Huawei Hides Displayed Chips to Protect Suppliers at MWC

Gotta keep them guessing.

For Huawei, it is close to impossible to procure chips for its server and communications products that are widely used in China and other countries. But that doesn't mean that the company cannot get chips at all; it just does not want anyone to know who sells them. At Mobile World Congress in Barcelona, the company demonstrated its new server motherboards with all chips covered with disguising tape and coolers to hide the names of its suppliers.

Huawei still sells boatloads of servers and communication equipment in China and a number of other countries, but to build those devices, it needs chips. Virtually all chips today — whether they are logic or memory ICs — are designed using electronic design automation (EDA) tools developed in the U.S. and produced on equipment containing technologies created in America, so their suppliers need to get appropriate licenses from the U.S. Department of Commerce to sell them to Huawei or its subsidiaries.

But getting those licenses is tricky, which is why Huawei likely has to buy chips on the gray market or use complicated means to get hardware from its developers. In both cases, the company prefers not to demonstrate what it uses openly and hides its suppliers, as we can see from images published on Twitter by Jay Goldberg, a 5G, IoT, and networking analyst focused on China. Of course, another reason to hide chips that it uses from prying is could be a way to conceal trade secrets from competitors (and we know that there are Chinese companies copying Huawei's products).

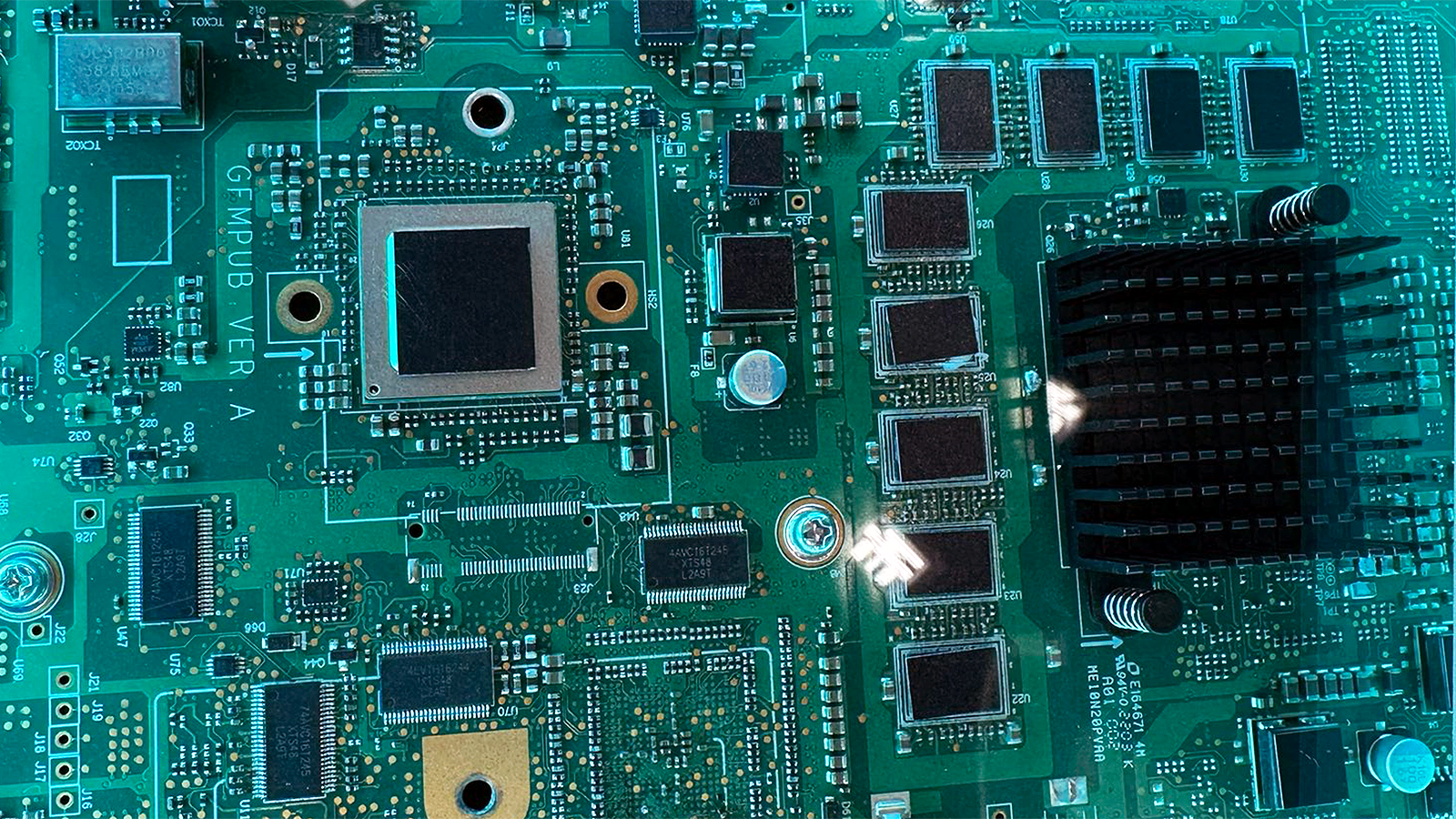

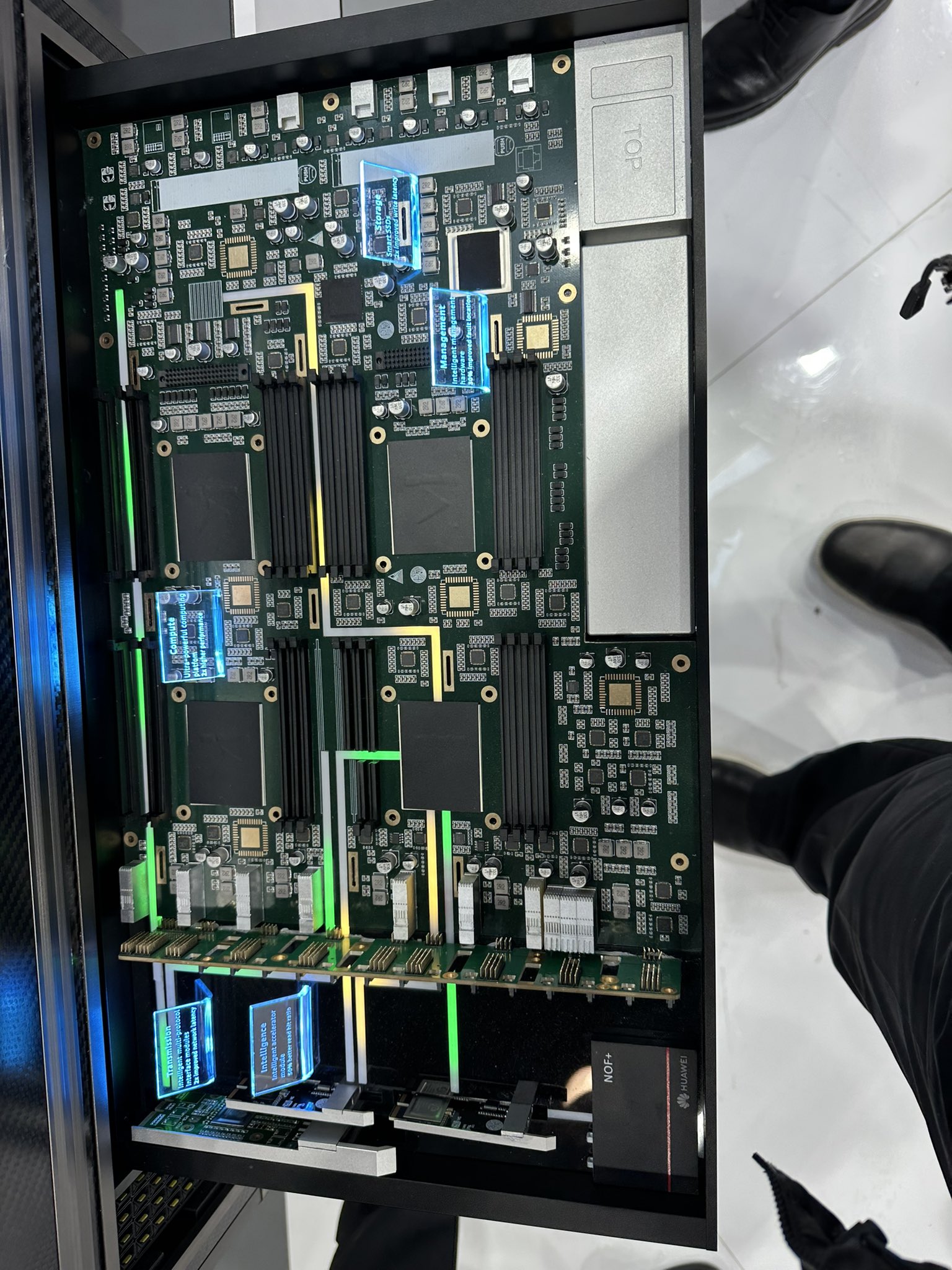

Visiting the Huawei booth #MWC2023. They have a dozen or so boards on display and the package of every single chip on every single board is obscured. pic.twitter.com/gwMDorOdA6March 1, 2023

You need to expand the above tweet to see the images. One of the boards (marked at GFMPUB Ver. A) not only conceals logic chips using a radiator or tape, but even hides the supplier of the memory ICs. Another board, which looks like a prototype (or even a mockup) of a 4-way server motherboard, not only conceals the markings on some of the chips, but even does not carry processors, perhaps to guarantee that no one could guess their producer even if the board gets stolen.

After Huawei became a victim of the ongoing trade war between the U.S. and China on the grounds that it has ties with the People's Republic army, the company can no longer procure hardware and software from U.S.-based companies or containing technologies developed in America without getting an appropriate license from the U.S. Department of Commerce. Huawei's HiSilicon subsidiary lost access to advanced semiconductor production outside of China, which to a large degree blocked its advanced chip development.

As it turns out, there are still ways for Huawei to obtain the chips it needs. Furthermore, the company is reportedly working with China-based SMIC — another company that lost its ability to develop at a rapid pace because of the U.S.-imposed sanctions — to build a fab capable of producing chips and system-in-packages it needs to build its products.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

PlaneInTheSky ReplyFor Huawei, it is close to impossible to procure chips for its server and communications products that are widely used in China and other countries.

Close to impossible? Where does this idea come from?

TSMC has giant factories in mainland China. TSMC fab 10 in Shanghai produces millions of chips for China each year. They're literally next door to China's own SMIC.

Chiang Shangyi, head of research of TSMC, is now head of research for China's SMIC.

SMIC also has complete access to EUV tech thanks to IMEC. It's just a matter of time before China has a working EUV production line.

If the West wants to cut off advanced chips to China, they need to also cut off TSMC and limit IMEC's deals with China, because Taiwan, China and IMEC have an open door policy when it comes to chips and research, tons of people working for TSMC now work next door for China's SMIC. Tons of people who helped design EUV at ASML and IMEC, now work for China's SMIC.

This idea that China can't access advanced chips is a made up fantasy.

-

BaRoMeTrIc Wouldn't it make more sense just to ask the suppliers not to silk-screen the chips allocated for them?Reply -

Integr8d “After Huawei became a victim of the ongoing trade war”Reply

Lol. Don’t you mean ‘after they were the beneficiary of rampant IP theft’? -

gg83 Reply

He can't say that because he'd offend people who don't like the West. It's a more democratic way to say it.Integr8d said:“After Huawei became a victim of the ongoing trade war”

Lol. Don’t you mean ‘after they were the beneficiary of rampant IP theft’? -

cirdecus Reply

Those fabs don't produce anything smaller than 16nm dude. And the approach to cutoff china is to reduce it's ability to procure the chips. They know it won't cut off all of them. It will simply buy us time.PlaneInTheSky said:Close to impossible? Where does this idea come from?

TSMC has giant factories in mainland China. TSMC fab 10 in Shanghai produces millions of chips for China each year. They're literally next door to China's own SMIC.

Chiang Shangyi, head of research of TSMC, is now head of research for China's SMIC.

SMIC also has complete access to EUV tech thanks to IMEC. It's just a matter of time before China has a working EUV production line.

If the West wants to cut off advanced chips to China, they need to also cut off TSMC and limit IMEC's deals with China, because Taiwan, China and IMEC have an open door policy when it comes to chips and research, tons of people working for TSMC now work next door for China's SMIC. Tons of people who helped design EUV at ASML and IMEC, now work for China's SMIC.

This idea that China can't access advanced chips is a made up fantasy.

-

passivecool as we have observed from intel, large structures + exorbitant electricity = competitive calculation performance.Reply -

Co BIY I'm surprised this isn't the industry standard. Even better, a black box and demonstrate the work it can do.Reply