Profits Are Drying Up For Ethereum Miners

Updated, 03/19/2018, 11:30am PT: Orriginal article incorrectly attributed NAND price as a factor for GPU pricing.

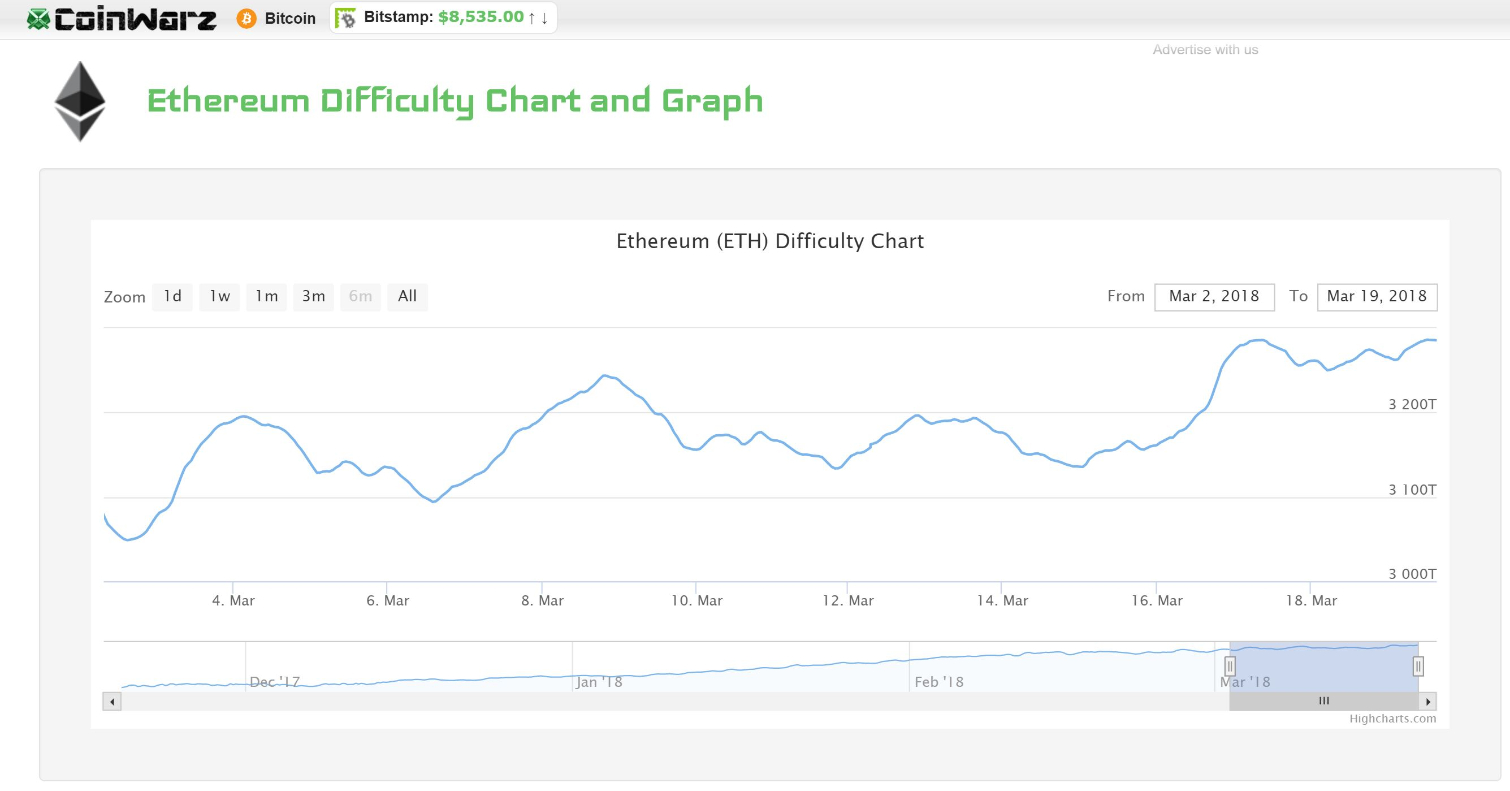

As the price of Ethereum continued to drop week over week, the mining difficulty continued to rise. At this pace, mining profits are quickly thinning out.

Last year, the price of Ethereum took off like a rocket and headed for the moon. At the beginning of the year, Ether coins traded for less than $10, and by the end of December, people were willing to shell out close to $1,000 per coin. The stratospheric rise in value also attracted a massive influx of cryptocurrency miners hoping to make a quick buck.

Last summer, we conducted an Ethereum mining experiment that involved the creation of a “profitable” mining rig out of older parts that had piled up and started collecting dust. In that article, we explored the possibility of earning profits from an inefficient mining system. We looked at the mining difficulty rating and how it would affect our income. We also touched on how much the cost of electricity would limit our profits. At the time of our experiment, our mining rig proved to be profitable in most cities, but if the price of Ether dipped by 25%, you would be losing money in markets with expensive electricity. (Something miners capitalized on by setting up shop in cities with cheap power like Plattsburgh, New York.)

For most of 2017, Ethereum miners were doing well, but 2018 hasn't been quite as lucrative. The coin traded for around $200 when we started our Ethereum mining experiment in July 2017, and throughout the fall, its value slowly crept up past the $300 and $400 marks. By mid-December the cryptocurrency craze was in full swing, and Ethereum's value reached $800. Then, in the first week of January 2018, it rose again.

On January 13, Ethereum peaked at more the $1,400 per coin, which translated to more than $14 per day from our 94Mh/s miner, but in early February Ethereum’s value was back to the $800 region, and it continued to slide through March. Over the weekend, Ethereum dropped to below $500 for the first time since early December.

In December, $500 Ethereum was like a dream come true for anyone with an established mining machine. However, $500 Ethereum today is a nightmare. In the same period that Ethereum’s value went from $500 to $1,400, and back down to $500, the mining difficulty doubled, and it hasn’t stopped climbing.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Back when we started our mining project, the Ethereum difficulty rating had just peaked at an all-time high of 1.2THash. In December, when the value jumped to $800 for the first time, the network difficulty had increased marginally to 1.5THash. Today, Ethereum mining difficulty is close to 3.3THash, and that rise in mining difficulty is eating away at the profits cryptocurrency miners are used to making from their operations.

Even when you take the price of Ether out of the equation, mining profits for long-term holders are way down. Because of the difficulty increase, mining machines are now pulling in half the amount of Ethereum per hour than they were late last year. The table below illustrates the dramatic drop in our weekly gains between December and today.

| Payout Date | Payout In Ether | Ether Value at Payout | Weekly Earnings |

|---|---|---|---|

| 2017-12-02 | 0.100082596 | $463.45 | $46.38 |

| 2017-12-08 | 0.100052232 | $456.03 | $45.63 |

| 2017-12-14 | 0.100048559 | $695.82 | $69.62 |

| 2017-12-21 | 0.097346387 | $821.06 | $79.93 |

| 2017-12-28 | 0.088950117 | $737.02 | $65.56 |

| 2018-01-04 | 0.087034286 | $980.92 | $85.37 |

| 2018-01-11 | 0.088419541 | $1,154.93 | $102.12 |

| 2018-01-18 | 0.078138401 | $1,036.28 | $80.97 |

| 2018-01-25 | 0.070455403 | $1,056.03 | $74.40 |

| 2018-02-01 | 0.064990133 | $1,036.79 | $67.38 |

| 2018-02-09 | 0.057578002 | $883.87 | $50.89 |

| 2018-02-16 | 0.053063318 | $944.21 | $50.10 |

| 2018-02-23 | 0.053833924 | $864.19 | $46.52 |

| 2018-03-02 | 0.053373855 | $856.85 | $45.73 |

| 2018-03-09 | 0.039195659 | $728.92 | $28.57 |

| 2018-03-16 | 0.047104371 | $601.67 | $28.34 |

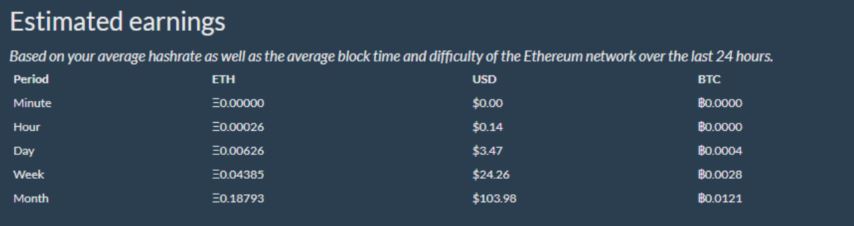

At the current difficulty rating, our mining pool estimates that our 94MH/s mining system would earn 0.04385 in time for our next weekly payout. At today’s value, that’s roughly $24 for the week. Our system burns about $10 per week in electricity, so it’s still profitable. But in a market with expensive utilities, such as San Francisco, which can pay up to $0.25 per kWh, you’d be losing money at today’s rate.

Don’t Expect GPU Prices To Drop

The profitability for Ethereum mining is drying up, but don’t expect to see graphics cards drop in price any time soon. Ethereum isn’t the only GPU-mineable coin, and most miners will switch to something more profitable instead of selling their rigs. Even if miners stopped buying graphics cards in massive quantities--which they won’t--it will take a while for supply chains to stabilize.

It's also important to remember that cryptocurrency markets fluctuate all the time and this is not the first time that profits have contracted. In July 2017, things were starting to look bad for miners but the market turned around about as quickly as we could report on it. We wouldn't be surprised to see that happen again.

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

andrewkelb A new generation not coming out til possibly August, which will possibly also get swallowed up by crypto farmers and resellers who drive up the price to sell to crypto farmer. I made the terrible decision to go ahead and buy a ridiculously overpriced gtx 1070. The urge to build overwhelmed my senses.Reply -

hannibal Yep. Those new generation GPU will be faster and use less electricity so miners are gonna get all they can get. And that means they will be extremely expensive a long, long time!Reply -

enzoozzytiger $0.25/KWh in SF? You got to be kidding. My usage is just average and I could only wish I would be paying $0.25/KWh. If you have a few mining rigs, you will be looking at double that price.Reply -

bit_user Reply

Haven't you been paying attention? They already are.20808104 said:Don’t Expect GPU Prices To Drop

I don't know how long it's been since Newegg had RX 580's for close to $400, but now they have a bunch.

I see a dip in GTX 1050 Ti and GTX 1080 prices, as well. I haven't been following others.

Not back to where they were 1 year ago, but prices are definitely falling.

-

TJ Hooker Reply

From what you're saying it sounds like your electricity rates tiered, i.e. cost per kWh increases as your total usage goes beyond certain level(s)? Maybe the author just looked at the very cheapest tier available in SF.20808821 said:$0.25/KWh in SF? You got to be kidding. My usage is just average and I could only wish I would be paying $0.25/KWh. If you have a few mining rigs, you will be looking at double that price. -

Tanyac I don't think GPUs, or any PC component is ever going to drop in price again. Manufacturers seem to prefer the current paradigm.Reply

We also have flash, PSU and memory price hikes. Again, I'd be surprised if prices ever dropped again. I doubt I'll see a 32GB DDR4-3200C15 kit for $269 (or equivalent) ever again. That same memory is now selling for a much as $699.

GPUs here have just recently had another price hike. A card that cost me $249 in September 2016 is now $539 (It was $489 about a month ago).

Case prices have skyrocketed to. Personally, I think the scarcity is intended so that prices can be driven up. I don't think any manufacturer ever wants to return to the pre-mining era, or pre-flash shortage etc... -

zodiacfml It is not ether but all coins as a change in the market affects most, if not all, coins.Reply -

csm101 prices are slowly dropping at least in ebay for the past 2 months from 1000 to 600 when it comes to gtx 1070 at least. once the price is set to 450 i wil get one. dose not matter whether its eaby or amazone or newegg.Reply -

andrewkelb Careful CSM101, yeah I am a sucker for paying full price but it will be new. I would be worried about paying a lot for a card that had been used for mining, might be like buying a high mileage rental car.Reply -

Ninjawithagun What Tom's forgot to include in their payout chart was the cost to build the rig, cost of operation (electricity), and cost of maintenance over time. Mining rigs wear out quickly as they are running 24/7. The cost of electricity alone would negate most of the profits shown. Our beloved consumer desktop GPUs are NOT designed for 24/7 operation - period. When used for crypto currency mining, they are especially susceptible to capacitor burnout and premature cooling fan failures - hence reasons NOT to buy used graphics cards off of eBay. These are from miners folks, so don't be stupid. Buy only brand new cards. Wait for them to get back into stock at retail resellers only. Also, consider buying the bundles being offered by etailers like Newegg and Microcenter. Both offer GPUs at retail prices if purchased with other hardware ;-)Reply