Chinese mining firm Bitmain has released a teaser of the company's upcoming Antminer E9 Ethereum miner. The company stated that the Antminer E9 would launch very soon, although it didn't commit to a specific date.

The Antminer E9 could be the answer to gamers' prayers. If cryptocurrency miners jump on this new ASIC miner, they could forgo buying Nvidia's Ampere offerings, and maybe, just maybe, gamers will finally be able to pick up a gaming graphics card. The shelves won't magically fill themselves since cryptocurrency miners aren't the sole cause of the graphics card shortage; we can also blame the pandemic for that as well. Perhaps we could see more stock on the market, though.

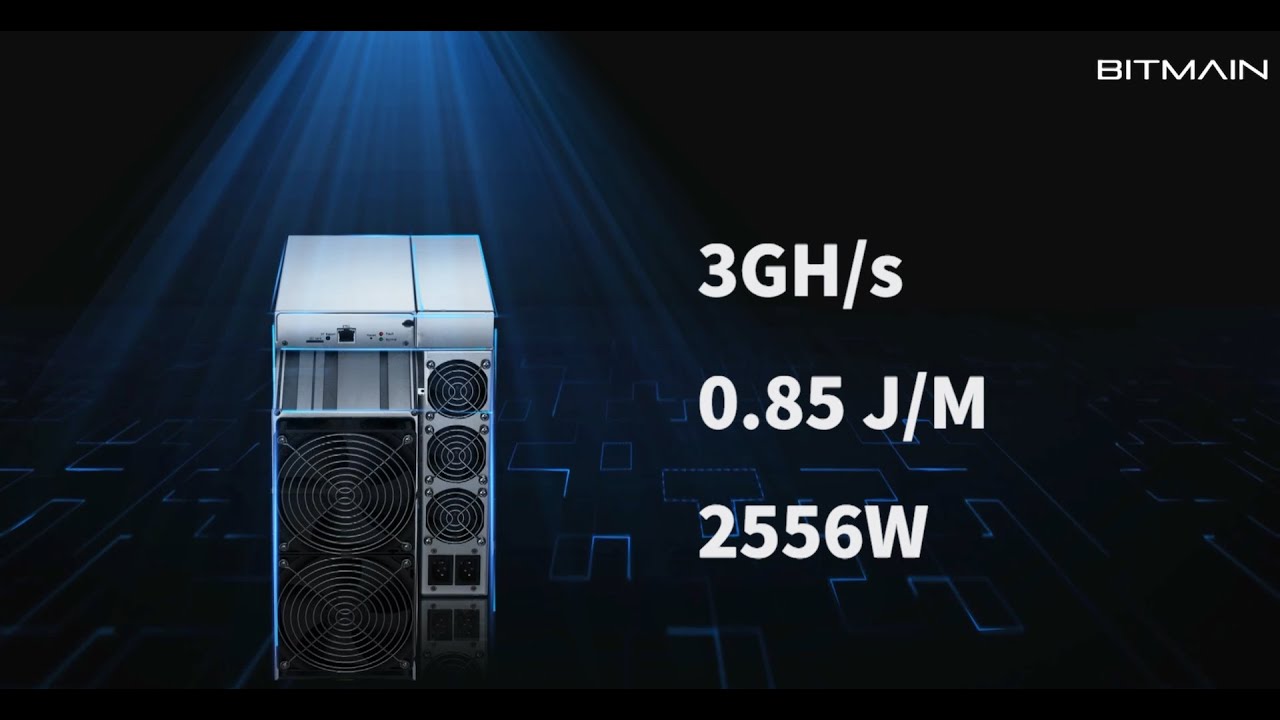

The Antminer E9 reportedly delivers an Ethereum hash rate up to 3 GH/s, equivalent to 32 Nvidia GeForce RTX 3080 (Ampere) graphics cards mining in unison. If Bitmain delivers on its promise, the Antminer E9 will be the fastest ASIC miner available and even outperform Linzhi's Phoenix Ethash ASIC miner that delivers up to 2,600 MH/s.

Bitmain didn't reveal too many details about the Antminer E9 except that it draws up to 2,556W and flaunts a power efficiency of 0.85 J/M. Therefore, the Antminer E9 isn't just faster than the Phoenix miner but also more energy-efficient. For comparison, the Phoenix miner pulls 3,000W, meaning the Antminer E9 has 14.8% lower power consumption.

Obviously, an ASIC miner of the caliber of 32 GeForce RTX 3080 graphics cards will not come cheap. The current speculation on Twitter is that the Antminer E9 could sell for over $20,000 easily. Linzhi's Phoenix miner sells for between $11,300 and $13,700. Even at $30,000, the Antminer E9 could be a very attractive option for mining farms since GeForce RTX 3080 graphics cards start at $2,500 nowadays, and purchasing 32 of them comes down to a whopping $80,000.

On the other hand, Nvidia probably won't be too pleased with the news of the Antminer E9 since the chipmaker's Ampere graphics cards are selling like hotcakes. Let's not forget that between $100 to $300 million of Nvidia's Q4 revenue originated from cryptomining sales alone.

On top of that, Nvidia recently rolled out its Cryptocurrency Mining Processor (CMP) products that focus on Ethereum mining. A little over a week ago, Nvidia updated its Q1 forecast for CMP sales to peak at $150 million, three times higher than its original estimate.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The Antminer E9 won't put a dent in Nvidia's cryptomining business unless Bitmain can produce the Ethereum miner on a large scale. It will certainly be a challenge given the global electronic component shortage that's hitting every industry.

Zhiye Liu is a news editor and memory reviewer at Tom’s Hardware. Although he loves everything that’s hardware, he has a soft spot for CPUs, GPUs, and RAM.

-

derekullo According to =3000&factor=2556&factor=0.0&factor=0.06&sort=Profitability24&volume=0&revenue=24h&factor=&factor=binance&dataset=Main&commit=Calculate']whatomineReply

This would make $239 a day and would break even in 126 days assuming a cost of $30,000.

Also assuming Ethereum holds at its current value. -

InvalidError Funny how more ETH ASIC mining becomes available 10 days after update to the latest eth2.0 proof-of-stake validator becomes mandatory for PoS network participants.Reply -

esmith11323 The statement, "Linzhi's Phoenix miner sells for between $11,300 and $13,700 ", is false.Reply

Linzhi Phoenix does not exist (yet), apart from a handful of evaluation units. There are several scam websites allegedly selling a 2600 MHash/s ASIC miner in this price range. It would have been an incredibly good deal, since, at the current ETH price and difficulty, the miner would pay for itself in about 2 months. None of them actually have any product to sell. We don't know when it will really be available or how much it would cost.

The only ETH ASIC miner that actually exists and is still capable of mining ETH today is Innosilicon A10 Pro, 500..750 MHash/s, it is sold out by the manufacturer, preowned units tend to go for about $10k a pop on ebay.

Keep in mind that ETH mining is rapidly approaching the end of the line, it'll cease after the PoS switch, which is now expected before the end of 2021, so any ASIC released today would be lucky to last 8 months before becoming an expensive doorstop. -

sstanic Reply

I don't follow crypto at all, and I see that you do. Do you think that GPUs will stabilize to their MSRP and when please?esmith11323 said:The statement, "Linzhi's Phoenix miner sells for between $11,300 and $13,700 ", is false.

Linzhi Phoenix does not exist (yet), apart from a handful of evaluation units. There are several scam websites allegedly selling a 2600 MHash/s ASIC miner in this price range. It would have been an incredibly good deal, since, at the current ETH price and difficulty, the miner would pay for itself in about 2 months. None of them actually have any product to sell. We don't know when it will really be available or how much it would cost.

The only ETH ASIC miner that actually exists and is still capable of mining ETH today is Innosilicon A10 Pro, 500..750 MHash/s, it is sold out by the manufacturer, preowned units tend to go for about $10k a pop on ebay.

Keep in mind that ETH mining is rapidly approaching the end of the line, it'll cease after the PoS switch, which is now expected before the end of 2021, so any ASIC released today would be lucky to last 8 months before becoming an expensive doorstop. -

teodoreh For $30.000 you can buy 45 RTX3060Ti and have 2700MH/s.Reply

If algorithm changes, you have no problem.

If eth2.0 goes exclusively PoS, you can sell those 45 cards and get back a significant amount of money.

The only advantage of this paper-product is power consumption. -

Krotow Replysstanic said:Do you think that GPUs will stabilize to their MSRP and when please?

Not so fast IMHO. Some manufacturers already raised their prices and retailers also become a new scalpers, it will take few years for prices to go down. -

sstanic Well yes, that much I do know. Although I wouldn't say "a few years" but until the next gen GPUs get a clearer performance and launch dates. Which may well be a few years away of course. And I actually support both board partners and retailers raising their prices, because I really don't see why they should let scalpers get away with huge margins with no effort or risk. They should've done it right away IMHO.Reply -

peachpuff Reply

When pigs fly...sstanic said:I don't follow crypto at all, and I see that you do. Do you think that GPUs will stabilize to their MSRP and when please? -

esmith11323 Replysstanic said:I don't follow crypto at all, and I see that you do. Do you think that GPUs will stabilize to their MSRP and when please?

It's difficult to make predictions, especially about the future. All I can say, if the current ETH2 timeline holds up, cryptomining purchases of new cards should dry up by September and boatloads of preowned cards should start hitting ebay by Christmas. Don't know if that'll be enough to stabilize the prices. PS5 still sells for double the MSRP 6 months after launch and that has nothing to do with crypto. -

esmith11323 Replyteodoreh said:For $30.000 you can buy 45 RTX3060Ti and have 2700MH/s.

If you can find them for that price.

Just scrolled through the first page of sold 3060ti listings on eBay, there was one that went for $1200, most were in the $1300-$1500 range.

More realistically, the choice is between buying an ASIC miner for $30K today, using it until the music stops, and then tossing it in the trash; or buying 45 RTX3060Ti's for $60K today, using them for the same period of time, and selling them. You'll need to be able to sell them for $700 each to break even (even ignoring the power consumption).