Intel's Optane Business Haemorrhaged Over Half a Billion Dollars in 2020

Sales were even weaker in 2021. Calculations suggest another $500 million loss occured.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

Intel Optane was launched with great fanfare in 2015, but seems to be slipping further from the radar as we enter 2022. Now storage focused tech news outlet Blocks & Files appears to have found the underlying reason why Intel is rolling back efforts to promote or highlight Optane.

Figures suggest Optane is a massive drain on company finances. In 2020, the last year with complete figures for Optane's income contributions, it inflicted a loss of $576 million, according to numbers from the official 10K SEC filing. Calculations suggest the Optane business has lost more than $500 million again in 2021.

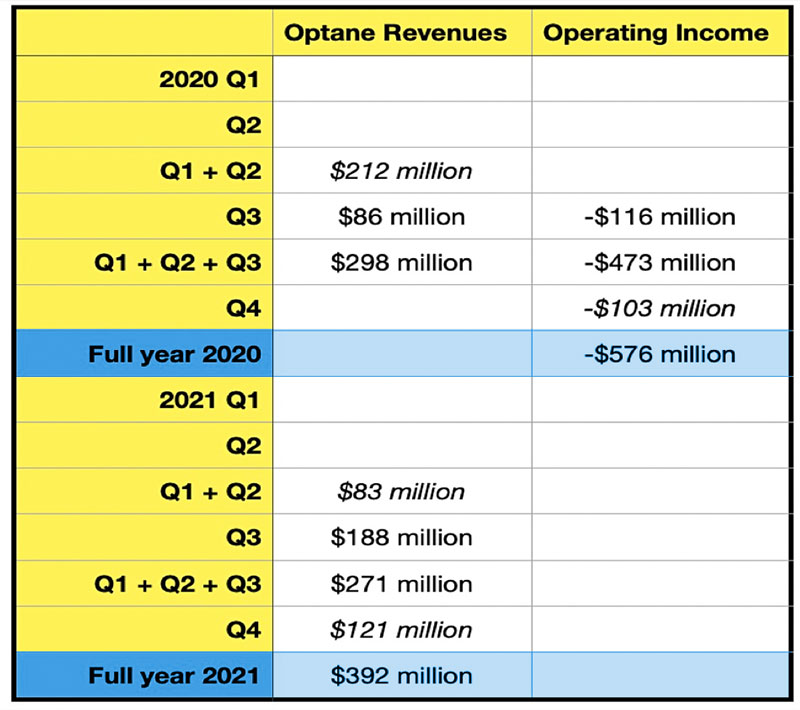

In its report, Blocks & Files checked through Intel's financial filings from the years 2020 and 2021. Intel doesn't always break out figures for the Optane business, but in 2020 it transferred this part of its operations between the Non-Volatile Memory Solutions Group (NSG) and Datacenter Solutions Group (DSG). This flipped the light on operating income in 2020, and allowed the source to fill some gaps (back-calculated figures are in italics in the table).

In the above chart, you can see a loss of $576 million, attributed to Optane business operations in 2020. In 2021, things aren't as clear, as we haven't had any financial event to surface Optane's operating income figures. But using the same ratio of revenues to income in 2021 as we saw in 2020, we might reasonably expect that Intel's Optane business lost around $530 million.

Summing up the financial revelation and speculation above, we can't say for sure that Intel again suffered a bruising loss of more than half a billion dollars thanks to its Optane business in 2021, but the numbers we know certainly don't look good. Still, despite such losses, Optane might be valued by Intel as one way to promote its Xeon servers.

Looking Back at the History of Optane

It is probably fair to say that Optane hasn't really lived up to its potential. The paradigm-shifting technology, which promised to bridge the gulf between DRAM and NAND, thanks to the innovative high-density non-volatile memory technology, vanished from the consumer sphere about a year ago. When Intel begrudgingly admitted that consumer devices were off the menu, the company had been recently supplying Intel Optane Memory H20 for laptop makers.

Last year also saw technology partner Micron give up making products based on the shared 3D Xpoint Technology (Optane is simply Intel's brand for devices packing 3D XPoint). A few months after that news, Micron sold its 3D XPoint Fab to Texas Instruments for $900 million.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

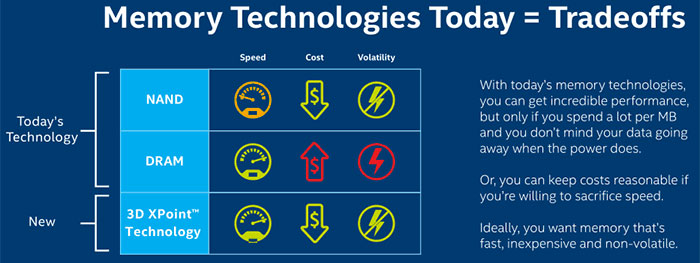

So, what went wrong with Optane? At launch, it was promoted as a memory technology with none of the trade-offs of DRAM or NAND. Intel and Micron said the new memory tech could nicely fit that yawning chasm by being fast, cheap, and non-volatile.

But on the consumer side, the first products were low capacity, pricey, and rather underwhelming in some applications. For example, HDDs paired with Optane Cache drives didn't cause much worry for SSD makers. And without mind share from enthusiasts and IT professionals driving its uptick in production, the technology never really caught hold at a scale that could push prices down dramatically, drive software development to optimize for it, and make it a product that consumers and datacenter managers were clamoring for.

Perhaps one day this kind of best-of-both-worlds tech will rise again with more of an impact. Emerging memory technologies, like UltraRAM for example, also attempt to unify memory and storage.

As universities and other institutions continue to work on related technologies, perhaps at some point Intel will earn back large chunks of its investment on patent licensing and we'll eventually get another round of truly stunning storage tech. But until then, for Intel, it seems likely Optane will remain a massive write-off as a technological moonshot that, while technically a success, never really got the adoption necessary to make it successful. But as big as those losses might be, as a company with close to $35 billion in cash as of late 2021, these are still losses that the tech giant can shrug off, as it looks to the next potential breakthrough technology.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Everyone writing about Optane forgets about the limitations Intel emposed on it. Had to have n-th generation CPU, same for chipset. It wasn't really the price, I'd buy one if I could. It was "you won't be able to use Optane because your Intel processor is to old and we don't care" logic that prevented me.Reply

-

maestro0428 Intel really missed the boat with pricing on the Optane drives and the timing as well. People were already dumping HDs for SSDs and the accelerator version of Optane was finicky to set up or recover data from. That said, I LOVE OPTANE. I have five of them in my workstation. Two PCIE 900p and two U2 900p and one 800p M2 stick. Everything thing is faster as all my data is on Optane. They get filled up but never slow down and they are far more durable than nvme drives. Sure, sequential is a bit slower, but in real life, you don't notice it. I came from Western Digital Blacks SN750s which are no slouch either. Just wish I could afford the new 5800x PCIE 4 versions of the drives.Reply -

Kamen Rider Blade As long as Intel makes it "Proprietary" with all these Gotcha's, it'll die on the vine.Reply

ThunderBolt was going that route until they opened it up to USB-IF.

If Intel wants Optane to take-off, it needs to hand over the specs, API's, tech to JEDEC and let everybody play without licensing costs.

Otherwise it'll be doomed. -

JayNor The most recent Sapphire Rapids chip slides show Gen3 Optane as supported. It was supposed to be used in the Aurora project.Reply

Leaked slides for Emerald Rapids show "CXL-MEM" as an addition. Someone at Intel gave a presentation, stating that Optane would be available in different package configurations via a memory controller that will be on the CXL bus. -

rluker5 Reply

The limitations depend on what you buy. I ran my pcie 900p as a boot drive on a few different Z97 motherboards with no issues. My Z97 boards didn't want to boot from nvme m.2 for some reason, but that same 800p would work fine for boot in a m.2 to pcie adapter. Of course my Z97s couldn't run the 16,32GB memory sticks to their potential. Just as tiny non boot drives so not worth it on that platform.tommo1982 said:Everyone writing about Optane forgets about the limitations Intel emposed on it. Had to have n-th generation CPU, same for chipset. It wasn't really the price, I'd buy one if I could. It was "you won't be able to use Optane because your Intel processor is to old and we don't care" logic that prevented me.

It is a shame it never caught on enough to scale down costs. It probably won't be tried again. I use it for OS and drag over my most played games. It mostly just helps load times. If you want to see how much check out 3dmark's ssd benchmark. -

watzupken This is a self inflicted injury in my opinion. Intel wanted to keep Optane within its ecosystem, and even within that ecosystem, they dictate that only certain chipset and processor will be able to use it. The high cost and high power consumption limited its use to mostly desktop or just a small cache in mobile device. So from the consumer standpoint, it is not surprising it failed.Reply

From an enterprise standpoint, I feel those restrictions are not the main issue, but I feel the cost and high power draw may have done it in. And as enterprise starts to use AMD and ARM based systems, it will further limit sales.

Overall my opinion is that Intel dropped the ball on Optane. I don't always follow the news on Optane, but I was quite excited about it at launch. It was a promising replacement for NAND based SSDs, but it is not without its problems. Intel could have worked on improving it, but I don't think much was done to address the shortfalls. -

TerryLaze Reply

Those limitations are imposed by the technology itself.tommo1982 said:Everyone writing about Optane forgets about the limitations Intel emposed on it. Had to have n-th generation CPU, same for chipset. It wasn't really the price, I'd buy one if I could. It was "you won't be able to use Optane because your Intel processor is to old and we don't care" logic that prevented me.

The whole idea was for the CPU to be able to directly read and write to the hard disk as if it where ram, a CPU that doesn't know it can do that...well, can't do that.

If your CPU can't do it you are left with using a software driver which defeats the purpose of circumventing the software to get higher speeds.

https://www.intel.com/content/www/us/en/architecture-and-technology/optane-technology/faster-access-to-more-data-article-brief.htmlAnd the Intel® Optane™ SSD has been designed to provide that advantage to the rest of the computing system through a hardware-only SSD read/write path through the SSD controller, unlike the firmware-involved path found in NAND SSD controllers.

Intel® Optane™ memory technology is byte addressable and allows rapid, in-place writes. NAND requires large block reads and a very large block erases before relatively slow writes. Data returned faster means less time waiting and faster application execution time.

-

Krotow Intel launched Optane for consumer market pretty much too late and for too high price. SSDs was already here and SSD price dropped very fast. Optane drives in end turned out as small system drives, often even slower than SSDs added by user later.Reply

Although because Optane is byte-addressable, it may work very well as unified RAM/storage substitute in embedded devices. So do not close coffin for Optane yet. It will be useful somewhere else. -

JayNor "...The high cost and high power consumption..."Reply

I read an article on the BSC supercomputer on nextplatform. They mention that Optane is 1/10 the power of same sized DDR. See "Building An Ecosystem for Heterogeneous Memory Supercomputing"