AMD Reaches Highest Overall x86 Chip Market Share Since 2013

Nibbles turn to chomps

AMD's Cinderella story continued today with a report from Mercury Research, one of the chip industry's premier market analyst firms, that indicates AMD had reached 18.3% of the overall x86 share and 19.7% of the client market. That's the company's highest share since the fourth quarter of 2013 and the first quarter of 2012, respectively. The company also broke its all-time record for notebook market share. We have the full breakdown below, including the company's gains in the desktop, notebook/mobile, and server segments.

The news comes on the back of AMD's stellar Q2 2020 earnings report, along with Intel's recent announcement that its 7nm process will be late to market, both of which combined to propel AMD to record stock valuations over the last week. Today AMD closed just shy of a $100 billion market cap, another record and a 50X gain in five years, as investors bought into the optimism – particularly around the company's share gains in the server market.

Here are the hard numbers from Mercury Research on the current state of play in the x86 semiconductor market.

AMD vs. Intel Desktop Market Unit Share Q2 2020

| Row 0 - Cell 0 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter (QoQ) pp | +0.6 | +0.3 | +0.3 | +0.9 | Flat | +1.3 | +2.8 | +0.7 | +0.1 | +0.2 | +1.1 | -0.2 | -0.3 | +1.5 | +0.8 | Row 2 - Cell 16 |

| Year over Year (YoY) pp | +2.1 | +1.5 | +2.4 | +5 | +4.8 | +4.9 | +3.8 | +2.1 | +1.2 | +0.8 | +2.1 | +1.8 | Row 3 - Cell 13 | Row 3 - Cell 14 | Row 3 - Cell 15 | Row 3 - Cell 16 |

AMD took its highest desktop PC processor share since Q1 2014 with 19.2%, a gain of and 2.1 points year over year (excludes IoT). This marks AMD's 10th consecutive quarter of growth in the desktop PC market.

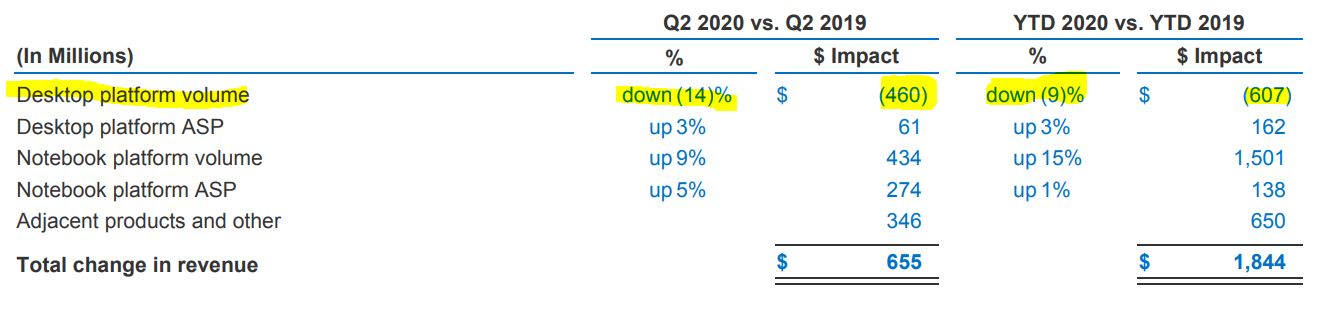

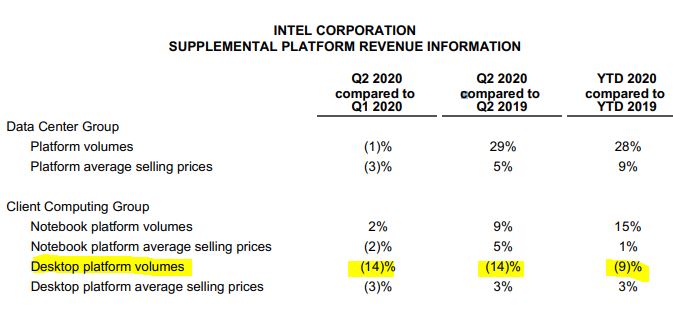

Intel's 2Q earnings report showed signs of weakness in its desktop processor sales, with desktop platform volumes dropping by 14% compared to both the prior quarter and year. For 2020 as a whole, Intel's desktop platform revenue is down 9%, or $607 million compared to the same point in 2019.

Meanwhile, AMD cited slightly reduced desktop processor sales compared to its prior quarter, even as its client segment boomed with the highest revenue of the last 12 years. Much of that gain came from the notebook segment we'll cover below. However, because AMD lumps consumer processors and GPUs into the same revenue segment, it was impossible to determine if its increased revenue came at the expense of Intel.

The share numbers indicate that even though we can probably chalk some of Intel's loss up to the impact of the coronavirus, AMD is creating plenty of pressure in the desktop PC market. AMD is also making inroads into the large pre-built OEM market for desktop PCs and workstations with custom chips, like the Threadripper PRO and the Ryzen 4000 "Renoir" APUs, destined for the systems market only. That will help the company gain share in a segment largely dominated by Intel, portending an accelerating rate of share gains that extended beyond the retail/DIY market.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel still has impressive performance in a few key areas, like gaming CPU performance benchmarks, but AMD also has its Zen 3 processors slated for release later this year.

AMD vs. Intel Notebook / Mobile Unit Share Q2 2020

| Row 0 - Cell 0 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 7 | Row 2 - Cell 8 | Row 2 - Cell 9 |

AMD's 19.9% of notebook processor share is the company's highest percentage of this lucrative segment in its history, marking the 12th consecutive quarter of growth for AMD in the notebook segment.

Notebooks comprise roughly 65% of the consumer CPU market and have been a long, slow haul for AMD. It's clear that AMD's targeted efforts have borne fruit with a 2.9 point gain over the prior quarter and a 5.8 point gain over the prior year. AMD announced during its earnings report that it had notched a 12-year high in consumer processor sales as its client computing group grew by 45%, and much of that gain came from Ryzen 4000 notebook processor sales. AMD's mobile processor sales doubled YoY, and another 30+ models will join the 50+ notebooks on the market by the end of the year. That means AMD has a solid runway for more growth.

The notebook market exploded in the wake of the pandemic as a new paradigm of working from home took hold, so Intel also increased its sales by 9%. However, though the pie grew larger for both companies, AMD's slice is obviously growing faster.

AMD made the wise decision to push into the lower rungs of the notebook market while Intel grappled with shortages last year, so Intel has felt the most share loss in cheaper, low-margin processors. Intel has invested heavily in increasing its production capacity, and CFO George Davis remarked during the company's earnings call that "We expect our share to improve throughout the remainder of the year as we begin to recover unit share in notebooks utilizing our smaller core products which we have not been able to fully serve given the strength of demand for our large core products."

That means we'll see stiff competition for the remainder of the year, especially as Intel is on the cusp of releasing its 10nm Tiger Lake CPUs.

AMD vs. Intel Server Unit Market Share Q2 2020

AMD bases its server share projections on IDC's forecasts but only accounts for the single- and dual-socket market, which eliminates four-socket (and beyond) servers, networking infrastructure and Xeon D's (edge). As such, Mercury's numbers differ from the numbers cited by AMD, which predict a higher market share. Here is AMD's comment on the matter: "Mercury Research captures all x86 server class processors in their server unit estimate, regardless of device (server, network or storage), whereas the estimated 1P [single-socket] and 2P [two-socket] TAM [Total Addressable Market] provided by IDC only includes traditional servers."

| Row 0 - Cell 0 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 9 | Row 2 - Cell 10 |

According to the Mercury Research analysis, AMD now holds 5.8% of the total server share. That's an increase of 0.7 points over the prior quarter, and 2.4 points over the prior year. AMD says it will share IDC's report soon, and we expect it will be closer to AMD CEO Lisa Su's projection that the company had finally reached its oft-quoted goal of a double-digit percentage of the server market. AMD also announced that it had doubled its EPYC server chip sales during the last quarter.

AMD's data center EPYC sales set a quarterly record and doubled year-over-year as the Enterprise, Embedded and Semi-Custom group delivered $565 million in revenue. For comparison, Intel's data center group recorded $7.1 billion last quarter, which highlights why investors are so optimistic about AMD's gains in the server market, especially in light of Intel's looming process delays.

Su said AMD has reached its goal, but didn't set a new market share goal. Su said at a recent investor event that the company wouldn't project server CPU sales based on market share in the future, instead focusing on revenue targets. During the company's earnings call, Su noted that EPYC comprised 20% of the company's revenue, which translates to roughly $386 million, so it's clear the company has plans for significantly more uptake in the future. She predicted accelerating uptake of the EPYC data center CPUs in the back half of the year, too.

Intel still holds 94.2% of the market, and its recent Xeon price cuts make it clear that the company is willing to sacrifice margins to remain competitive. In fact, the company's margins dropped from its historic ~60% range to 53.3% last quarter (the lowest since 2009). Intel also notched strong server revenue of its own last quarter (up 43% YoY) due to pandemic-spurred uptake of server gear.

AMD has its EPYC Milan chips coming this year while Intel has its 10nm Ice Lake Xeons in the hopper, so the rest of the year should be incredibly competitive as AMD works to improve its standing.

AMD vs. Intel Total Market Share Q2 2020

| Row 0 - Cell 0 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 4Q18 | 3Q18 |

| AMD Client | 19.7% | 17.5% | 17.0% | 15.8% | 15% | 13.5% | 11.6% |

| Client PP Change QoQ / YoY | +2.2 / +4.7 | -0.5% / ? | +1.1 / +3.5 | +0.8 / +4.2 | ? | ? | - |

| AMD Overall x86 | 18.3% | 14.8% | 15.5% | 14.6% | 13.9% | 12.3% | 10.6% |

| Overall PP Change QoQ / YoY | +3.5 / +1.2 (+3.7?) | -0.7 / ? | +0.9 / +3.2 | +0.7 / +4 | ? | ? | - |

Here we have the final word on the matter, at least for now. AMD has taken 18.3% of the overall x86 share - the highest since the fourth quarter of 2013. The company also has taken its highest share of the client x86 market since the first quarter of 2012 at 19.7%.

We've reached out for more clarity on a few points, and will update as necessary.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

watzupken I feel AMD's gained market share at an accelerated pace over the last few years because Intel stumbled and isn't nimble enough to pick themselves up. I think they grossly underestimated AMD's come back, and gave themselves too much time to rectify their 10nm issues. The next few years will likely see a lot of competition between the 2 as Intel claimed that their 10nm issue is fixed and a flurry of 10nm products to be released starting 2021. Though I still feel they will continue to bleed market share because Intel tend not to compete on price, which AMD easily takes advantage of. Let's see.Reply -

Kamen Rider Blade I don't think their 10nm is quite as "Fixed" as they proclaim it to be.Reply

And inside leaks state 7nm is a even worse debacle than 10nm. -

Gam3r01 It makes me happy to see AMD doing well for themselves again, competition is good and prevents the market from getting stale (again).Reply

Now if only AMD had the revenue to manufacture in house like intel does, imagine the progress. -

PapaCrazy Replywatzupken said:I feel AMD's gained market share at an accelerated pace over the last few years because Intel stumbled and isn't nimble enough to pick themselves up. I think they grossly underestimated AMD's come back, and gave themselves too much time to rectify their 10nm issues. The next few years will likely see a lot of competition between the 2 as Intel claimed that their 10nm issue is fixed and a flurry of 10nm products to be released starting 2021. Though I still feel they will continue to bleed market share because Intel tend not to compete on price, which AMD easily takes advantage of. Let's see.

Intel's failure defines the current market. Hard to tell who is running to AMD, and who is running away from Intel. Unfortunately, Intel's failures also affected x86 market share as a whole. With MS experimenting with Windows ARM and Apple completely shifting over, Intel created an x86 crisis that will impact AMD too. The next few years will be interesting to say the least. -

escksu This is the reality. Intel still has 80% of the end user market and almost 95% of the server market.Reply

Amd needs to continue its momentum and chip away intel's share. A few years of superior product alone isnt enough to overtake intel. Its a marathon. -

Soaptrail ReplyKamen Rider Blade said:I don't think their 10nm is quite as "Fixed" as they proclaim it to be.

And inside leaks state 7nm is a even worse debacle than 10nm.

It is always worse than what we hear so Intel is not fixed and has systemic issues that money cannot solve otherwise they would not be in this position. -

derekullo "However, because AMD lumps consumer processors and GPUs into the same revenue segment, it was impossible to determine if its increased revenue came at the expense of Intel."Reply

I think it's safe to say AMD did not steal any revenue from Nvidia. -

Jimbojan AMD's share gain is down in the noise. Just wait until Intel's 10 nm Tiger Lake CPU and Xe graphic come in volume, and see how much market share AMD will gain. AMD is actually competing with its 7nm chip with Intel's 14 nm chip so far. Intel is still owns the market, clearly it cannot hold over forever, now that it declared 10 nm has arrived both in CPU and graphic, let's see what the battle field is looking like. Intel said it is increasing its capex to increase its 10 nm production in light of the 7nm delay. Just wait for a few more days, Intel will say something about it.Reply -

jimmysmitty ReplyPapaCrazy said:Intel's failure defines the current market. Hard to tell who is running to AMD, and who is running away from Intel. Unfortunately, Intel's failures also affected x86 market share as a whole. With MS experimenting with Windows ARM and Apple completely shifting over, Intel created an x86 crisis that will impact AMD too. The next few years will be interesting to say the least.

To be fair AMD caused it by pushing AMD64 instead of us going to IA64.

Either way though it wont be as bad as people think. Apple is still a marginal market share and has very little bearing on the overall PC market. I also wouldn't be surprised if a lot of people get upset since now all their software will be useless.

I am not sure we will see major changes even with MS doing ARM. They are doing it because its smart to do but people hate and resist change, its why AMD64 won so easily over IA64, so it may be interesting but we may not see any real change to the consumer desktop market apart from AMD having more market share. -

Jimbojan Replyderekullo said:"However, because AMD lumps consumer processors and GPUs into the same revenue segment, it was impossible to determine if its increased revenue came at the expense of Intel."

I think it's safe to say AMD did not steal any revenue from Nvidia.