Intel: Slower Growth Ahead; May Have Taken Share from AMD

Intel has posted its highly anticipated Q2 quarter results, which were preceded by reports of slowing PC sales and predictions of a decelerating PC business overall.

Intel today reported revenue of $13.5 billion for the quarter, up from $12.9 billion sequentially and up from $13.1 billion for Q2 2011. The result is roughly on track with Intel's forecast from April 17, when the company said it expects revenues of about $13.6 billion, plus or minus $500 million. Intel CFO Stacy Smith said that Intel missed the $13.6 billion mark due to "softness" in the company's NAND memory business. He added that the demand trends for the core business of Intel "played out as expected".

Second quarter net income was $2.8 billion, up from $2.7 billion in Q1 and down from $3.2 billion in Q2 2011. While it is good news that Intel was able to grow its sales and profit, growth has slowed considerably. Year over year, Intel revenue gained about 3 percent, while its Q2 2011 growth increased by 22 percent.

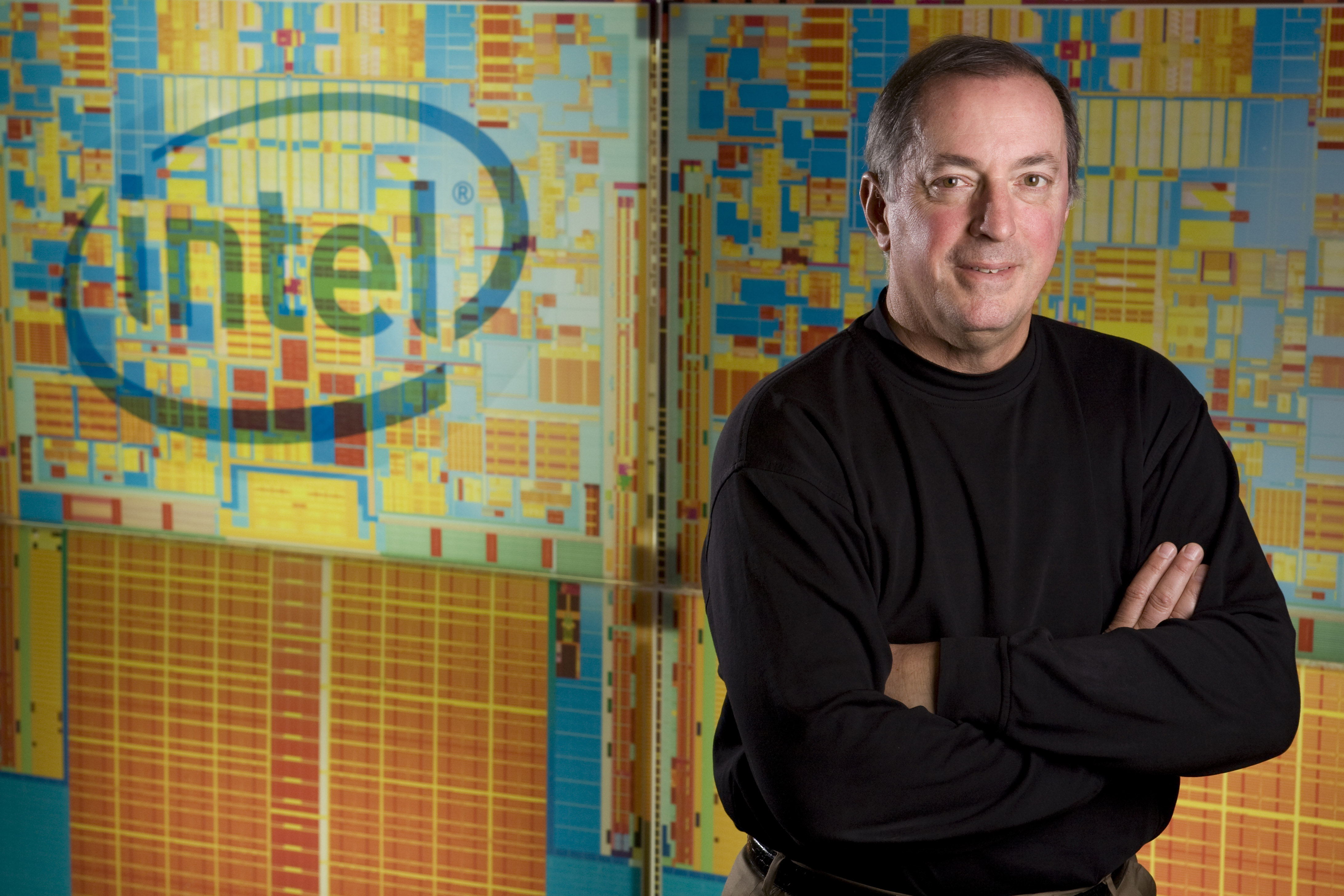

Intel CEO Paul Otellini stated in the official press release that Intel showed "solid execution with continued strength in the data center and multiple product introductions in Ultrabooks and smartphones" during the quarter. However, he warned investors that Intel's growth will be "slower than [the company] anticipated due to a more challenging macroeconomic environment" that is based on weaker than expected consumer demand in Western Europe and North America, as well as "moderating" growth in the BRIC countries (Brazil, Russia, India and China). He believes that Intel's product mix will help the company weather the storm. He highlighted Ultrabook, tablet and phone introductions in the second half as the reason why Intel is "well positioned for this year and beyond."

Intel expects Q3 revenue of about $14.6 billion, give or take $500 million to the south and north. Aggregate annual growth has been adjusted to the 3 to 5 percent range, down from "the high single digits," Intel said. Interestingly, Intel expects the slowdown to last only one quarter. For Q4 of this year, Smith said that he would expect a "seasonal quarter on the back of a below seasonal Q3". His optimism was based on low inventory levels in Q3 as well as the expectation of a strong Windows 8 launch.

Investors took the Q2 news and market outlook news with a notably positive attitude and kept Intel's stock about flat in immediate after hour trading.

During the conference call with analysts, Otellini responded firmly to previous speculation that Ultrabooks could not be selling as well as originally predicted. The executive noted that Ultrabook shipments met Intel's shipment goal and that the company was "very pleased with the level of innovation in the market". There are currently 140 Ivy Bridge Ultrabook designs in the "pipeline", 40 of them being touch enabled and 12 being convertible designs. In addition, Intel expects to see 20 Clovertrail-based Windows 8 tablets, in addition to Core-based products.

Otellini stressed that the $699 price goal for Ultrabooks will be met by fall of this year. That goal is apparently on the roadmap without price cuts for Ivy Bridge processors. Contrary to rumors, Smith said that Intel does not plan on cutting Ivy Bridge prices. "I have not seen those [price cut] reports," Smith said. "But we are not changing our pricing strategy. Perhaps those reports to the fact that we are filling in more Ivy Bridge SKUs."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The overall tone of the call was clearly set against any concerns that question the appeal to Ultrabooks (and Intel tablets) in the market. Questions referring to possible threats were quashed rather quickly. For example, a question asking what the impact of Microsoft's Surface tablet may be, was answered with a simple "I don't know" and the note that Intel would want Microsoft as a customer again. "We haven't sold chips to them since the Xbox days," Otellini said.

Needless to say, Otellini was also focused on stressing an "exciting" upcoming launch of Windows 8 "just around the corner". As usual, the executive also commented on the state of its production ramp. According to Otellini, nearly 25 percent of all processors built by Intel are now made in 22 nm. The ramp is proceeding much faster than the 32 nm ramp, he stated.

Based on Intel's statements, it is almost impossible to conclude that there is a serious downturn for the industry looking ahead. The general mood was cautiously positive, which, of course, now raises questions of what may have happened to AMD? If Intel was able to slide through the quarter with a few dings here and there, why was AMD apparently bruised so badly?

AMD recently said that it expects its revenue to decrease about 11 percent sequentially. The reason may be that AMD is much more exposed to the consumer business than Intel is and economic troubles in Western Europe and North America may reveal themselves much more than they do at Intel, which still has a blossoming enterprise business. Intel and AMD executives usually do not comment on each other's businesses, but they do place needle pokes whenever they can. When Otellini was asked why AMD declines and Intel does not, the executive said that Intel may have "taken share" from its rival especially in the low-end consumer business, which would be rather remarkable and troublesome for AMD.

The low-end consumer business is AMD's strength and should have been resistant against an Intel attack, given the fact that AMD secured the supply of more 32 nm APUs in Q2. AMD's recent strategic changes were especially targeted at this market segment and if Otellini is right, AMD may have to make some adjustments.

AMD will report its Q2 results on Thursday.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

CaedenV If memory serves correctly Q2 of last year was during or shortly after Sandy Bridge, and all of the chipset issues were taken care of. SB offered an amazing value at the time of performance per price compared to the previous generation, which made for a very compelling purchase (heck, even I picked one up later in the year). Ivy bridge is no slouch, but it does not offer the same kind of leap ahead that SB did, focusing instead on laptop and ultrabook sales... which... well... nobody needs one, and we are all happy with our SB chips, so it is no wonder that things have slowed a bit.Reply

At least they get to tell their board of directors 'well... at least we aren't AMD' -

rocknrollz Intel expects Q3 revenue of about $14.6 million, give or take $500 million to the south and north.Reply

I hope they don't expect that.lol I think you meant billion. -

ddpruitt AMD said it expects revenues to decline 11% not that they actually have (could be higher or lower). I doubt it's as bad as it seems, it's Intel's interest to paint a bleaker picture of AMD.Reply -

tomfreak I hate to say this but, if AMD did not catch up in1-2yrs, which they are admmiting themselves that they are not completing with Intel. At this kind of rate Intel move, AMD main core business will be GPU, not CPU anymore.Reply -

sp0nger Didnt AMD recently say they werent going to compete with Intel anymore? Lol well Intel is competing with you sooooReply -

DroKing Intel is still a shitty company. The only reason why they own majority of market is because of their dirty tactics back in 90's therefore you are a shitty company Intel. You bought your way to market supremacy, you didnt achieve it by selling good products so GET THE FUDGE OUT.Reply -

nforce4max Here is a little trick if they really do want a quick buck, cut prices and increase volume rather than wait for demand on the bases of business and ordinary consumers to upgrade when they need to or they could just host a rebate program. Drop the prices of the Pentium and Core i3 line then sales will begin to pick up a little. As for the Celeron make up the losses on the backs of the i5 and i7 sales then sell Celerons for less than what it costs to make them for like $20 a pop boxed with a cooler. It will eat into Atom sales but it also will put pressure on AMD. As for AMD it needs to transition to different fabs such as TSMC and use more modern process tech that isn't as costly to develop for cpu development. May as well begin using similar tools as what they use for their gpu development when it comes to transistor design. AMD can still put plenty of heat on Intel in the low end and low power consumption arena but they need some new meat behind the management department.Reply -

teh_chem TomfreakI hate to say this but, if AMD did not catch up in1-2yrs, which they are admmiting themselves that they are not completing with Intel. At this kind of rate Intel move, AMD main core business will be GPU, not CPU anymore.I think it's important to look at the bigger picture though. CPU speeds have vastly exceeded what any average user needs. By a huge amount. But at the same time, CPU speeds alone can't net what things like GPGPU computing can (in terms of performance). In theory, the APU is a great introduction--it will (hopefully) encourage software producers to adopt the hybrid hardware package and implement things like OpenCL in a much wider form than currently.Reply

Other than that, the APUs are fine. Not bleeding edge performance, but so few people need that, and it's not even priced to be bleeding edge.

Intel has made significant gains with the HD4K chipset, but unless you're buying a higher end IB CPU, most mid-range IB CPUs will be getting the HD2500 (IIRC--like the i3's and some i5's, I think...). Kinda defeats the purpose since most people who buy high-end CPUs will also be doing graphically-demanding tasks (most--of course not all).

This financial forecast is...a handjob from the analyst to intel. AMD might have missed some financials, but they're making progress. And even being a hardware enthusiast, I have to side with AMD--the desktop market is slowly dwindling. Why bother making huge R&D investments to win the CPU clock performance battle if few-to-none of the consumers really care? -

aicom DroKingIntel is still a shitty company. The only reason why they own majority of market is because of their dirty tactics back in 90's therefore you are a shitty company Intel. You bought your way to market supremacy, you didnt achieve it by selling good products so GET THE FUDGE OUT.Where have you been living? In my book, Intel has been offering superior products for years. Since the Conroe days, we've seen win upon win from Intel.Reply