Intel's Fourth-Gen Optane Teased, but Future Looks Gloomy

Too expensive to own, too valuable to drop.

As of 2020, Intel had plans for 3rd- and 4th-generations of Optane products based on 3D XPoint memory (via Blocks & Files), but it is seemingly becoming increasingly unlikely that we'll see those products come to market. Especially given that we haven't heard much information about them.

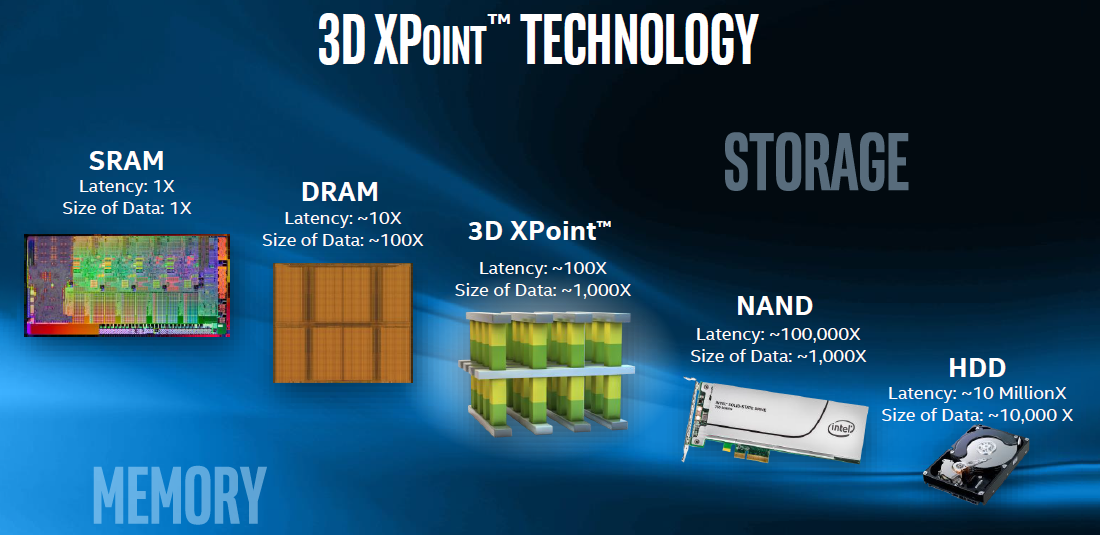

Once considered a brand-new class of non-volatile memory enabling innovative applications, 3D XPoint is now looking more like a suitcase without a handle: While it still has a lot of value both for Intel and the industry, its development and production costs could be too high to keep evolving the technology.

Big Plans, Limited Returns

Aimed at performance and longevity-demanding applications, 3D XPoint memory, jointly developed by Intel and Micron, was meant to co-exist with 3D NAND for years to come. But while the developers once had big plans for the technology, Micron was the sole volume Optane manufacturer and its fate appears particularly dire after Micron abandoned it.

Today, the destiny of Intel's Optane-branded products based on 3D XPoint remains completely unclear: Intel has a boatload of 3D XPoint memory in stock that it obtained from Micron and it has a product roadmap, but the Optane lineup has bled money for years, cheaper CXL-based technology options are emerging, there is nowhere to produce 3D XPoint (for now), and Intel's Optane team is losing members.

Due to the structure of 3D XPoint, it is not as easy to scale vertically as traditional 3D NAND. To that end, Intel has only commercialized two generations of 3D XPoint memory (and two major generations of Optane products with some enhanced versions in between) since their first emergence in 2017.

As of 2020, it appears that Intel had plans for its 3rd-and 4th-generations of Optane products, as it appears from a video that is still located at Intel's website (found by Blocks & Files) and which shows Darren Denardis, the executive responsible for Intel's 4th-Generation Optane Program. This new generation of Optane was developed in Rio Rancho, New Mexico, where 3D XPoint memory was made in small batches for R&D purposes.

Producing 3D XPoint memory is generally more expensive compared to producing 3D NAND, and stacking 3D XPoint layers is harder too. These factors make its price-per-bit significantly than flash. But 3D XPoint/Optane also promises lower latencies, faster reads and writes as well as higher endurance, benefits that are hard to overestimate for many applications.

Both generations of Intel's 3D XPoint memory have been used for various kinds of Optane-branded products. But because these products are rather expensive compared to 3D NAND-based devices and their addressable market is limited, Intel's Optane business has generated some massive losses. In 2020 alone, Optane inflicted a loss of $576 million. Meanwhile, Optane sales in 2021 totaled $392 million. Such massive losses are likely a result of high production costs as well as fab underutilization due to limited demand (extremely low yields are also a possibility, though this seems unlikely at this point).

Nowhere to Produce?

Back in November, SemiEngineering reported that Intel began to move the equipment out of the 3D XPoint production line in New Mexico after halting capital spending on the technology. The report cites 'multiple sources in the equipment industry' and seems generally credible. It's noteworthy that the Rio Rancho facility was only used for 3D XPoint research and development, so while it did produce the memory, it didn't produce enough to be considered a high volume manufacturing facility. Instead, that role fell to Micron.

Intel's Rio Rancho, New Mexico facility is currently used to fab chips using 14 nm process technology and will be used to package chips using Intel's Foveros technology, so while the fab is probably busy. However, it is hardly as busy as it used to be when the majority of Intel's products were made using its 14 nm node. To that end, if Intel is moving out equipment required for 3D XPoint memory production, it is either ceasing to produce this type of memory or is setting up a new development and volume production facility somewhere else.

Ceasing the production of 3D XPoint ICs does not mean the end of Optane products. As noted above, Intel had acquired a large supply of 3D Xpoint memory from Micron before the latter sold its fab in Lehi, Utah, to Texas Instruments in October 2021. Therefore, if Intel wants to continue developing its Optane products, it can certainly do so.

But at least some executives are leaving the Optane ship. Earlier this month, Alper Ilkbahar, vice president and general manager of the Intel Optane Group, departed from the company for personal reasons, according to CRN. He will be replaced by David Tuhy, who previously headed Optane and SSD software efforts at Intel.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Persistent Memory for the Win?

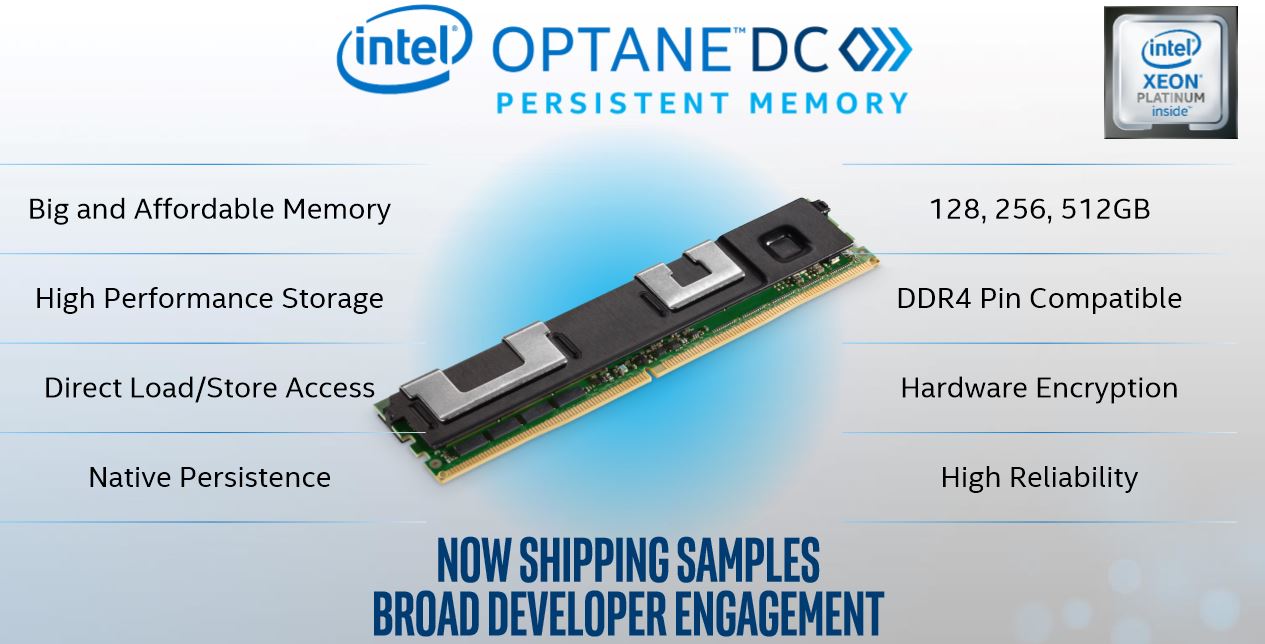

Intel has used 3D XPoint for four types of products: caching Optane SSD Modules for hybrid storage subsystems in client PCs, mid-range client SSDs with Optane Memory cache, high-end client SSDs, datacenter Optane DC SSDs, and non-volatile Persistent Memory modules for Intel Xeon Scalable processors.

Keeping in mind the costs of Intel's Optane products, Intel's efforts have shifted to high-end datacenter SSDs as well as Persistent Memory modules for select Xeon Scalable CPUs that need large pools of data available close to them at low latency.

Intel currently offers Persistent Memory 100-series for Xeon Scalable 'Cascade Lake' CPUs (codenamed Apache Pass) and Persistent Memory 200-series for Xeon Scalable 'Ice Lake' and 'Cooper Lake' CPUs (codenamed Barlow Pass). It also has Optane SSD DC P4800X and P5800X drives for servers with a PCIe 4.0 x4 interface.

Having launched Persistent Memory 100/200-series, Intel had at least two more generations of Persistent Memory modules for Intel Xeon Scalable processors in development: the codenamed Crow Pass for Sapphire Rapids with a PCIe 5.0 interface and the codenamed Donahue Pass for Granite Rapids, reports Blocks & Files.

We can only speculate that Crow Pass was supposed to use 8-layer 3D XPoint dies with a 512Gb capacity, and Donahue Pass could use 16-layer 3D XPoint ICs with a 1Tb capacity. Meanwhile, Intel hasn't disclosed anything about 3rd-Gen Persistent Memory with a DDR5 interface for Sapphire Rapids CPUs. In fact, we have not even heard rumors about the sampling of appropriate modules.

CXL In, Optane Out?

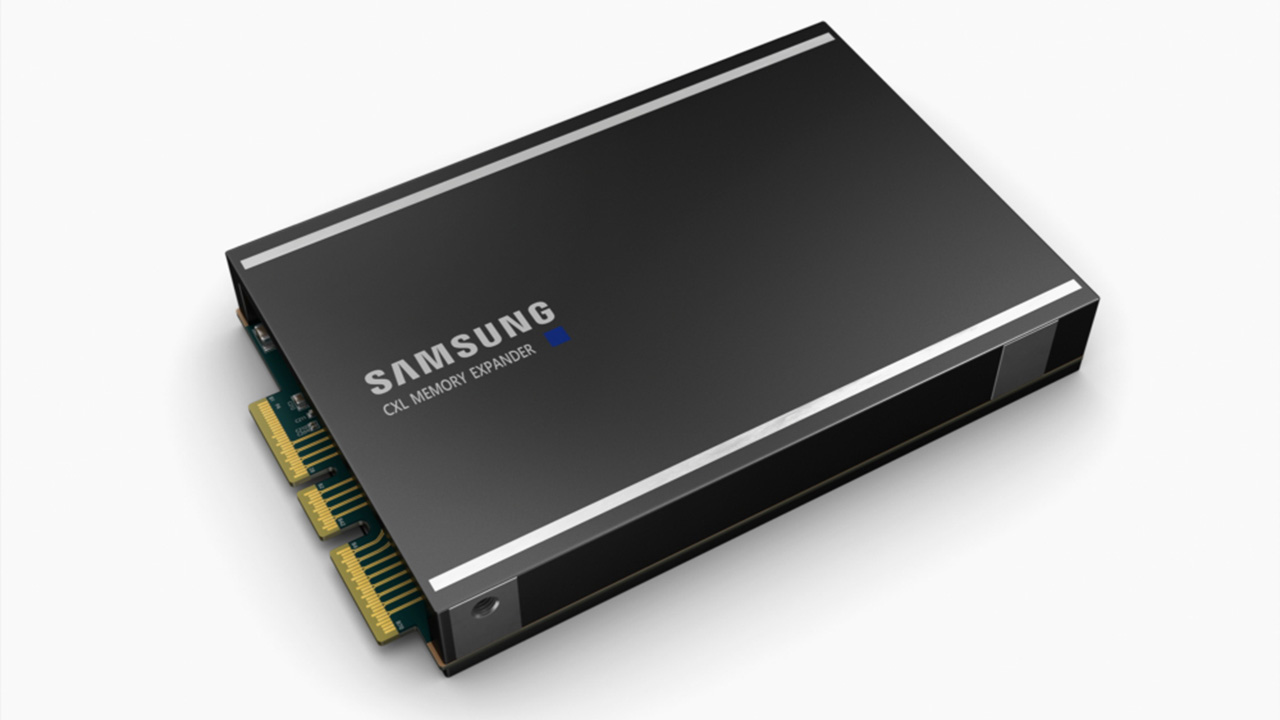

There is another looming problem for Optane. The first products featuring the industry-standard Compute Express Link (CXL) coherent low-latency interconnect protocol are due to be available this year.

CXL enables sharing system resources over a PCIe 5.0 physical interface (PHY) stack without using complex memory management, thus assuring low latency. CXL is supported by AMD's upcoming EPYC 'Genoa,' Intel's forthcoming 'Sapphire Rapids,' and various Arm-powered server platforms.

The CXL 1.1 specification supports three protocols: the mandatory CXL.io (for storage devices), CXL.cache for cache coherency (for accelerators), and CXL.memory for memory coherency (for memory expansion devices). From a performance point of view, a CXL-compliant device will have access to 64 GB/s of bandwidth in each direction (128 GB/s in total) when plugged into a a PCIe 5.0 x16 slot.

PCIe 5.0 speeds are more than enough for upcoming 3D NAND-based SSDs to leave Intel's current Optane DC drives behind in terms of sequential read/write speeds, so unless Intel releases PCIe 5.0 Optane DC SSDs, its existing Optane DC SSDs will lose their appeal when next-gen server platforms emerge. We know that more PCIe Gen 4-based Optane DC drives are incoming, but we haven't seen any signs of PCIe 5.0 Optane DC SSDs.

Meanwhile, CXL.memory-supporting memory expansion devices with their low latency provide serious competition to proprietary Intel Optane Persistent Memory modules in terms of performance. Of course, PMem modules plugged into memory slots could still offer higher bandwidth than PCIe/CXL-based memory accelerators (due to the higher number of channels and higher data transfer rates). But these non-volatile DIMMs are still not as fast as standard memory modules, so they will find themselves between a rock (faster DRAMs) and a hard place (cheaper memory on PCIe/CXL expansion devices).

Summary

While Intel's 3D XPoint memory and Optane products continue to offer numerous performance and longevity benefits over 3D NAND, and density benefits over DRAM, their future looks gloomier than it did a year ago.

With the arrival of PCIe Gen 5 CXL-supporting devices that will be compatible with all server platforms, the attractiveness of Intel's existing Optane DC SSDs will fade and so will the appeal of Intel's Optane Persistent Memory for Xeon Scalable CPUs unless Intel comes up with another generation of Optane products.

Intel has certainly benefited from selling Optane Persistent Memory-supporting Xeon Scalable processors with enhanced memory support, but the Optane business has bled money, possibly due to limited demand. Therefore, the open question is whether it makes financial sense for Intel to keep developing Optane products and making 3D XPoint memory.

In fact, it is completely unclear whether Intel plans to keep producing 3D XPoint memory and develop its future generations now that it is reportedly removing the appropriate production equipment from its Rio Rancho fab in New Mexico.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

JayNor I believe Intel's manufacturing deal with Micron did not go beyond Gen2 Optane used on Ice Lake, so Micron's early exit would not affect Intel's Gen3 Optane plans.Reply

Intel doesn't have to produce pcie5/cxl SSD drives to use cxl. They only need to produce an external cxl memory controller chip that communicates with the current DIMM chips in whatever package format they are converted to. -

emv optane is still selling gen 1 very slowly. so we will never see gen 3 or 4... those are doomed. it was a nice experiment but its time for intel to refocus on foundry and logic processes and see how that gamble goes.... it a big gambleReply