Consumer DRAM Prices Set to Drop 18% in Q3 — TrendForce

As consumer demand for PC softens, DRAM prices are expected to drop.

In the last couple of weeks, multiple companies issued warning statements that demand for client PCs and other consumer electronics is softening. This, logically, tends to cause an oversupply of hardware components and price drops. Prices of commodity dynamic random access memory (DRAM) serve as one of the best immediate indicators of hardware market oversupply or undersupply, and we are in the midst of oversupply, believes TrendForce.

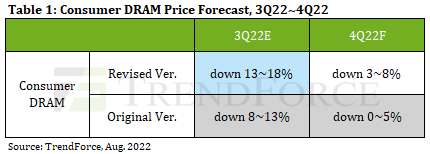

Seeing how enthusiastically large DRAM makers are sacrificing pricing for sales, TrendForce now believes that prices of consumer DRAM will drop by 13% ~ 18% in Q3 2022 and then by another 3% ~ 8% in Q4 2022. Previously, the company expected DRAM quotes to drop by up to 13% in Q3 and then be by up to 5% in Q4.

While relatively low-capacity consumer DRAM chips are not exactly what PC makers use for their mainstream products (they still use low-capacity DDR4 ICs for cheap tablets, netbooks, and Chromebooks), oversupply of consumer DRAM ICs indicates that the market is oversupplied in general, so expect similar — 13% ~ 18% in Q3 2022 — price drops of PC DRAMs this quarter.

While it is hard to estimate how significantly prices of DDR4 and DDR5 will drop this quarter, it seems likely that prices of these ICs will drop by at least 10% in the coming weeks and months. It of course remains to be seen how this will affect prices of actual modules, since both AMD and Intel are rolling out their new DDR5-supporting platforms this fall. But building a DDR5-supporting system later this year will almost certainly be more beneficial from a price and performance point of view than it was several months ago.

When chips in general were in short supply (and many of them still are), PC makers and large consumer electronics producers stockpiled memory in order to ensure steady production of their systems. But as demand for consumer desktops and laptops softens, hardware suppliers tend to use memory from their stocks rather than buy new chips from DRAM manufacturers.

The big players in the space are already trying to compensate. To stimulate demand (and perhaps motivate PC makers to increase memory content in their products), Samsung and SK hynix slashed prices of their mainstream DRAM. Other suppliers (most notably Micron) had no choice but to follow suit.

Earlier this week, Micron issued a statement claiming that. due to macroeconomic challenges, it would not meet its revenue and bit shipment goals for the ongoing quarter and will have to cut down CapEx.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

"Due to macroeconomic factors and supply chain constraints, we have seen a broadening of customer inventory adjustments," a Micron filing with the SEC reads. "As a result, our expectations for CY22 industry bit demand growth for DRAM and NAND have declined since our June 30, 2022 earnings call, and we expect a challenging market environment in Q4 FY2022 and Q1 FY2023. Q4 FY2022 revenue may come in at or below the low end of the revenue guidance range provided in our June 30 earnings call."

In Q1 FY2023, bit shipments are now expected to decline sequentially, and we expect significant sequential declines in revenue and margins. […] To address the near-term environment, today we are announcing new FY2023 wafer fab equipment (WFE) capex reductions adding to the WFE capex reductions discussed in our June 30 earnings call, and now expect FY 2023 total capex to be down meaningfully versus FY2022."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Jimbojan All PC and GPU makers like AMD, NVDA and Intel will suffer for a long time to come, I cannot see why AMD and NVDA still have a price to earnings ratio ( PE) over 60 - 90, while Intel is 8, thanks to those analysts pump and dumpReply -

hannibal Replythisisaname said:Hope the price drop includes DDR5 :)

Well the demand for DDR5 is going up and demand for DDR4 is going down. What prices are gonna drop and what can go up or stay same?

But yeah, eventually DDR5 prices also come down, but I am afraid that not yet. -

watzupken Reply

DDR5 prices are unsustainable and will hinder adoption. This will eventually have to come down, and it is obvious that it is coming down when we compare the prices now against what we saw end of last year.thisisaname said:Hope the price drop includes DDR5 :)

Anyway, I will take whatever analysis with a tablespoon of salt because clearly they are reactive despite it being a prediction. I've seen so called prediction basically just being adjusted accordingly based on what we can already observe.