AMD Smashes Earnings Records, Chip Shortages To Last Until Second Half of 2021

AMD continues to charge

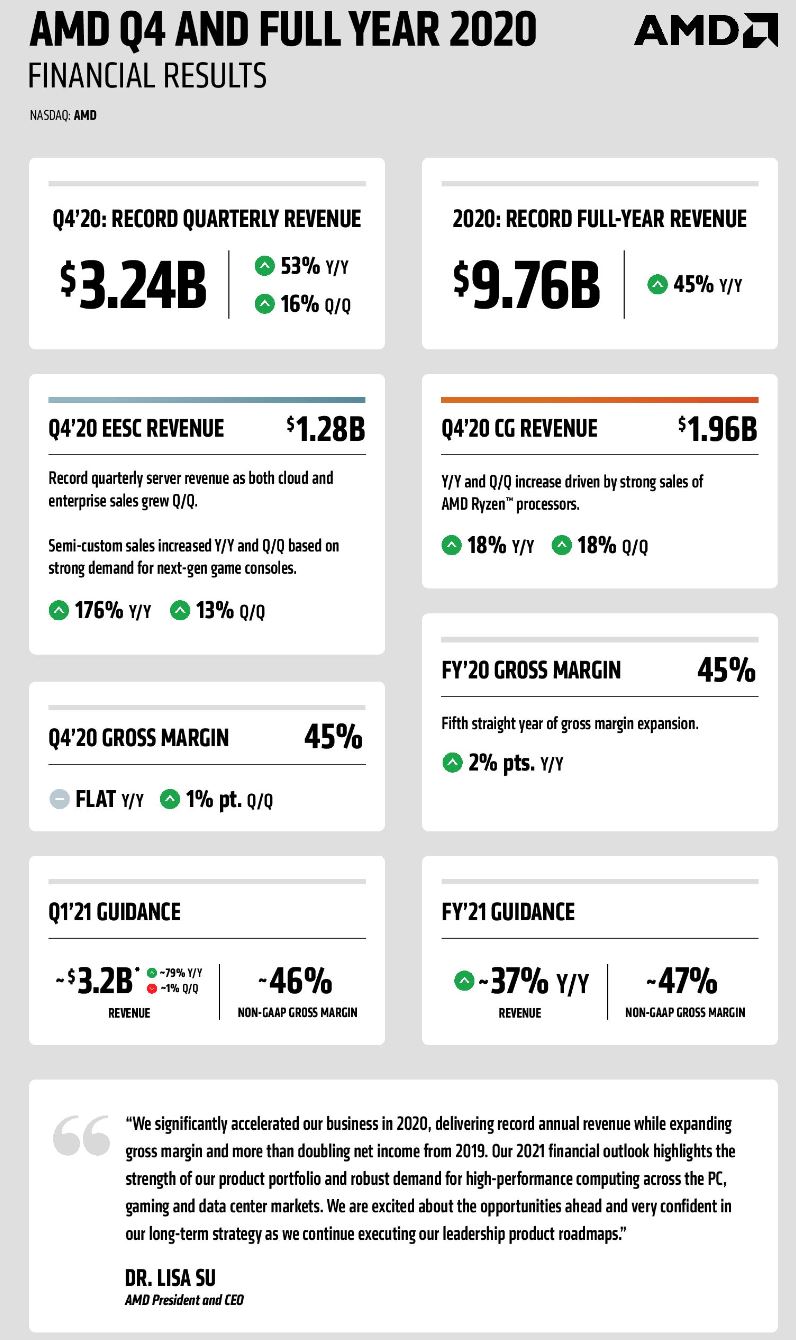

AMD reported its fourth-quarter 2020 and full-year results today, setting new records as it continues to whittle away market share from its archrival Intel despite the challenges associated with the pandemic and US-China trade war. AMD is making strides in all facets of its operation; CPU, GPU, data center, and console sales are all strong, but exceptional demand driven by the pandemic has led to rolling shortages.

AMD CEO Lisa Su said the shortages primarily impact the gaming (both consoles and gaming CPUs and GPUs) and the low end of the PC market, and overall demand has exceeded its planning. That's particularly challenging given that, in the first quarter of availability, the company's Ryzen 5000 processors have sold twice the number of units compared to any other Ryzen series in history.

Su expects to see 'tightness' throughout the first half of 2021 until added production capacity comes online. That means we could see a limited supply of AMD's PC and console chips until the middle of the year. Su also explicitly called out the low end of the PC market and consoles as being impacted the most, meaning higher-margin products are more readily available at retail.

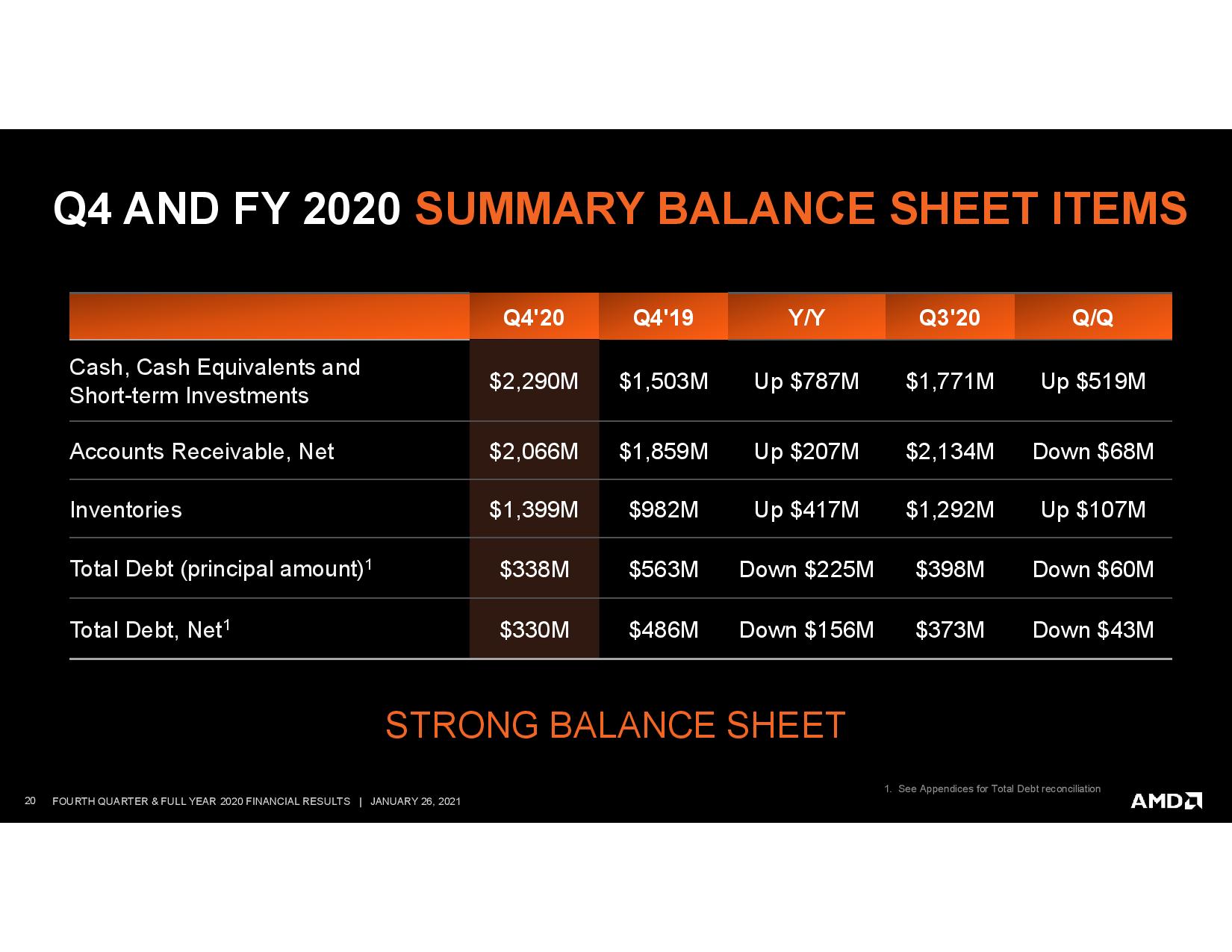

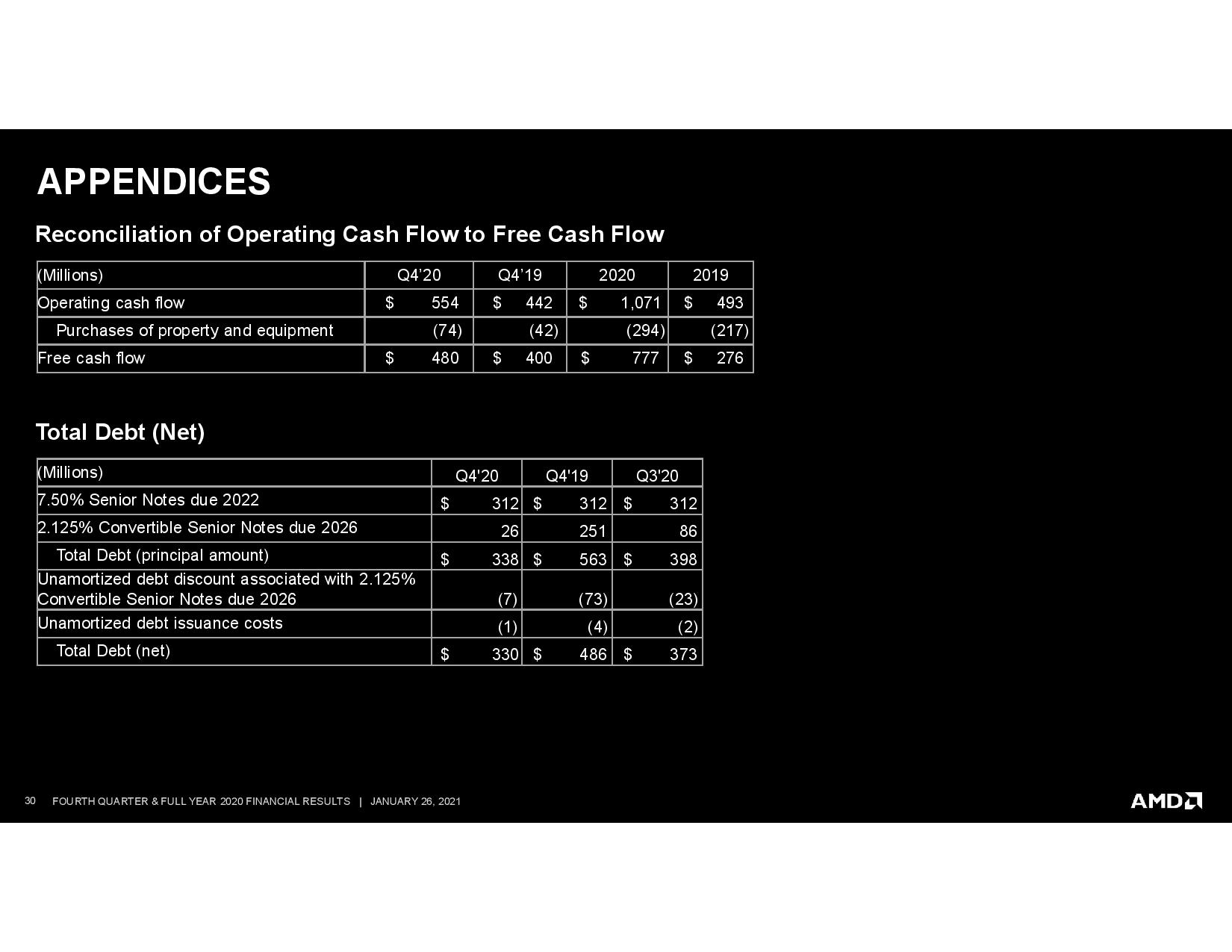

Interestingly, AMD's inventory swelled during the quarter, reaching $1.4 billion in unsold goods (up from $930 million the prior quarter), which seems odd given that the company has unmet demand. An AMD representative tells us that the company's inventory values can consist of chips in various stages of production, so it's possible that AMD's increased wafer starts at TSMC has resulted in more chips in various stages of production. AMD also confirms that packaging shortages continue to be a pinch point in the supply chain. That implies that there could be plenty of chip dies also awaiting packaging, meaning lithographic capacity at TSMC (i.e., wafer starts) aren't the only factor impacting the company's ability to deliver chips.

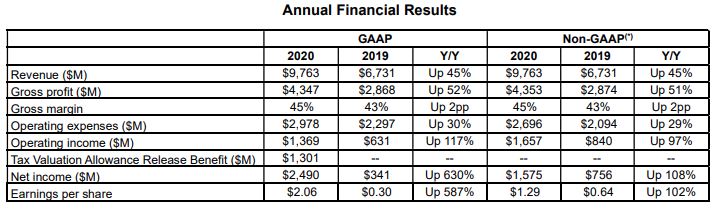

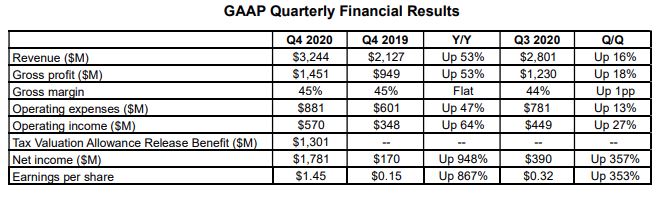

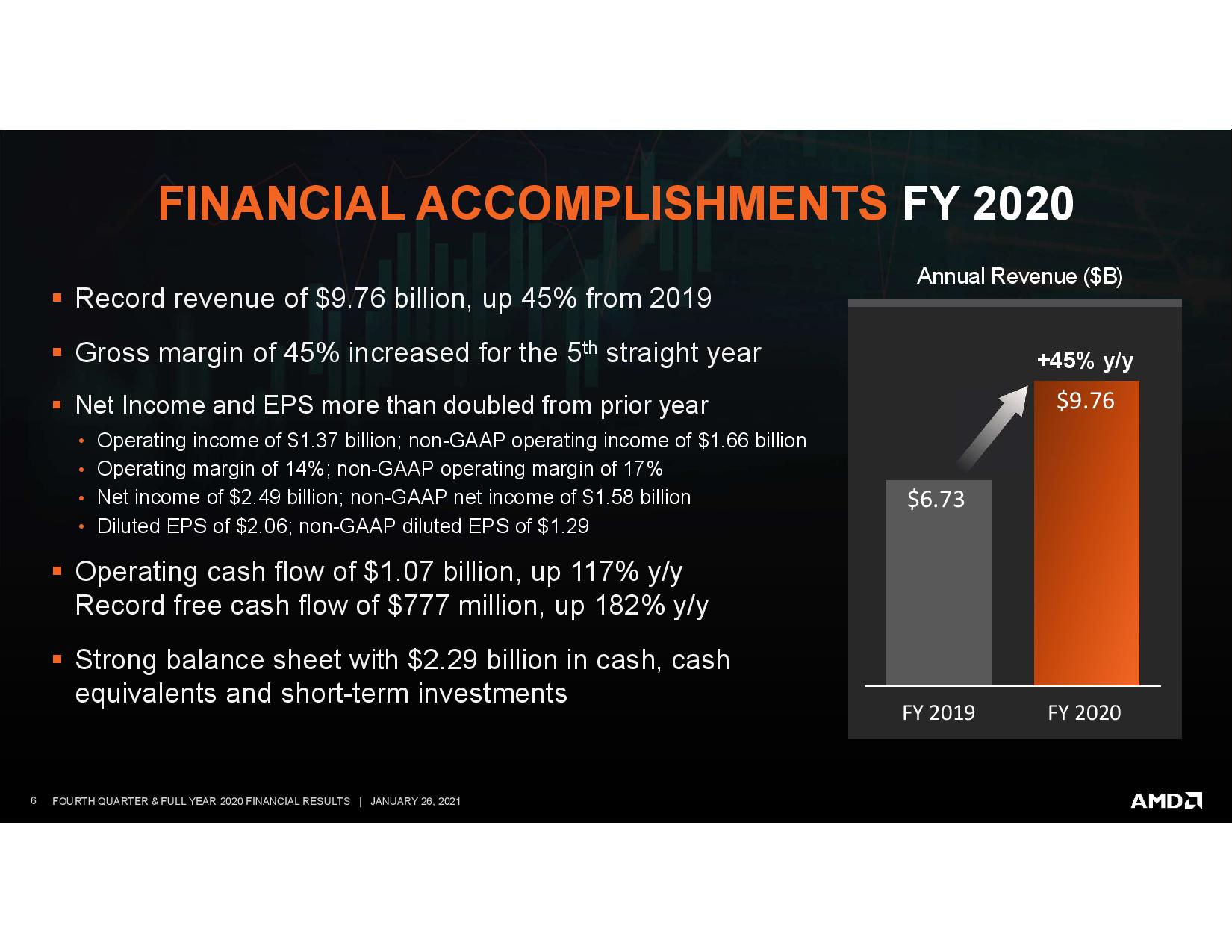

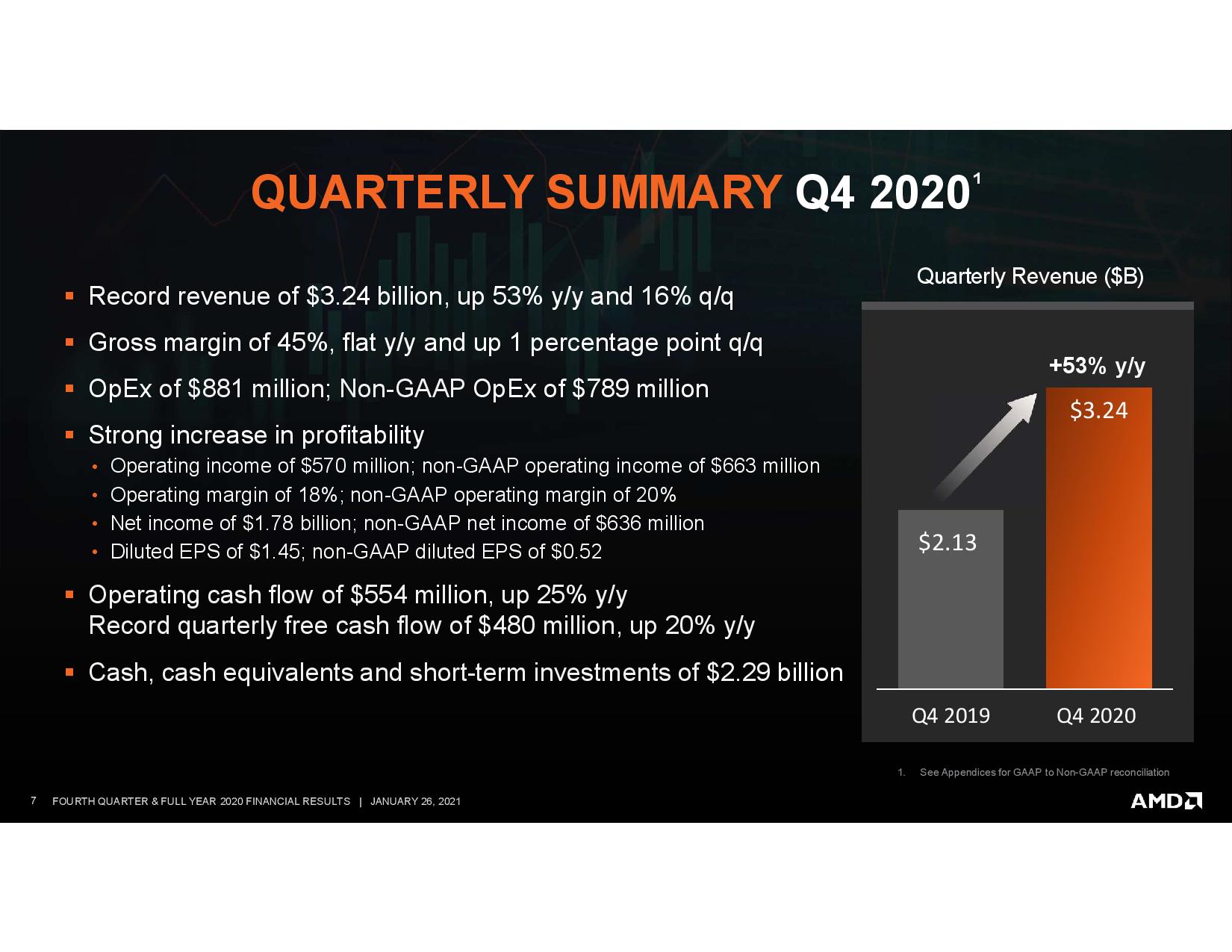

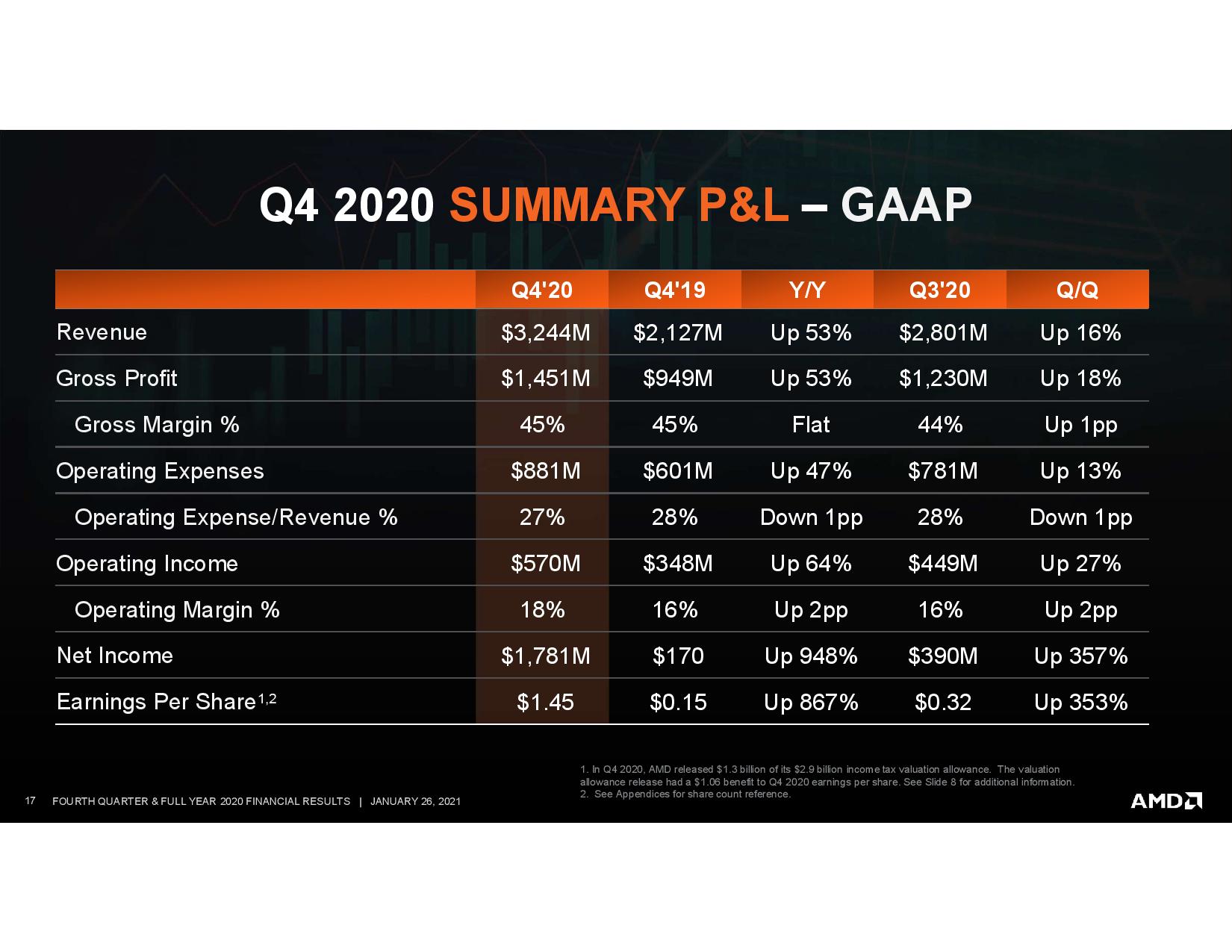

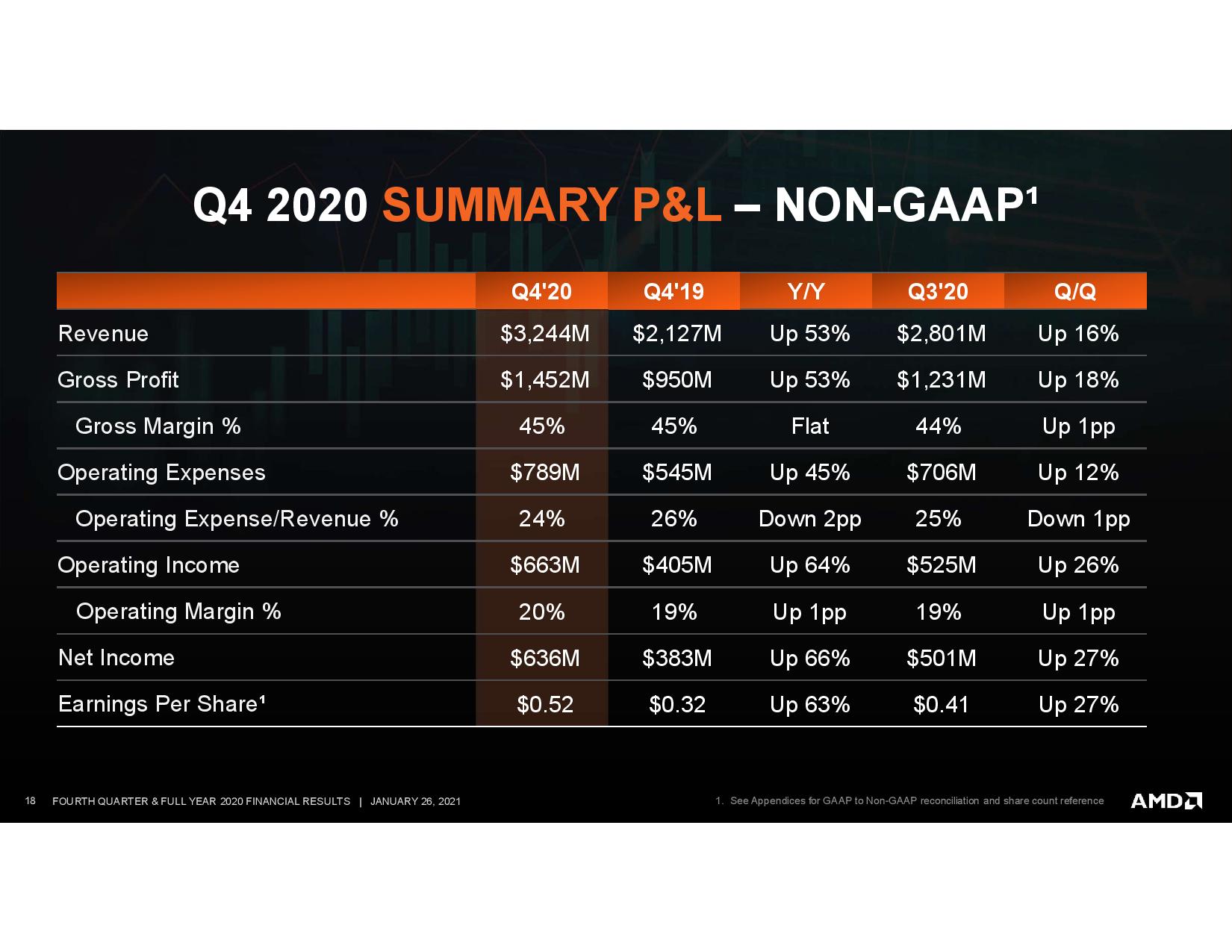

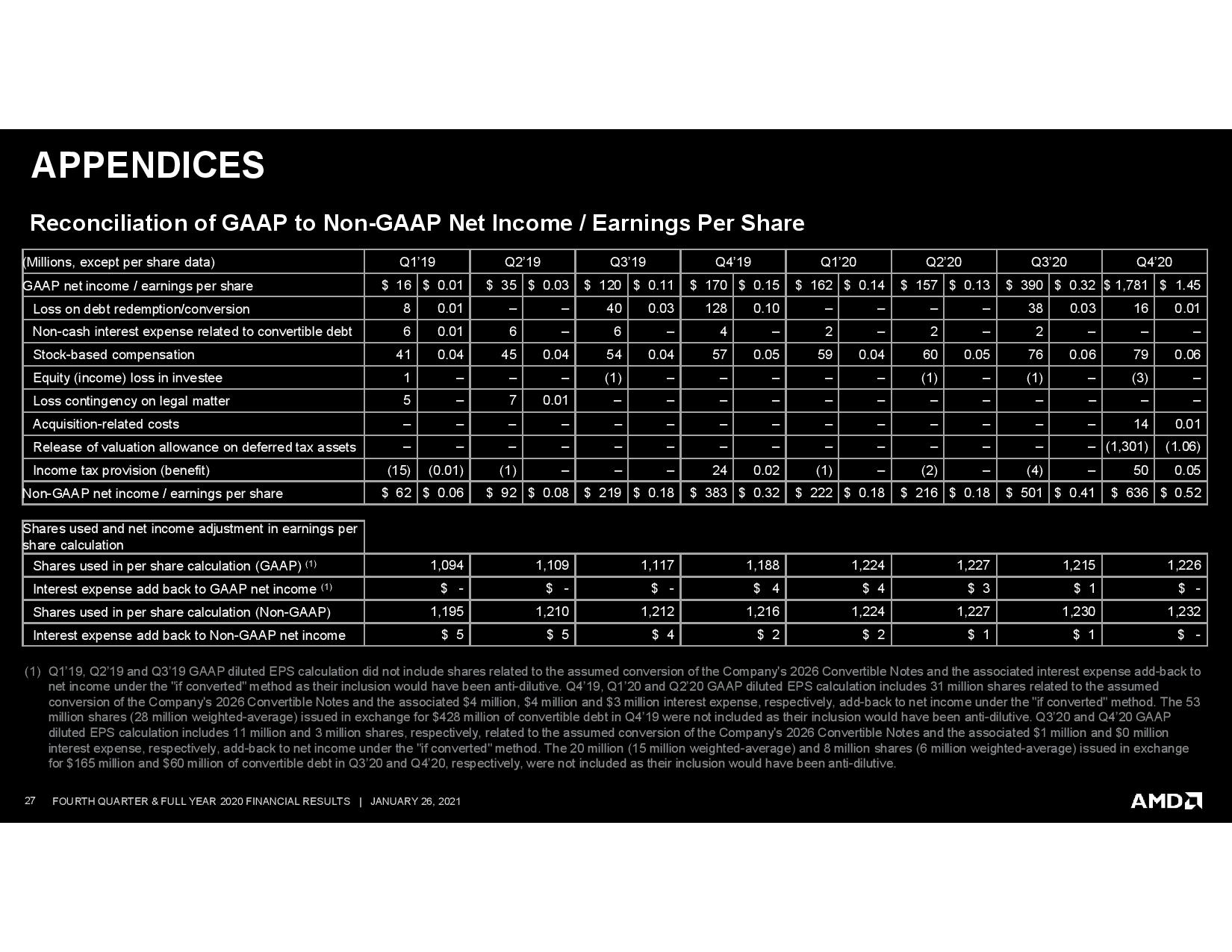

If there's one certainty, it's that AMD is selling every chip it can put on shelves. AMD raked in a record $3.24 billion in revenue in the fourth quarter, up 53% over the year prior, and net income weighed in at $1.78 billion, a staggering 948% increase over the prior year, albeit buoyed by an income tax benefit of $1.3 billion.

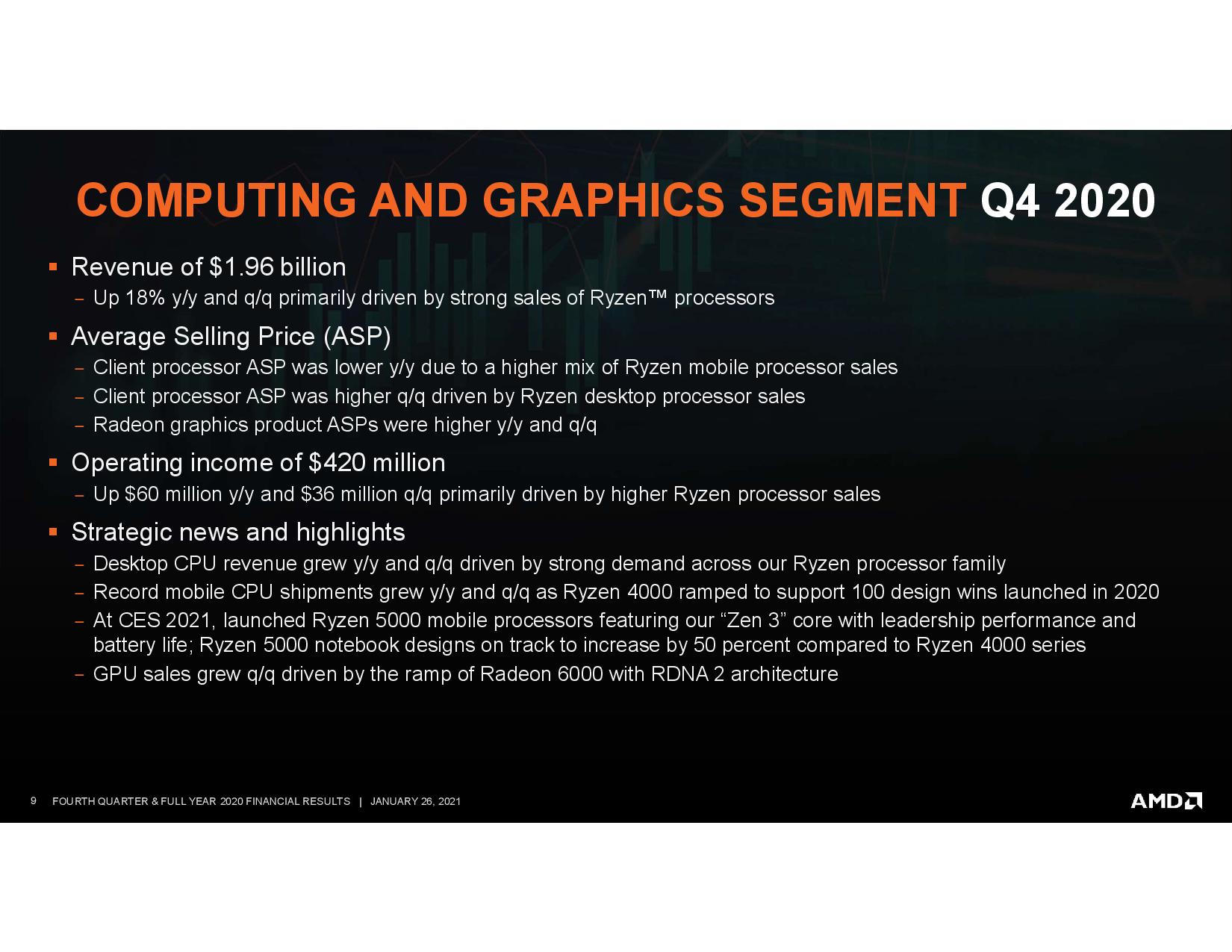

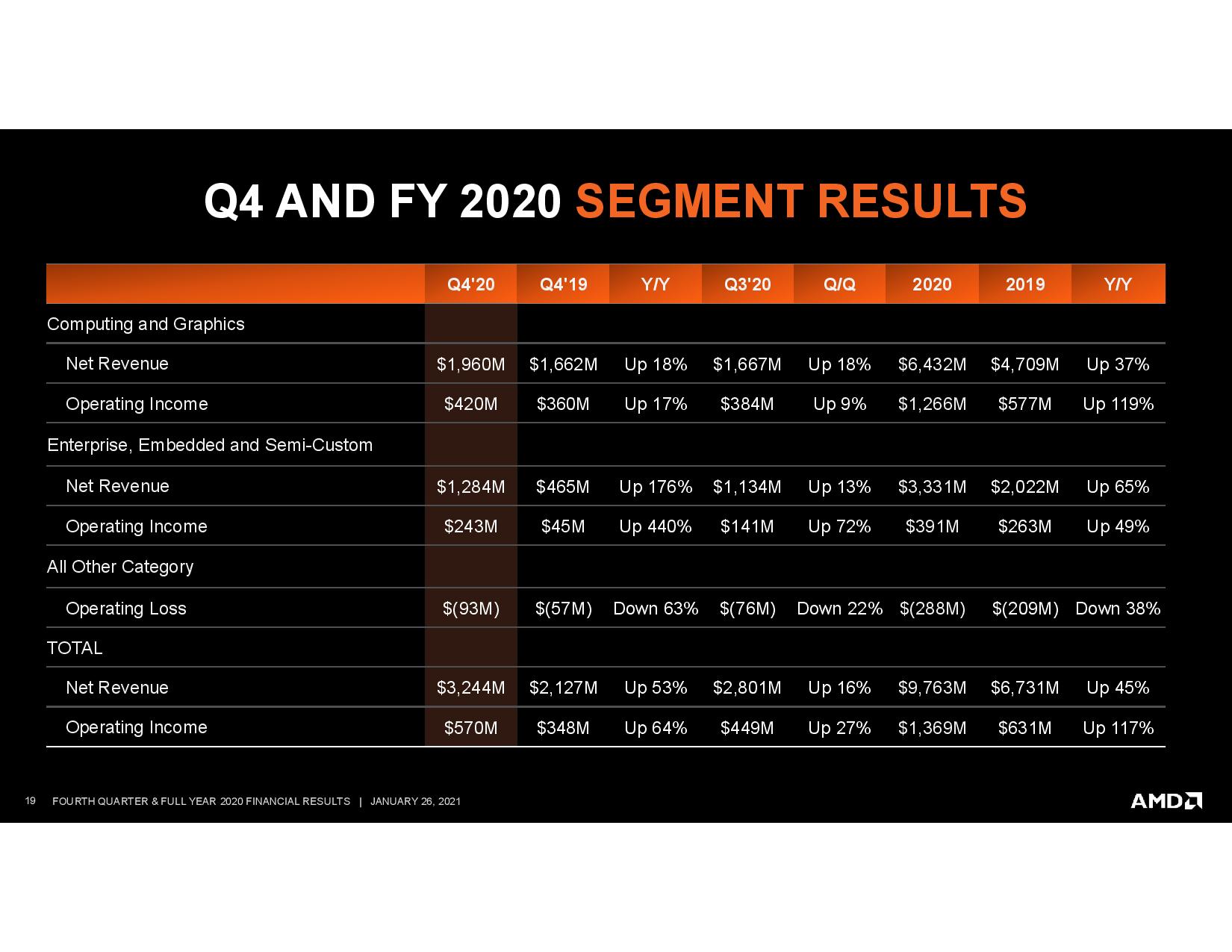

On the client group side of the house that produces both consumer CPUs and GPUs, AMD's $1.96 billion in Q4 revenue marked an 18% YoY and quarterly increase. AMD says higher sales of Ryzen processors drove this performance and average selling prices (ASPs) increased during the quarter, though ASPs lagged the prior year due to a higher mix of Ryzen Mobile sales.

That higher mix of laptop chips isn't surprising - AMD recently recorded its highest laptop market share in history. AMD also says that its Ryzen 5000 processors doubled the launch sales of any prior-gen Ryzen processor. As a result, annual processor revenue grew 50% even though the PC market only grew 13%, meaning the company gained more market share during the year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

On the graphics side of the house, Su said that demand for Radeon 6000 GPUs is strong, marking the fastest-selling GPU over $549 in AMD's history, and ASPs are up for both the quarter and the year. The company will launch RDNA 2 GPUs in the first half of 2021.

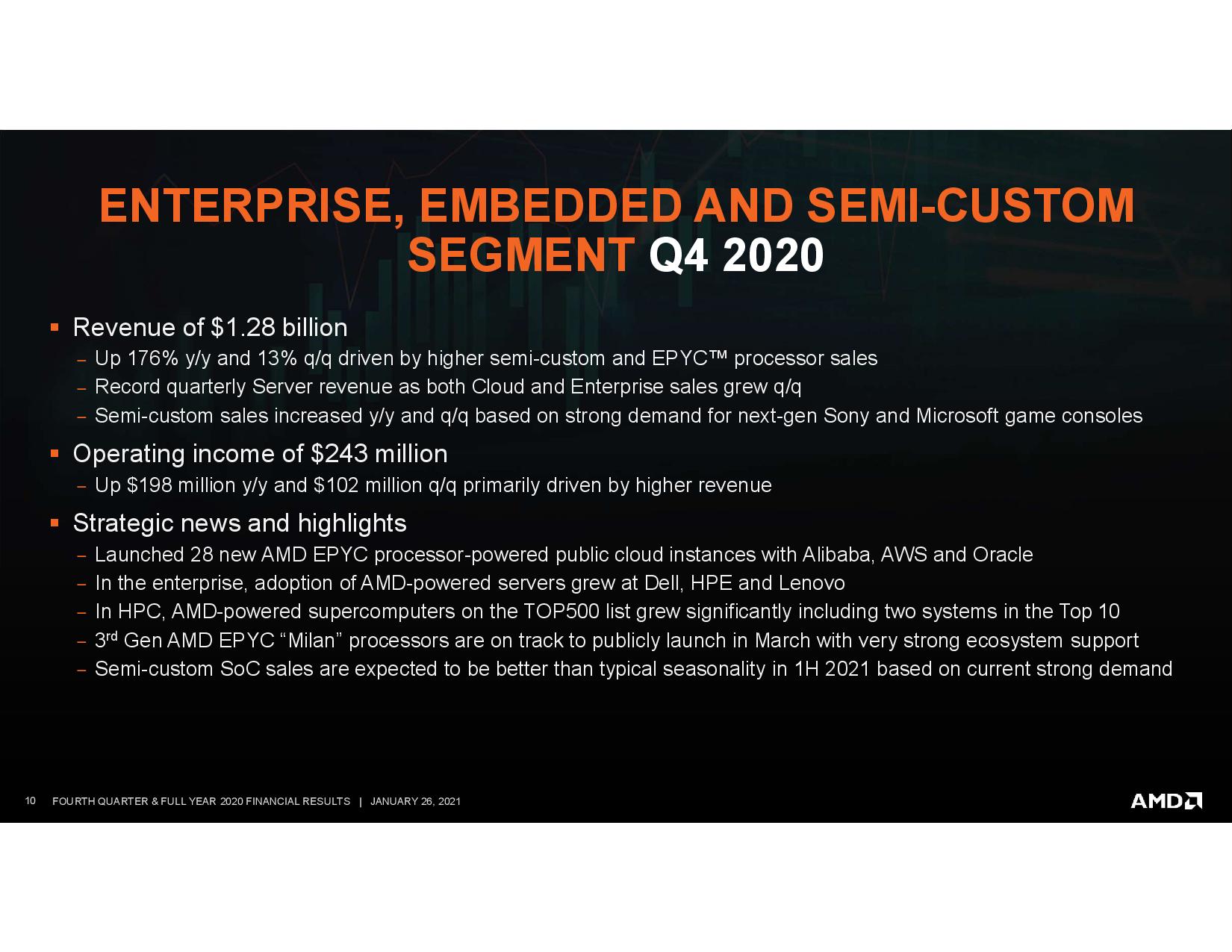

For the company's EESC unit, which comprises its data center and semi-custom business, AMD raked in $1.38 billion in revenue, a 176% year-over-year (YoY) increase. Su said that the Sony PS5 and Microsoft Xbox ramp is faster than the previous cycle, which seems to be a given in light of the constant shortages. AMD says that it expects sales of its console chips to stay strong in the first half of the year, bucking the normal historical trend of reduced console sales in Q1.

AMD lumps both data center and game console processors under this same unit, making it hard to determine how much of the revenue gain can be attributed to its server chip business. However, during the earnings call, Su noted that server processor revenue reached an all-time high in the fourth quarter and now comprises "high mid-teens" percentage of the company's overall revenue (for both the quarter and the year), implying AMD raked in ~$550 to ~$600 million in revenue for EPYC server chips for the quarter, and ~$1.4 billion for the year. That's a big step forward but still lags behind Intel's $6.1 billion in data center revenue in 2020.

AMD did note that its EPYC ASPs were higher sequentially, meaning the company is making more money per chip. Meanwhile, Intel has taken a haircut on ASPs, and thus margins, as it has cut pricing to fend off AMD's EPYC.

AMD began production of its next-gen EPYC Milan in the fourth quarter of last year and sampled to HPC and cloud providers. Su said the company is on track for the official launch in March with very strong ecosystem support.

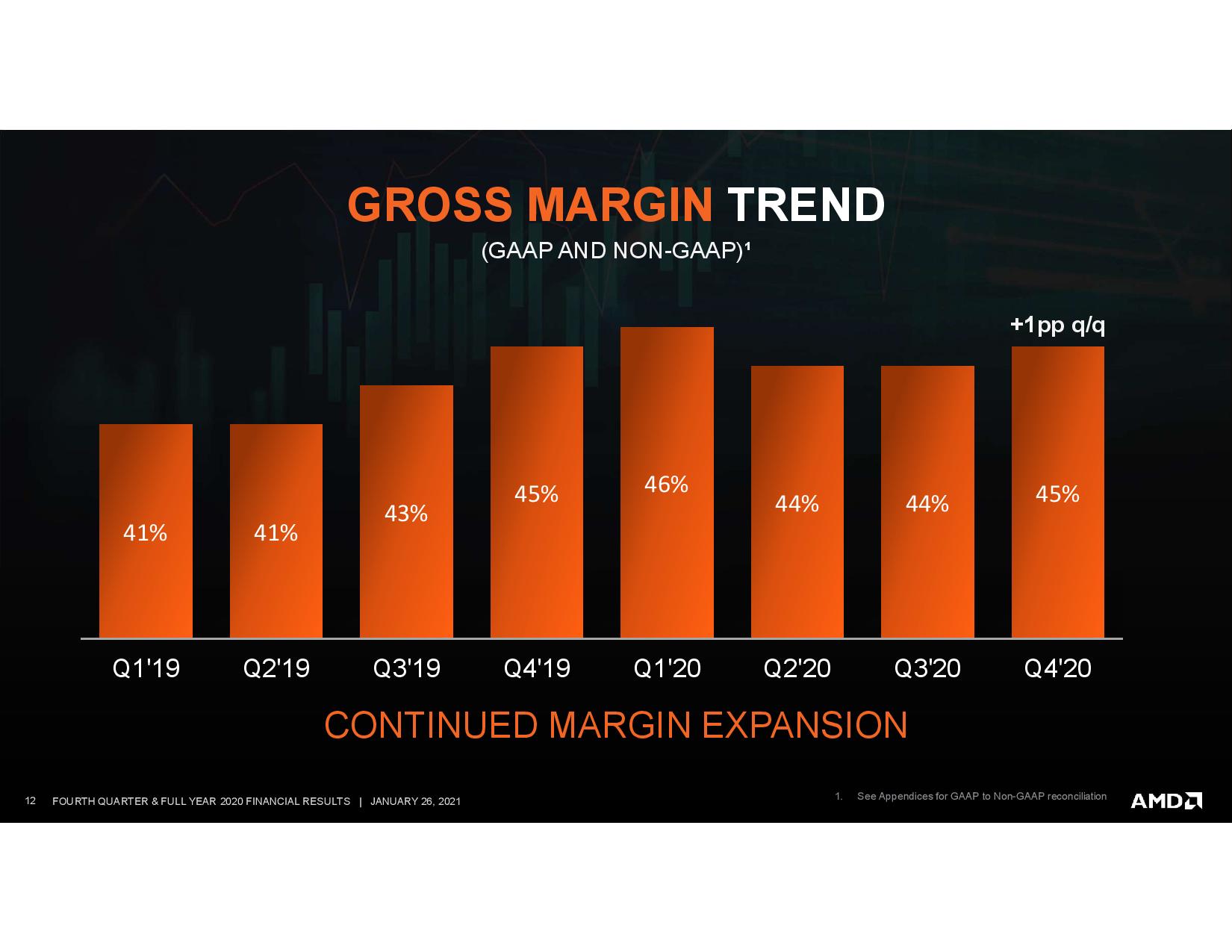

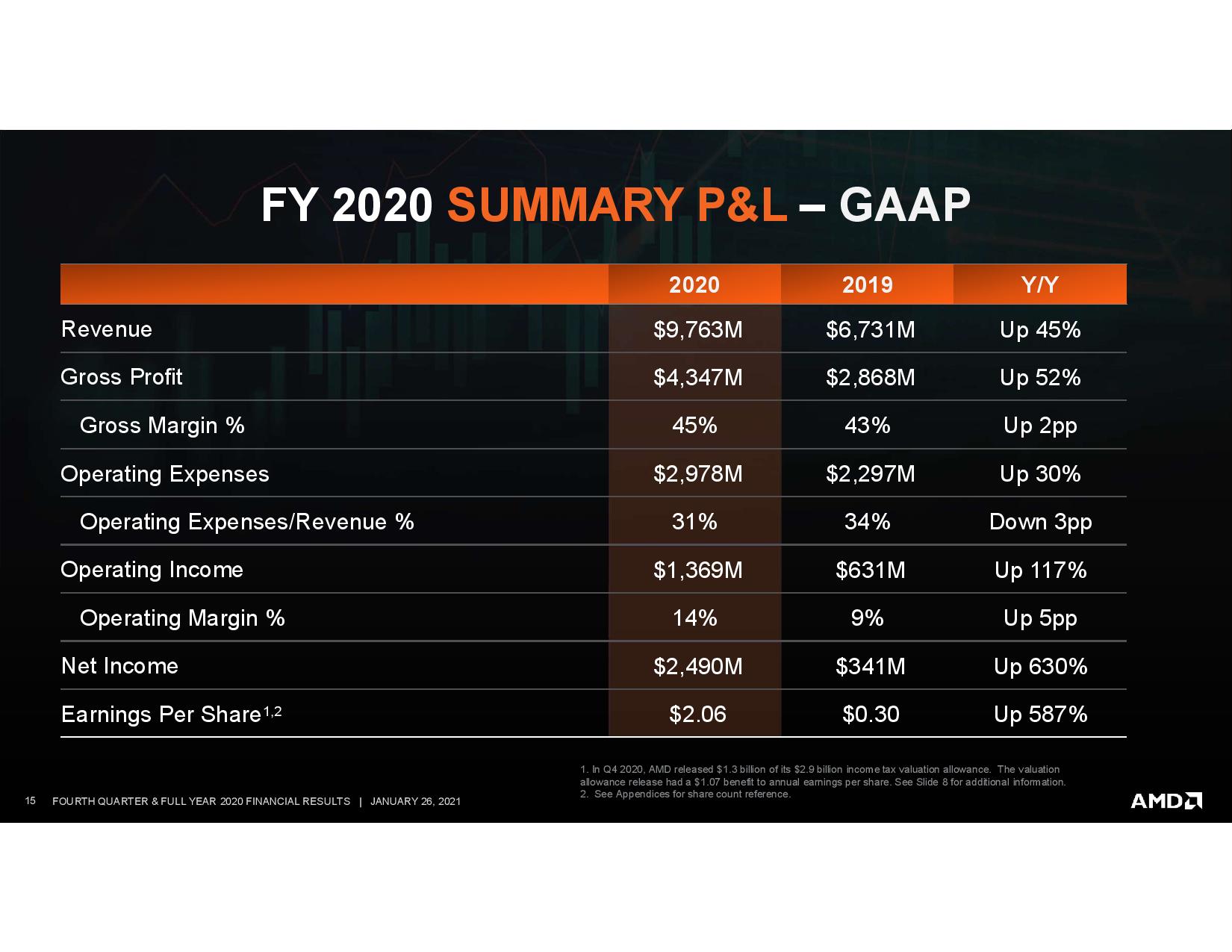

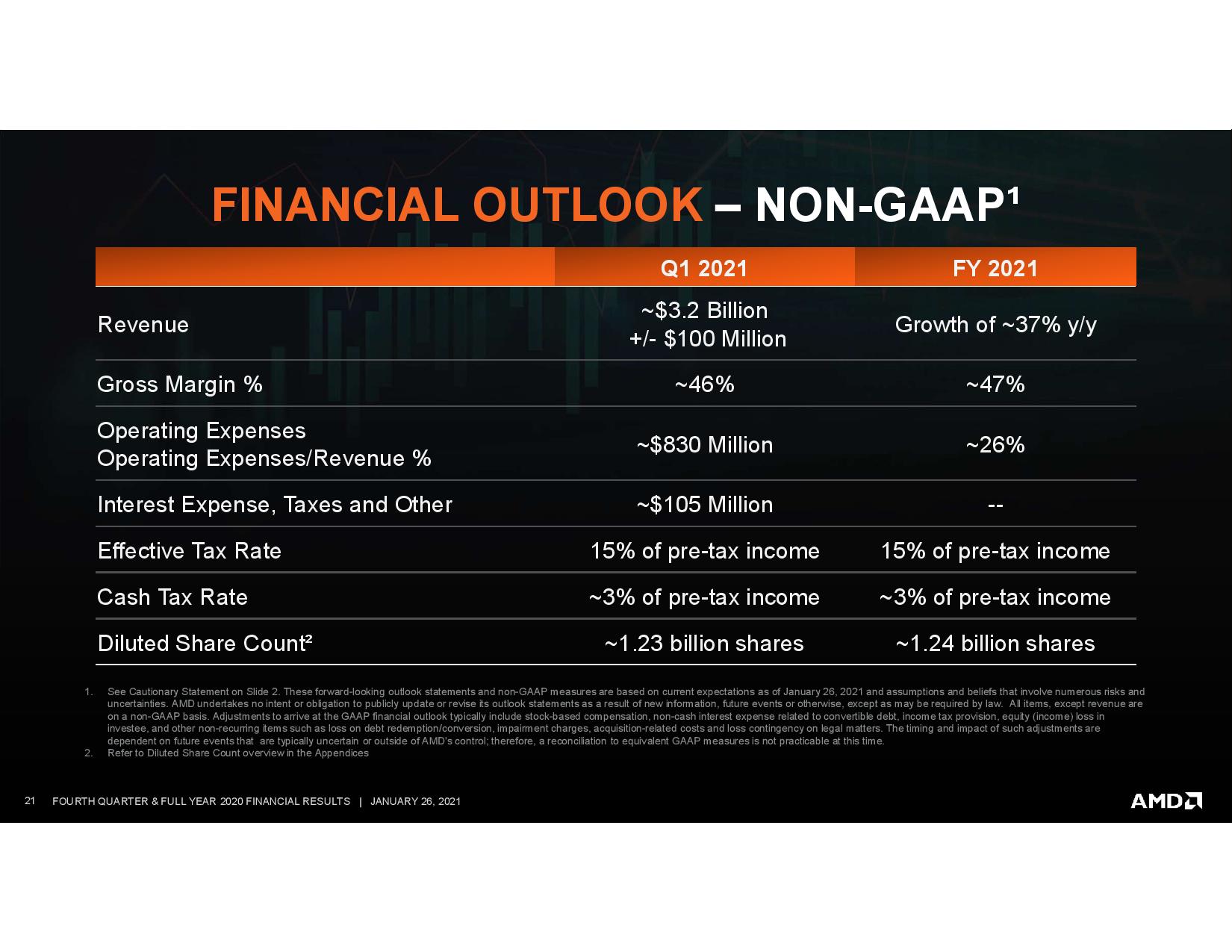

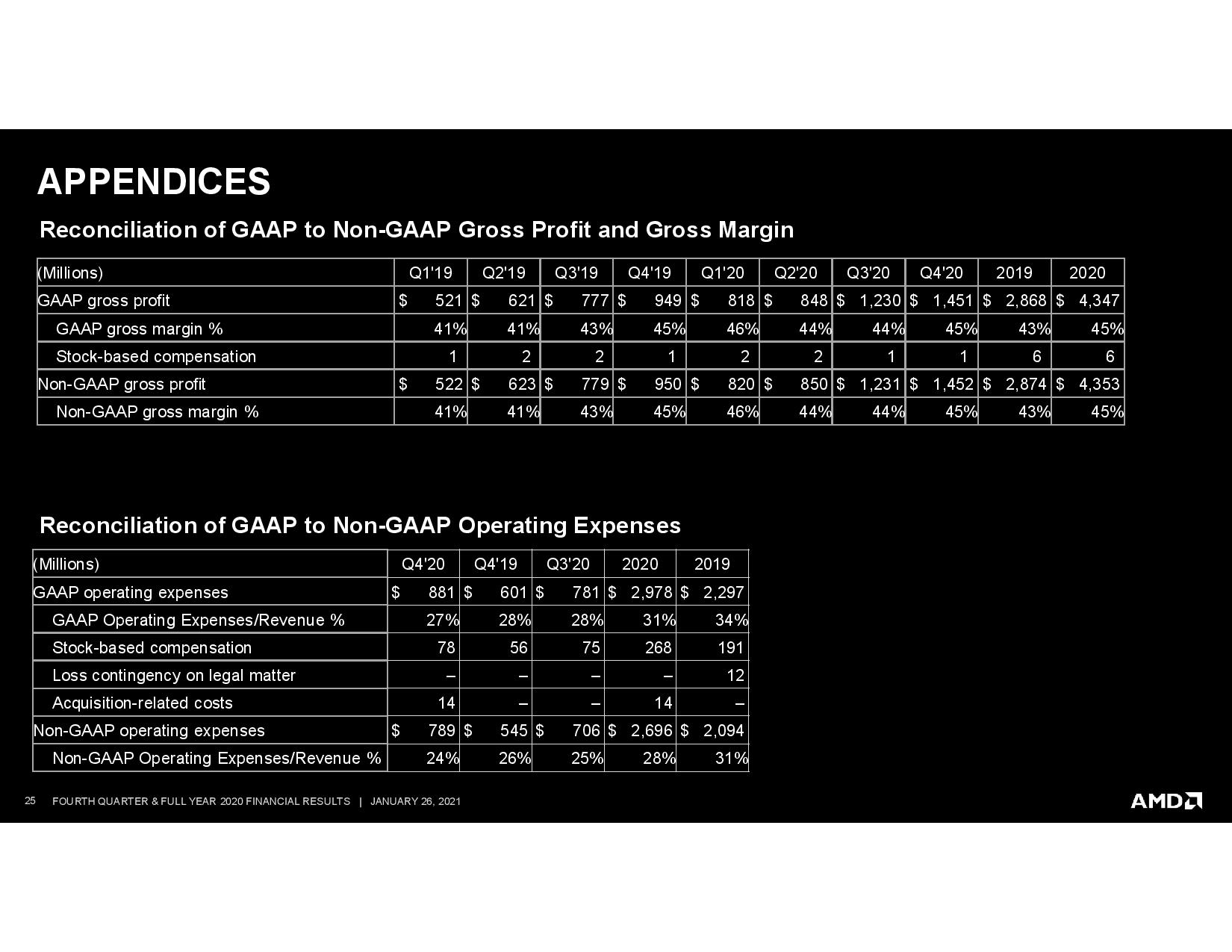

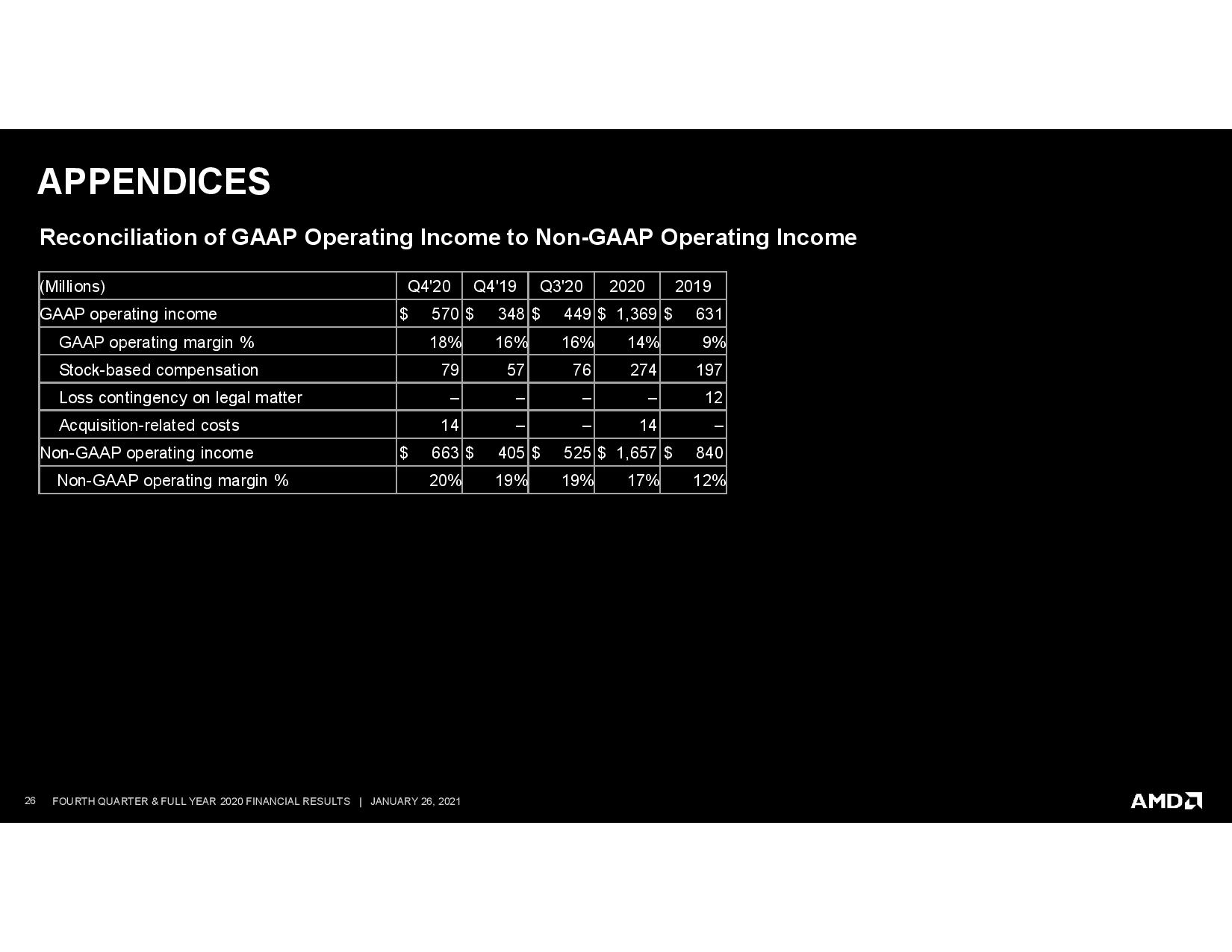

AMD's Q4 gross margins were flat YoY at 45%. For the next quarter, AMD guides for $3.2 billion in revenue, up 79% YoY and down 1% on the quarter.

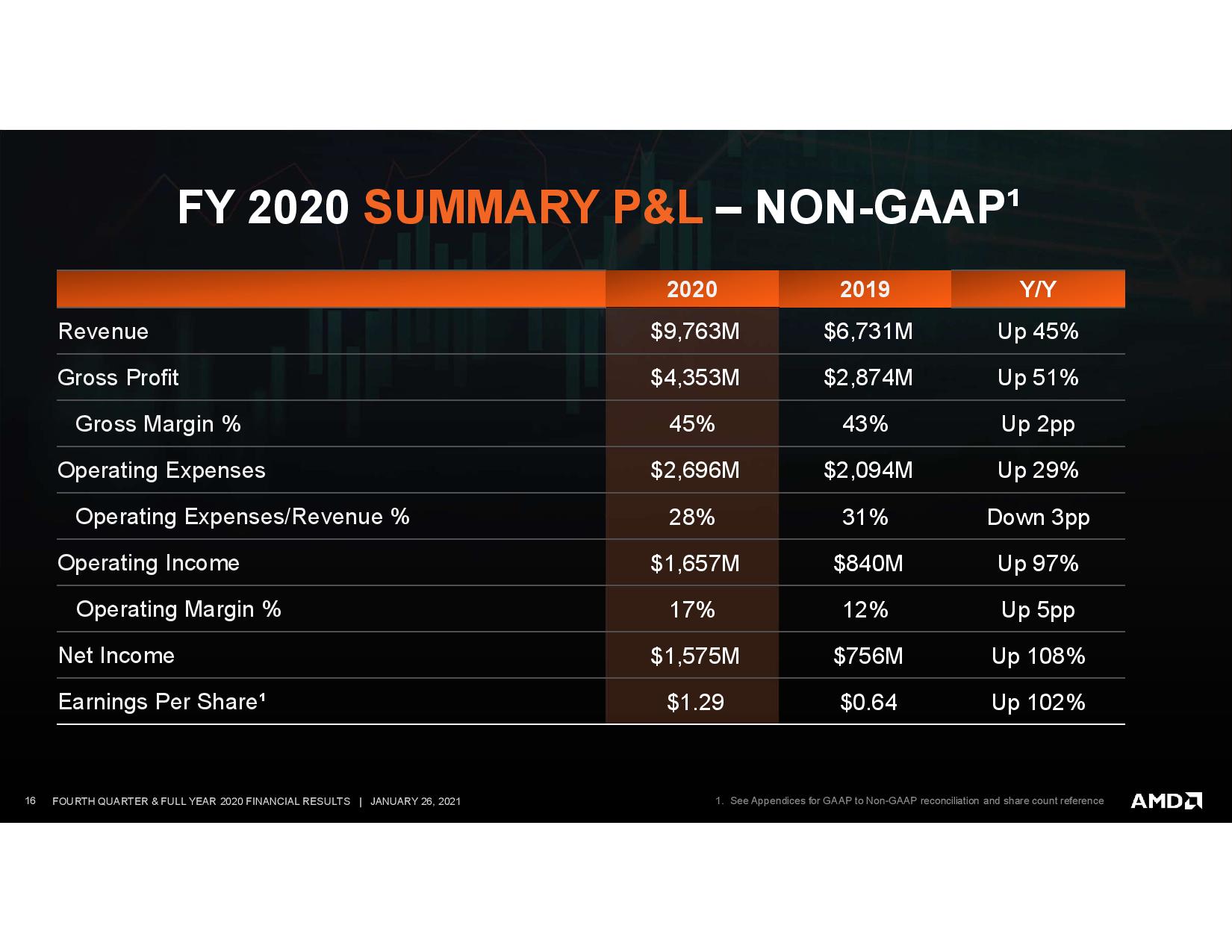

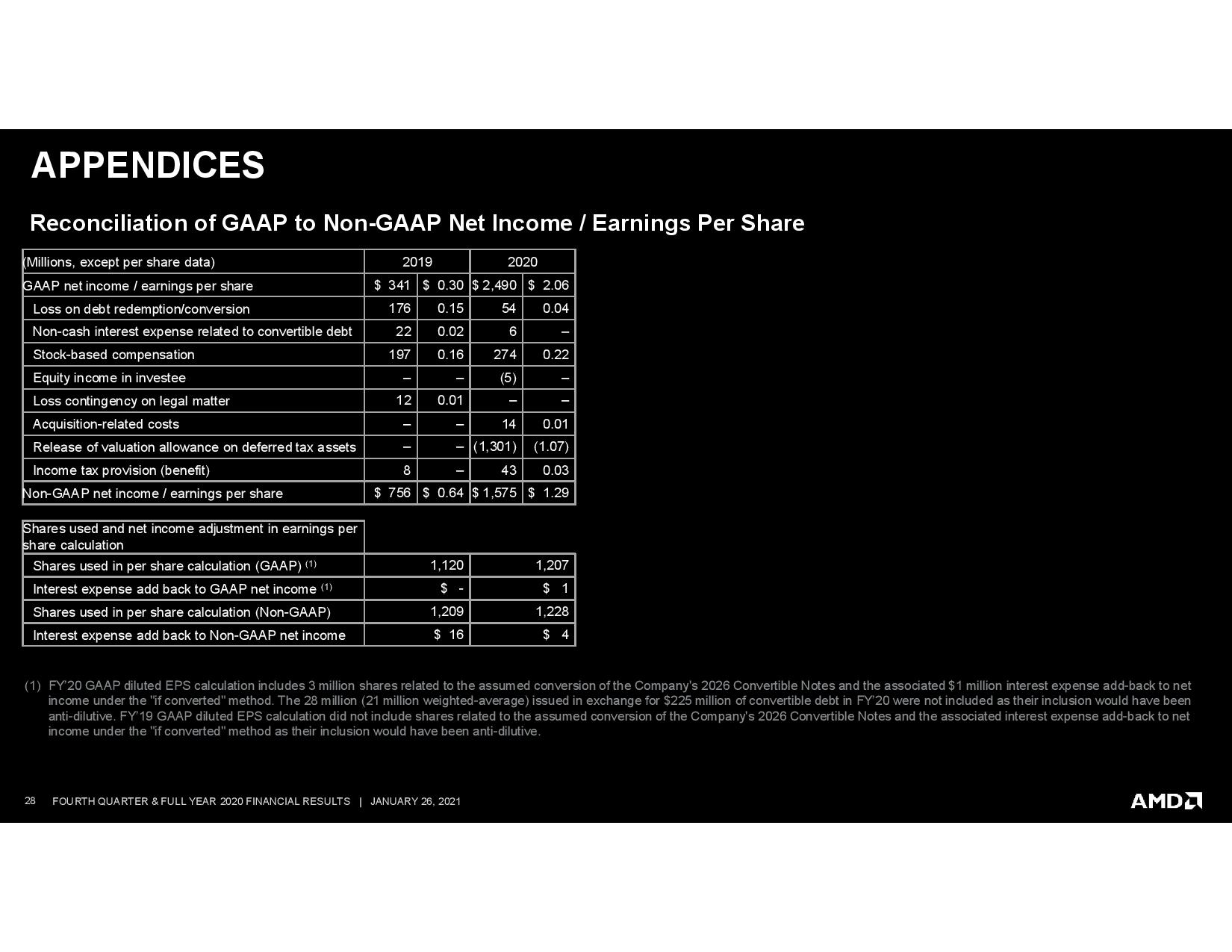

AMD's full-year results were exceptional, as well. The company raked in a record $9.76 billion in revenue, a 45% YoY jump, and net income hit $2.5 billion, a staggering 630% increase over the prior year.

For the full-year 2021 guidance, AMD pegs revenue to grow ~37% (~$13B) and non-GAAP gross margins to weigh in at 47%, driven by growth across all of AMD's business segments.

AMD also says it is on track to complete its Xilinx acquisition, which should be complete by the end of 2021.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

spongiemaster Reply

Sadly, scalpers of their products are probably pulling better margins than that. Really sucks seeing middlemen making more money off of products than the company that did all the work developing them and bringing them to market.digitalgriffin said:A quite remarkable feat. 47% margin is nothing but insanely good. -

TerryLaze Reply

That's gross margin and far less impressive than what you might think.digitalgriffin said:A quite remarkable feat. 47% margin is nothing but insanely good.

If you look at the money they made by their own accord it's 1.37 (operating income) divided by revenue that's about 13% for operating margin.

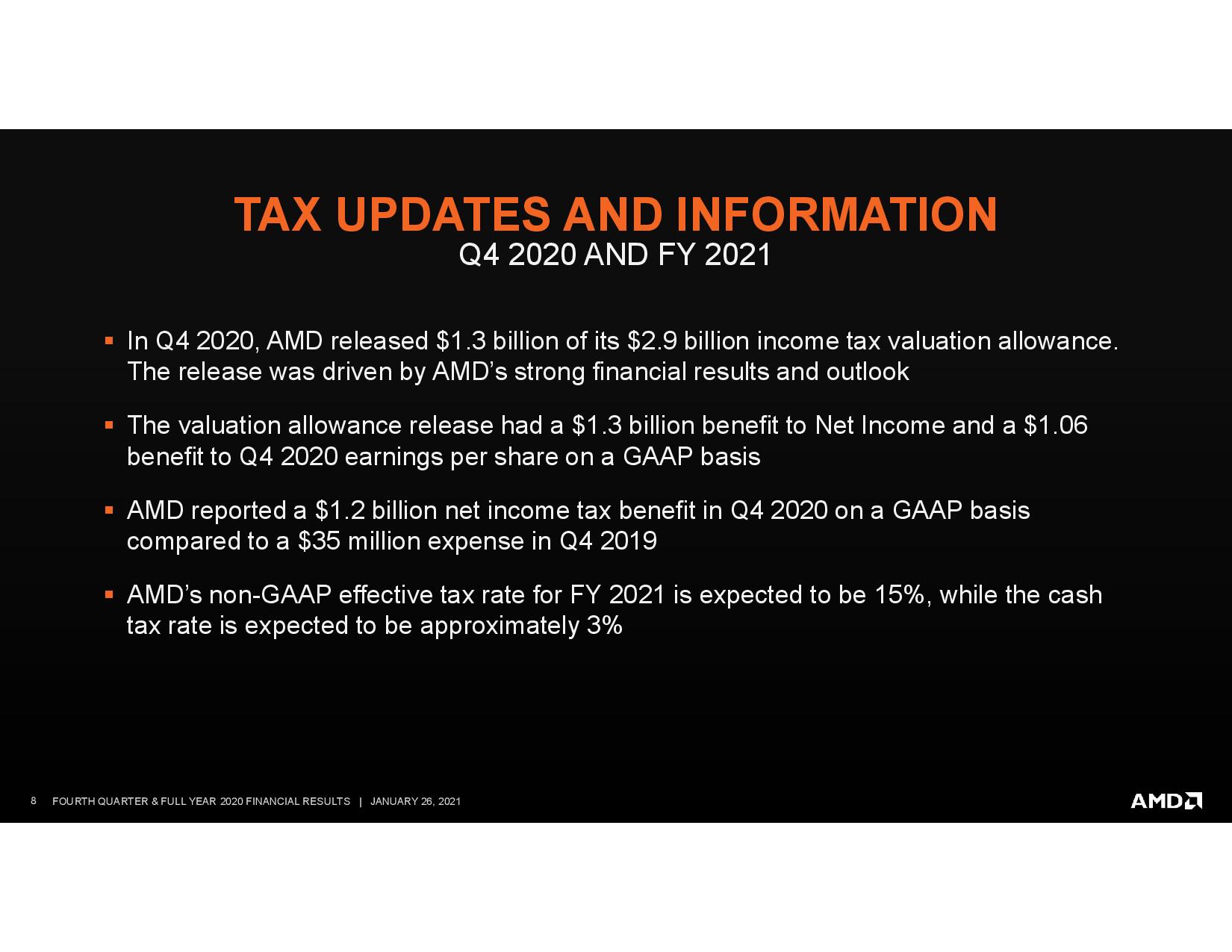

The real story here is the TAX benefit of 1.3b that basically doubles AMDs profit, were did that come from? -

Chung Leong ReplyTerryLaze said:The real story here is the TAX benefit of 1.3b that basically doubles AMDs profit, were did that come from?

Probably losses carried forward from years when it was operating in the red. Plus investment losses associated with GloFo. -

gggplaya ReplyChung Leong said:Probably losses carried forward from years when it was operating in the red. Plus investment losses associated with GloFo.

Yes, most likely. A single years earnings can be impressive but it's all relative if you've been pumping tons of money into capital the last few years and scaling your business just to make this single year profit. The IRS looks at your earnings over 6 years "I think." Looking at earning over a span of this time, you still aren't in the black if the last 5 years were red. -

SyDiko Replydigitalgriffin said:A quite remarkable feat. 47% margin is nothing but insanely good.

Their intended market can barely get a hold of their product... Margins are up now, thanks to bots, but at this rate they'll eventually lose their 'best bang for your buck' base (to Intel) again and they'll be right back to Square 1. -

spongiemaster Reply

Bots don't affect AMD's margins.SyDiko said:Their intended market can barely get a hold of their product... Margins are up now, thanks to bots, but at this rate they'll eventually lose their 'best bang for your buck' base (to Intel) again and they'll be right back to Square 1. -

digitalgriffin ReplySyDiko said:Their intended market can barely get a hold of their product... Margins are up now, thanks to bots, but at this rate they'll eventually lose their 'best bang for your buck' base (to Intel) again and they'll be right back to Square 1.

It's simple really. If demand isn't there, the prices will lower until it's either A) no longer profitable or B) equilibrium is reached and sales stabilize. The later is usually the peak of the total revenue curve.