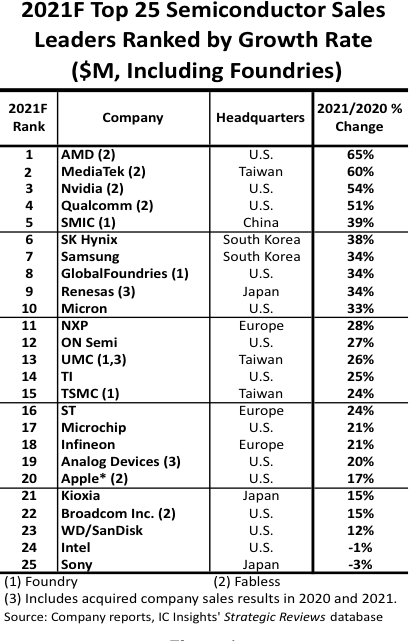

AMD Leads Yearly Semiconductor Revenue Growth Forecast by 65%; Intel Shrinks by 1%

IC Insights forecasts on revenue growths for 2021 - and not all companies are equal.

IC Insights' forecast on the semiconductor industry's projected revenue growth for 2021 paints a clear upwards trend. AMD leads the pack with a 65% revenue growth YoY (year-on-year) - the company has been seeing strong growth across all categories of personal, professional, and HPC (High Performance Computing) markets across both its GPU and CPU products. Intel, on the other hand, has had its revenue growth fall by 1%. The only other negative revenue growth lies with Sony and its -3% result.

The forecast paints clear growth for the industry at large, with predicted 23% higher revenues on average - led by 20% higher shipping volumes (the number of sales) and 3% higher ASP (Average Sale Price). A higher growth has not been seen since 2010, when the IC industry grew by about 33% YoY on the aftermath of the global recession of 2008/2009.

A more detailed look at the numbers does yield the more interesting bits, however. AMD leads with its 65% growth, closely followed by Taiwanese MediaTek (60%). AMD's 65% revenue growth and leadership of this growth forecast is indicative of how the company has managed to carve itself comfortable spaces in the consumer market, but its revenue explosion mostly comes from the increase in ASP of its products. This in itself is a result of strong, unwavering execution: AMD has impressed the server market with its EPYC products. And the company has catered to HPC customers, doubling the number of systems running on AMD hardware in the Top 500 compared to 2020 - from 21 to 49. And that's where the biggest profits are to be made.

Nvidia takes a close third spot with a 54% revenue growth. Qualcomm comes in fourth with a 51% increase, followed by Chinese semiconductor manufacturer SMIC, which reached a 39% revenue growth. This also renders the interesting note that for the top 5 earners for 2021, there are four silicon design, fabless companies - only SMIC actually manufactures silicon wafers. IC Insights forecasts that the currently perceived strongest pureplay silicon manufacturing company, TSMC, will post revenue growth of 21% - and it's the lowest growth posted by a pureplay semiconductor manufacturer. Dropping along the 25 company scale, we find that WD/SanDisk is actually the company facing the lowest revenue growth at 12%.

Intel is the first entrant into negative revenue territory, shrinking 1% compared to 2020 - despite the company having now shipped its first wafers to external consumers as part of its newly established IFS (Intel Foundry Service) group. That new revenue source for Intel is part of the reason its revenue stayed relatively flat, though: the company has had to pivot its strategy against an emerging AMD and changing market conditions - Nvidia and Arm have both played a role in this. At the same time, Intel has also been faced with supply bottlenecks for both its manufacturing business, and via system integrators - all of these elements contribute to impacting Intel's financial results. And remember that Intel too is investing in more manufacturing capacity for both itself and its partners through IFS. These are capital-intensive business decisions that all play out against the company's bottom line. Sacrificing today's profits for larger gains tomorrow is what investing is all about, after all. Intel does have a projected revenue for 2021 that's in the $77 billion metric - completely different from AMD's projected $15 billion in revenue for 2021. This is in-line with IC Insight's current forecast for 65% growth compared to the $9.76 billion full-year revenue for 2020.

Sony is the final act in the list, closing it at a -3% growth, despite the PS5 flying off the shelves. Sony has had difficulty in securing components amidst the ongoing logistics and demand discrepancies in abnormal market conditions - so much so that the company reduced its forecast for PS5 console sales until March 2022 by 1 million units.

All in all, it seems that the semiconductor market is going through a strong growth spurt not seen in 11 years. The fact that this is happening on the basis of increased shipments more so than by increased ASPs bodes well for the consumer and technological market in general, and is a sign more of the increased focus on the digital, following the COVID-19 pandemic. The crisis forced the logistics and hardware manufacturing segments to stretch beyond what they were capable of enduring.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

dalek1234 Good news, as expected. Bought AMD stock at $51. Wish I had done some way earlier. There is still room to grow, market share to take from Intel and eventually Nvidia, so the future should be bright for years to come anyway.Reply