Micron Loses $2.312 Billion as Demand for DRAM and 3D NAND Nosedives

Micron will further reduce 3D NAND and DRAM output as it preps for steepest revenue drop in decades.

For its second quarter of fiscal 2023 Micron posted a year-over-year revenue drop of nearly 53% and said its earnings will decline further in the ongoing quarter as demand for 3D NAND and DRAM remains soft. The company had to write down inventory worth billions of dollars, and said it would maintain conservative spending but would have to fire more people than it planned to this year. However, Micron remains confident that demand for memory will skyrocket by 2025 as the world embraces more computing.

Worst Downturn in Years

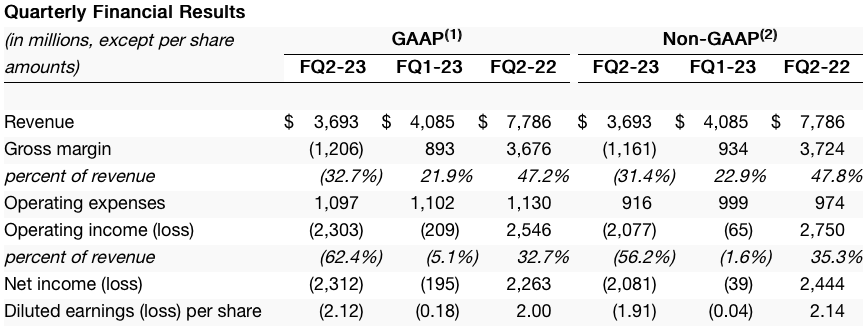

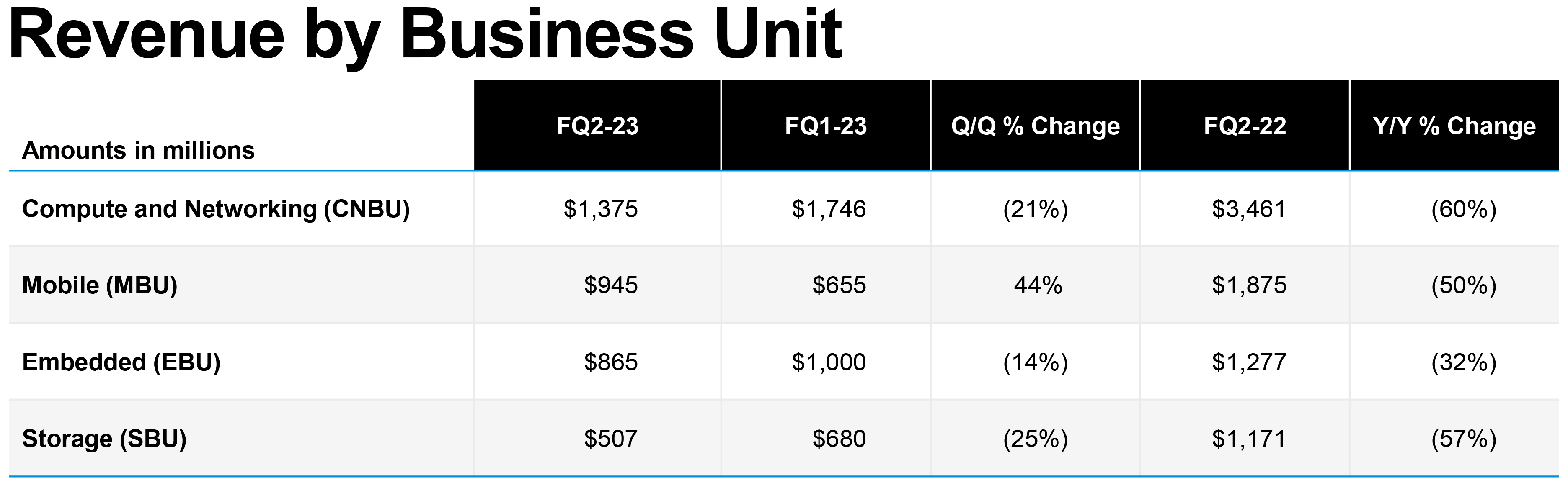

Micron earned $3.693 billion in Q2 FY2023 (which ended on March 2, 2023) — down from $7.786 billion in the same period a year ago, but still within guidance set by the company last quarter. Micron posted a whopping $2.312 billion GAAP net loss as it had to write down $1.43 billion worth of 3D NAND and DRAM inventory and saw its gross margin collapse to -32.7% — down from 47.2% in Q2 FY2022.

Despite the fact that its loss per share totaled $2.12, Micron has declared a quarterly dividend of $0.115 per share, payable in cash on April 25, 2023.

Low average selling prices (ASPs) due to oversupply remain the main challenge for 3D NAND and DRAM industries. To somehow slowdown bit output increase, Microsoft said it had further reduced DRAM and NAND wafer starts by ~25% YoY.

"The semiconductor memory and storage industry is facing its worst downturn in the last 13 years, with an exceptionally weak pricing environment that is significantly impacting our financial performance," said Sanjay Mehrotra, chief executive of Micron. "We have taken substantial supply reduction and austerity measures, including executing a companywide reduction in force. We now believe that customer inventories have reduced in several end markets, and we see gradually improving supply-demand balance in the months ahead."

Due to uncertainties about demand for DRAM and flash memory in the short and mid-term, the company continues to conservatively invest in capacity expansion and intends to accelerate job cuts. Micron announced that it would maintain its FY2023 CapEx at approximately $7 billion (down over 40% from FY2022 and down over 50% for fab tools), which is at the lower end of its previously forecasted range. Micron will also cut its headcount by 15% this year — up from its earlier goal of 10%.

PC Business Remains a Concern

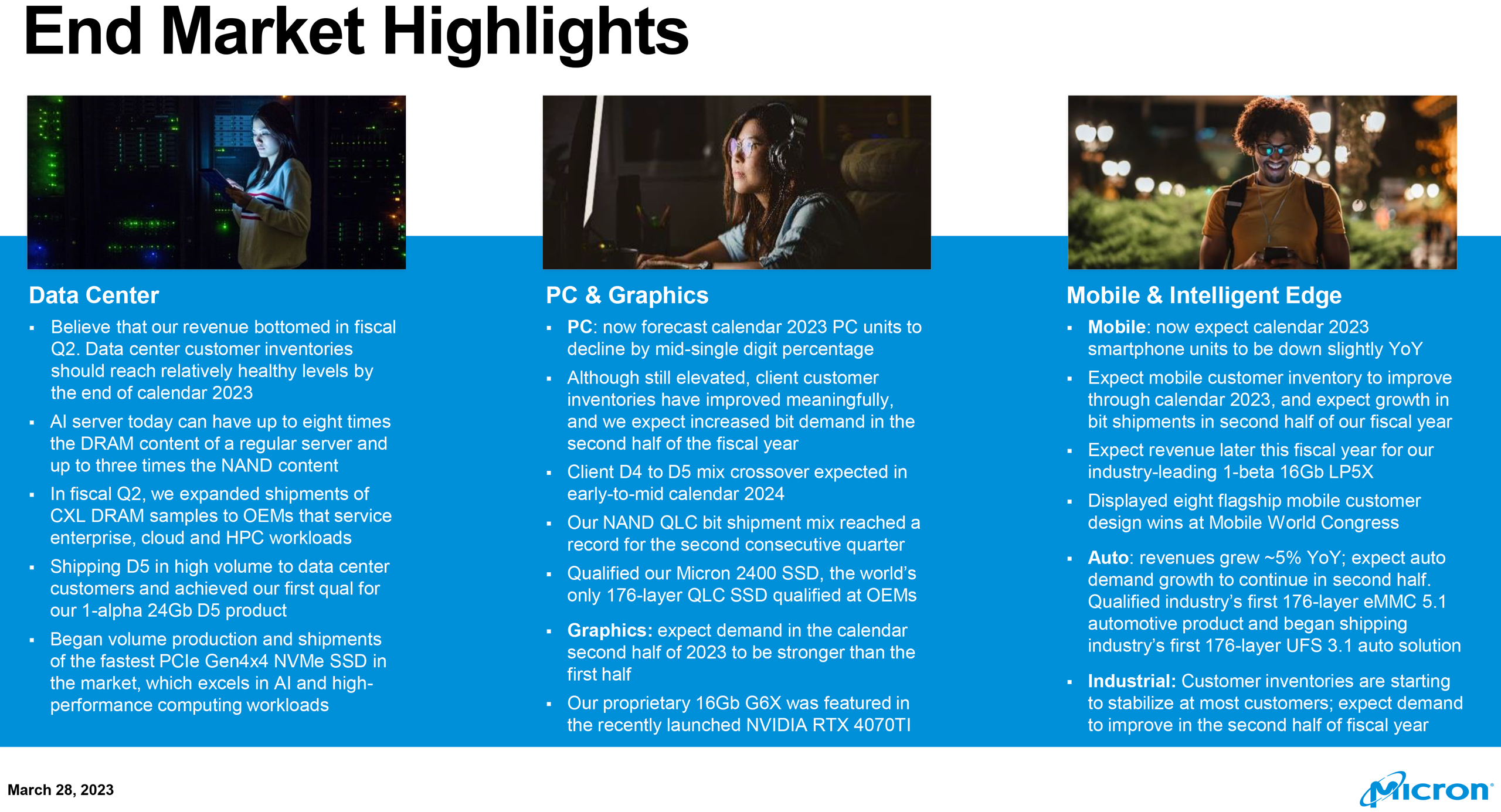

Micron's PC business is a cause for concern: the company has projected a mid-single-digit decline in PC unit volume in 2023, which will bring the volume back to pre-COVID levels. Although client customer inventories are still high, they have deteriorated significantly and Micron anticipates a surge in bit demand in 2H FY2023.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Micron is significantly more optimistic about its datacenter business — it forecasts revenue growth in fiscal Q3 (its DC revenue bottomed in Q2 FY2023). The company projects its datacenter customer inventories to return to relatively healthy levels by the end of calendar year 2023.

As for its mobile business, Micron seems to consider this a mixed bag. On one hand, smartphone shipments are expected to decline in 2023 compared to the prior year. On the other hand, while some smartphone suppliers' inventories have returned to normal levels, other OEMs' inventories remain high. Micron anticipates an improvement overall in mobile customer inventory throughout the remainder of calendar year 2023 — and predicts growth in mobile DRAM and NAND bit shipments in H2 FY2023 compared to H1 FY2023.

By contrast, Micron's graphics and automotive memory businesses remain profitable and look like they'll stay that way going forward.

On the graphics side, Micron says that customer inventory adjustments are proceeding smoothly and the company expects a stronger demand in H2 2023 (which is inline with yearly trends for sales of discrete graphics cards). The memory maker cites industry analysts who anticipate that graphics DRAM total addressable market (TAM) to grow at a compound annual rate higher than that of the general market due to its application in both the client and datacenter domains.

Micron also anticipates a persistent rise in demand for auto memory in the second half of the year, thanks to the gradual reduction of non-memory supply constraints and a rise in memory content per vehicle.

Great Yields of 3D NAND and DRAM

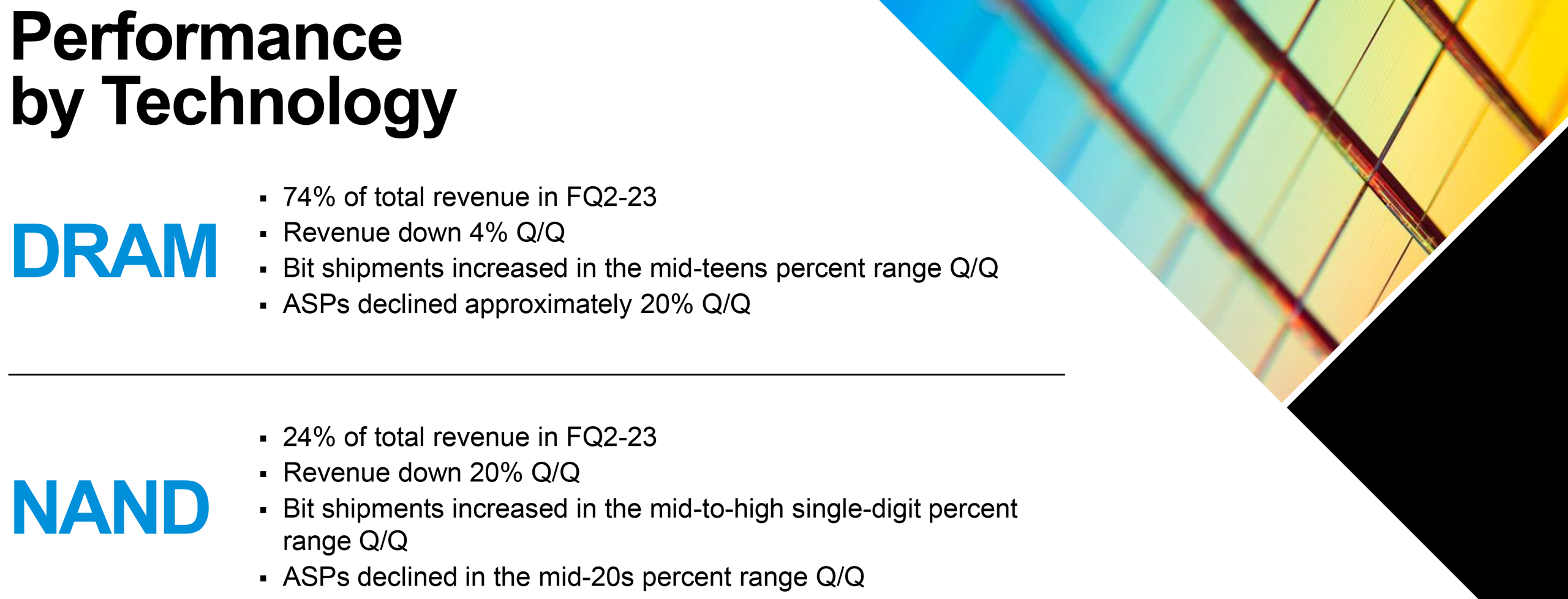

DRAM accounted for 74% of Micron's revenue — and while the company attempted to reduce output of computer memory, its bit shipments increased in the mid-teens percent range quarter-over-quarter.

Micron has achieved record-breaking yields for 1α DRAM, surpassing the yields of any other node in its history. Furthermore, the targeted yields for 1β (1-beta) manufacturing node — which increases DRAM bit density by 35% and improves power efficiency by 15% — have been achieved ahead of schedule and faster than any of Micron's previous nodes, the company said. Regardless, because average selling prices of DRAM dropped 20% QoQ, the DRAM business still generated a huge loss for the company.

NAND memory accounted for 24% of Micron's Q2 FY2023 revenue, and, since the company accelerated transition to its more sophisticated 176-layer and 232-layer nodes, its bit shipments also increased during the quarter — despite efforts to cut down flash memory output.

More than 90% of Micron's NAND bit production in Q2 FY2023 was represented by 176-layer and 232-layer production nodes, whereas 3D QLC NAND accounted for over 20% of the company's flash memory bit production and shipments. Micron says it has achieved record yields for 176-layer NAND — surpassing the yields of other nodes in Micron's history. Additionally, the targeted yields for 232-layer 3D NAND memory have been reached — not only ahead of schedule, but faster than any of the company's previous nodes.

High yields constrain Micron's losses somewhat. However, since 3D NAND and DRAM ASPs continue to drop, the company will continue to generate losses in the coming quarter (or even quarters).

2025 Set to Be Record Year

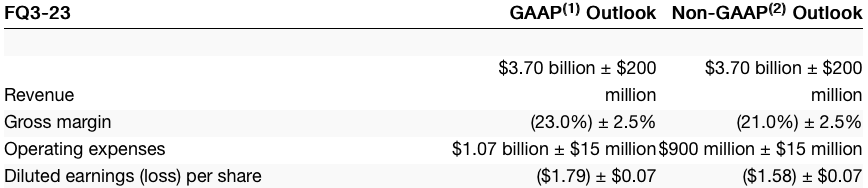

Micron now guides GAAP revenue of $3.7 billion ± $200 million for Q3 FY2023, which will represent an approximately 46% year-over-year drop, from $8.642 billion in Q3 FY2022. This is going to be the steepest YoY earnings drop since the dot com bust in 2001. The company forecasts a $1.79 ± $0.07 loss per share in the ongoing quarter.

Micron remains optimistic about demand for DRAM and 3D NAND going forward as the industry adopts more memory and storage-intensive applications, such as ChatGPT-like large language models (LLMs).

"While our industry faces significant near-term challenges, we believe that the memory and storage total addressable market (TAM) will grow to a new record in calendar 2025 and will continue to outpace the growth of the semiconductor industry thereafter," said Mehrotra. "Recent developments in artificial intelligence (AI) provide an exciting prelude to the transformational capabilities of large language models, or LLMs, such as ChatGPT, which require significant amounts of memory and storage to operate."

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

pug_s Call me an idiot, but in the same day when Micron loses billions but their stock jumped up 7%?Reply -

Alvar "Miles" Udell ReplyTo somehow slowdown bit output increase, Microsoft said it had further reduced DRAM and NAND wafer starts by ~25% YoY.

Don't think that's right Anton... -

sitehostplus I live in Syracuse, NY, and this is NOT good news!Reply

They are supposed to be planning to build a chip plant up here, anyone want to start an office pool to bet when Micron pulls the plug on that deal? -

TechieTwo Historically Micron has over-produced and then used low prices to move the excess volume. In the good times they rake in boatloads of cash so they typically can manage the slow times.Reply

Some poorly managed companies thought that the high take rate during COVID would last forever. That was wishful thinking. With a world wide economic recession and high inflation this downturn is going to last awhile. Mismanagement on many fronts accounts for such difficult economic times. -

jkflipflop98 Replysitehostplus said:I live in Syracuse, NY, and this is NOT good news!

They are supposed to be planning to build a chip plant up here, anyone want to start an office pool to bet when Micron pulls the plug on that deal?

If they're smart they'll go full steam ahead on the project. The whole COVID thing basically forced everyone into a focused upgrade cycle. We all know the tech sector is cyclical. . . things are great for three years then it sucks for three years then it's amazing and bust over and over and over and over. Right now is the downturn. Those who are smart enough to invest now will reap the rewards when the next boom cycle comes along in a few years.

If you start building and hiring when the boom happens, it's too late. By the time you have a factory and people to run it, the bust has started. -

PlaneInTheSky High GPU and motherboard prices are killing PC sales.Reply

There is a massive shift to consoles taking places as PC gaming has become something for the rich. -

AlskiOnTheWeb Reply

The key detail you missed was "was within guidance". So, it wasn't unexpected. In other words, they seem good at predicting where their market is going.pug_s said:Call me an idiot, but in the same day when Micron loses billions but their stock jumped up 7%? -

Endymio Reply

You're seeing the phenomenon of market-sentiment as a leading indicator. Investors had already 'baked in' an even larger loss into the stock price, so if the actual results are not as bad as expected, the share price rises. It's not uncommon.pug_s said:Call me an idiot, but in the same day when Micron loses billions but their stock jumped up 7%? -

jonathan1683 I think maybe the lack of innovation as well, moving from 1-2-3-4 TB isn't a giant difference and the speeds are not moving up that fast either. I would like to see 10-50TB ssds in a consumer price range. I did see a crucial 4TB nvme drive for like $220 at newegg, while it's a good price, I still think it's not a lot of space. I would buy one around 8TB to toss my out my main backup drive.Reply