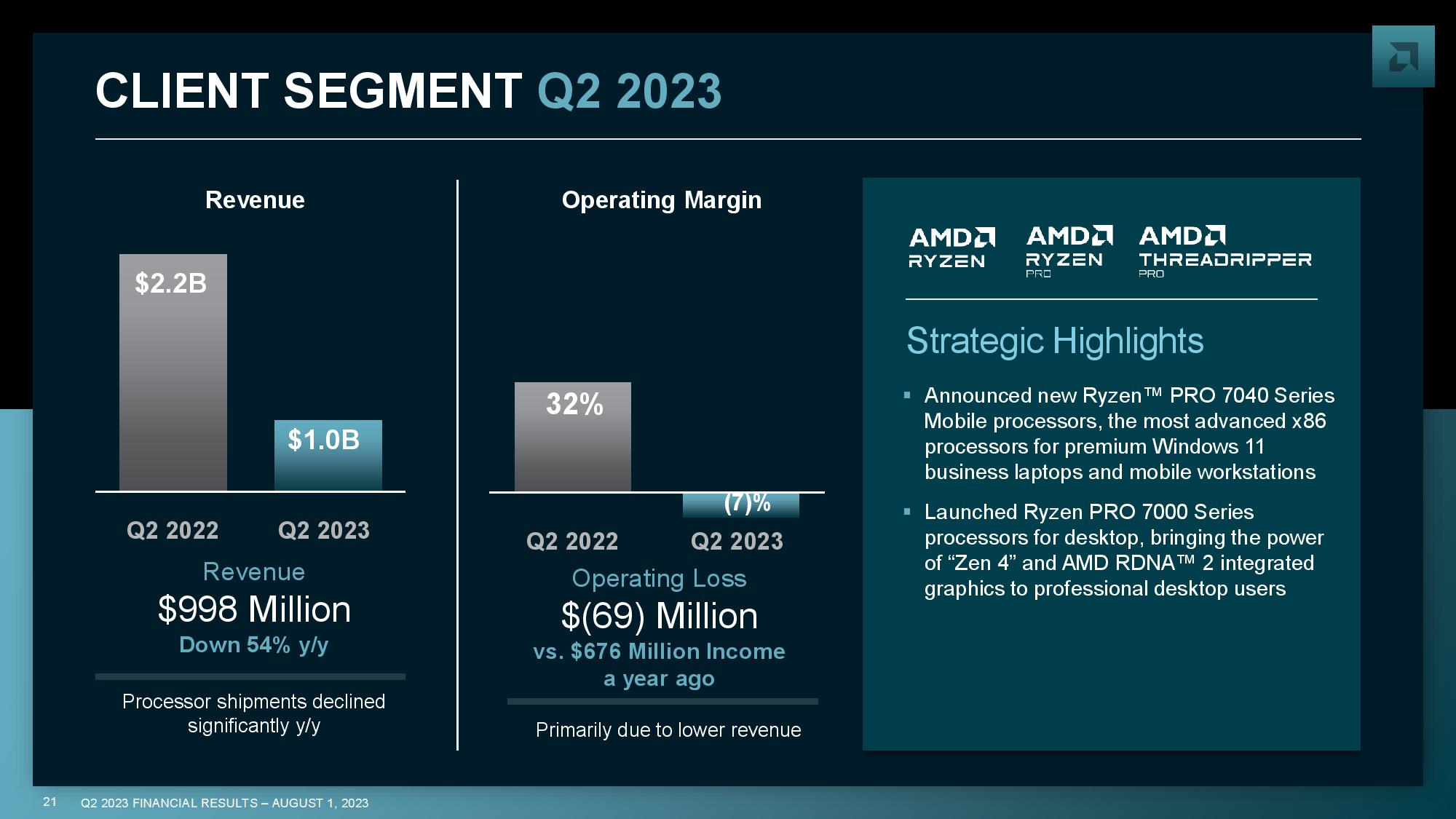

AMD's consumer chips raked in $998 million during the quarter, down 54% year-over-year as the chip glut, which also impacted Intel's sales during the quarter, continues. Like Intel, AMD also says it has seen PC market conditions improve as its revenue increased 35% over the prior quarter. Much of that gain comes from increased Zen 4 Ryzen 7000 processor sales. AMD posted a $69 million operating loss for this segment, but the company expects this segment to return to profit next quarter and post double-digit revenue growth.

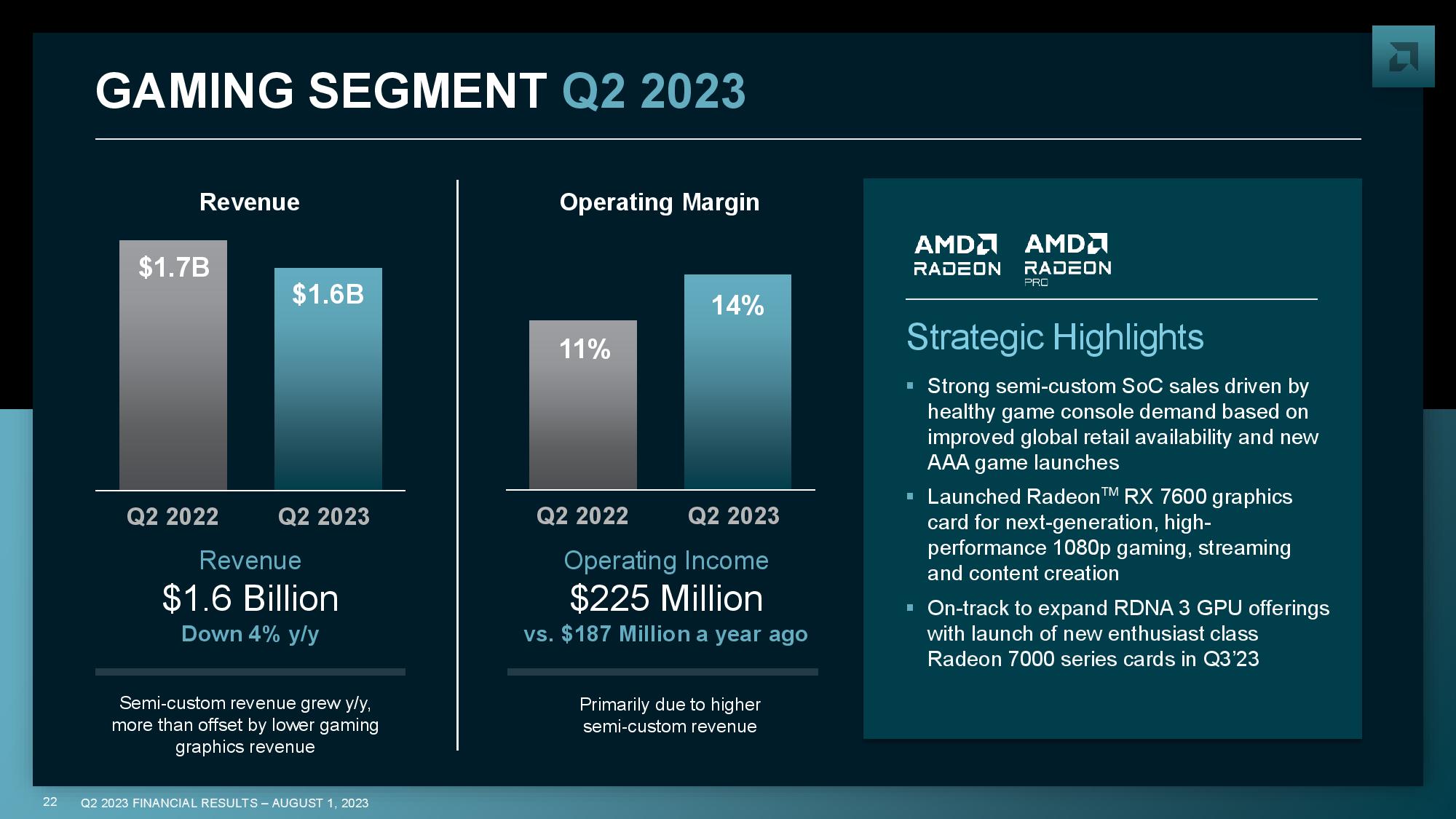

AMD's gaming segment revenue totaled $1.6 billion, down 4% on the year and 10% from the prior quarter. AMD cited lower sales of its gaming GPUs as the primary reason for the slump, while semi-custom sales to Microsoft and Sony remained brisk. AMD says it will launch new enthusiast-class Radeon 7000 GPUs in the third quarter. The group posted a $225 million operating margin, up 11% year over year.

AMD says its data center revenue dropped 11% year-over-year to $1.3 billion as sales of its third-gen EPYC Milan cooled due to a weak market. That was partially offset by sales of the pricier fourth-gen EPYC Genoa models, so revenue for this segment grew by 2% over the prior quarter. AMD's data center group posted $147 million in operating income for the quarter, which is markedly better than Intel's data center performance this quarter, which saw its data center group losing $200 million.

Su said she expects fourth-gen EPYC sales to increase by double digits in the next quarter and also signaled that the company sees creating China-optimized AI products, which are meant to conform to US sanctions, as an opportunity.

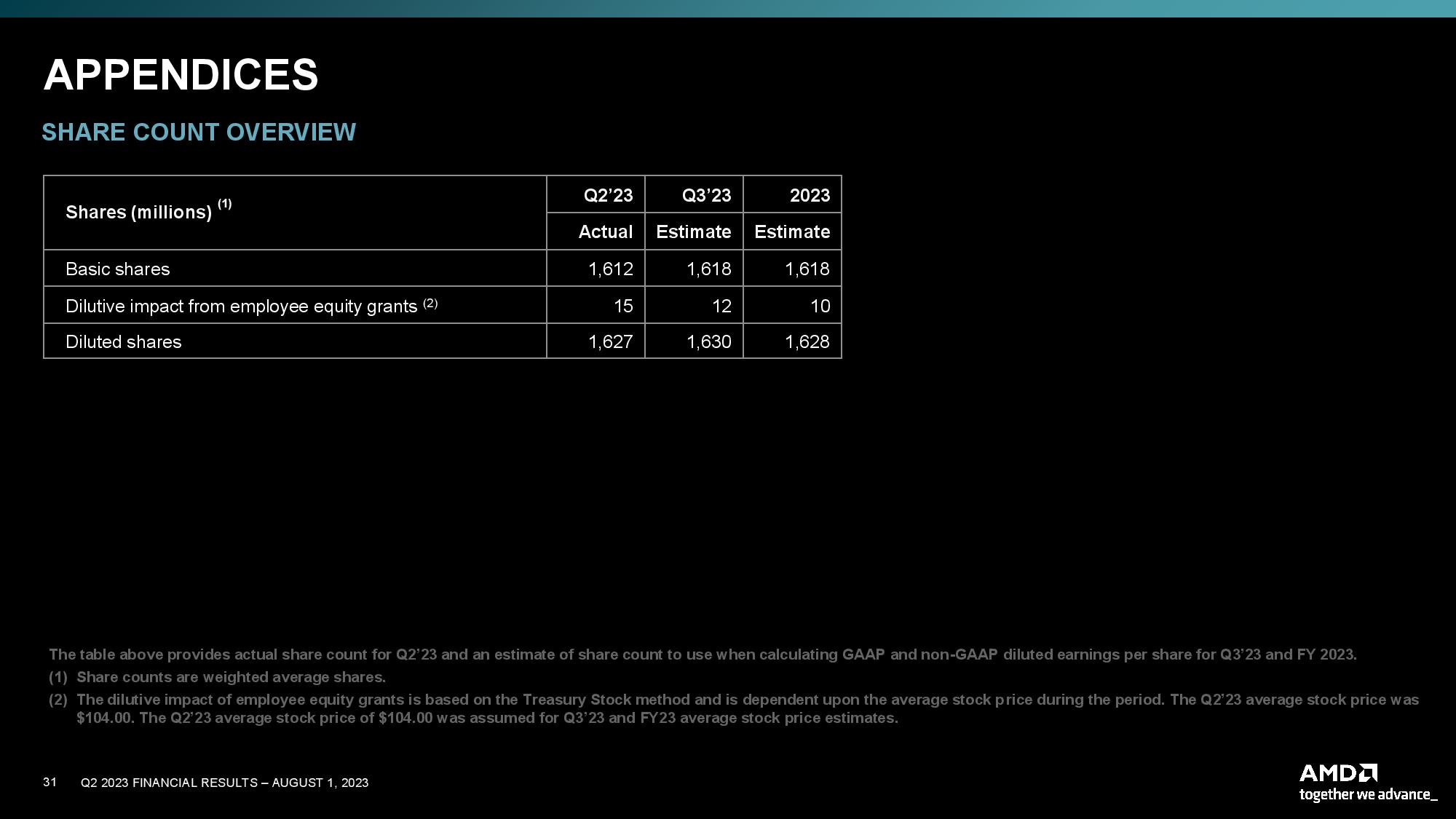

$AMD AMD Q2 FY23:• Revenue -18% Y/Y to $5.4B ($40M beat).• Gross margin 46% (-1pp Y/Y).• Operating margin (0%) (-8pp Y/Y).• Non-GAAP EPS $0.58 ($0.01 beat).Q3 FY23 guidance:• Revenue ~$5.7B ($0.2B miss). pic.twitter.com/4wKONw8uCjAugust 1, 2023

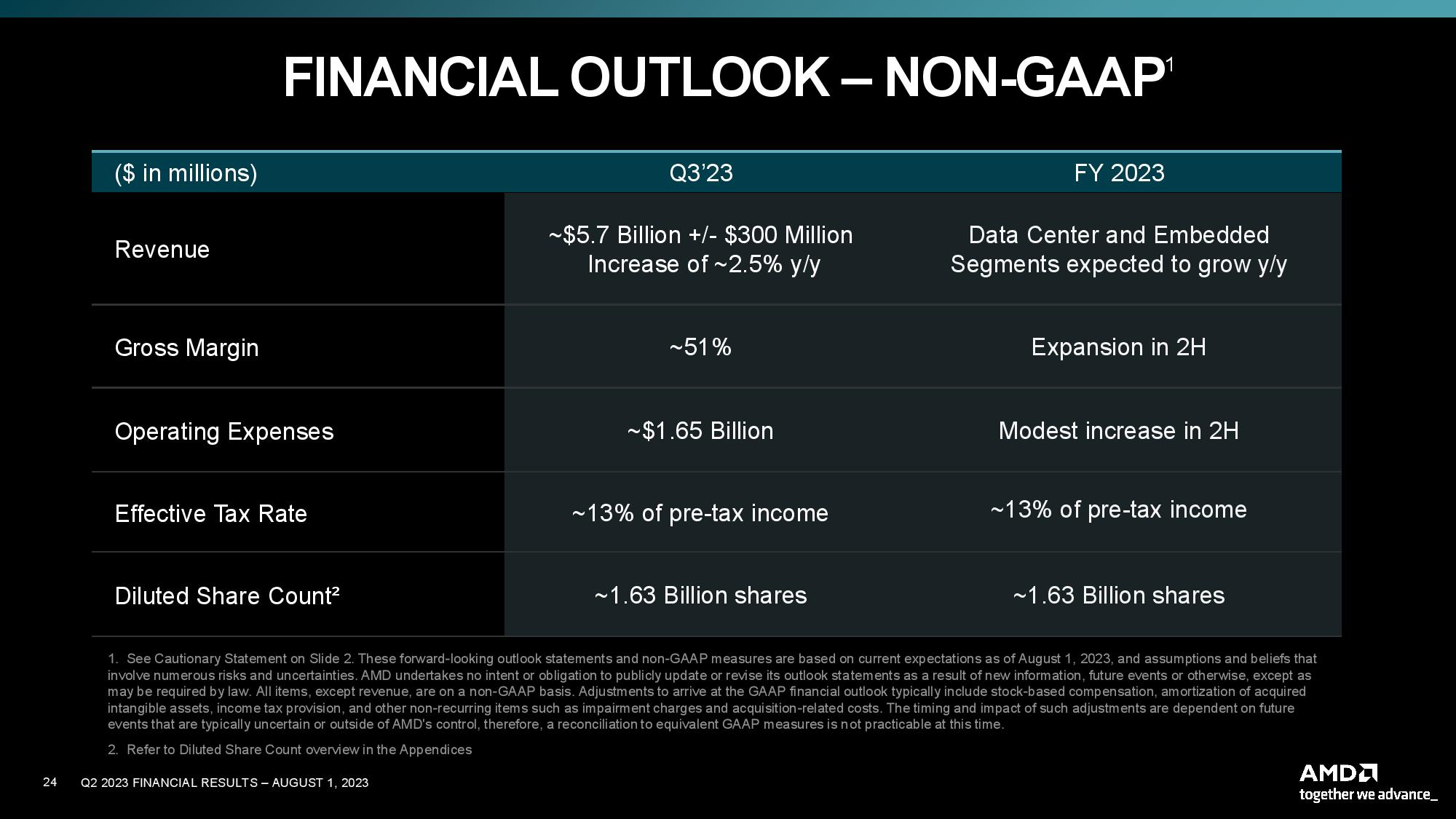

AMD expects $5.7 billion (+/- $300M) in the next quarter, a 2.5% gain year over year, and margins to weigh in at 51%.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

bit_user AMD has been trying to compete in the AI sector for so long, and it's been pretty sad to watch. If they can't get any traction now, they should just hang up their hat and move on. That, or maybe use some of that lofty stock price to buy someone like Cerebras or Tenstorrent.Reply

Also, I'm sort of hoping those new GPUs include a 7950 XTX, although probably the most I'd realistically consider would be a 7800 XT. -

Jimbojan AMD actually lost money on the quarter if not for it to get the money back from its previous taxes; it is like Intel, except Intel has been paying taxes for many years, therefore it gets a large sum of money back for the profit, where AMD gets only $27M back.Reply