Intel's Back in the Black, Says Arrow Lake Already in the Fab

Intel pulls profit out of its hat.

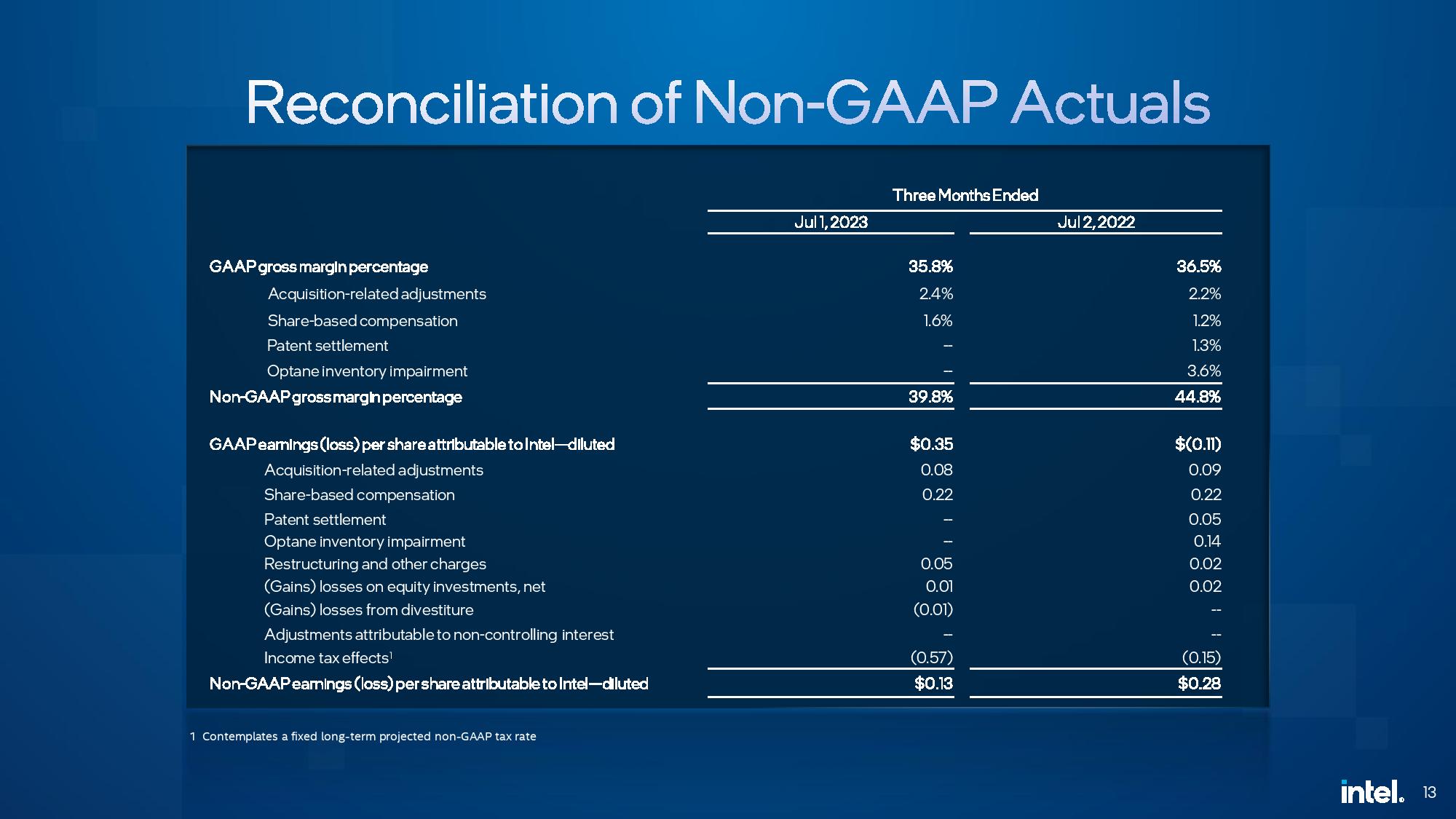

Today, Intel announced it had generated its first profit in two quarters, raking in $1.5 billion in net income on $12.9 billion in revenue during the second quarter of 2023, and the company posted a more optimistic outlook than expected. Much of the success came on the back of unexpected income from Intel's PC division, sending its stock up 8% in after-hours trading. Intel beat both its own projections and market consensus handily, with its EPS of $0.13 beating consensus estimates of -$0.19.

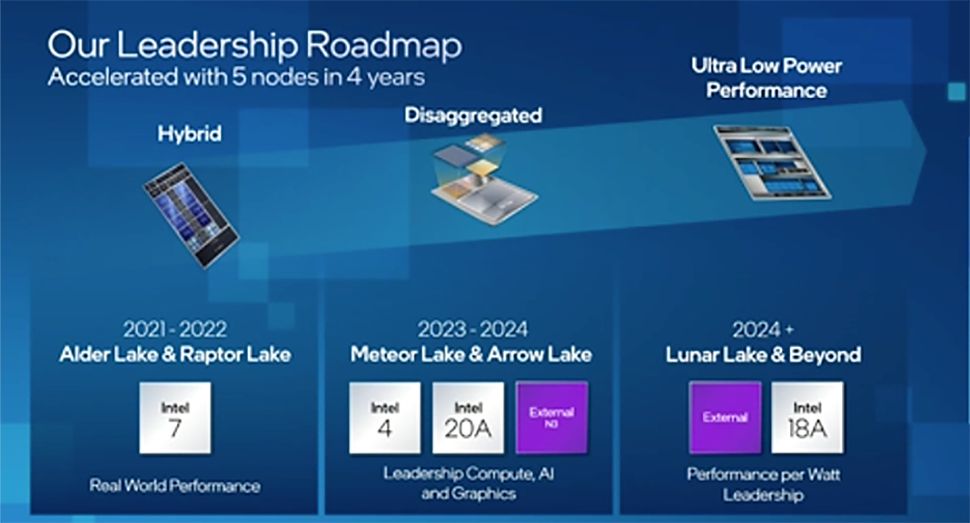

Intel CEO Pat Gelsinger reported that the company remains on track with its audacious goal to deliver five nodes in four years, noting that the company's next-gen Meteor Lake chips, the first to use the 'Intel 4' node, are in production and on schedule for a Q3 launch. These will be the company's first high-volume consumer chips to use a chiplet-based architecture tied together with the 3D Foveros interconnect tech.

Intel's next-next-gen Arrow Lake chips, which build on that same design methodology, are already progressing through the fab, too. These chips are the company's first to use Intel's 20A node (2nm), which includes new innovations like the PowerVia backside power delivery, which Intel will be first to use, and RibbonFet Gate-All-Around (GAA) technology.

Gelsinger noted that the first stepping of the Arrow Lake chips are moving through the fab, meaning these are the first test chips of the new architecture to be put through their manufacturing paces.

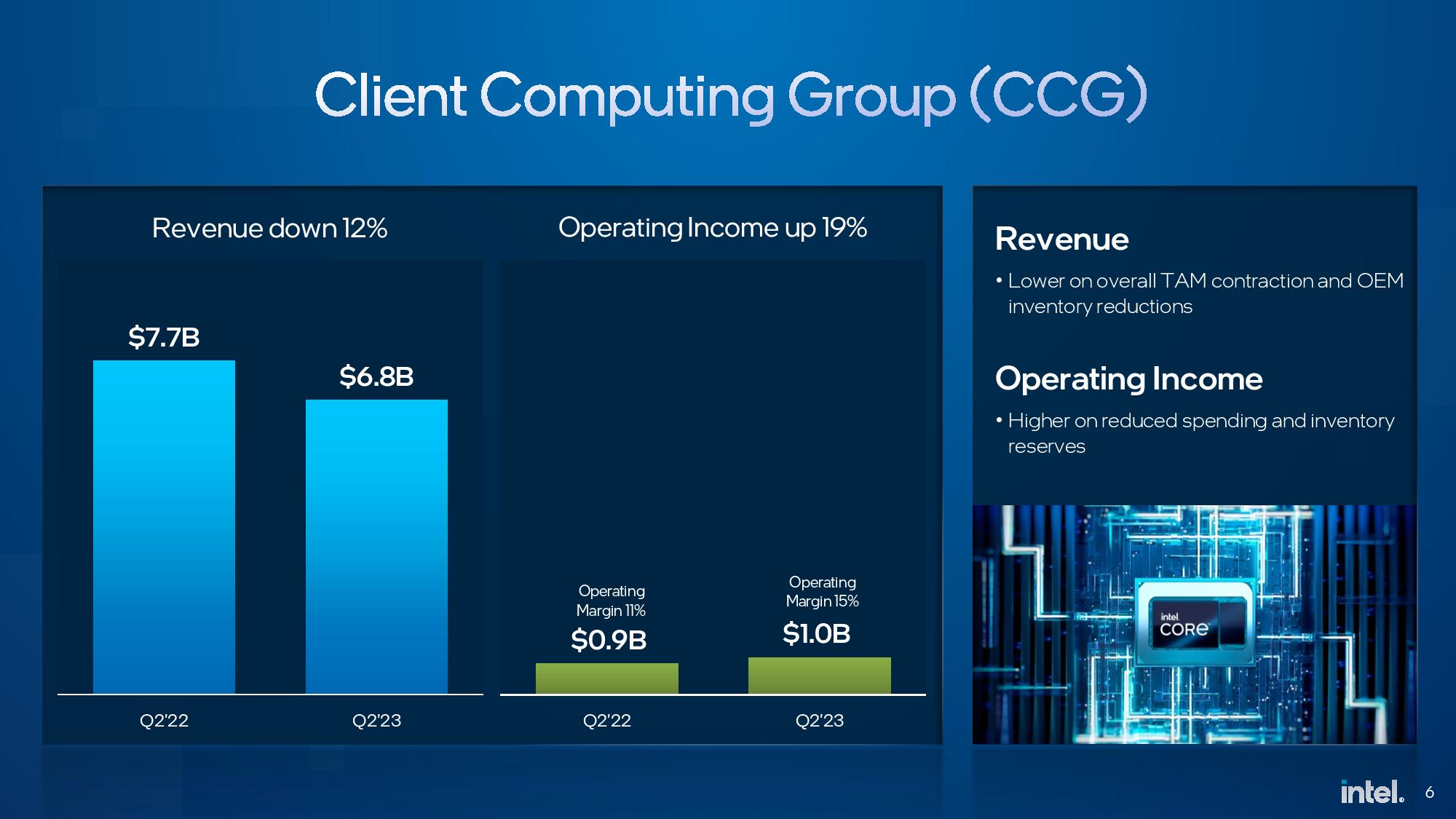

Intel's consumer CPU sales in the quarter remained depressed, with revenue down 12% while operating income increased 19%. Still, Gelsinger said he expects sell-in (the number of CPUs sold into the channel) to nearly match sell-through (the number sold to customers) soon, signaling that the end of the consumer CPU oversupply looms.

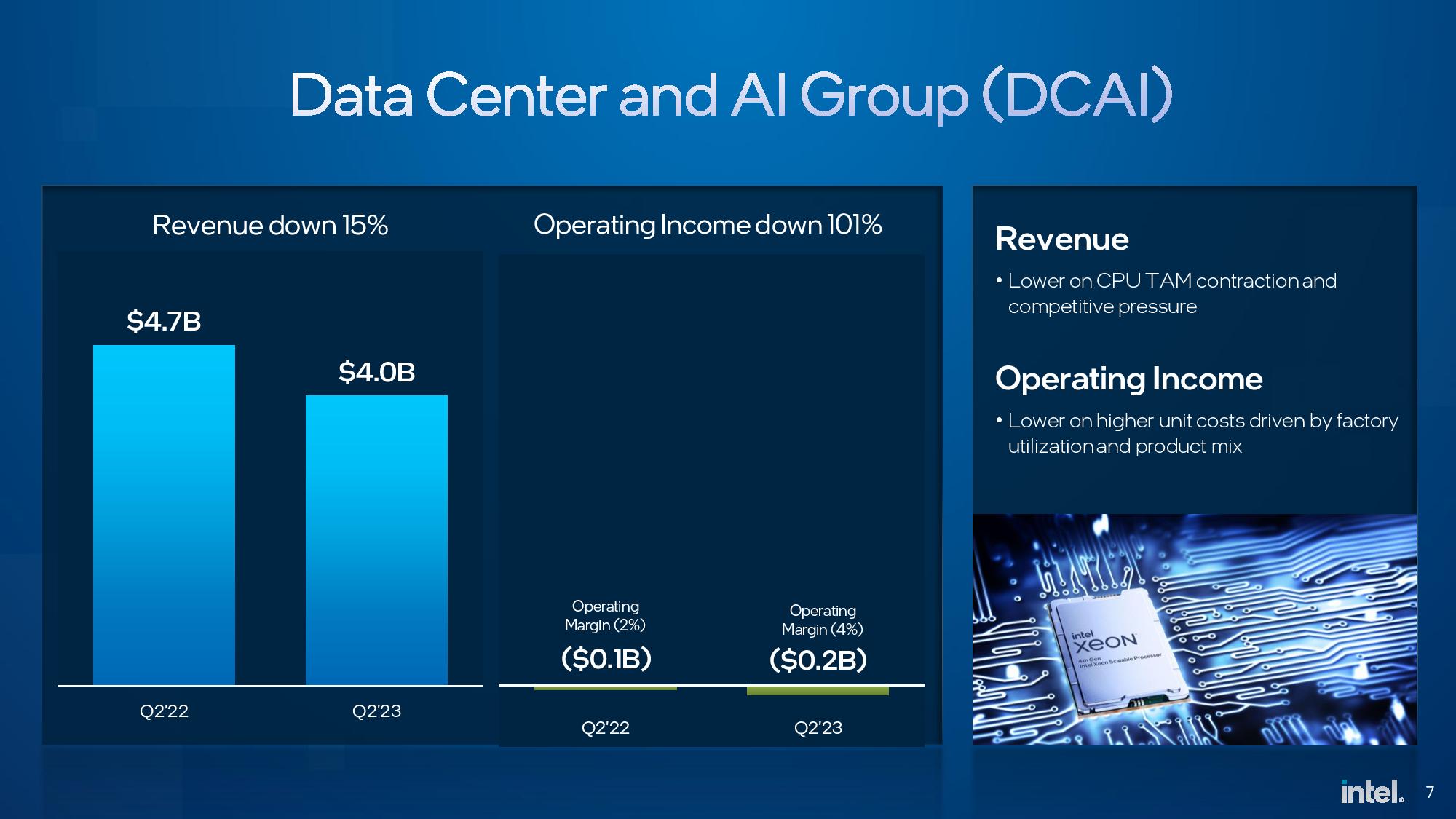

Intel expects to sell its millionth fourth-gen Xeon "Sapphire Rapids" processor in the coming days, but things still aren't very rosy on the data center side of the business. Intel's Data Center and AI Group (DCAI) saw revenue drop by 15% for the quarter while operating margins remained negative (-$200M).

Gelsinger tempered expectations for a quick rebound in server CPU sales, reporting that a significant portion of the data center and cloud spend for the rest of the year will be devoted to AI buildouts, meaning GPUs will steal from the data center budgets typically reserved for CPUs. That will result in lower sales next quarter for Intel's DCAI as more investments get diverted to Nvidia's data center GPUs.

Intel also continues to face fierce competition from AMD's server chips, and the China market has been slow to recover. As such, the data center CPU recovery likely won't occur until the latter part of the year. Intel did note that it has seen strong interest in its Gaudi chips for AI workloads, and it now has its first Gaudi 3 wafers in hand.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

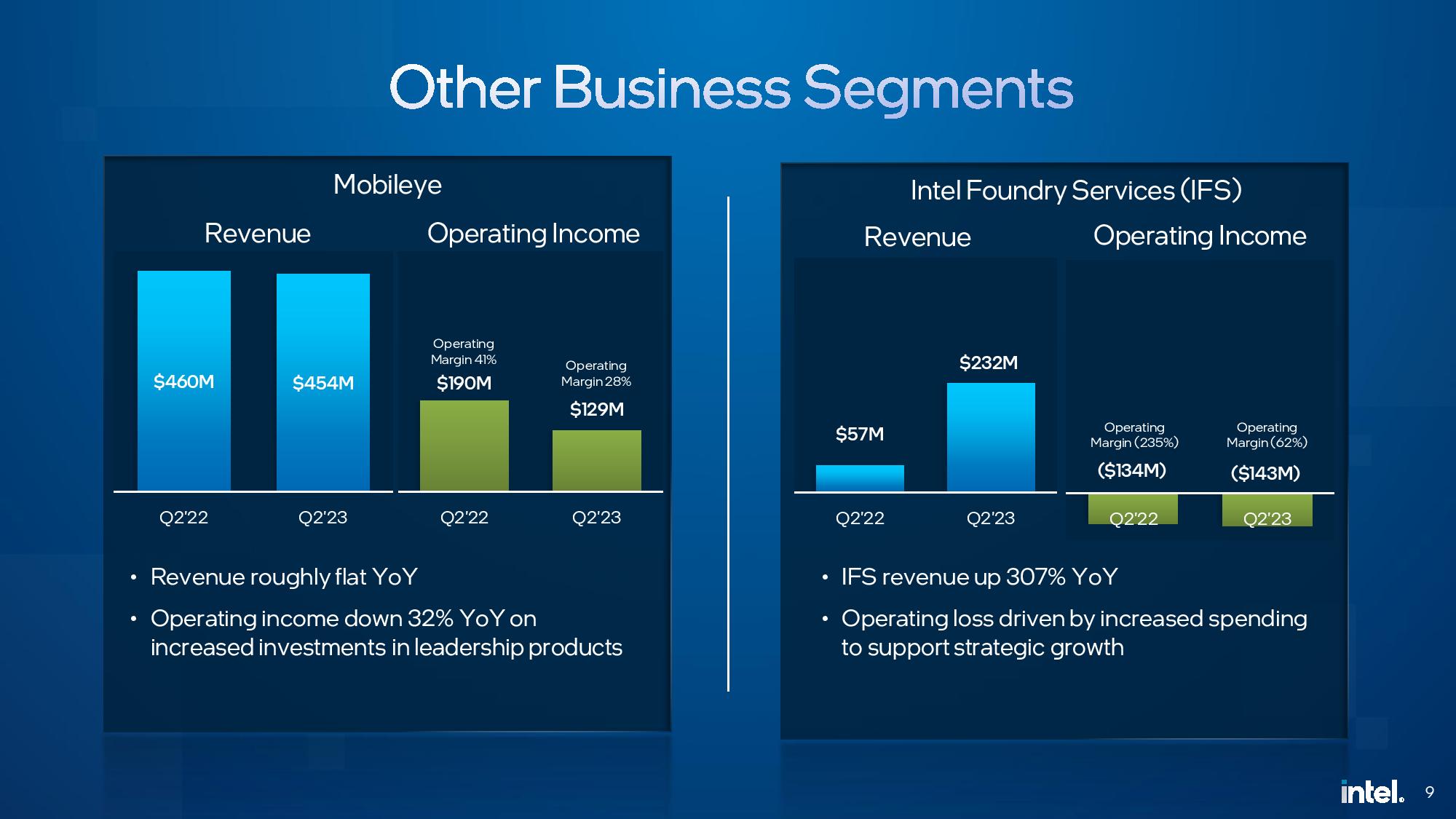

Intel Foundry Services (IFS) saw an impressive 307% year-over-year uptick in revenue, much of it from new packaging deals and sales of IMS nanofabrication tools. Still, it's important to remember that Intel's accountings have separated IFS into its own P&L, so much of its revenue comes from Intel's own internal groups. However, Gelsinger did note that the company had seen interest in its packaging services from external customers. This news comes amid a broad shortage of advanced packaging capacity in the industry, particularly for AI accelerators and GPUs. Intel has set up a packaging business unit in its foundry, so it is primed to capitalize on that opportunity.

Intel has continued to adjust its strategy as it slims down to focus on core competencies and foundry expansions, having now exited nine businesses during Gelsinger's tenure. That has saved the company $1.7 billion this year alone, putting it on track to save $3 billion for the full year.

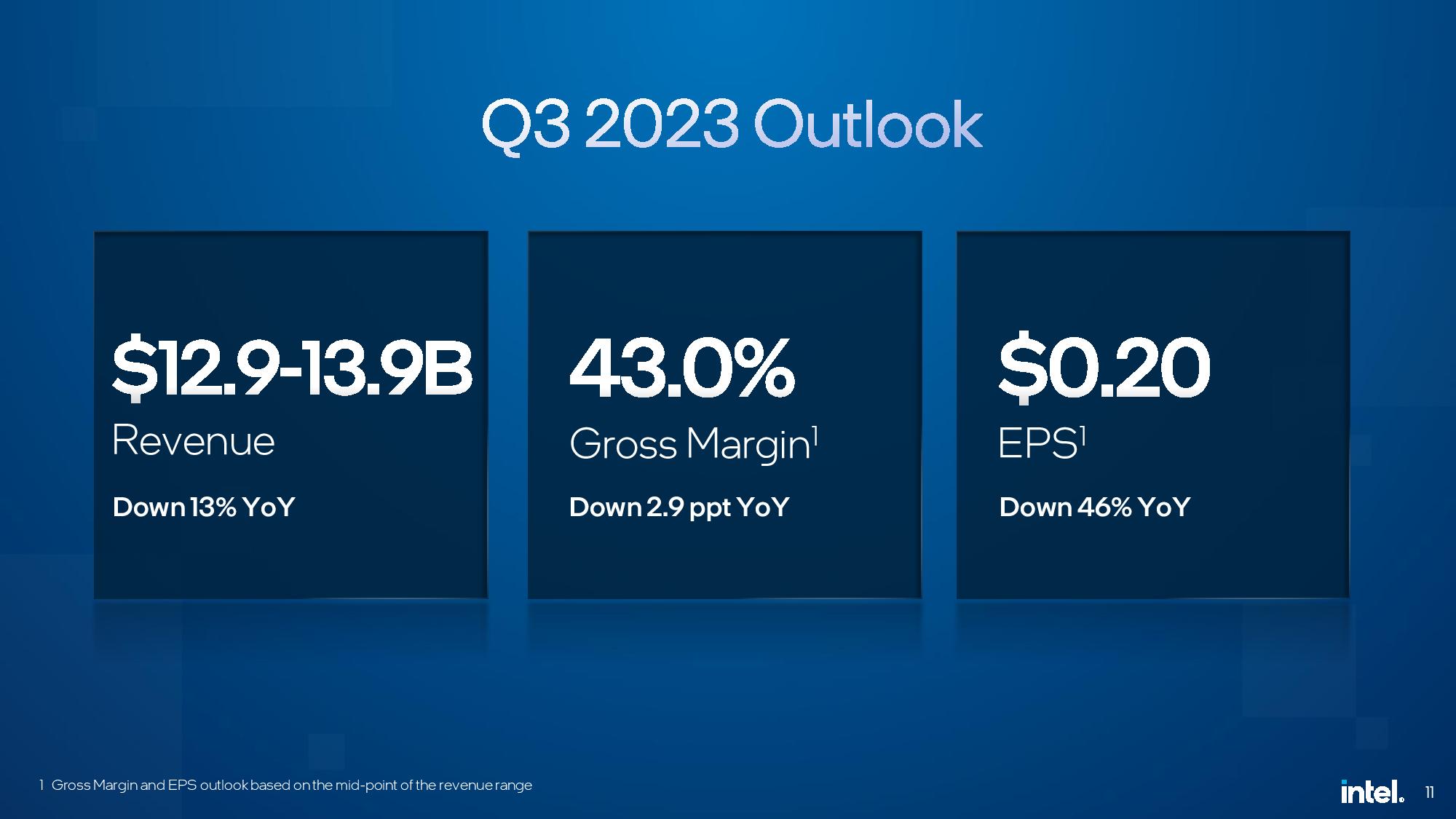

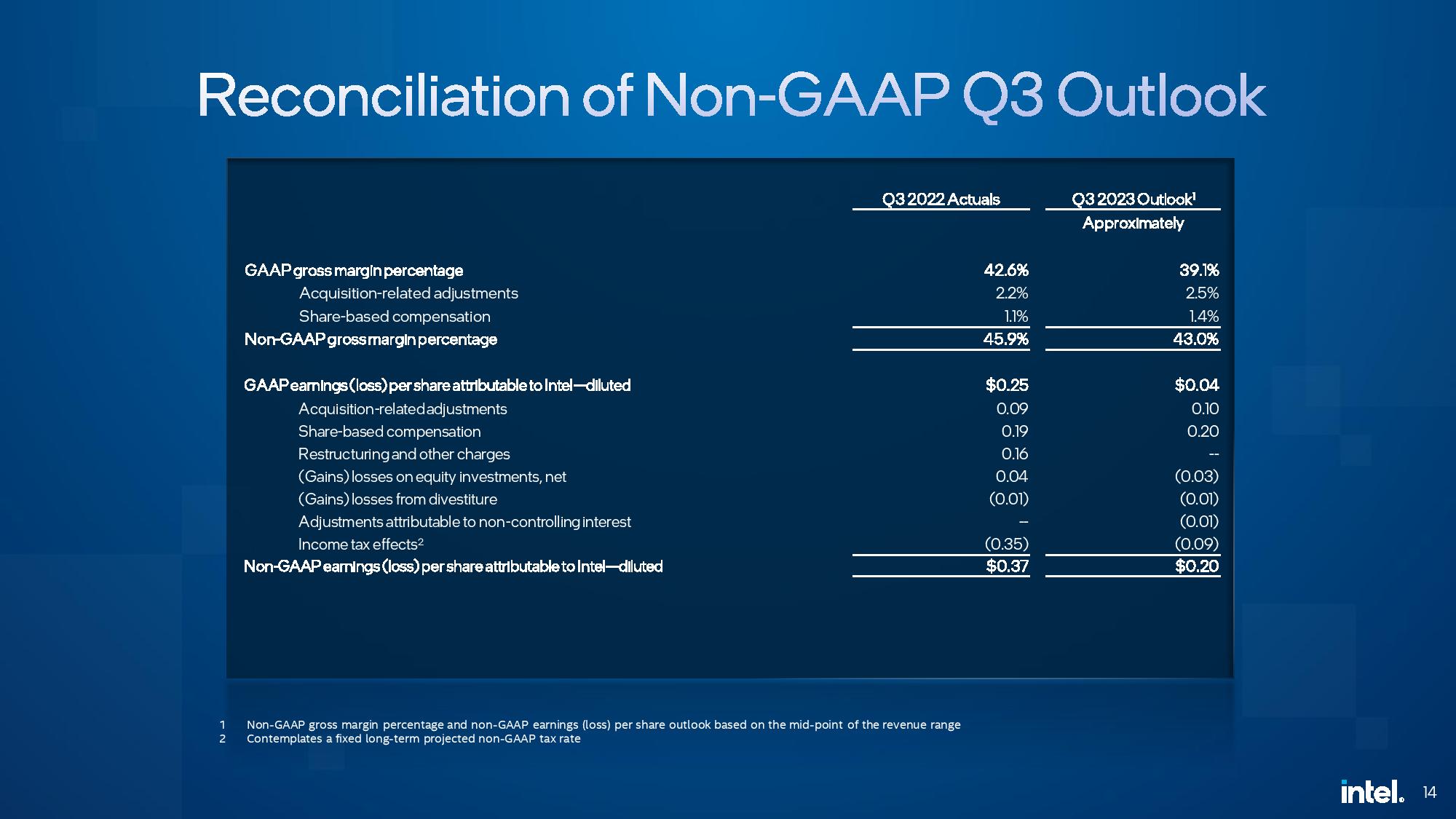

Intel's revenue fell 15% year-over-year, but its trajectory looks better than analysts expected. Intel's gross margin for the quarter improved to 39.8%, a far cry from the +60% of yesteryear but still better than last quarter's 34%. The company guides for a 43% gross margin in Q3, along with $12.9 to $13.9 billion in revenue and $0.20 EPS, all of which outstripped consensus expectations.

However, while this quarter's results and forecast look much better than expected, it will still be several years before Intel overcomes the primary hurdle to recovery — regaining its lost lead in process node technology. In the meantime, on-time delivery of its Meteor Lake and Emerald Rapids processors is paramount.

$INTC Intel Q2 FY23:• Revenue -15% Y/Y to $12.9B ($0.8B beat).• Operating loss margin -8% (-3pp Y/Y).• Non-GAAP EPS $0.13 ($0.16 beat).Q3 FY23 Guidance: • Revenue ~$12.9B-13.9B ($13.3B expected).• Non-GAAP EPS $0.20 ($0.03 beat). pic.twitter.com/Opfex57jQTJuly 27, 2023

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

jasonf2 The last time I looked at the numbers Intel's red ink was heavily related to internal reinvestment in R&D, not lack of sales. I have long contested that rumors of their demise have been greatly exaggerated.Reply -

TerryLaze Reply

Looms is something you would say for something bad, CPU oversupply ending would be a good thing for intel because it would get new CPU sales going again, unless you are showing bias here it should be 'is on the horizon' and not 'looms'

signaling that the end of the consumer CPU oversupply looms.

Intel was never not on top, having some bad quarters after years of a huge bubble due to the pandemic is normal, and also it's not like this is some super good quarter for intel. -

bit_user I wonder how much of this profitability comes from income generated by selling off various businesses and assets vs. actual increase in volumes or margins.Reply

The reason I'm wondering is that I actually do care about Intel recovering. I'm just not sure they really have, yet. -

jasonf2 Reply

I briefly looked at the Q2 financial statement. It looks like gross revenue was up about a billion (12.9 b) for the quarter (still down from 15.3b YOY). But in addition to the Q1Q2 revenue increase YOY R&D and MG&A (grouped together) was down to 5.5 billion from 6.2 Q2 22. The net income was at 1.5 billion so it looks like a combination of reduced spending and increased revenue created the net 1.5b profit. Because they group MG&A and R&D together it is difficult to say if they are actually slowing down R&D or simply didn't have loss charges from bad acquisitions that they were trying to get off of the books though so some of that is like playing poker.bit_user said:I wonder how much of this profitability comes from income generated by selling off various businesses and assets vs. actual increase in volumes or margins.

The reason I'm wondering is that I actually do care about Intel recovering. I'm just not sure they really have, yet. -

watzupken Reply

It is likely because of cost cutting. Intel's cash cow is business from data center, which I don't see recovering. I also don't believe that retail chips sale revenue is improving when demand for PC is slumping and Intel have likely been offering their retail chips at thinner margins to compete.bit_user said:I wonder how much of this profitability comes from income generated by selling off various businesses and assets vs. actual increase in volumes or margins.

The reason I'm wondering is that I actually do care about Intel recovering. I'm just not sure they really have, yet. -

JamesJones44 Reply

They factored those out for the non-GAAP earnings which was .13 cents overall. I did find it odd that the booked revenue from MobileEye since they spun them out a while ago. However, I've not looked into whether the spinout entitles Intel to some kind of parent dividend while they own a certain percentage of the company (not completely uncommon).bit_user said:I wonder how much of this profitability comes from income generated by selling off various businesses and assets vs. actual increase in volumes or margins.

The reason I'm wondering is that I actually do care about Intel recovering. I'm just not sure they really have, yet. -

TerryLaze Reply

They lost 0.8 bil and only made 1.5 because they got 2.2 from taxes, but I have no idea about how this works and if they plan for this or what, I see this all the time in AMD statements as well,jasonf2 said:I briefly looked at the Q2 financial statement. It looks like gross revenue was up about a billion (12.9 b) for the quarter (still down from 15.3b YOY). But in addition to the Q1Q2 revenue increase YOY R&D and MG&A (grouped together) was down to 5.5 billion from 6.2 Q2 22. The net income was at 1.5 billion so it looks like a combination of reduced spending and increased revenue created the net 1.5b profit. Because they group MG&A and R&D together it is difficult to say if they are actually slowing down R&D or simply didn't have loss charges from bad acquisitions that they were trying to get off of the books though so some of that is like playing poker.

Income (loss) before taxes

(816)

(909)Provision for (benefit from) taxes

(2,289)

(455)

You also benefited from that, probably way more than me, if intel didn't do that then AMD wouldn't have existed for you to build that AM4 system, they would have closed down years ago.

But AMD does a lot of shady stuff was the point I was making, they lied and keep lying about the power draw by hiding ppt as much as possible and by separating cores from io draw, they lied about the max clock speed of pretty much every single generation, they dropped the low end CPUs to force people like you to build bigger systems then they normally would, they made a gen with low quality control that started melting and blowing up, and so on. -

jasonf2 While I would definitely question Intel's ethics when it comes to fair trade practices over the years I would have to say that when it comes to raping customers Intel is middle of the pack at most. If you want to talk about Nvidia, Apple, AMDs GPU branch (or any GPU partner or reseller thru the pandemic) then we can talk about being taken advantage of. The fact is that Intel got behind on nodes because accountants were running the company (rather than engineers). The recent spat of red ink is heavily tied to turning their R&D back on and having to play catch up with TSMC, AMD and in many ways ARM. That R&D will be reflected in strong product performance increases for years to come. In this game the only way for Intel to truly get on top is for their hardware to hands down out perform their competition. So for me personally Stockholm syndrome would be grossly inaccurate. I just want performance to continue to improve at a fair price. That means that both Intel and AMD need to be making money and competing for the performance crown. Intel failing is not good for consumers or the industry in general.Reply