Intel 14nm Processors Facing Shortages, Increasing Prices

The first signs of a shortage of Intel's 14nm processors is emerging in the form of increasing prices, spotty availability for some processors, unavailable chipsets, and complaints from Intel's partners. These concerns come after Intel has acknowledged production issues and is poised to launch its new 9000-series processors, though it's becoming more likely that we'll see a repeat of last year's quasi-paper launch of the Coffee Lake processors.

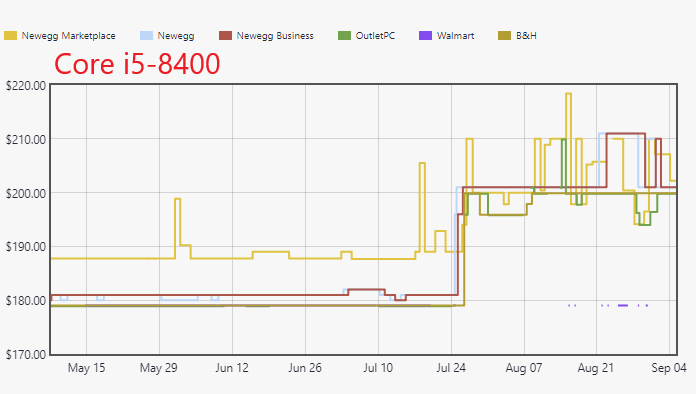

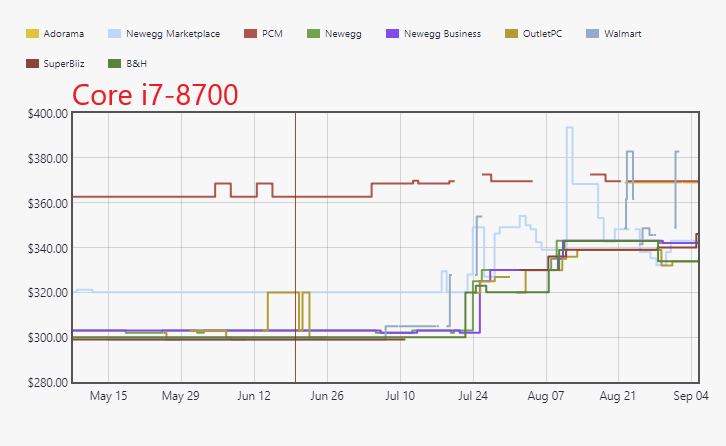

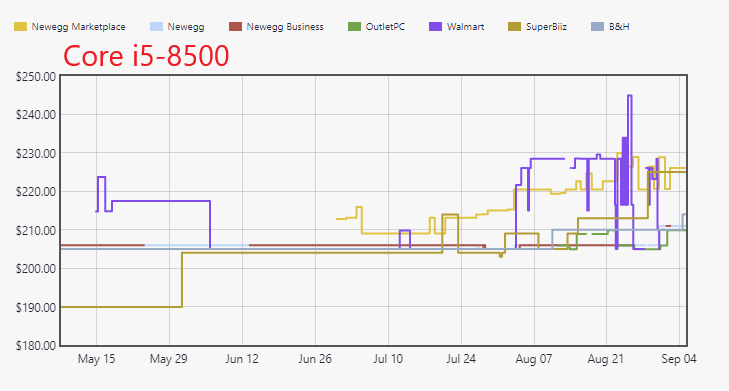

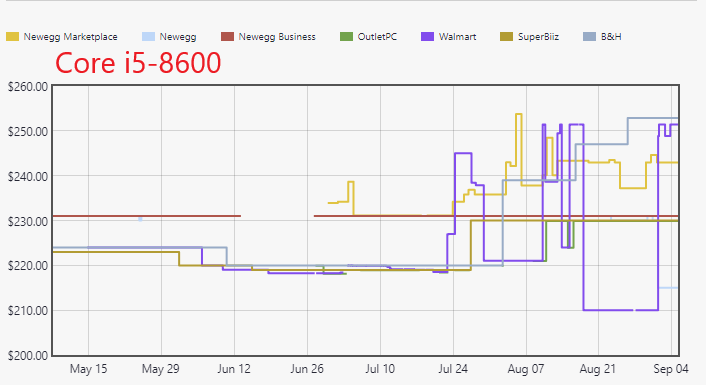

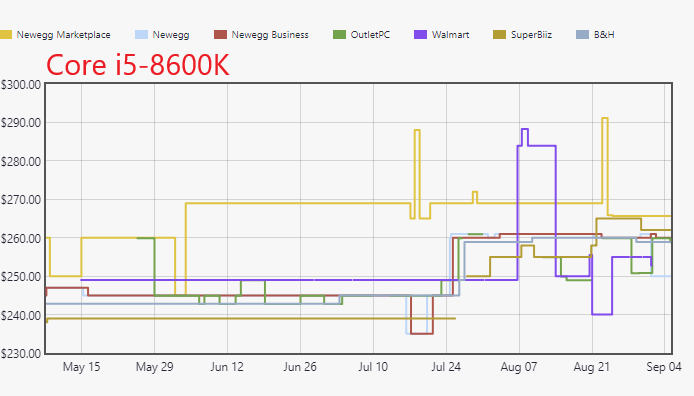

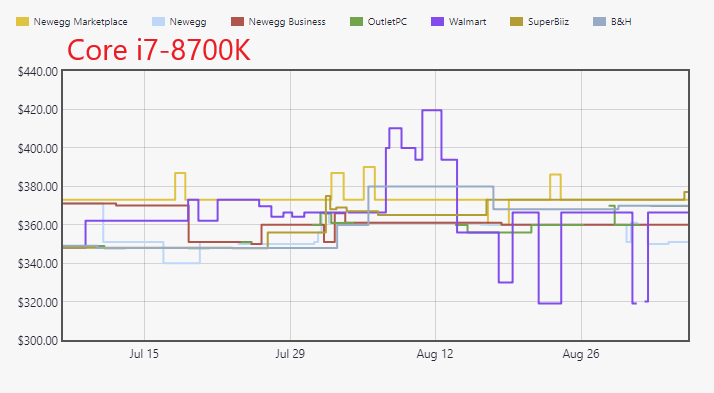

We searched through recent pricing history at pcpartpicker.com and found that many of Intel's less expensive models, such as the Core i5-8400, i5-8500, i5-8600 and i7-8700, are now selling well above MSRP. Meanwhile, pricier SKUs, such as the K-series models, aren't as impacted.

| Row 0 - Cell 0 | MSRP | Approximate Retail |

| Core i5-8400 | $182 | ~$200 |

| Core i7-8700 | $303 | ~$340 |

| Core i5-8500 | $192 | ~$210+ |

| Core i5-8600 | $213 | ~$230+ |

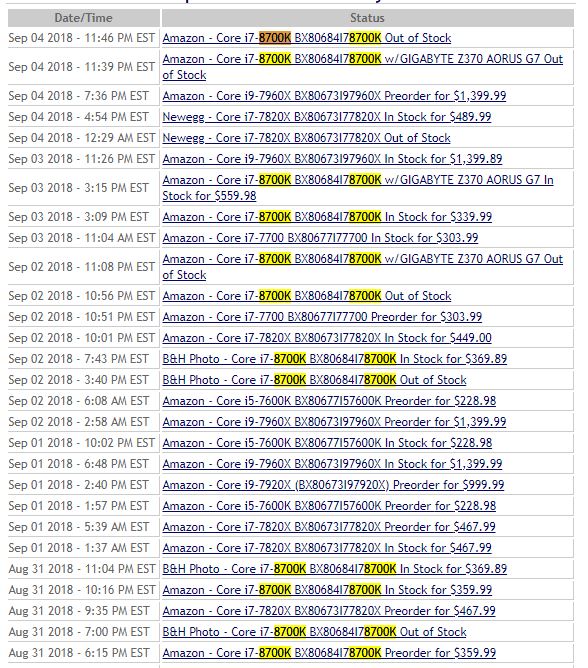

We also checked availability at NowInStock.net and confirmed that the Core i7-8700K, which we've seen come in and out of stock at both Newegg and Amazon over the last month, is having sporadic availability issues.

The Core i7-8700K continues to be Amazon's number one seller in the U.S., so the spotty availability obviously hasn't hampered Amazon's sales significantly yet. But it is telling that prices are increasing on the less-expensive models. This appears to be damage control done right; it makes sense for Intel to prioritize production of its higher-margin products. Unfortunately, it could also be the early signs of a more severe shortage.

A Shortage Takes Shape

The first signs of the shortage emerged in May. Intel's chipsets typically lag a node behind the flagship processors. meaning that until recently, Intel fabbed its chipsets on the 22nm process. Intel's recent 300-series chipset refresh found its new chipsets coming to market with the 14nm process, which is necessary to meet California's new power standards. Shortly after that, several vendors reported that Intel's H-series chipsets were in short supply, or simply not available, due to overbooked 14nm production.

In July, Intel finally confirmed the 14nm supply challenges during its earnings call, saying, "Our biggest challenge in the second half [of 2018] will be meeting additional demand, and we are working intently with our customers and our factories to be prepared so we are not constraining our customers' growth."

The company cited an unexpected $4.5 billion increase in demand as a key contributor, but other aspects, such as the delay of the company's 10nm node, likely play a role. Planning silicon production capacity is a multi-year process that involves getting the production facilities and tooling in place for mass production, but Intel fully planned to be in high volume production of 10nm processors at this point. As a result, the delayed 10nm process has likely exacerbated production challenges by pushing more unanticipated demand back to the 14nm production lines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

DigiTimes reported on September 1 that Acer chairman and CEO Jason Chen confirmed that tight supply of Intel's 14nm processors is already impacting supply chains. CP Wong, president of notebook ODM Compal Electronics, also told DigiTimes that 14nm supply issues could have more of an impact on the PC industry during the latter half of the year than the U.S.-China trade war.

Intel is known to prioritize high-volume customers, like large OEM and ODMs, during supply shortfalls, meaning it diverts limited supply to high-volume customers first. Intel's struggles to fill those prioritized orders could be an ominous sign for the retail market.

Intel also recently launched its Whiskey Lake and Amber Lake processors. As with all launches, that required a significant production ramp to meet initial demand. That ramp is occurring as Intel is also bringing production of its 14nm XMM 7560 modems online for Apple during the second half of this year. The new Apple contract, which consists of millions of modems for iPhones, will certainly be a top priority at Intel's fabs.

Much of the 14nm demand also stems from Intel's data center business, which grew 27 percent quarter-over-quarter. The company is shipping its Purley platform and preparing for the Cascade Lake Xeons that arrive this year. These large processors range up to 28 cores, which reduces the number of die Intel can harvest per wafer, thus reducing overall supply. Intel's current Coffee Lake lineup and the forthcoming 9000-series processors feature more cores that previous-gen models, again chewing into more of the company's wafer output.

All of these factors suggest the shortage could become more severe. That could also mean the much-anticipated 9000-series launch will mirror the Coffee Lake launch last year, with rampant shortages and sky-high pricing being the norm for the first few months.

We reached out to Intel for comment on the latest developments, and the company responded:

Customer demand has continued to improve over the course of the year, fueling growth in every segment of Intel’s business and raising our 2018 revenue outlook $4.5 billion from our January expectations. We will have supply to meet our announced, full-year revenue outlook and we’re working closely with our customers and factories to manage any additional upside.

Meanwhile, AMD has a seemingly solid supply of 14nm and 12nm chips from GlobalFoundries as it heads into the holiday season, and the company is working to transition quickly to the 7nm node early next year. GlobalFoundries recently abandoned the 7nm node, which might eventually create challenges for AMD as it competes with Nvidia, Apple and Qualcomm for production capacity at TSMC. But the short-term outlook for AMD's production capacity looks strong headed into the holiday season, while Intel could struggle. That could lead to a repeat of AMD's strong holiday performance last year.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

philipemaciel AMD having a lead in lithography, while Intel struggles.Reply

Who would have imagined this scenario back in, say, early 2017!... -

JamesSneed AMD needs to get there Zen2 server parts out ASAP. Take maximum advantage of having a better product in the server space while your competitor is at max capacity and being a full node behind on the process side as long as you can.Reply -

AgentLozen Intel's been using the 14nm lithography for a few years now. It has to be matured to the point where yields are very high. Where is this shortage coming from?Reply

I'm pretty sure Intel owns all of its own fabs. It doesn't have to compete with other companies for chips. They can just print their own. Have a bunch of Intel fabs gone down recently? -

hannibal They have moved production that was done to 22nm or even larger to 14nm because They were expecting to move cpus to 10nm... so They have booked old 14nm production to new products, but now They need that same production capasity to cpus also... and so we have production capasity shortage.Reply -

none12345 "Intel's been using the 14nm lithography for a few years now. It has to be matured to the point where yields are very high. Where is this shortage coming from?"Reply

1) Increased core counts mean a bigger die, a bigger die means less dies per wafer. Wafers per month per factory are pretty much fixed, so that means less product to sell when they add more cores. They went from 4 to 6 and now to 8, that's a significant impact to number of cpus they can crank out. Its not just the difference between die sizes either, if you increase your die size by 30%, you decrease the number of chips you can get by more then 30% due to the fact that bigger dies come with an increased chance that there will be a defect on the die. As well as adding more waste per wafer, rectangular dies dont fit perfectly on a circle wafter, there will be less complete dies that fit near the edges.

2) Moving their chipsets from 22nm to 14nm. This further eats into 14nm capacity because they assumed they would be on 10nm by now for the cpus, so they would have spare 14nm capacity for the chipsets. That is not the case. For every cpu they sell, they pretty much need to sell 1 chipset die, its a smaller die, but that still adds up to a lot of 14nm wafers going to chipsets instead of cpus.

3) Increased demand, if this is real demand, and not just the above 2 issues, then that further exasperates the issue. -

gggplaya Reply21295029 said:AMD having a lead in lithography, while Intel struggles.

Who would have imagined this scenario back in, say, early 2017!...

To be fair, TSMC has a lead in lithography, not AMD. AMD is contracting them to make their chips.

AMD's Fab which they spun off as global foundries to a major middle eastern investor, but is still a major owner, has given up on 7nM.

-

cryoburner More like a "shortage" so they can justify increasing prices on their 9000-series CPUs? >_>Reply

It does make sense that they would want to ramp up production on their upcoming processors though, rather than continuing to produce existing chips at full capacity just to have them sit on shelves once the new processors are out. It sounds like their next set of processors will likely be launching within a couple months, after all.