Gartner and IDC Blame Falling PC Shipments on Intel

Usually the only thing analysts can agree on is the importance of their jobs. Otherwise, they differ in how they collect data, how they interpret that information, and what conclusions they draw as part of their processes. Now we've found another exception to what we're calling the Law of Analytical Disagreement: Gartner and IDC both said the ongoing shortage of Intel processors is to blame for a global decline in PC shipments.

Both research firms released their findings on April 10. There are still a few differences between their findings: Gartner thinks PC shipments fell by 4.6 percent, IDC thinks they fell 3 percent; Gartner has Lenovo as the market leader, IDC has HP, and Gartner focused more on Chromebook growth than IDC. Yet their findings are otherwise similar, and they even landed on the same number of units shipped this quarter, at 58.5 million.

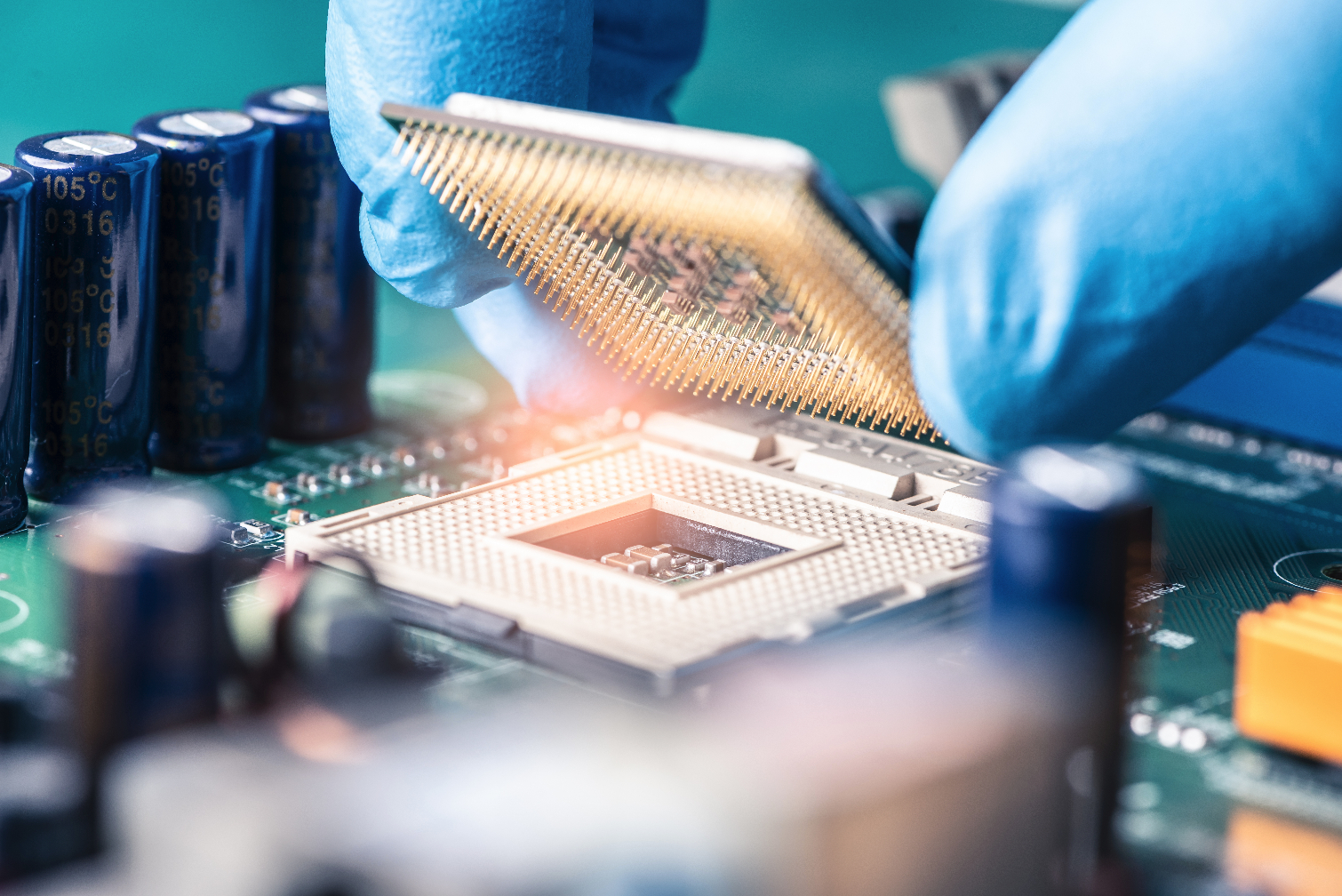

Gartner and IDC both agreed that Intel's CPU shortage affected the low end of the market and forced manufacturers to look elsewhere. There's a reason why AMD has finally established a foothold in the Chromebook market, for example, and why companies focused more on business-ready products than their consumer counterparts. There simply aren't enough Intel processors to support the low end of the PC market right now.

“The supply constraints affected the vendor competitive landscape as leading vendors had better allocation of chips and also began sourcing alternative CPUs from AMD,” Gartner senior principal analyst Mikako Kitagawa said. “The top three vendors worldwide were still able to increase shipments despite the supply constraint by focusing on their high-end products and taking share from small vendors that struggled to secure CPUs."

Kitagawa also said that shift in focus away from consumer products and towards high-end devices could benefit the big three (HP, Lenovo, and Dell) manufacturers. Component prices have dropped, but that doesn't mean the price of these enterprise products has declined. That could lead to improved profit margins, and because other companies can't source CPUs, the shift in focus doesn't hurt these companies' consumer offerings.

IDC also noted that more manufacturers have turned to AMD for their CPU needs, and said the U.S. market, in particular, was affected by the processor shortage. "Intel CPU shortages continued to pose a production bottleneck for PC makers," the research firm said, "making it difficult to meet new demand especially from the business side as the Windows 10 migration continues." Dwindling consumer demand is also an issue.

These findings support what we've already suspected: that Intel is far from the only company affected by its processor shortage and that manufacturers are turning to AMD for their CPUs rather than simply waiting for Intel to ramp up production. Finding evidence of those claims from one research firm would be validating; finding it from two firms that don't agree on pretty much anything is even more so.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nathaniel Mott is a freelance news and features writer for Tom's Hardware US, covering breaking news, security, and the silliest aspects of the tech industry.