Sales of Microprocessors to Top $100 Billion in 2021, Says Report

Record ASPs drive sales of MPUs to new heights.

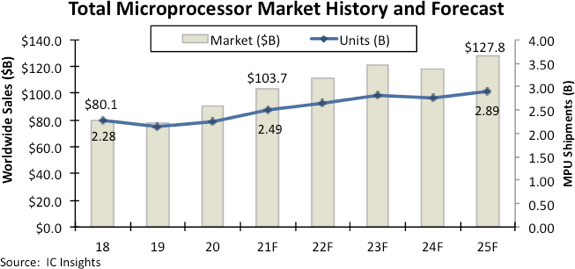

According to a report from IC Insights, sales of microprocessor units (MPUs) are on track to exceed $100 billion this year, which will be an all-time record, because of strong demand for computer CPUs and smartphone SoCs. Also, shipments of MPUs are projected to hit 2.49 billion for the first time ever. CPUs for PCs and servers will account for 46.7% of the global MPU sales, significantly exceeding sales of smartphone SoCs.

MPU Sales Hit New Records

Demand for MPUs — central processing units (CPUs) and system-on-chips (SoCs) for various applications — is record-high (just like demand for all types of chips these days) as the world is transforming and new kinds of MPU-based devices emerge. Unit shipments of MPUs are expected to increase 11% year-over-year- to almost 2.49 billion units, which is a tangible increase from the previous record of 2.28 billion units in 2018, according to IC Insights.

IC Insights projects MPU sales to reach $103.7 billion this year, a 14% increase year-over-year. Record MPU revenues and unit shipments are driven by unprecedented demand for CPUs and SoCs, high average selling prices as chip designers integrate more compute horsepower and features into their products, and prioritization of high-end SKUs over other models by vendors.

CPUs for PCs and Servers Still Rule the MPU Market

Sales of CPUs for PCs and servers will hit $48.4 billion in 2021, an increase of 4% year-over-year, a clear indicator that microprocessors for computers is still the biggest MPU market as far as revenues are concerned. Meanwhile, unit shipments of processors for personal computers and servers will increase 6% in 2021 compared to 2020.

While unit shipments of PCs nowadays are high compared to previous years, they are not as great as they were about a decade ago. Yet, shipments of servers with expensive microprocessors inside are beating records, which has a positive effect on the whole market. In fact, $48.4 billion is a record-high CPU revenue, IC Insights claims. Ironically, but the difference between CPU sales growth and unit shipments surge indicate that ASPs of CPUs will actually drop a bit this year.

Revenue for smartphone SoCs will climb to $35.7 billion, a 34% increase per annum as ASPs for such chips are on track to increase 20% YoY as developers integrate more cores and 5G modems into their designs. Unit shipments of smartphone SoCs are projected to increase 34% in 2021.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Sales of embedded MPUs are on track to reach $19.7 billion, an 11% growth year-over-year despite serious shortages. Embedded MPU segment is the largest category of all MPUs in terms of unit shipments as over a billion of such chips is used for such applications as automotive, consumer electronics, industrial, IoT, medical, networking, and telecomequipment. In terms of units, shipments of embedded MPUs will raise 12% YoY, but the unit growth is constrained by shortages and inability of foundries to boost production overnight.

MPU Sales to Hit $127.8 Billion in 2025

IC Insights predicts that MPU revenues will increase to $127.8 billion in 2025 as the market will ship 2.89 billion of CPUs and SoCs for existing and emerging applications.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.