Analysts Expect Client SSD Pricing to Drop 15-20% in Q4

Even cheaper storage could soon be a reality

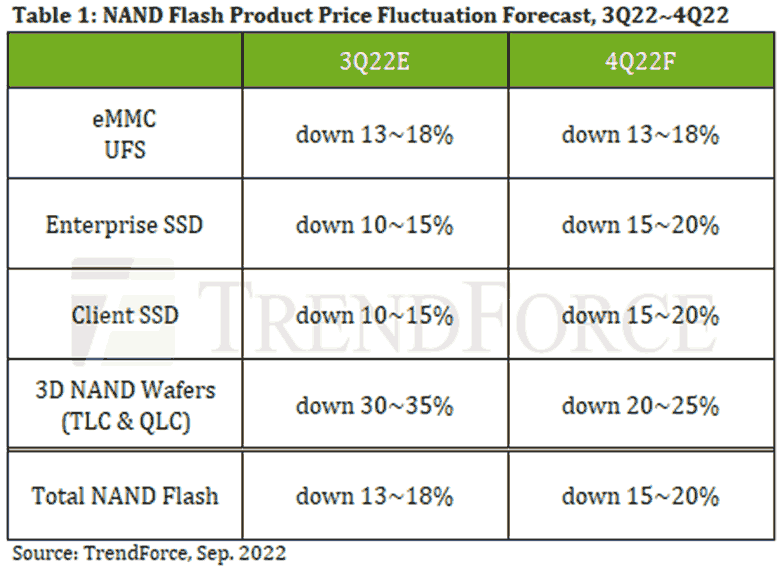

Semiconductor market analysts at TrendForce have pushed out a gloomy report for NAND Flash memory makers, and related industries. According to the firm’s latest research, there are pressures from multiple sides of the business, meaning NAND flash memory chips are likely to continue to slide in value. The scale of the memory component price slide is expected to be 20-25% during Q4 2022, resulting in 15-20% price drops on storage devices including the best SSDs for 2022, and similar drops for eMMC and UFS storage.

One of the significant downward pressures on NAND pricing is that buyers of this semiconductor commodity are currently destocking. Moreover, TrendForce says NAND Flash customers are reducing purchases as Q3 was a washout – no back to school computing or late summer smartphone rush occurred this year. Previously we have talked about the industry being affected by recessionary forces, the Ukraine war, and the cyclical nature of PC refreshes.

If you have a feeling that could be described as déjà vu at this juncture, that’s because TrendForce published a very downbeat report about Q2 2022 just a couple of weeks previously. Looking back, you will see NAND Flash makers were already reeling from a likely wafer price drop of 30-35% in Q3, and Q4 continues the pain in a significant way.

But enough about the somewhat abstract notion for consumers – and talking about wafers and NAND flash, what does TrendForce says about SSD pricing in the coming months? For these so called ‘client SSDs’, the source reports that “purchasing demand in 2H22 is far less than that in 1H22.” Moreover, PC brands are pessimistic about any upturn in business, so they wish to destock, prompting SSD makers to cut prices to try and shift their stock.

TrendForce also observes that 512GB SSDs have become the focus of supply for SSD makers. As the new ‘default’ choice among PC makers, and for the masses when shopping for a new/extra SSD, price competition at this capacity has heated up, creating another downward force on prices. However, a glimmer of positivity can be seen in one of the trends with consumer SSDs this year. The IT market analysts say that PCIe 4.0 SSD shipments have continued to rise through 2022, and more suppliers have latched onto this trend, launching 176-layer products to increase the penetration rate of this interface.

In summary, if you are in the market for an SSD right now, it doesn’t look a terrible time to buy. However, if you can hold on you should see decent savings become available.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.