AMD Rising: CPU And GPU Market Share Growing Rapidly

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

According to two recent reports, AMD's CPU market share growth is accelerating, and its GPUs are enjoying an even more drastic upswing.

As we all know, AMD wasn't very competitive for several years, but the underdog is finally regaining ground against its two much larger and entrenched competitors. That success stems from Zen and Vega. The Zen microarchitecture has been wildly successful in Ryzen processors, and although the Vega graphics architecture isn't the performance leader in the desktop space, it has helped AMD improve key metrics such as average selling price (ASP), and it serves as a great integrated graphics solution for the Raven Ridge processors.

For AMD, executing well with both architectures is the key to returning to its former glory, and according to the recent reports, the company is doing just that. We'll cover CPUs first, then move on to GPUs.

AMD's CPU Growth Continues, More To Come

The last time we caught up with AMD's CPU market share the company had begun its slow resurgence with the Ryzen processors, but the numbers don't include the lucrative fourth quarter and Black Friday/Cyber Monday sales. AMD slashed pricing during this period and competed against a largely absent Coffee Lake. In fact, Lisa Su said the company tripled its sales during this period.

| Header Cell - Column 0 | 3Q16 | 4Q16 | 1Q17 | 2Q17 | 3Q17 | 4Q17 |

|---|---|---|---|---|---|---|

| AMD Desktop Unit Share | 9.1% | 9.9% | 11.4% | 11.1% | 10.9% | 12.0% |

Now the numbers are in. We're using market research data from Mercury Research, a trusted firm in the semiconductor industry. These numbers reflect AMD's share of the overall desktop unit share and exclude IoT sales.

AMD jumped an additional 1.1% in the last quarter of 2017, which matches its growth for the preceding four quarters. That indicates that the company had a successful holiday season and that the rate of growth could be accelerating. Meanwhile, Intel's share fell to 87.8%, which is down 1% on the quarter and 1.9% on the year. (VIA is also declining, which explains the gap between the Intel and AMD numbers.)

All of the desktop CPU vendors sold roughly 96 million processors last year, meaning that AMD sold roughly 11.5 million processors. Overall, based on its market share growth, AMD gained an additional 2 million processor sales in 2017 over 2016.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

| AMD Ryzen Releases | Ryzen 7 | Ryzen 5 | Ryzen 3 | Threadripper | Raven Ridge |

|---|---|---|---|---|---|

| Release Date | March 2, 2017 | April 11, 2017 | July 27, 2017 | August 10, 2017 | February 12, 2018 |

AMD's growth story in the desktop PC space comes from Ryzen sales, but the 2.1% market share growth over an entire year may seem a bit lackluster. But we have to view the numbers in perspective: AMD rolled out its Ryzen 7 processors in March of last year, so we still don't have a full year of competitive data that reflects the rise of Ryzen. It also took time for AMD to address other market segments as the Ryzen 5, 3, and Threadripper processors rolled out.

We spoke with Dean McCarron of Mercury Research for more perspective on AMD's market share:

"Limiting the comparison solely to the consumer market for Intel's i5 and i7 CPUs with AMD's Ryzen 5 and Ryzen 7, the TAM is about 25 million units in 2017, of which AMD had an 11 percent share for the year and a 14 percent share for the quarter. Limited to specific niches such as high-end gaming, the share could be higher, while including all i5 and i7 systems such as business PCs lowers the share to about 7 percent."

AMD also just rolled out its Raven Ridge processors with the Vega graphics architecture (to critical acclaim). Those models will help AMD penetrate two important segments: the sub-$100 market and the large portion of people who don't have a discrete graphics card. The percentage of systems with discrete GPUs fluctuates, but Q4 2017 found an attach rate of 54%, meaning that 46% of systems are sold without a discrete graphics card. AMD did not have a Ryzen-based processor with integrated graphics during 2017, placing a big portion of the desktop PC market out of reach. As a result, AMD's market share in the areas it could compete in, such as enthusiast systems, is larger than we see in the overall market share numbers.

But there are even more important segments on the horizon. AMD CEO Lisa Su spoke at the Morgan Stanley conference earlier this week, stating:

"...if you look at 2017, it was really the year of Ryzen in desktops [...] and do-it-yourself type systems, and it was a significant impact on our revenue growth as well as on our margin expansion. What is even more exciting is in 2018 we really have the rollout of MMC or OEM platforms, which is actually a larger piece of the overall PC market, so I actually see 2018 as exciting, or more exciting, for Ryzen than 2017." (emphasis added)

The OEM market drives much more volume than the enthusiast segment. Su also explained that the company is pushing further into the commercial space. AMD has an impressive stable of partners, including HP, Lenovo, and Dell, that have committed to Ryzen platforms.

The new Ryzen Mobile processors also feature integrated graphics, and Su said AMD expects to have 60 new Ryzen-based notebook platforms come to market this year alone. AMD hasn't been competitive in the laptop market, which is ~60% larger than the desktop PC market, so more penetration in that segment could also dramatically boost AMD's revenue.

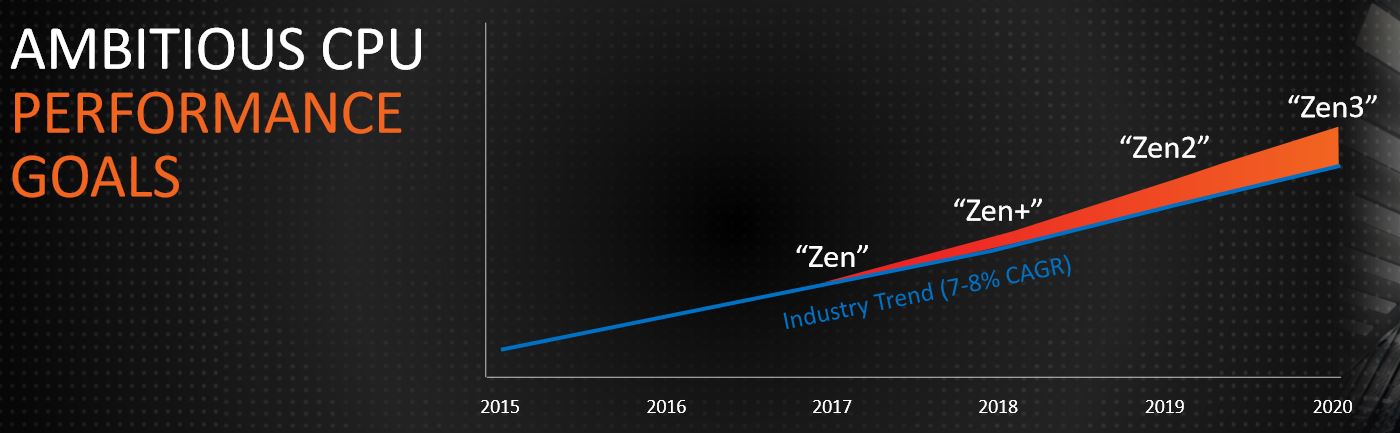

AMD isn't resting on its laurels, though. The company also has the Zen+ processors, which are a refresh of the Ryzen processors with a more efficient 12nm LP process and other new capabilities, coming to market in April.

Finally, AMD's server ambitions with its EPYC processors are moving along at the expected pace--which is to say, slowly. The enterprise is notoriously reluctant to switch from the incumbent (Intel), and moving over to new systems requires significant hardware and software qualification. That typically doesn't pay off over a single generation of products, so data center customers switch to new processors for the long run. As a result, AMD has to prove that it can execute on its road map before it sees a rapid advance in the server market. That places the onus on the coming refresh cycle. AMD has already said the Zen 2 design phase is complete and that the processors will ship to partners this year. The company is also actively working on 7nm CPUs.

AMD gained 1/2 a point of server market share during 2017 (to 1%), but that is within expectations. Lisa Su commented on the planned trajectory:

"..we have a short-term goal [...] By the end of 2018, to have an exit velocity of mid-single-digit share, and then we will get the next four to five quarters beyond to double-digit share, and then we aim for the beyond."

Growth in the high-margin enterprise space is important. Even reaching the "mid-single-digits" this year will contribute nicely to AMD's bottom line.

AMD's GPU Sales Are Booming, But With Caveats

Jon Peddie Research (JPR) released its discrete graphics card market share report this week. JPR reports that AMD has improved its market share by 6.5% quarter-over-quarter and 4.2% year-over-year. As expected, Nvidia's market share fell accordingly.

| GPU Supplier | Market Share This Quarter | Market Share Last Quarter | Market Share Last Year |

|---|---|---|---|

| AMD | 33.7% | 27.2% | 29.5% |

| Nvidia | 66.3% | 72.8% | 70.5% |

| Total | 100% | 100% | 100% |

JPR said that over 3 million discrete graphics cards were sold to cryptocurrency miners in 2017, for an estimated total of $776 million in revenue. The firm further stated that AMD is the largest benefactor of those sales, but it didn't provide specific percentages. AMD's growth came during a 4.6% sequential decline in the graphics card market, which JPR attributed to the "sharp rise in prices driven by cryptocurrency miner’s demand.”

Boosting production to meet cryptocurrency demand can result in oversupply if the crypto market crashes. That's happened in the past, so both AMD and Nvidia are reluctant to give their investors a clear view of how many of their graphics cards are headed to miners. For instance, during Nvidia's last earnings call, CFO Colette Kress said, "While the overall contribution of cryptocurrency to our business remains difficult to quantify, we believe it was a higher percentage of revenue than the prior quarter." That's obviously an intentionally vague statement.

AMD's Su has been a bit more forthcoming:

So, it is hard to estimate. I think we said before, it's hard to estimate just given some of the crypto sort of GPUs are sold through the same channels as our gaming channel. I previously said, we thought it was about mid-single digit percentage of our annual revenue, it maybe a little bit higher than that, let's call it a point or so, but it's really a lot of our growth is outside of the blockchain market.""So, look on the Computing and Graphic segment, we grew about $140 million sequentially. And if I look at that growth, it was across Ryzen and Radeon. If you look at block chain in particular, our estimates are that it was about a third of the growth, a third of the $140 million. "-- Seeking Alpha

Memory shortages continue to plague production at AMD. Su stated at this week’s conference:

"..we have increased supply quite a bit towards the end of the fourth quarter here into the first quarter. We are prioritizing gamers and our key audiences to make sure that particularly system builders and OEMs that are building with our Radeon graphics are getting prioritized. [...] eventually we see supply catching up with demand, and there are some component shortages that we are working through." (emphasis added)

The end of the graphics card shortage will likely coincide with the end of the memory shortage, and we don't expect that to happen soon. Samsung did recently announce its intentions to increase manufacturing (after the threat of a Chinese investigation into DRAM price fixing), but that likely won't have a material impact until later this year.

Thoughts

Executing well in both CPUs and GPUs could be AMD's ace in the hole. It is, after all, the only company in the world that manufactures both x86 CPUs and discrete GPUs. Intel has a new initiative underway, sure, but it will take time to come to fruition. Meanwhile, AMD has a graphics architecture that scales from discrete cards down to integrated graphics, and it easily beats Intel's UHD Graphics 630. Vega is so well-suited for integrated graphics that Intel has even come onboard as a customer with its Kaby Lake-G processors.

But being strong in both CPUs and GPUs means that AMD has the unlucky task of competing with two industry heavyweights. Intel has a commanding presence in the desktop PC market and controls ~99% of the server market. Nvidia is also a fierce competitor in the desktop GPU market and dominates the fast-growing AI segment in the data center. Nvidia recently posted gross margins that exceed 60%, which is surprising given its reliance on third-party silicon production, and Intel has been over the 60% threshold since 2014. That means that both of AMD’s competitors have much more money to fuel all the various facets of competition, such as R&D, engineering talent, staffing, and sales and marketing.

AMD's accomplishments with far fewer resources are incredibly impressive. Considering its rapidly improving growth in both CPUs and GPUs, which provides more revenue to fuel further growth, the company could be authoring one of computing's greatest comeback stories ever.

EDIT 2/28/17 4PM PST: Clarified Lisa Su comments on percentage of revenue based on cryptomining.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

nitrium Pretty sure my next system will be an AMD one. Currently I'm still on a i5 760, but am looking forward to replacing it with a Zen+ sometime this year. That said, single thread performance is is still a key user experience metric (unfortunately many apps still aren't multithreaded) and AMD hasn't really been able to match Intel there. Hopefully AMD have addressed this one issue I have and will increase boost clocks to more closely match Intel's with Zen+. Have to wait and see.Reply -

singuy8888 Pretty sure Lisa Su said Crypto accounts for mid single digit(5%) of total 2017 revenue, not 10%.Reply -

jpe1701 Reply20750948 said:Pretty sure my next system will be an AMD one. Currently I'm still on a i5 760, but am looking forward to replacing it with a Zen+ sometime this year. That said, single thread performance is is still a key user experience metric (unfortunately many apps still aren't multithreaded) and AMD hasn't really been able to match Intel there. Hopefully AMD have addressed this one issue I have and will increase boost clocks to more closely match Intel's with Zen+. Have to wait and see.

I can't wait to see what they have come up with but if you're coming from an i5 760 it will be great. I have started using my 1700x pc as my main computer because it can handle so much more going at once than my 6700k and things don't feel any slower so they're not too far behind already. -

Arbie @Nitrium: The small difference in AMD vs Intel in single-threaded today is immaterial next to the huge difference we'd have with AMD out of the market. Somehow they rallied and gave us a leading-edge product in Ryzen. That forced Intel to finally produce some of what they could have done years ago, with overnight announcements of more lakes than Wisconsin. Who do you want to reward with your purchase? If the AMD product is even competitive (which it certainly is!), go with them.Reply

AMD needs and deserves our support. They may not be able to come back from the brink again. Just consider that, and the decision is easy. -

btmedic04 Reply20750948 said:Pretty sure my next system will be an AMD one. Currently I'm still on a i5 760, but am looking forward to replacing it with a Zen+ sometime this year. That said, single thread performance is is still a key user experience metric (unfortunately many apps still aren't multithreaded) and AMD hasn't really been able to match Intel there. Hopefully AMD have addressed this one issue I have and will increase boost clocks to more closely match Intel's with Zen+. Have to wait and see.

IPC wise, current gen ryzen is comparable to broadwell (intel i5/7 5xxx series) so they're not too far off. Ryzen+ will pluck the low hanging fruit and increase clock speeds but yes, we have to wait till April to find out just how much further they go. Last summer I went from an i5 3570k to a Ryzen 7 1700 and overall the platform feels much smoother so I'm happy with my purchase.

Its great to see amd getting off of life support and I really look forward to an Athlon 64 like golden age again -

nitrium Reply

I'm 100% value based consumer; bang for the buck is the only thing I care about. Zero brand loyalty - after all, we don't work for them! This is why I switched to AMD for my GPU needs to an HD7950, because nVidia priced its competing GTX 770 at a significantly higher price (and with a 1GB less memory!) - that has since been replaced with an R9 390 with the same rationale (the competing GTX 970 with its paltry 3.5 GB vs 8GB on an R9 390 for the same price). Ryzen has definitely made AMD extremely compelling in the CPU space. Unless Intel drastically reduces it's prices, or the upcoming i5 8650K is something special, it'll likely be an AMD system for me.20751073 said:AMD needs and deserves our support. They may not be able to come back from the brink again. Just consider that, and the decision is easy.

-

Paul Alcorn Reply20751037 said:Pretty sure Lisa Su said Crypto accounts for mid single digit(5%) of total 2017 revenue, not 10%.

Might have been a misunderstanding here. I edited the article and added the direct Su quote from the Seeking Alpha transcript. -

Math Geek Reply20751107 said:I'm 100% value based consumer; bang for the buck is the only thing I care about. Zero brand loyalty,

amen to that. not a single brand is loyal to me and takes advantage whenever they get a chance. an extra 10% ipc is not worth an extra 30% in price at all. bang for the buck is the only way to go. 90% of the performance for 70% the cost is a no-brainer no matter how you try to rationalize it. -

Nintendork @NITRIUM, stop thinking about IPC, Skylake/Kabylake/CoffeeLake only got 5% extra IPC over Ryzen.Reply

The main difference you could see on single thread was intel's better turbo.

IPC

http://www.guru3d.com/articles-pages/amd-ryzen-5-2400g-review,8.html