Intel Engaging in 'Semi-Destructive' Actions Against AMD, Says Firm

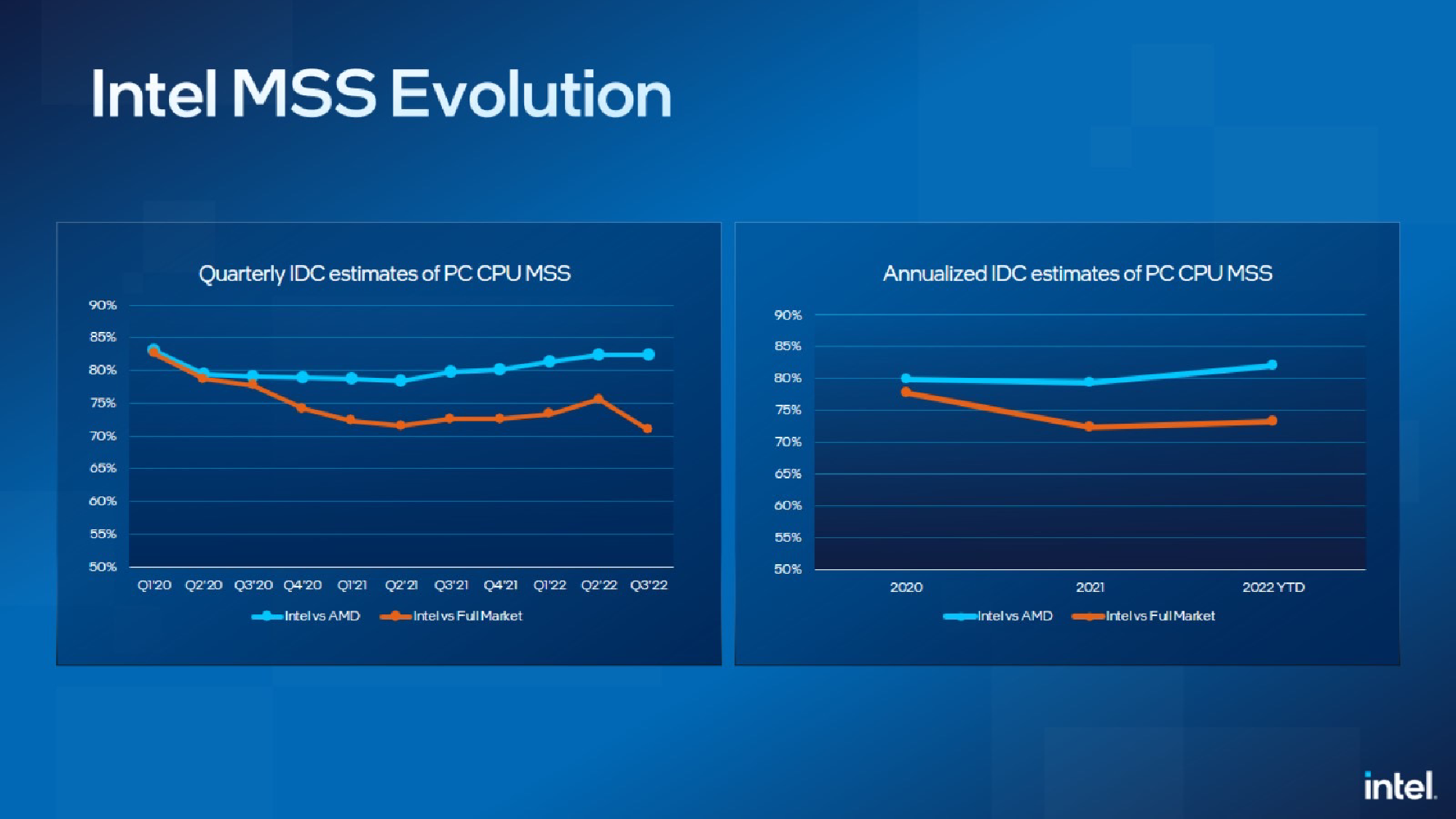

Intel uses capacity and price to sustain market share, limit AMD's PC market share expansion.

A leading Wall Street firm has downgraded AMD, saying that Intel had engaged destructive actions against its smaller rival in the desktop PC space to slowdown its market share expansion. These actions could eventually hurt Intel itself, but for now it can use its vast manufacturing capacity and ability to offer competitive pricing to outsell its competitor and prevent its penetration into lucrative high-end notebook space.

"In recent months we have been growing more wary of potential PC dynamics, both given the market outlook as well as exacerbated by Intel's semi-destructive behavior as of late as they use both price and capacity as a strategic weapon, continuing to overship even amid broader breakdowns in the industry," Stacy Rasgon, an analyst with Bernstein Research, wrote in a note to clients, reports SeekingAlpha. "It seems to us that Intel has decided that if the channel is going to hold parts, it might as well be their parts."

Around 53% of Intel's revenue came from its Client Computing Group in Q3 2022, which is why it needs to protect this business unit at all costs. Yet, while the company's most recent generations of client CPUs — Alder Lake and Raptor Lake — are extremely competitive, it is getting harder for Intel to maintain its client PC earnings.

First up, its rival AMD focuses primarily on higher-end CPUs for desktops and notebooks; While this somewhat limits its market share growth, it steals sales and profits from Intel's CCG.

Secondly, one of Intel's most important customers — Apple — now uses its own processors for the vast majority of its computers. Apple's PC market share is increasing and in Q3 2022 it controlled 13.5% of PC shipments, which means that Intel lost around 13% of the PC market since late 2020 when Apple began to use its own system-on-chips instead of Intel's processors.

Finally, the PC market is weak and sales of CPUs is down and the competition between Intel and AMD is getting fiercer. To ensure that AMD does not ship all the units it can, Intel is apparently using its vast production capacities, heavy discounts, and close ties with PC makers.

"Naturally this will hurt Intel as well, but as their economics are already in free fall perhaps they don't care as much anymore," wrote Rasgon, reports The Street.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

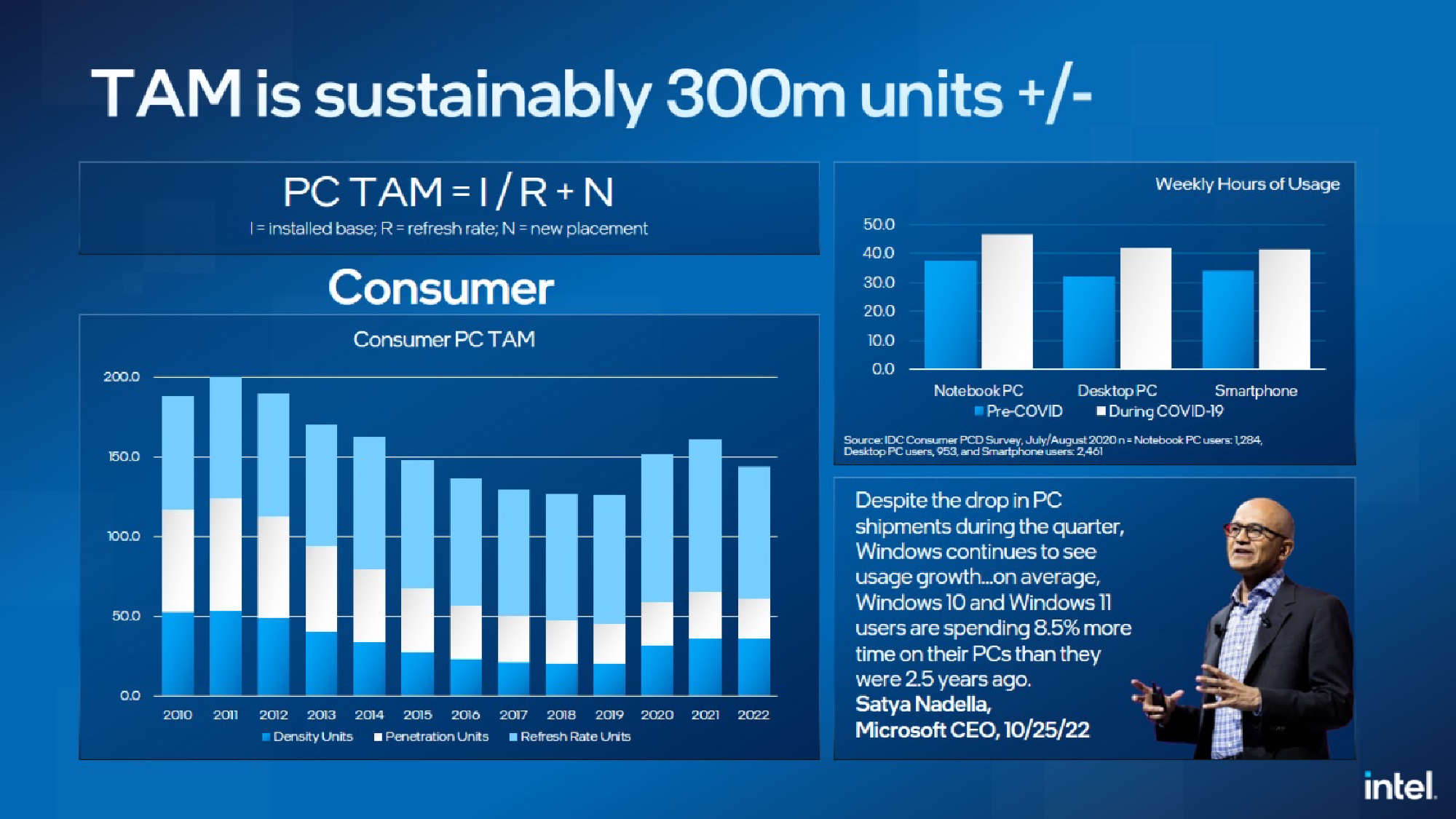

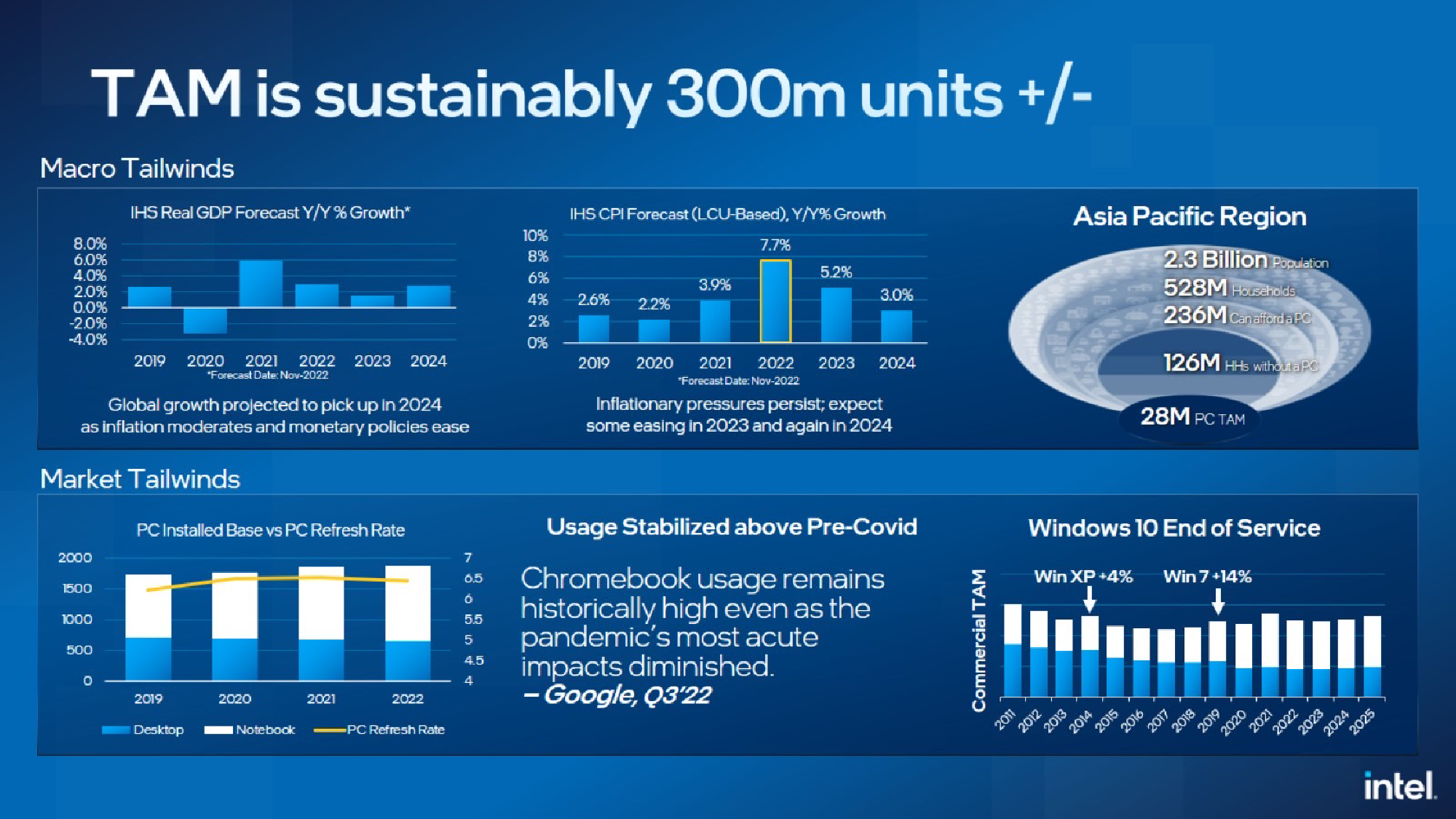

But Intel seems to have different opinion about the future of PC market. The company is confident that total available market of PCs is about 300 million units a year, and it predicts PC TAM to be in the range between 270 million and 290 million in 2023, Intel disclosed at its recent PC TAM event for analysts and investors. Furthermore, Intel competes against AMD pretty successfully in the PC space (at least based purely of unit share), so perhaps its aggressive actions are aimed not only at AMD, but on Apple, which eats sales of Intel's customers like Lenovo, HP and Dell.

But it looks like for now, AMD suffers more than Apple. While the company is particularly strong with its datacenter-oriented EPYC CPUs, it is relatively weak on the PC market, which is why Bernstein Research cut its per share target for AMD from $95 to $80.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Jimbojan Intel wants to gain market share by lowering its product price, that is nothing wrong with it. It is likely to gain shares in Graphics, and server ( data center) too as it is lowering price with better performance in these graphic and server markets.Reply -

-Fran- Intel also offers HP, Dell and other OEMs to design full systems around their hardware, so they don't have to incur in R&D costs for it. So Intel is not just "selling cheap" (bulk, priority and premier partner), but also amortizing their OEM's R&D costs, which is bananas. This is definitely running Intel dry and fast, so the question here is: how long does Intel have before getting too close to the point of no return? These are clearly short term strats which should be punishing their share price, but they're so big and widespread that they're betting on drying AMD first.Reply

Regards. -

nimbulan So shrinking margins to improve competitiveness is considered "semi-destructive actions" now?Reply -

Soaptrail This Tom's article is poorly written and a nothing sandwich. If there Intel is attempting to do some more shady stuff to stop AMD this article did not convey that to the readers.Reply -

helper800 Reply

It depends on what they mean, right? If they mean that they are overproducing and getting zero or negative margin to flood the market then it makes sense saying it this way.nimbulan said:So shrinking margins to improve competitiveness is considered "semi-destructive actions" now? -

bluvg "Breaking news! Company reduces prices to be more competitive!" First people complain that Intel's prices are too high. Now they're complaining they're too low? If Intel becomes unprofitable, perhaps then there's something to talk about beyond just the short-sighted impact on stock price.Reply -

bit_user Reply

I would also liked to have seen more detail, but you're missing a key point. The first sentence of the article reads:Soaptrail said:This Tom's article is poorly written and a nothing sandwich. If there Intel is attempting to do some more shady stuff to stop AMD this article did not convey that to the readers.

"A leading Wall Street firm has downgraded AMD, saying that Intel had engaged destructive actions against its smaller rival in the desktop PC space to slowdown its market share expansion."

And the article ends with:

"... Bernstein Research cut its per share target for AMD from $95 to $80."

So, it's not Toms who's saying this - they're just reporting that a Wall St. firm saying it.