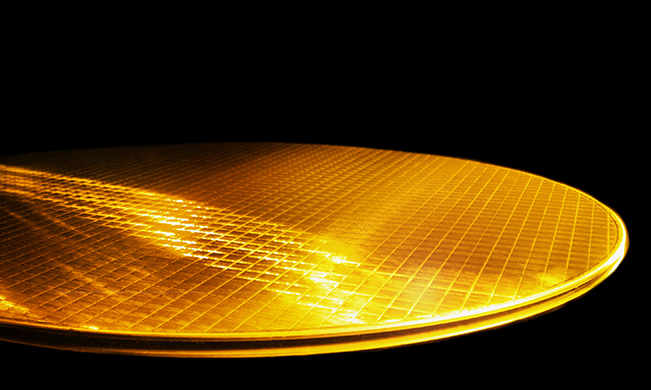

China Retaliates: Restricts Vital Chipmaking Materials Gallium and Germanium

China restricts exports of materials as part of new foreign policy laws.

China has announced new export controls on gallium and germanium, two important metals used in semiconductor, telecommunications, solar power, and electric vehicle industries, Bloomberg reports. This move marks a significant escalation in the ongoing technology trade war with the US and Europe and could be a part of the country's new foreign policy law (as revealed by CNN) that enables the government to "take corresponding countermeasures and restrictive measures."

The new export rules will require Chinese companies to obtain an export license for gallium and germanium metals as well as products containing them starting August 1, 2023, in the name of China's national security. China is the world's largest producer of both gallium and germanium, as it has significant reserves of these metals and produces a large proportion of the global supply. China accounts for about 94% of the world's gallium production, so its restrictions could have a drastic effect on numerous industries, including semiconductor, LED, and solar power. Meanwhile, such restrictions will inevitably hurt Chinese companies, too.

The move will not have a drastic effect on the production of high-performance components like CPUs, GPUs, and memory. But GaN and GaAs are used for power chips, radio frequency amplifiers, LEDs, and a number of other applications.

"It will be disruptive - germanium and gallium are absolutely critical to high-tech industries," said Anthony Lipmann, a director of London metals trader Lipmann Walton & Co, in a brief interview with Bloomberg.

Both gallium and germanium are essential to high-tech industries and are used to produce compound semiconductors. Although the metals are not rare, they have been kept cheap by China and can be relatively expensive to mine elsewhere. The move may initially boost the price of these metals, but this could also make it more economically viable for other countries to begin extracting these metals, potentially reducing China's market dominance.

"When they stop suppressing the price, it suddenly becomes more viable to extract these metals in the West, then China again has an own-goal," Christopher Ecclestone, principle at Hallgarten & Co., told Bloomberg. "For a short while they get a higher price, but then China’s market dominance gets lost - the same thing has happened before in other things like antimony, tungsten, and rare earths."

The move by the Chinese government could be a response to sweeping sanctions against the country's semiconductor and supercomputer sectors by the U.S. implemented last October. Last week the Dutch government announced plans to restrict sales of ASML's advanced chip-making tools to Chinese companies, a decision that sparked strong opposition from China.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

gg83 Reply

I think good for overall global economy. Plus I believe part of the reason the metals are cheap is due to little to no environmental protections are taken. With an uptick in price will make environmentally conscious companies able to compete.Kamen Rider Blade said:Less reliance on China for those materials = Good for Western Economy.