Nvidia Has A Crypto-Hangover, Mid-Range Turing Cards Likely Delayed

Nvidia announced its third quarter financial results, but a worrying glut of graphics cards in the channel, which Nvidia CEO Jensen Huang chalked up to a "Crypto hangover," impacted overall earnings and guidance. The news sent the company's stock plummeting 18% in after-hours trading. Nvidia expects the oversupply to require "one to two" quarters to recede.

The oversupply specifically impacts Nvidia's GTX 1060 graphics cards, which could result in a delay in shipments of Nvidia's forthcoming Turing 2060 cards because Nvidia will surely wait for the existing stock to be liquidated before it floods the market with newer, faster video cards in the same price range.

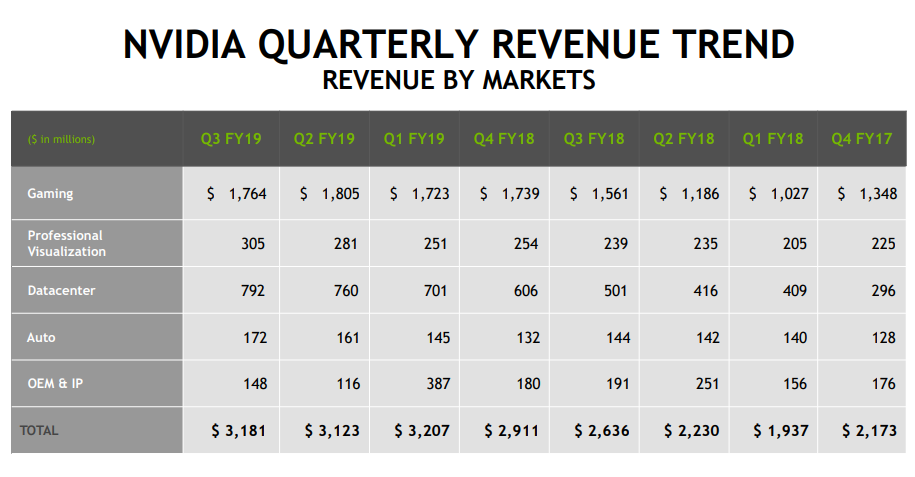

AMD also released the RX 590 yesterday, which it designed specifically to compete with the GTX 1060. That could complicate matters for Nvidia as it tries to liquidate the excess inventory. The inventory announcement overshadowed the record revenue generated by several of the company's key segments, like data center and automotive.

Nvidia's Jensen Huang summarized the excessive inventory of mid-range graphics cards, meaning the GTX 1060, as a byproduct of the blockchain/cryptomining crash. That's similar to AMD's recent earnings report that was impacted by poor demand after cryptocurrency-driven demand had dried up. Huang stated that the oversupply of mid-range graphics cards would take "one to two" quarters to clear up, which is similar to AMD CEO Lia Su's prediction of "several" quarters before the graphics card market returned to normal.

Nvidia originally announced in May 2018 that it expected revenue from cryptocurrency to drop by two-thirds, sending its stock sliding. The company failed to correctly predict the nature of the recovery, as its channel partners didn't lower prices as quickly as expected while the market normalized. That, coupled with a miscalculation of a return of demand, caught Nvidia off guard during the tail end of the quarter.

Nvidia plans to stop delivery of mid-range Pascal graphics cards entirely during this quarter, and we shouldn't expect to see new mid-range Turing graphics cards on the market until the inventory recedes. It wouldn't be surprising to see either reduced pricing or new game bundles for the Nvidia GTX 1060 cards over the coming months.

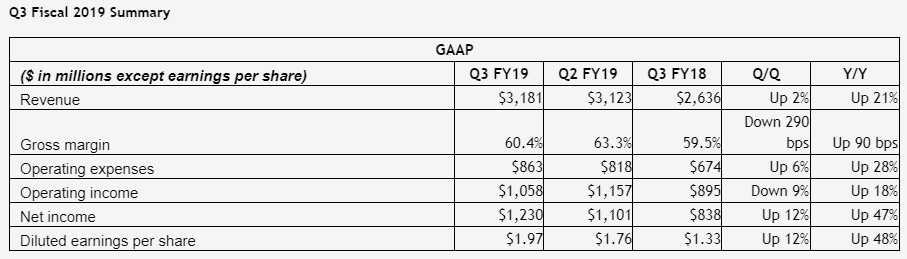

Overall Nvidia continues to exhibit solid fundamentals and is executing well on its long-term roadmap, with revenues coming in at $1.97 billion, which is up 21% year-over-year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

velocityg4 Not surprising. Considering used GTX 1060 6GB go for $150 and new are mostly still listed in the $250 to $300 range. It will make them even harder to unload. They're trying to get more for them now than they were selling for 18 months ago (via PCPartpicker). These cards are two and half years old and they are still trying to sell them at or above the original MSRP of $249.Reply

-

mortemas Wait, there's a glut AND high prices at the same time? This can only mean that nVidia tightly controls the flow of its existing inventory of chips like DeBeers controlled the supply of diamonds.Reply -

kinggremlin Did you read the whole article? Channel partners haven't lowered prices as quickly as expected. This has nothing to do with Nvidia. A huge glut of product is not a goal for Nvidia. Resellers continue to price gouge their customers. This is how it works in all markets. When a shortage takes place, prices shoot up. However, when demand subsides, the prices don't fall nearly as fast as they shot up.Reply -

PapaCrazy Nvidia priced Turing high to make Pascal look cheap, but a dollar is still a dollar and people can't earn them any quicker than before. High prices don't move volume. Once Pascal is all gone, they think with Turing the situation is going to get... better? haReply -

littleleo People were shell-socked at the ridiculously high price of the RTX series, at least I know I was. I was thinking of upgrading my 970 but I'm not paying the inflated prices out there for GPUs. I'm fine staying with what I got I can play everything I want at decent FPS so no pressing need for me. If price get down to what I feel is reasonable I may get a new GPU, but I decide what is reasonable for me not Nvidia or their board partners, and $1K for a GPU isn't in the ballpark. If they want me to buy, then they have to have something attractive to offer besides a new tech no current games uses and maybe 5-7 will next year (really) and a $1K+ price tag for a card that catches on fire. Sorry Tom's "Just Buy It" article didn't move me to waste my green stamps on this mess.Reply -

kinggremlin NVidia isn't selling 2080's at $800 to move 1060's. They did it to move 1080ti's. And it worked perfectly. Go look at the gamersnexus youtube video on this. They saw a huge surge in 1080ti sales through their referral program right when the rtx line was announced. Over 60% of all cards purchased were 1080ti's. That's ridiculous for such a highend card. There have been plenty of recent articles reporting on the dwindling stock of 1080ti's. Nvidia's RTX pricing scheme has absolutely achieved the goal of clearing highend Pascal stock.Reply

They're trying to clear 1060 stock by not releasing a 2060 as the above article stated. -

littleleo Reply

I agree and disagree Nvidia has a lot to do with the prices. They sell the chips to the board partners so the prices they sell to the board partners affect what the partners can sell them for. If you pay $300 for a GPU you can't build a card for it and sell it for less. Plus many times Nvidia has MSP (minimum selling price) levels set, so they are more involved than you think. They just got very greedy from the mining crazy. They were hoping the market had adjusted to the higher prices as the new norm.21491570 said:Did you read the whole article? Channel partners haven't lowered prices as quickly as expected. This has nothing to do with Nvidia. A huge glut of product is not a goal for Nvidia. Resellers continue to price gouge their customers. This is how it works in all markets. When a shortage takes place, prices shoot up. However, when demand subsides, the prices don't fall nearly as fast as they shot up.

-

stdragon Reply21491776 said:NVidia isn't selling 2080's at $800 to move 1060's. They did it to move 1080ti's. And it worked perfectly. Go look at the gamersnexus youtube video on this. They saw a huge surge in 1080ti sales through their referral program right when the rtx line was announced. Over 60% of all cards purchased were 1080ti's. That's ridiculous for such a highend card. There have been plenty of recent articles reporting on the dwindling stock of 1080ti's. Nvidia's RTX pricing scheme has absolutely achieved the goal of clearing highend Pascal stock.

They're trying to clear 1060 stock by not releasing a 2060 as the above article stated.

That's diabolically genius!

-

hannibal If nvidia is smart (not considering customers) they make the new Turing middle range cards using 7nm... And maybe start selling them next year... maybe autumn, maybe earlier if 1060 stock runs out. If it does not... the best bang for the Nvidia would be the holiday season at the end of 2019...Reply

Let's hope that warehouses are empty from old cards by the summer... Other vice we have very boring half year ahead... -

kinggremlin Reply21491827 said:

I agree and disagree Nvidia has a lot to do with the prices. They sell the chips to the board partners so the prices they sell to the board partners affect what the partners can sell them for. If you pay $300 for a GPU you can't build a card for it and sell it for less. Plus many times Nvidia has MSP (minimum selling price) levels set, so they are more involved than you think. They just got very greedy from the mining crazy. They were hoping the market had adjusted to the higher prices as the new norm.21491570 said:Did you read the whole article? Channel partners haven't lowered prices as quickly as expected. This has nothing to do with Nvidia. A huge glut of product is not a goal for Nvidia. Resellers continue to price gouge their customers. This is how it works in all markets. When a shortage takes place, prices shoot up. However, when demand subsides, the prices don't fall nearly as fast as they shot up.

Nvidia has no control over how much over MSRP re-sellers charge. They can't tell any company selling their products to lower prices. During the height of the mining craze, Nvidia could have given away their GPU's for free to AIB's, and there would have been no price drop. The market charges what the customer is willing to pay. Remember, Nvidia never raised the prices of the cards on their website during the few seconds they were in stock during the mining craze. They always sold for MSRP. Nvidia certainly benefited from being able to sell every GPU they could produce, but they didn't get the benefit of higher margins because all the price gouging was done by the distributors and re-sellers which NVidia lacks any legal power to prevent.