AMD Is On Track To Become a Top 3 Fabless Chip Designer

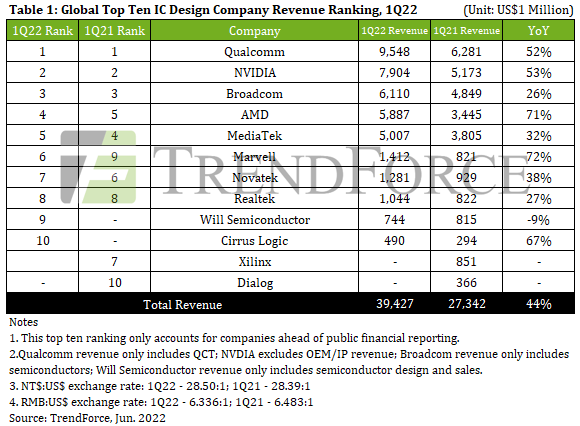

Leading chipmakers enjoy a 44% revenue growth in Q1 2022.

In the first quarter of 2022, the Top 10 fabless chip designers increased their cumulative sales to $39.43 billion, or by a whopping 44% year-over-year, according to TrendForce. Qualcomm and Nvidia continued to remain on top of the list, but AMD — now in the fourth place — is slowly but surely increasing its sales and has all chances to become the third largest fabless chip designer in the coming quarters.

Being the world's leading supplier of smartphone SoCs and RF modules, Qualcomm enjoyed the natural growth of these businesses in Q1 2022. In addition, the company experienced growth in its automotive and IoT sales, so Qualcomm's earnings for the first quarter totaled $9.548 billion (excluding its licensing business), up 52% from the same quarter a year ago.

Nvidia continued to benefit from the growing demand for discrete graphics processing units for client PCs and datacenter GPUs for AI and high-performance computing applications. Hence, its revenue for Q1 reached $7.904 billion, up 53% annually. By contrast, Broadcom was not that lucky, so its sales 'only' increased by 26% YoY to $6.11 billion.

AMD replaced MediaTek from the No.4 spot in Q1 mainly because it added Xilinx sales to its revenues. Still, AMD's CPU and GPU sales significantly increased in the first quarter due to strong demand for high-performance processors and graphics cards. As a result, AMD's earnings exceeded $5.887 billion in Q1 2022, up 71% from the same quarter last year. Once the company adds Pensando to its results and ramps up production of CPUs, GPUs, and console SoCs due to seasonality later this year, it will probably outpace Broadcom in terms of earnings. It will become one of the world's Top 3 fabless designers of chips, a landmark event for a company that almost went bankrupt about half of a decade ago. Of course, it remains to be seen how smooth integration of Pensando and Xilinx will proceed, but for now, the sky is blue for AMD.

While MediaTek switched its place with AMD, its Q1 revenue grew a healthy 32% year-over-year to $5.007 billion. The company continues to address all kinds of smartphones and tablets with its mobile SoCs. As its portfolio expands and the performance of application processors increases, the company can charge more significant premiums for its products.

Marvell was another company in Q1 2022 to demonstrate an over 70% revenue growth year-over-year (to $1.412 billion) mainly due to its acquisition of Innovium, a cloud and edge data center networking solutions designer, in October 2021. Meanwhile, Marvell was not the only company to improve its business results by adopting an M&A strategy. For example, Cirrus Logic (No.10) took over Lion Semiconductor to boost its mixed-signal business in mid-2021, so its Q1 2022 sales reached $490 million, up 67% year-over-year.

Demand for different chips continues to remain strong, particularly in 5G, automotive, AI, high-performance computing, and edge computing spaces. But the geopolitical and macroeconomic situation may pose challenges even for the seemingly resilient semiconductor market. As a result, it will be fascinating to watch how the leading chip companies will address these challenges in the coming quarters.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.