AMD Drops 24 Percent After Low Revenue and Guidance, Crypto Crash

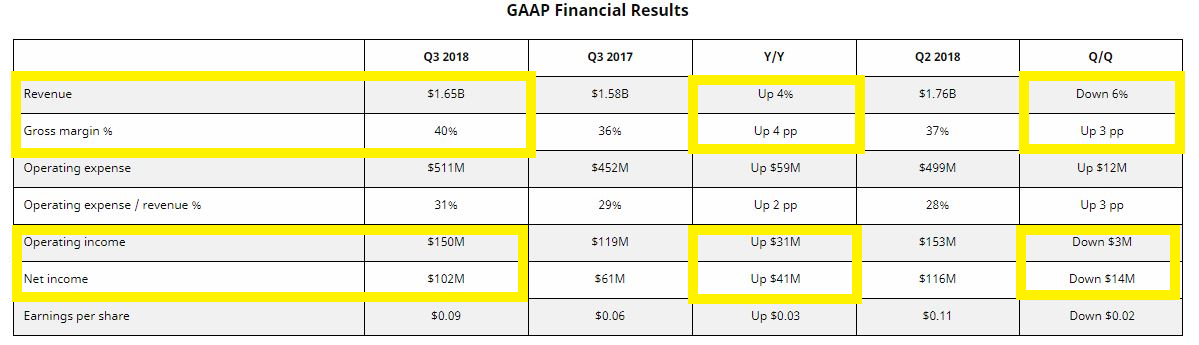

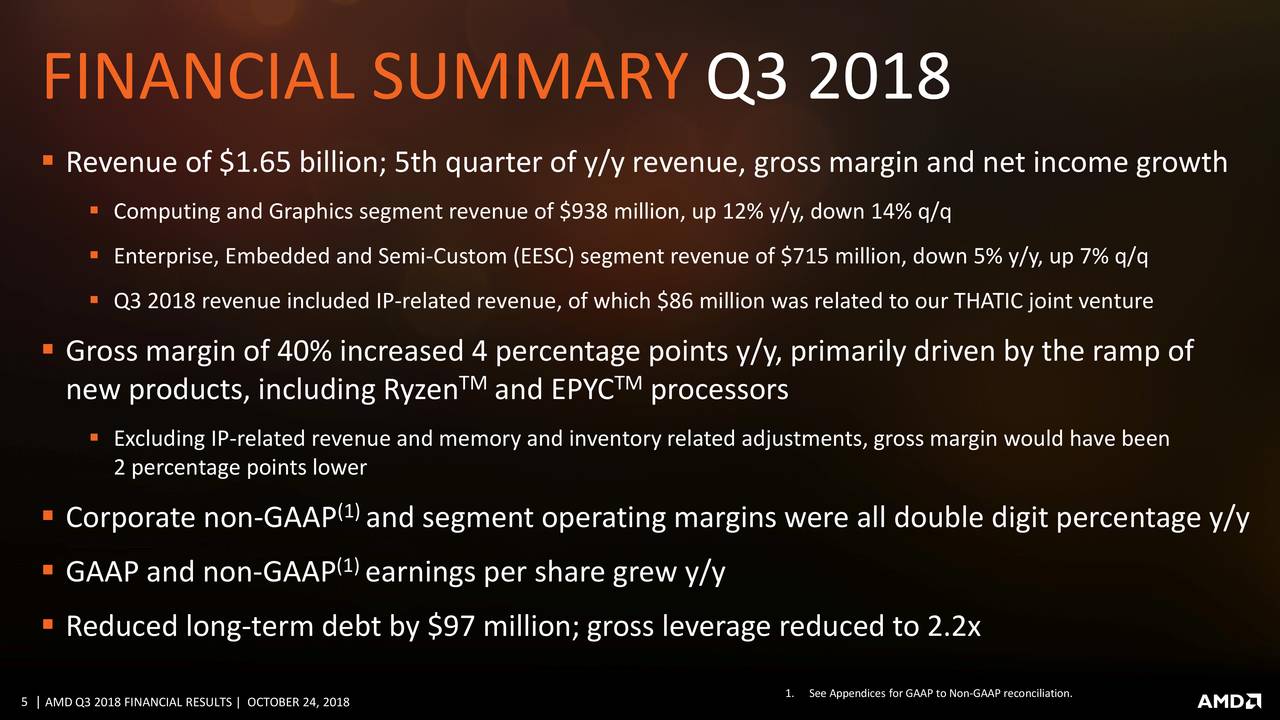

AMD's third-quarter earnings report wasn't as promising as expected, which sent shares tumbling 24% in after-hours trading. AMD blamed the lower-than-expected revenue and guidance on a sharp downturn in the graphics market, which was largely fueled by the collapse of the cryptocurrency/blockchain market. The massive downturn in GPU sales left AMD's channel overstocked with inventory, which AMD CEO Lisa Su says could take 'several quarters' to correct. This comes after the company largely avoided the pitfalls of the crashing cryptocurrency market earlier this year. Overall, the company's $1.65B in revenue represented a 4% year-over-year (YoY) increase, but a 6% decline over the previous quarter.

AMD also predicted $1.45B in revenue next quarter, which falls short of consensus estimates of $1.6B.

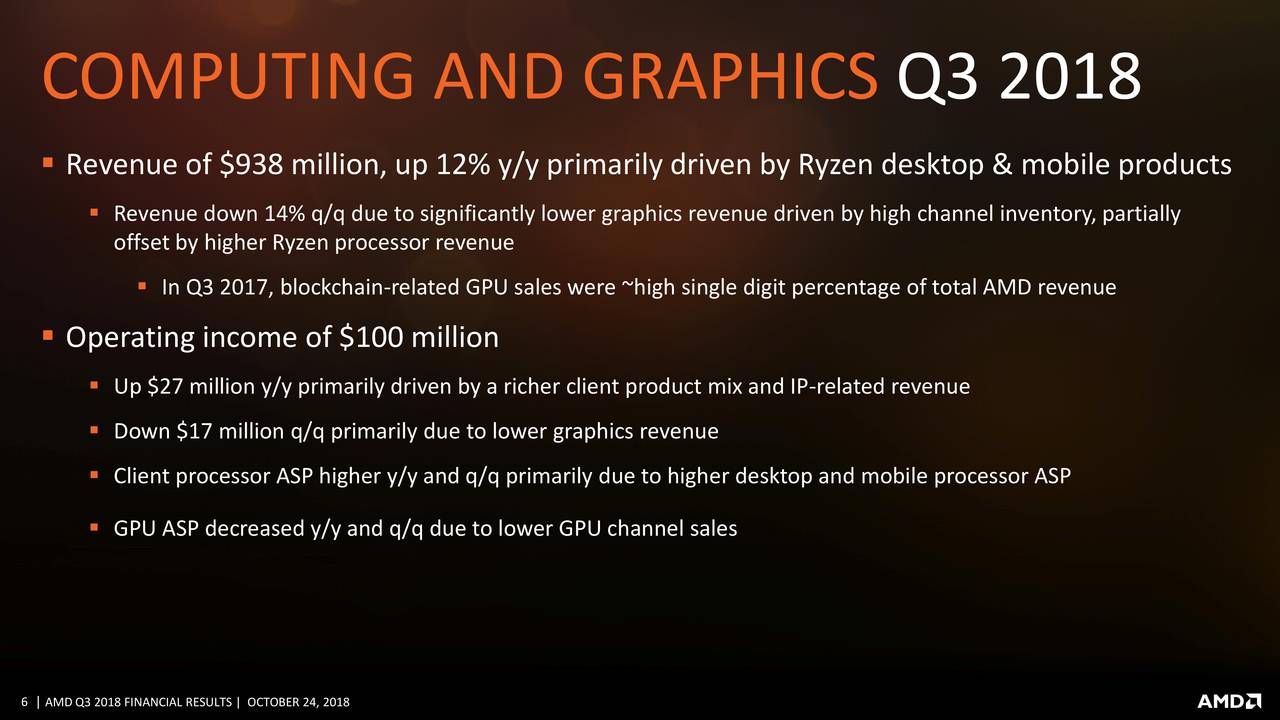

AMD's Computing and Graphics (C&G) business raked in $938 in revenue during the quarter but missed the consensus $1.05 billion estimate. Su attributed the low revenue to a $150 million shortfall in GPU sales, while the company had only planned for a $50 million decline. Nvidia did launch its own graphics cards recently, but AMD attributed the slowdown "almost entirely" to the crypto/blockchain crash.

Last year, Su stated that the company had boosted GPU production despite risks of a blockchain/crypto crash. At the time, Su cited several factors that would shield the company from oversupply in the event of a decline, but it is unclear if the boosted production played a role in the current glut. Su did state that it would take "several quarters" for its graphics segment to return to normal. The company also experienced a downturn in its semi-custom business as the market for aging consoles continues to decline. That trend is expected to continue into the seasonally-weak Q4 console season.

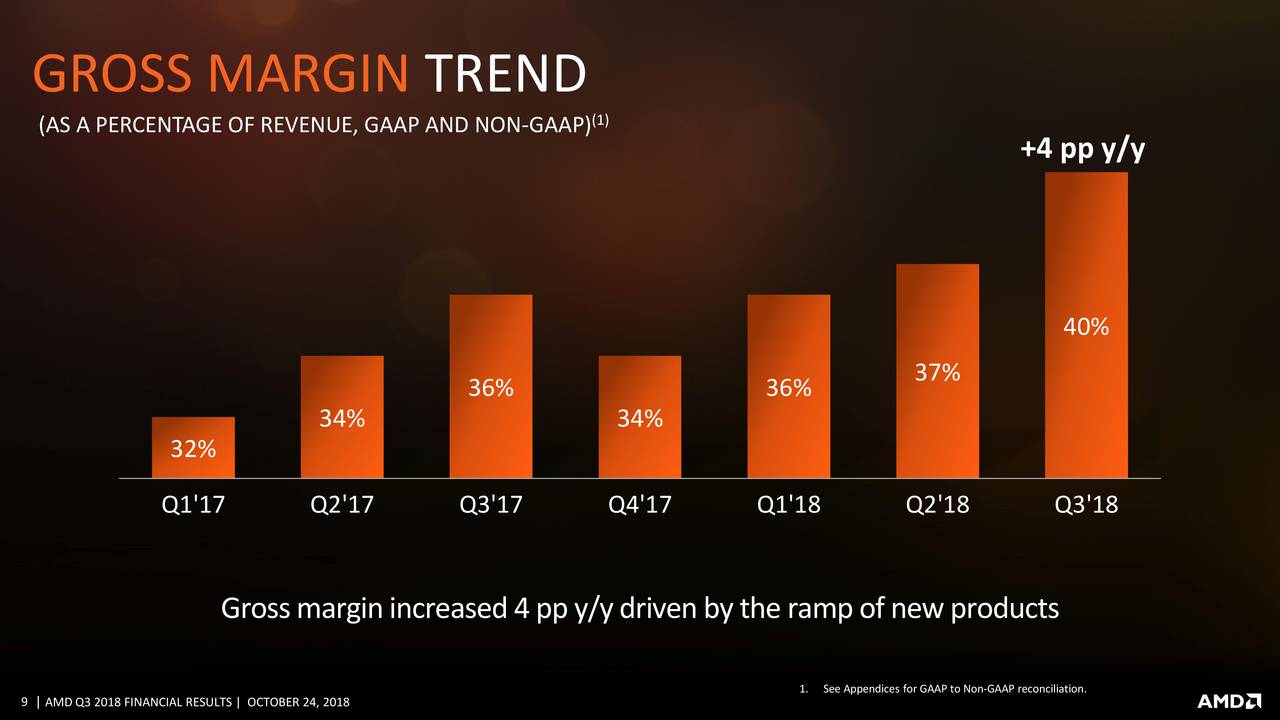

Sales of Ryzen processors were an expected bright spot. Su claimed the company gained share in the client market during the quarter and that Ryzen chips now comprise 70% of the company's revenue from processors. The company also achieved its highest processor unit shipments since Q4 2014. That's driving a richer mix, higher ASPs (Average Selling Price), and improved margins. AMD is working steadily towards its long-term margin expansion goals, reaching 40% gross margin in the quarter. That's up 4% year-over-year.

Su also stated the company had witnessed "pockets of shortages" in the processor market, almost assuredly in reference to Intel's production shortage, and says the company has boosted production in response. Su said the company is benefiting "a bit" from the shortages but didn't elaborate.

There are plenty of promising signs ahead for AMD. The company is already sampling its 7nm EPYC 2 CPUs and GPUs. Su said the company had sold $20 million of its next-gen 7nm GPUs to data centers this year, with more expected as the company moves into next year. AMD will also ship its EPYC 2 "Rome" processors for revenue in 2019.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AMD's existing EPYC data center processors are still on track. The company cited a double-digit increase in both revenue and shipments over the prior quarter. Su said the processors would reach mid-single digit share this year and accelerate to double-digit market share next year.

AMD also made $68 million in IP income, which is largely a byproduct of its licensing agreement with Chinese companies to produce x86 processors. Those processors are coming to market quickly. AMD also isn't seeing any material impact of the tariffs yet, but the company is adjusting its supply chain, which is already multi-source, to reduce the impact of further hikes.

The lucrative holiday season awaits. That could bode well for AMD's sales as Intel continues to grapple with a production shortage, but as we've covered, market share growth takes time. AMD isn't forecasting a drastic upswing in sales during the next quarter, either. AMD's continued focus on improving profitability and focusing on a richer product mix will pay off in time, but investors are obviously looking for shorter-term gains. AMD still hasn't given us a hint when its mainstream 7nm processors will debut, but that will be a critical factor as the company tries to fend off Intel's 9th Generation processors.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

elbert Seems AMD never got its bread and butter GPU's back to original asking price. The RX 570 launched at $169 but still hovers around $200. This not to mention the need for a discount due to GPU's age. AMD made it easy for cryptocurrency GPU's to be sold on ebay at their once regular price. The RX 580 has only recently returned to its regular price for the 8 GB version. For the past 2ish months the RX 580 4GB version had hovered around the price point of the 8GB version. This played into Nvidia's hands as the 1050ti has been occupying the RX 570 price point for months. Nvidia had the Turing coming so they was happy to focus on getting their high end cards back to regular price. I can only guess AMD expected cryptocurrency to pick up again.Reply -

s1mon7 Still not bad, shows that their CPUs are going strong.Reply

They clearly need a new Zen in the GPU space. Something that could be competitive across all tiers, not just lower mid-range. I understand that they had to make major compromises before, but now they seem to be in a position to invest back into their GPUs. The high end is where the margins and brand-building products are. I think Nvidia gave them an opening by making their lowest raw performance increase over time with Turing (while costing Nvidia much to manufacture and taking a hit to power efficiency). I hope AMD have something around the corner to take advantage of that, as with future Nvidia gens likely being faster and Intel entering the GPU space, AMD won't have a better time to strike back than now. -

SkyBill40 It doesn't help when there are speculators in the financial industry who are essentially sabotaging AMD's position and earnings by making negative projections about them in opinion pieces and heaping praise on Intel when the latter hasn't done anything but struggle as of late. Where's 10nm? Where's the new architecture?Reply

The tech industry apparently hasn't any interest in seeing AMD succeed and Intel fail. Anything and everything to keep Intel at the top or so it would seem. -

mindbreaker AMD at a fantastic bargain. They miss revenue expectation by 14% so they drop 31%...how does that fit? I think we will be getting that 17% back soon. Cripto was blown way out of proportion. It was low single figure % of sales last time, not a big deal if that is lower. Other things were up above expectation like the enterprise embedded and semi-custom sales which was $715 million, while $653 million was expected.Reply

I bought after hours. -

mlee 2500 Reply21430017 said:AMD at a fantastic bargain. They miss revenue expectation by 14% so they drop 31%...how does that fit? I think we will be getting that 17% back soon. Cripto was blown way out of proportion. It was low single figure % of sales last time, not a big deal if that is lower. Other things were up above expectation like the enterprise embedded and semi-custom sales which was $715 million, while $653 million was expected.

I bought after hours.

Probably not a bad investment...I'll admit that I considered it when I saw the ticker today.

What's attractive to me is that there are so MANY ways this company can have an upside if they just execute; they could make serious inroads in the data center, they could possibly become performance-competitive with Intel in the higher margin end of consumer desktop silicon, they are still a recognized brand in the GPU market if they can just regain product parity with the competition, they seem to be developing the same sort of lucrative IP licensing revenue model which has worked out so well for Qualcomm, and the console SOC market is theirs to lose.

Of course execution is the key phrase here, and semiconductor development is an expensive and complicated proposition, even if you're fabless. So much so that a "mere" $1.6BN in revenue might not be enough to pursue all the opportunities they have in front of them. Their competitors either have a narrower product focus (NVIDIA), or ALLOT more cash to invest (Intel). Heck, NVIDIA has both of those things.

Still, AMD has come to market with a remarkable array of diverse products with apparently allot less investment. As someone who has worked in that space I'm not certain how they do it. -

ElectrO_90 All of American companies are in trouble right now with 6 days straight of declining Nasdaq.Reply

AMD is not falling because of just missed targets, it is being exagerated by the collapse of the current trading being done in America. -

bit_user Reply

They're not "in trouble" because of that. The valuations were too high. This is simply an overdue market correction.21430097 said:All of American companies are in trouble right now with 6 days straight of declining Nasdaq.

AMD, in particular, was priced virtually beyond perfection. In other words, they had no plausible path towards a P/E that would justify their recent valuations. Even after the drop, it's probably still overvalued. -

bit_user BTW, GPU makers getting caught out by the inevitable crypto crash should've surprised exactly no one.Reply

Anyway, just imagine how much worse it could've been if Nvidia launched a 2060 or 2050 GPU that were competitively priced.

IMO, Vega is probably AMD's biggest pain point. I feel like Polaris is still competitive in the lower-end, which is probably why they're doing a refresh. -

nsomniac They should just invest 200billion into crypto, it would drive the price of the currency and encourage more growth in their GPU business, it would also be a good show of faith in something that causes people to buy the cards hand over fistReply