AMD Rockets Onto Nasdaq-100 Index

AMD's meteoric rise from the brink of bankruptcy to a potent competitor in the processor market has earned the company plenty of praise from the enthusiast community, but the fruits of its labors also extend to its bottom line. AMD's steady cadence of Ryzen and EPYC processors, paired with its efforts in other critical segments, has paid off today with the announcement of the company's inclusion in the prestigious Nasdaq-100 index.

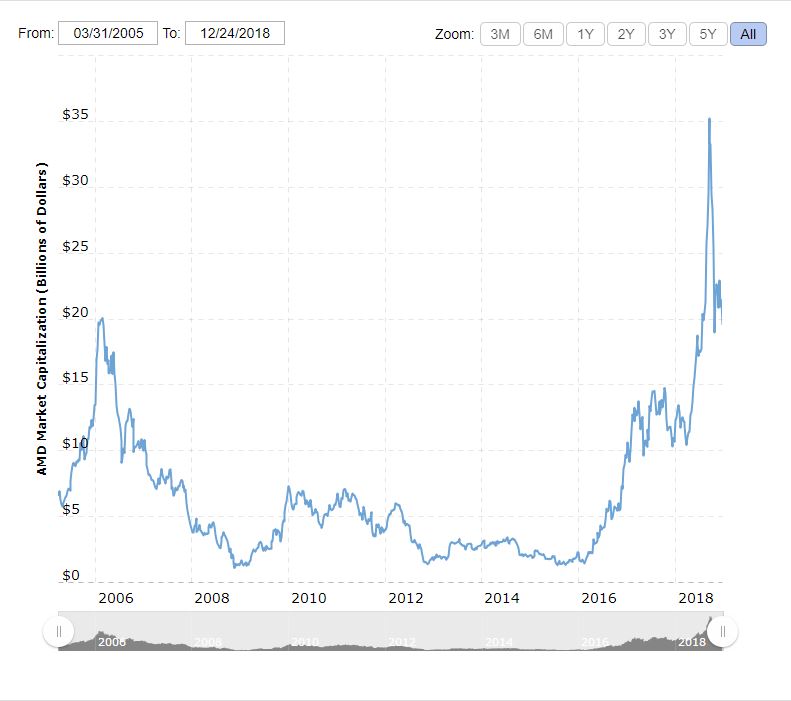

AMD will join the Nasdaq-100 prior to market open on December 24. The vendor's addition to the list, which includes the largest non-financial companies on the Nasdaq listing based on market capitalization, comes as the company has settled at a $17.72 billion market capitalization. That's down from a peak of $33.2 billion in September, with most of the losses attributable to the sudden crash of the cryptomining market. That's also punished industry stalwart Nvidia, which is also listed on the Nasdaq-100.

Album Credit: Macrotrends

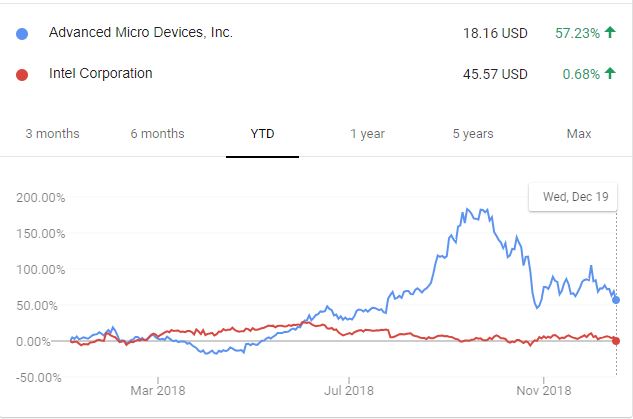

But AMD has fared far better in the market over the last year than Nvidia, whose shares have lost 34.81 percent of their value, while AMD has experienced a 57.23 percent improvement. Intel has also had a tumultuous year, but the company isn't as subject to the whims of the market due to its heavily diversified technology portfolio, notching a 0.68 percent gain in 2018 (thus far).

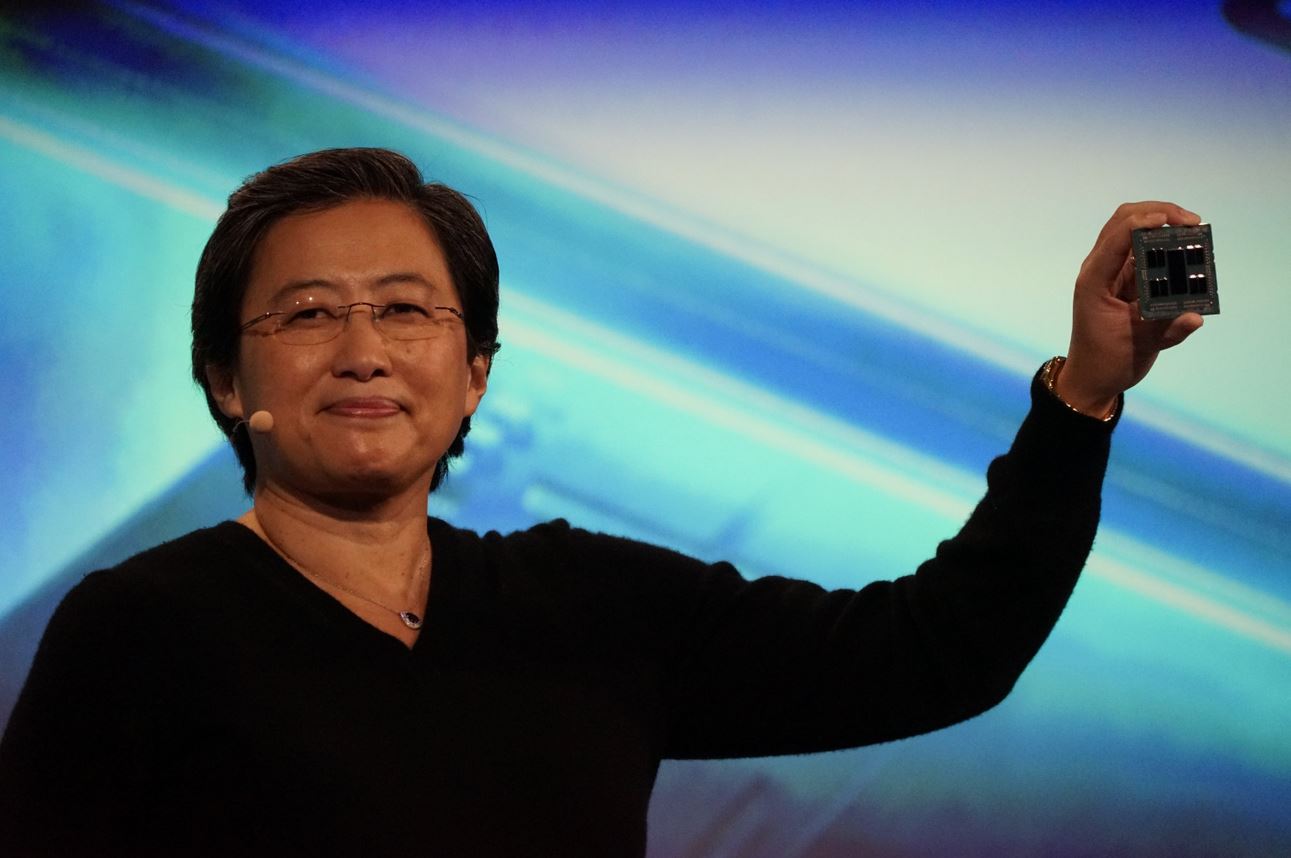

“2018 has been another exciting year for AMD as we delivered new high-performance computing and graphics products for the gaming, PC and datacenter markets,” said Ruth Cotter, senior vice president, Worldwide Marketing, Human Resources and Investor Relations. “Joining the NASDAQ-100 Index further demonstrates the progress we’ve made in recent years to transform the company, execute our long-term strategy and deliver a robust product and technology roadmap.”

Market capitalization isn't the only key to success, though. At the end of the day, it boils down to profitability. But AMD's been on a streak there, too, as its gross margins recently reached 39.99 percent, an amazing turnaround from its 4.51 percent gross margin in September 2016. That explosive improvement comes courtesy of the company's return to building high-performance, high-margin chips, like the Ryzen and EPYC processors.

With yet another accolade under its belt, now it's time to look to the future. For the first time in its history, AMD will have the process node leadership position over Intel in 2019, setting the stage for even more success with 7nm processors. AMD will also beat Nvidia to the 7nm punch with its new Radeon Instinct GPUs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.