IDC: Only 500K Ultrabooks Sold So Far

Sales don't quite match the marketing yet.

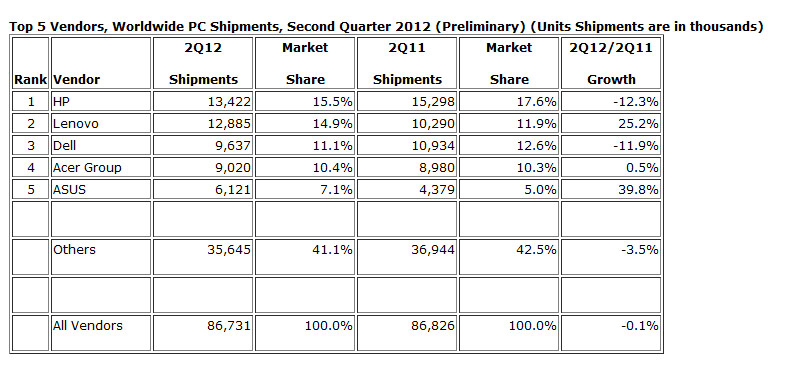

Following a rather sobering Q2 PC market report from Gartner yesterday, IDC has also released some worrying news about the state of the PC market. IDC researchers estimate that shipments fell 0.1 percent from the same quarter last year. The company said that the result is below the projected path of 2.1 percent overall growth for the year, but are in line with slow growth for Q2 and accelerating growth for Q3 and Q4.

Of course, much of that growth would depend on notebooks and the adoption of Ultrabooks, which not only carry Intel's hope to sell more processors, but the hopes of an entire industry that you and I will walk into Best Buy, Fry's or hhgregg and replace an aging system with an ultrathin expensive notebook. Apparently, that has not happened yet on a wider scale, as IDC estimates that only 500,000 Ultrabooks were sold in H1. This compares to forecasted sales of about 225 million notebooks for the year. We remember that Ultrabooks were predicted by Intel to capture about 30 to 40 percent of the market once fully available. "Ultrabooks have not yet produced a significant rise in volumes – in part due to anticipation of improvements such as Windows 8, which is expected later this year, but also due to pricing," IDC said.

From a regional view, the U.S. PC market is developing into a significant concern for the industry. "The U.S. market suffered a double-digit contraction in the second quarter as market saturation and economic factors combine with anticipation of Windows 8 and other changes later in the year. In this context, consumers are delaying purchases, and vendors and retailers are slowing down their PC activities to clear existing inventories," said IDC's David Daoud. "The situation is exacerbated by consumer notebook saturation, a slowing replacement cycle in the commercial sector, and the big macro-economic and political events affecting confidence and spending." Even worse, Daoud believes that Windows 8 will not show its impact on PC sales until Q4.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

killerclick I love it when something overhyped fails so badly.Reply

I look forward to reading about the failure of Microsoft Surface and Windows 8 next year.

Innovation should happen from the bottom up, not from the top down. -

Ultrabooks are simply overpriced and it has nothing to do with anticipation of Windows 8. From what I've seen of Windows 8 and the reviews its new interface is getting, Windows 8 is shaping up to make Windows Vista and Windows ME look like overwhelming successes.Reply

-

Vorador2 To get a decently specced ultrabook, you need to pony up a lot of money. Most people what they want is something to replace their desktop, and sometimes carry around if they're gonna travel. For that a conventional laptop is sufficient. Ultrabooks are targeted to the road warrior, and most of them can do with current smartphones for their field work.Reply

Also, the lower end market for mobility is getting eaten by tablets. So more or less the only market remaining is higher end pricey ultrabooks for people who need both mobility and power. -

I've been shopping for an Ultrabook for about two months. The thing I've been waiting for is the Ivy Bridge processor, because of the substantial graphics boost. Current models either have lackluster specs (eg 32 Gb SSD, 4 Gb ram), or are wildly overpriced. If manufacturers would be a little more reasonable on profit margins, there would be plenty more buyers. One more thing, it sucks when you combine the lackluster specs with the inability for the user to swap in a new SSD or add more ram. That's the real deal-breaker for me. Nobody is waiting for Windows 8 to make a purchase.Reply

-

sundragon 1. The first/second gen Ultrabooks are okay but not great.Reply

2. Apple knows it customers. They made a bet and in 2008 realized their customers are interested in purchasing a macbook with Industrial Design that makes it very thin and light with nearly the processing power of a full notebook.

3. I think most people looking to purchase a Windows based laptop are going for lower price for performance and the Ultrabooks are still not as good bang for buck as regular laptops. Based on what people on this forum say (anti Apple holy war aside) They want a laptop that as specific performance level at the lowest possible price. Finally - the current Industrial Design for Windows based Ultrabooks is not spectacular - It may take Sony/Dell/Lenovo a generation before they use their R&D to come up with designs that are unique and stand out among their competition.

4. The introduction of Haswell based Intel processors (2013) should change the performance/price calculation. (If you believe Intel's marketing/disclosures) - It will bring a much better GPU architecture and far better energy use envelope compared to the current Ivy Bridge.

Time will tell (2013) if Haswell is 80% of what Intel says it's gonna be, we are all going to have laptops that will use far less energy and have GPUs that will give AMD a run for their money. -

memadmax killerclickI love it when something overhyped fails so badly. I look forward to reading about the failure of Microsoft Surface and Windows 8 next year.Innovation should happen from the bottom up, not from the top down.Reply

Then you design the next great processor architecture you dumb punk... I bet you are one of the 99%'rs huh? You sound like one... I bet you think all the banks need to be destroyed too huh? -

scannall Part of the problem is that a lot of people who would by a Windows laptop is still stuck in the 'race to the bottom' mindset. Not a lot of people look at Windows laptops as a 'premium' product. So, in order to meet the race to the bottom crowd a lot of the Ultrathins take shortcuts, and use crappier materials than they really should.Reply

That isn't saying that every Windows Ultrathin is a pile of crap. But enough of them are that it taints the ones that aren't. -

razor512 I wonder why people are not buring an ultrabook, who here doesn't want a $1000+ computer, with the specs of a $400 computer (minus the DVD drive) but is a bit thinnerReply

(even though the thickest part of a laptop is the cd drive, and the motherboard+ heatsink only takes up about half of the thickness of the unit (meaning you can make an ultra book by simply making the case thinner and getting rid of the CD drive and using a lithium polymer battery)

hmm

anyway, in terms of functionality and performance, a ultrabook is basically in between a netbook and a laptop and for it to sell, it should be priced as such.

The thinness doesn't really help since if you are in a situation where you cant bring a standard laptop, then you wont be able to have an ultrabook with you either.

the only benefit you get is less weight meaning the laptop bag will not feel as heavy. which is not worth the huge price increase. -

Kami3k memadmaxThen you design the next great processor architecture you dumb punk... I bet you are one of the 99%'rs huh? You sound like one... I bet you think all the banks need to be destroyed too huh?Reply

I know you are a Fox News drone as you had to bring politics into this. Not everything is about politics FYI. -

sundragon UltraIvyBookI've been shopping for an Ultrabook for about two months. The thing I've been waiting for is the Ivy Bridge processor, because of the substantial graphics boost. Current models either have lackluster specs (eg 32 Gb SSD, 4 Gb ram), or are wildly overpriced. If manufacturers would be a little more reasonable on profit margins, there would be plenty more buyers. One more thing, it sucks when you combine the lackluster specs with the inability for the user to swap in a new SSD or add more ram. That's the real deal-breaker for me. Nobody is waiting for Windows 8 to make a purchase.Reply

If you can wait till 2013 - you may be rewarded with a better cpu/gpu combo with Haswell and a considerably larger SSD (as SSD chips prices are falling and the competition is heated).