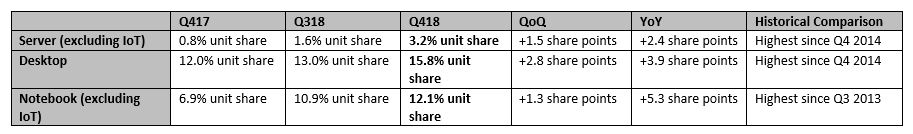

AMD Market Share Gains Accelerate in Desktop PCs, Servers and Notebooks

During the company's recent earnings call, AMD CEO Lisa Su alluded to market share gains in the fourth quarter of 2018 but didn't provide specific figures.

Today AMD shared numbers from third-party industry analyst firm Mercury Research that outline those gains. AMD gained share in desktop PC processors, notebooks, and servers, highlighting that its Zen-based processors continue to pressure Intel on all fronts, but more importantly, AMD's rate of growth is also accelerating. These improvements come as the company is on the cusp of releasing 7nm processors for the desktop PC and server markets, marking its first process node lead over Intel.

Desktop PCs

AMD now holds 15.8% of the desktop processor market, a 2.8% gain on a quarterly basis and a 3.9% year-over-year (YoY) improvement. That represents the company's largest portion of the market since the fourth quarter of 2014.

| Row 0 - Cell 0 | 3Q16 | 4Q16 | 1Q17 | 2Q17 | 3Q17 | 4Q17 | 1Q18 | 2Q18 | 3Q18 | 4Q18 |

| AMD Desktop Unit Share | 9.1% | 9.9% | 11.4% | 11.1% | 10.9% | 12.0% | 12.2% | 12.3% | 13% | 15.8% |

| Quarter over Quarter (QoQ) | Row 2 - Cell 1 | +0.8% | +1.5% | -0.3% | -0.2% | +1.1% | +0.2% | +0.1% | +0.7% | +2.8% |

Combining those statistics with the data Mercury Research has shared with us in the past, we see that AMD's rate of market share gain is accelerating, obviously propelled by strong sales during the holiday shopping season. This marks the second year in a row the company has dominated the holiday season–in 2017 the company tripled its sales on Black Friday and Cyber Monday.

AMD has made several strategic moves to capture sales opportunities, but Intel's nagging processor shortages have given the company plenty of room to maneuver while competing products are either not available or selling with big markups. We followed up with Mercury Research's Dean McCarron for more insight on AMD's share gains:

One is the long-term rise of Ryzen in both desktop and mobile -- the company has been slowly gaining share for many quarters. Even in the third quarter when Intel was setting records AMD's PC share was up more than 3 points on year, underscoring the slow-and-steady gains Ryzen has been delivering -- and these gains are largely in the mid- to upper-end of the market, not the low end. The other is the short-term issue, Intel's client units at the very low end (Celeron) dropped sharply in Q4, and AMD picked up a little bit of that business, and that added an extra boost to AMD's share this quarter, both because Intel was lower and because of the extra business that AMD got as a result. Depending on how Intel manages the low end business and how sticky it is, this portion of the share gains are likely far more volatile in the future.

Intel is focusing its production efforts on high margin products, meaning low-end desktop processors like Pentium and Celeron are the most impacted by shortages. That allows Intel to maximize its profitability at the price of ceding some share to AMD on the low end. Intel's production woes have also impacted the company's partners. As MSI CEO Charles Chiang recently told us, AMD is gaining share on the low end as sales of Intel chipsets have suffered. Those gains could be short-lived if Intel corrects its supply issues quickly, but it does provide AMD an opening to attract more long-term customers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD also announced last year that it would focus on expanding its stable of OEM systems to build market share. That strategy appears to have paid off, as McCarron also attributed part of AMD's success to increased OEM adoption.

Notebooks

Notebook processors are critical because they comprise two-thirds of the overall processor market, but AMD has been plagued by slow uptake. That tide seems to be turning as the company gained 1.3% share on the quarter and a whopping 5.3% more share YoY. That marks the company's highest percentage of the notebook market since Q3 2013.

McCarron also attributed AMD's notebook growth to higher sales of low-end processors and increasing OEM adoption, but called out that Intel's supply of low-end chips suffered more in notebooks than the desktop, giving AMD a bigger boost in the notebook market.

Much of this growth comes on the back of the company's Ryzen Mobile processors, but as AMD CEO Lisa Su recently told us, notebook sales take longer to build due to the plethora of OEMs and retailers involved.

AMD has its second-gen Ryzen Mobile chips (codenamed Picasso) coming to market soon. Those chips come with new H-series models to attack the high end and new A-Series processors to tackle the Chromebook market, opening up two new segments. AMD also already has 33% more design wins in 2019 with OEMs, so the company is primed for more growth this year.

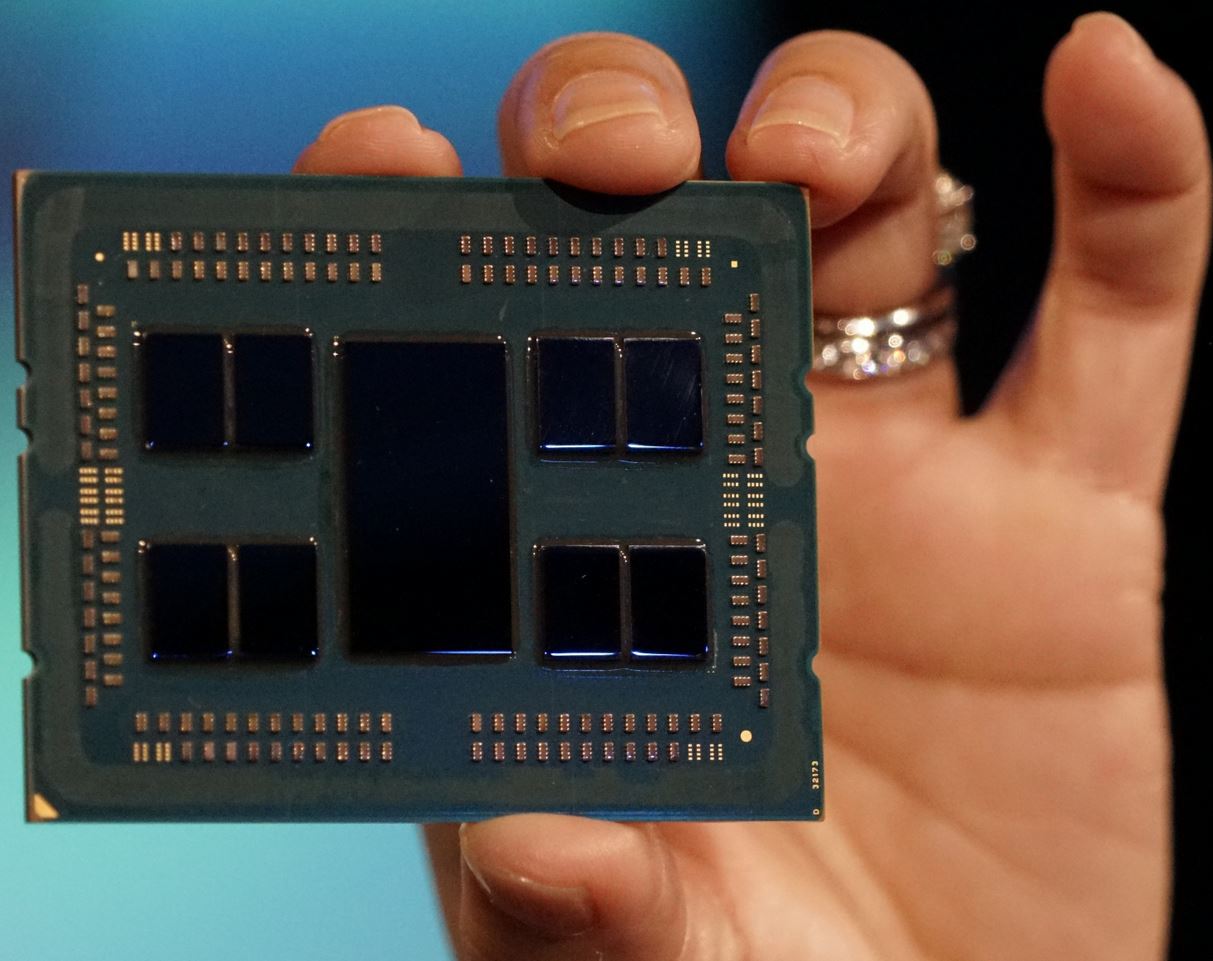

Servers

During the company's recent earnings call, Lisa Su said that AMD had achieved its goal to claim "mid-single-digit" data center share in 2018. However, Mercury Research's server share projections are lower at 3.2% unit share. AMD shared its take on the disparity:

Mercury Research captures all x86 server class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers. We used IDC’s server forecast of the 1P and 2P server TAM of roughly 5M units to compute our server market share estimates. We believe that in Q4 2018 we achieved ~5% unit share of the 1P and 2P server market addressed by our EPYC processors (as defined by IDC).

AMD has made several notable gains in the server market with its first-gen EPYC processors, particularly with cloud service providers and hyperscale data centers, but growth hasn't been as explosive as many have projected.

The enterprise is notoriously slow to adopt new platforms, so many of AMD's early sales have been to customers evaluating the systems' suitability for long-term deployments. AMD has wisely focused its early efforts on cloud service providers because it allows potential customers to test applications with a minimum of investment.

Uptake for AMD's 7nm EPYC Rome processors is expected to be more enthusiastic due to the advantages of a smaller manufacturing process, like higher performance and lower power consumption, paired with a more established platform.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

redgarl It is hard to believe that OEM are still dragging their feet in adopting AMD CPUs. What are they going to do when AMD is on 7nm and Intel on 14nm+++?Reply

I am still waiting for a laptop with a great IPS screen, a thin form factor and a 2700u/3700u offering. As of now, most of the Ryzen mobile laptops are garbage. -

bramahon Reply21745340 said:As of now, most of the Ryzen mobile laptops are garbage.

Could you be more precise on that? Is it the configuration, price or drivers? From where I hail, the main issue is availability, with retailers bent on shoving only Intel down the throat of hapless customers.

-

TJ Hooker @bramahon I can't speak for @redgarl, but I've heard a lot of complaints about drivers. Driver distribution was left to OEMs, who by all accounts have been doing a terrible job at making up-to-date drivers available.Reply

https://www.tomshardware.com/news/amd-responds-ryzen-mobile-drivers,38123.html

I think there may also be a lack of quality options with AMD parts, and instead they get stuck in cheaper units with low res TN screens, slow HDDs, etc that make them less desirable. -

compprob237 Reply21745622 said:21745340 said:As of now, most of the Ryzen mobile laptops are garbage.

Could you be more precise on that? Is it the configuration, price or drivers? From where I hail, the main issue is availability, with retailers bent on shoving only Intel down the throat of hapless customers.

Most of them are considered "cheap" alternatives to the Intel models. They typically get paired with awful laptop HDDs, low RAM, and get paired with a wimpy mobile GPU. That's probably what they're talking about. -

msroadkill612 The mobile processor is brilliant. Correctly optioned and with proper divers direct from amd, it is unbeatable in the largest segment - sub dgpu mobile.Reply

There are very good rigs from oems like HP & dell, which allow customising, and amd are taking charge of drivers very soon.

oems have made getting a KISS good one stock very messy, and the retail sales force seems very incentivised to shift intel inventory to customers.

Merit won thru for zen desktop DIY and more gradually pre-builts, and it will for mobile, but the same lag factors are even greater.

Decent graphics are non negotiable on a modern rig. For a road warrior, 4 cores is sufficient, but intel's included graphics don't cut it.

Add an Nvidia graphics card, and intel is back to being competitive, but at a very different price and power consumption point - but that point's bar will rise hugely in a year or so with 7nm APU mobiles. -

newageretrohippy @Bramahon Most of the OEMs have used terrible cooling solutions and power management options leading to severe throttling with Ryzen mobile.Reply -

mateau Reply21745833 said:21745622 said:21745340 said:As of now, most of the Ryzen mobile laptops are garbage.

Could you be more precise on that? Is it the configuration, price or drivers? From where I hail, the main issue is availability, with retailers bent on shoving only Intel down the throat of hapless customers.

Most of them are considered "cheap" alternatives to the Intel models. They typically get paired with awful laptop HDDs, low RAM, and get paired with a wimpy mobile GPU. That's probably what they're talking about.

Actually a couple of years ago I bought the ASUS FX550IU-WSFX laptop from NewEgg. For what I paid for it I have zero complaints. It has the Bristol Ridge AMD Quad Core FX-9830P Processor with a Radeon RX 460 and 1920 x 1080 screen.

Of course Ryzen is better; faster and more capable. But I find it hard to justify replacing the Asus for something better. Unless of course I can find a laptop that is thinner and lighter. The Asus was also quite a bit lighter than the

Lenovo W-540 I was schlepping around and the screen is better. My primary reason for an HD laptop was for Autocad Civil 3d in the field, the screen is phenomenal. I also travel a lot internationally and my laptop is essential communications for everything as well as entertainment.

AMD products are every bit as good as Intel if not better with Radeon on die. They are also cheaper.

-

BulkZerker @compprob237Reply

That's not completely the case now, the Ryzen laptops are saddled with sub par screens, battery, and likely also using a mechanical HDD (of larger capacity but who cares) compaired to an Intel laptop of the same price range. Which matters way more than if the laptop can play crysis. -

Paul Alcorn Reply21745692 said:@bramahon I can't speak for @redgarl, but I've heard a lot of complaints about drivers. Driver distribution was left to OEMs, who by all accounts have been doing a terrible job at making up to date drivers available.

https://www.tomshardware.com/news/amd-responds-ryzen-mobile-drivers,38123.html

I think there may also be a lack of quality options with AMD parts, and instead they get stuck in cheaper units with low res TN screens, slow HDDs, etc that make them less desirable.

AMD did update its policy here, now it provides drivers directly.

AMD also addressed recent customer complaints about drivers for existing Ryzen Mobile parts, which currently only come from OEMs. Now all Radeon software updates apply to all Ryzen Mobile Laptops, even the previous-gen Ryzen models. That should allow customers to get their bugfixes and day-zero game drivers directly from AMD as they are released.

https://www.tomshardware.com/news/amd-3000-series-picasso-apu-ryzen,38290.html