AMD Will Hold 20% of Server CPU Market in 2023, Analysts Say

Intel set to lose datacenter market share this year, analysts believe.

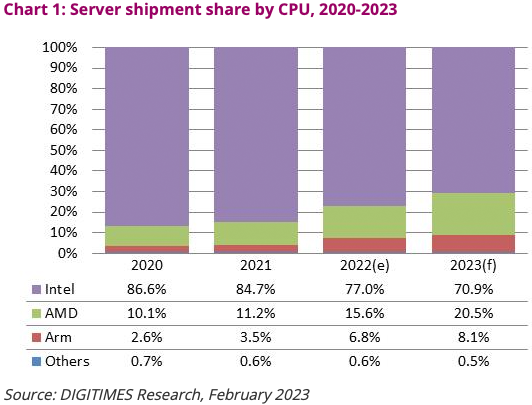

AMD has been steadily gaining datacenter CPU market share since 2017 — when it launched its EPYC processor for servers — and is expected to command over 20% of shipments this year, according to DigiTimes Research. Meanwhile, various developers of Arm-based system-on-chips (SoC) for datacenters are projected to occupy around 8% of the market. While Intel will maintain the lead, its share will decline significantly.

AMD Is Gaining Share

There are several factors that will allow AMD to continue grabbing market share from Intel this year, according to Frank Kung from DigiTimes Research. These include higher core count of AMD's latest EPYC processors compared to range-topping Intel's Xeon Scalable (96 vs 60), lower prices of EPYC CPUs when compared to Intel Xeon Scalable products with similar core count, and better supply of AMD's latest EPYC CPUs made at TSMC when compared to Intel's Xeon Scalable produced in house.

Although not mentioned directly by DigiTimes Research, there are two other major factors driving adoption of AMD's EPYC platform: introduction of new processors without major delays and better performance compared to the latest offerings from Intel as the latter arrived considerably later than they were supposed to.

Late last year AMD introduced its EPYC 'Genoa' processors with up to 96 cores based on the Zen 4 microarchitecture for mainstream servers and this platform will ramp up gradually in 2023. Later this year the company plans to release its EPYC 'Bergamo' CPUs with up to 128 cores featuring the Zen 4c architecture for cloud datacenters, which will further improve positions of AMD as Intel is only set to ship its Sierra Forest CPUs for cloud workloads in 2024. Also, AMD plans to introduce its EPYC 'Siena' processors for communications market this year.

Arm Is Getting Stronger

There is a fundamental headwind for Arm-based SoCs when it comes to gaining server market share — software compatibility. Performance wise, these SoCs can compete against x86 processors, but if they cannot run programs, they will not be adopted.

Nonetheless, Arm-powered SoCs from companies like Amazon, Ampere, Alibaba, and Marvell increased their share from 3.5% in 2021 to 6.8% in 2022, according to estimates by DigiTimes Research. Analysts expect such processors to command 8.1% of the server CPU market as new players (such as Nvidia) enter the scene and established players (such as Ampere) roll-out their new offerings.

Given how strong Nvidia's compute GPUs are in AI and HPC fields, its Arm-based processors for servers are poised to grab a significant share of the market.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As Arm-based datacenter SoCs gain software compatibility with popular applications, they will also gain market share. As a result, only time will tell what market share such processors will control several years down the road. According to the analyst from DigiTimes Research, it is almost guaranteed that Arm-based SoCs will continue to gain share in datacenter and edge computing servers.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

punkncat I can only imagine this is purely within the private sector. Much of the government space is dominated by Dell/Intel builds, by contract.Reply -

Kamen Rider Blade Reply

AMD Now Powers 101 of the World's Fastest Supercomputerspunkncat said:I can only imagine this is purely within the private sector. Much of the government space is dominated by Dell/Intel builds, by contract. -

Jimbojan I am sorry, I do not agree with your assessment. I believe Intel will gain back the data center share starting in 2023 as Intel is putting out cheaper products and better performance than AMD's, starting in 2024, Intel will have a product even more power efficient than ARM's as Intel claimed. We just have to wait and see to verify it.Reply -

Avro Arrow I'm honestly surprised that Intel still has as much of the market as they do because they've been getting their butts handed to them by EPYC for nearly six years now. It just goes to show you how too many people are in positions that they're not really qualified for. Noobs buy by brand, experts buy by spec.Reply -

Avro Arrow Reply

Really? I thought that government supercomputers were dominated by Cray (which HP bought). I'm not doubting you, I'm just really surprised.punkncat said:I can only imagine this is purely within the private sector. Much of the government space is dominated by Dell/Intel builds, by contract.

Yeah, it's pretty incredible, eh?Kamen Rider Blade said:AMD Now Powers 101 of the World's Fastest Supercomputers -

pointa2b This fight for survival between the two will benefit the consumer in terms of performance/efficiency/cost, regardless of the company you prefer.Reply -

Neilbob ReplyJimbojan said:I am sorry, I do not agree with your assessment. I believe Intel will gain back the data center share starting in 2023 as Intel is putting out cheaper products and better performance than AMD's, starting in 2024, Intel will have a product even more power efficient than ARM's as Intel claimed. We just have to wait and see to verify it.

You do love banging this pro-Intel drum I've noticed, especially with regards to energy efficiency - where it has been shown time and time again by multiple publications that Intel, while a bit closer than before, is not more efficient. Unless I'm very much mistaken, didn't even Intel acknowledge that AMD would remain ahead for this year in servers?

And I genuinely wouldn't put any trust at all in their claims about being competitive with ARM until that has been properly verified.

I'm all in favour of there being competition, just to be clear. Your view on the other hand seems rather myopic. -

tamalero Reply

Doesn't matter much if Intel provides better performance for 300% more power.Jimbojan said:I am sorry, I do not agree with your assessment. I believe Intel will gain back the data center share starting in 2023 as Intel is putting out cheaper products and better performance than AMD's, starting in 2024, Intel will have a product even more power efficient than ARM's as Intel claimed. We just have to wait and see to verify it.

Performance per watt is still king in the server market. -

jeremyj_83 Reply

This is a complete falicy. With SPR Intel has caught up to Zen 3 based Milan on a per core basis. They are quite a bit behind Genoa in absolute performance. Intel doesn't even try to say they are faster per core. They are showing how much faster they are using their accelerators. The problem with accelerators is you need software that is aware of them and able to use them. Right now there aren't a lot that can.Jimbojan said:I am sorry, I do not agree with your assessment. I believe Intel will gain back the data center share starting in 2023 as Intel is putting out cheaper products and better performance than AMD's, starting in 2024, Intel will have a product even more power efficient than ARM's as Intel claimed. We just have to wait and see to verify it. -

TerryLaze Reply

They are getting their butts handed to them in pure number crunching but that has stopped being a mayor part of servers a long time ago...Avro Arrow said:I'm honestly surprised that Intel still has as much of the market as they do because they've been getting their butts handed to them by EPYC for nearly six years now. It just goes to show you how too many people are in positions that they're not really qualified for. Noobs buy by brand, experts buy by spec.

Now it's all AI and media transcoding and serving.

Sure supercomputers are still a thing and ryzen is great for that, but do we know what kind of percentage supercomputers are in the whole server/datacenter market?!

In any case we don't have any of the numbers of how many servers use number crunching or media or AI or whatever else, so any comment anyone makes is completely unfounded.

Maybe people in the server market are stupid for buying only by brand, maybe they know what they are doing and just don't need a purely number crunching system.